Partner Relationship Management Market Size and Forecast 2025 to 2034

The global partner relationship management market size was calculated at USD 91.30 billion in 2024 and is predicted to increase from USD 106.47 billion in 2025 to approximately USD 424.82 billion by 2034, expanding at a CAGR of 16.62% from 2025 to 2034.The growth of the market is driven by the need for businesses to improve partner collaboration.

Partner Relationship Management MarketKey Takeaways

- In terms of revenue, the partner relationship management market is valued at $ 106.47 billion in 2025.

- It is projected to reach $424.82 billion by 2034.

- The market is expected to grow at a CAGR of 16.62% from 2025 to 2034.

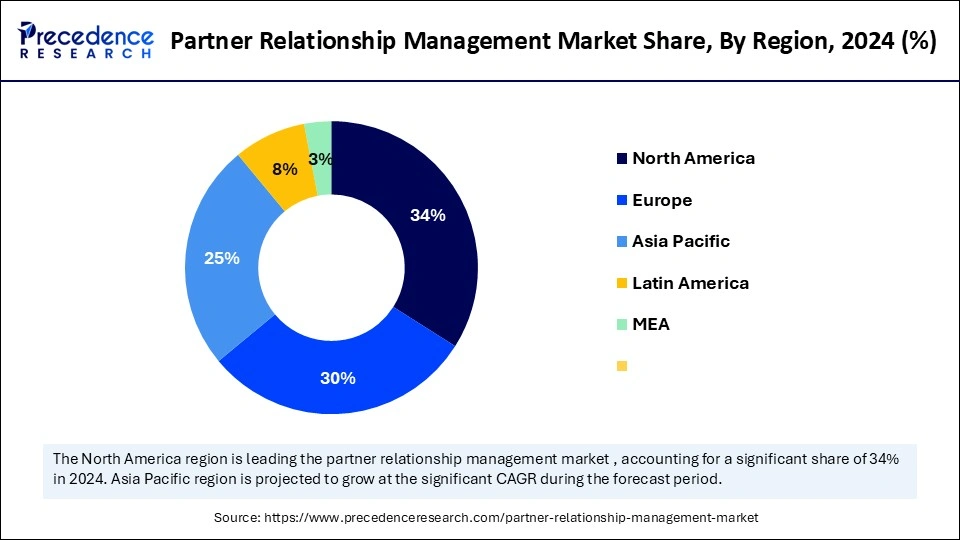

- North America held the biggest revenue share of 34% in 2024.

- Asia Pacific is expected to witness the fastest growth throughout the forecast period.

- By component, the software segment dominated the market by holding a 62.50% share in 2024.

- By component, the services segment is expected to grow at the highest CAGR of 14.80% in 2024.

- By deployment mode, the cloud-based segment held a 55.30% market share in 2024 and is expected to grow at the highest CAGR of 13.90% over the forecast period.

- By organisation size, the large enterprises segment led the market by holding 47.60% market share in 2024.

- By organisation size, the small enterprises segment is expected to grow at the highest CAGR of 14.50% in 2024.

- By channel type, the distributors segment dominated the market with a 21.70% share in 2024.

- By channel type, the technology & strategic alliances segment is expected to have the highest CAGR of 15.20% in 2024.

- By business function, the partner onboarding & enablement segment held an 18.90% market share in 2024.

- By business function, the incentive & loyalty program management segment is expected to grow at the highest CAGR of 14.70% in 2024.

- By industry vertical, the IT & telecom segment led the market by holding 23.50% market share in 2024.

- By industry vertical, the healthcare & life sciences segment is expected to grow at the highest CAGR of 15.30% in 2024.

How AI is Impacting the Partner Relationship Management Market?

AI is revolutionizing the market for partner relationship management by enhancing partner interactions, streamlining workflows, and improving data-driven decision-making. Businesses are now leveraging AI-powered analytics to gain insights into partner performance, customer demand trends, and market opportunities. Through AI, PRM platforms can offer predictive analytics, helping businesses identify high-performing partners and allocate resources effectively. Chatbots and Virtual Assistants provide instant support to partners, resolving queries and offering training resources. AI automates lead distribution, enhancing lead scoring and routing and ensuring partners receive high-potential sales opportunities. Additionally, with AI-driven automation and predictive intelligence, PRM systems are empowering businesses to enhance their partner ecosystems, resulting in greater efficiency, transparency, and revenue growth.

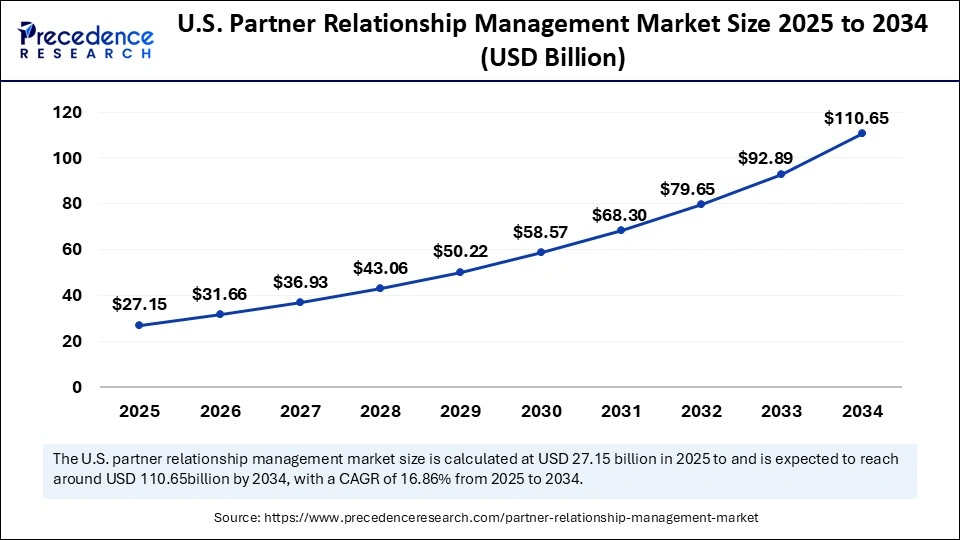

U.S. Partner Relationship Management Market Size and Growth 2025 to 2034

The U.S. partner relationship management market size was exhibited at USD 23.28 billion in 2024 and is projected to be worth around USD 110.65 billion by 2034, growing at a CAGR of 16.86% from 2025 to 2034.

North America dominated the global market by holding more than 34% of revenue share in 2024. This is mainly due to the increased technological advances and the presence of major PRM solution providers. There is a heightened adoption of advanced technologies, including PRM solutions, among businesses to improve operations. Many businesses in the region rely on channel partner networks, bolstering regional market growth.

The U.S. leads the North American partner relationship management market, with businesses across various industries investing in PRM solutions to enhance partner collaboration and increase sales. The country's robust IT infrastructure and a strong focus on digital transformation further support the market's growth. There is rising adoption of AI-driven PRM solutions, enabling businesses to leverage data analytics for better partner performance insights.

Asia Pacific is likely to experience the fastest growth in the coming years. The growth of the market in Asia Pacific is attributed to rapid digitalization and the expansion of the IT sector. The region is witnessing rapid digital transformation, with businesses adopting cloud-based PRM solutions to manage diverse and widespread partner networks effectively. Countries like India and China are major contributors to the market, with a surge in tech-savvy population and a growing number of IT and telecom enterprises. These companies are focusing on optimizing collaborations and communications with their channel partners. Moreover, Japan's partner relationship management market is expanding as companies seek to enhance partner collaborations to support international expansion and innovation.

Europe is considered to be a significantly growing area. The partner relationship market in Europe is growing steadily, with organizations focusing on improving partner engagement and operational efficiency. The region's emphasis on data protection and privacy encourages the adoption of PRM solutions that comply with stringent regulations. The UK is a major player in the European market, with businesses investing in PRM solutions to navigate the complexities of post-Brexit trade relationships and to strengthen their positions in the global market. European companies are increasingly integrating PRM systems to gain a comprehensive view of partner and customer interactions. This integration facilitates better decision-making and enhances the overall efficiency of partner management strategies.

Market Overview

Partner relationship management solutions are essential for businesses looking to streamline collaboration with channel partners, distributors, and resellers. These platforms enhance partner onboarding, communication, sales tracking, and performance management. The partner relationship management market is experiencing substantial growth, driven by the increasing need for seamless partner collaboration, automation, and data-driven decision-making. Businesses are prioritizing cloud-based PRM solutions that offer scalability, integration with CRM and ERP systems, and AI-powered insights. The market is seeing strong adoption across IT & telecom, BFSI, retail, and manufacturing sectors. The growing demand for AI-driven PRM platforms to optimize partner engagement and sales further supports market growth. Expansion of SaaS-based PRM solutions also contributes to market growth. These solutions provide businesses with flexibility and cost efficiency. Integration of PRM with customer experience (CX) tools offers a unified view of partner and customer interactions

Top Countries for PRM Adoption

| Top 5 countries | Advancements | Aim/Focus |

| U.S. | AI driven PRM adoption, cloud-based solutions. | Enhancing sales and automation |

| Germany | Integration of PRM with ERP/CRM systems | Improving partner engagement |

| UK | AI-enabled predictive analytics for PRM | Strengthening indirect sales channels |

| China | Growth in SaaS-based PRM solutions | Expanding reseller and distributor networks |

| India | Rising adoption in mid-sized enterprises | Digital transformation of partnerships |

Top 5 products

| Companies | Products |

| Salesforce | Partner Relationship Cloud |

| Oracle | Oracle PRM cloud |

| Microsoft | Microsoft Partner Center |

| Zinfi | Unified Channel Management |

| Impartner | Impartner PRM Suite |

Partner Relationship Management Market Growth Factors

- The increasing need for businesses to optimize their channel partner programs boosts the growth of the market.

- Companies are investing in PRM solutions to enhance partner collaboration and communication, boosting the market's growth.

- The rising emphasis on data-driven decision-making supports market growth. PRM provides a partner's data that enables companies to make informed decisions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 424.82 Billion |

| Market Size in 2025 | USD 106.47 Billion |

| Market Size in 2024 | USD 91.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.62% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Deployment, Organization Size, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for AI-driven PRM Solutions

The rising demand for AI-driven PRM solutions is a major factor driving the growth of the partner relationship management market. Businesses are increasingly adopting AI-powered PRM solutions to enhance partner engagement, automate workflows, and optimize performance tracking. AI enables personalized partner experiences and predictive analytics, helping businesses identify the most profitable partner relationships. AI-powered PRM solutions improve partner analytics, lead management, and engagement strategies.

Recently, Microsoft introduced AI-driven predictive analytics in its Partner Center to help businesses identify high-value channel partners.

Restraint

Data Security & Compliance Challenges and High Costs

As PRM platforms handle sensitive partner and customer data, businesses face challenges related to data privacy, compliance, and cybersecurity risks. Managing GDPR, CCPA, and other regulations adds complexity to PRM adoption, limiting the growth of the partner relationship management market. In addition, implementing PRM solutions requires substantial investments in software and training, impacting the market's growth.

Opportunity

Expansion of PRM in Emerging Markets

Developing regions like India, Southeast Asia, and Latin America are witnessing rapid digital transformation, leading to increased adoption of PRM software among SMEs and mid-sized businesses. The demand for affordable and localized PRM solutions is on the rise. There is a high demand for SaaS-based solutions as they provide cost-effective and scalable partner management tools. PRM platforms are being integrated with ERP, CRM, and marketing automation tools to create a unified partner management ecosystem.

In March 2025, a leading PRM provider, Zinfi Technologies, expanded its operation in India and Brazil, offering customized SaaS-based PRM solutions for regional businesses.

Component Insights

The software segment dominated the market by holding a 62.50% share in 2024. The dominance of the segment can be attributed to the growing need for enhanced efficiency and streamlined partner management, along with the ongoing shift towards cloud-based solutions. Also, PRM software offers a centralized and secure portal for partners to access company resources and tools.

The services segment is expected to grow at the highest CAGR of 14.80% in 2024. The growth of the segment can be credited to the growing demand for specialized expertise and the rising demand for ongoing support and maintenance. Furthermore, businesses often need specialized solutions to fulfil unique channel programs, a task generally handled by experienced service providers.

Service Insights

The training & consultation services segment held the largest share of the partner relationship management market in 2024. As businesses adopt PRM solutions, there is a heightened demand for training programs and consulting services to effectively implement and utilize these systems. This trend is particularly notable among small and medium-sized enterprises (SMEs) seeking to optimize partner relationships.

The managed services segment is anticipated to grow at a remarkable CAGR throughout the forecast period, as organizations increasingly outsource the management of their partner ecosystems to specialized providers. This approach allows companies to focus on core competencies while ensuring efficient partner collaboration and performance monitoring. In addition, managed services allow organizations to adapt quickly to changing partner needs.

Deployment Insights

The cloud-based segment held a 55.30% market share in 2024 and is expected to grow at the highest CAGR of 13.90% over the forecast period. This is mainly due to the increased use of cloud-based PRM solutions. Businesses often preferred these solutions for their enhanced scalability, cost-effectiveness, and ease of integration with existing systems. Organizations prefer cloud deployments to facilitate real-time collaboration and data access across geographically dispersed partner networks

Organization Size Insights

The cloud-based segment held a 55.30% market share in 2024 and is expected to grow at the highest CAGR of 13.90% over the forecast period. This is mainly due to the increased use of cloud-based PRM solutions. Businesses often preferred these solutions for their enhanced scalability, cost-effectiveness, and ease of integration with existing systems. Organizations prefer cloud deployments to facilitate real-time collaboration and data access across geographically dispersed partner networks.

Channel Type Insights

The distributors segment dominated the market with a 21.70% share in 2024. The dominance of the segment can be credited to the rising adoption of cloud-based PRM solutions and the growing need for streamlined partner operations and improved efficiency.PRM platforms provide robust analytics features that track KPIs, identify trends, and offer insights into partner performance.

The technology & strategic alliances segment is expected to have the highest CAGR of 15.20% in 2024. The growth of the segment can be linked to the rising channel partner networks, coupled with the need for streamlined collaboration and digital transformation activities.PRM vendors form partnerships and alliances to improve their service offerings and expand market reach.

Business Function Insights

The partner onboarding & enablement segment held an 18.90% market share in 2024. The dominance of the segment can be driven by its ability to offer digital access to resources by supporting PRM platforms. This segment is important for boosting trust, fuelling partner performance, and revenue by ensuring partners feel empowered.

The incentive & loyalty program management segment is expected to grow at the highest CAGR of 14.70% in 2024. This emphasizes cultivating relationships with individuals and businesses such as distributors, resellers, and affiliates, through incentives and rewards to encourage their engagement to boost long-term brand loyalty.

Industry Vertical Insights

The IT & telecom segment led the market by holding 23.50% market share in 2024. IT and telecom companies are the largest adopters of PRM solutions, driven by the need to manage extensive partner networks, streamline operations, and enhance customer experiences. With the increased digitization, the adoption of cloud-based PRM solutions has increased among IT and telecom businesses to enhance communication and collaboration among various stakeholders.

The healthcare & life sciences segment is expected to grow at the highest CAGR of 15.30% in 2024. The growth of the segment is due to the growing adoption of AI and cloud-based PRM alternatives globally, along with the key benefits such as enhanced regulatory compliance through controlled access and data security, leading to further segment growth.

Application Insights

The IT & telecom segment led the partner relationship management market with the largest share in 2024. IT and telecom companies are the largest adopters of PRM solutions, driven by the need to manage extensive partner networks, streamline operations, and enhance customer experiences. With the increased digitization, the adoption of cloud-based PRM solutions has increased among IT and telecom businesses to enhance communication and collaboration among various stakeholders.

The BFSI segment is expected to grow at the fastest rate in the upcoming period. BFSI institutes are rapidly embracing PRM solutions to strengthen partnerships, improve service delivery, and navigate complex regulatory landscapes. The increasing emphasis on customer-centric approaches and digital banking initiatives contributes to the growth of this segment.

Partner Relationship Management Market Companies

- Allbound

- Channeltivity

- Oracle

- Salesforce

- Impartner

- LogicBay

- Magentrix

- ZINFI Technologies

- Zift Solutions

- Mindmatrix

- PartnerStack

- ChannelXperts

- Creatio

- AppDirect

Recent Developments

- In January 2025, ZINFI Technologies, Inc. launched the next-generation Partner Relationship Management (PRM) platform. This newly launched AI-driven platform enhances the partner experience through hyper-personalization, allowing brands to configure, deploy, and manage partner operations more efficiently than ever.

In February 2024, Zift Solutions announced the launch of ZiftONE AI Assistant. This industry's first generative AI solution assists partners with content discovery and guidance for an enhanced partner portal experience that boosts productivity, giving suppliers a competitive edge.

Segments Covered in the Report

By Component

- Software / Solutions

- Partner Onboarding & Training

- Deal Registration

- Partner Portal / Dashboard

- Lead Management

- Incentives & Commission Management

- Partner Marketing Management

- Business Planning & Forecasting

- Sales & Performance Analytics

- Content & Document Management

- Partner Collaboration Tools

- Compliance & Risk Management

- Mobile Access & Alerts

- Services

- Consulting Services

- Integration & Implementation

- Training & Support

- Managed Services

- Custom Development Services

By Deployment Mode

- Cloud-Based

- On-Premise

- Hybrid

By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

By Channel Type

- Distributors

- Value-Added Resellers (VARs)

- System Integrators

- Managed Service Providers (MSPs)

- Independent Agents & Brokers

- Technology & Strategic Alliances

- Franchise Partners

- Retailers & Resellers

- OEM Partners

- Referral Partners

- Consultants & Freelancers

By Business Function

- Partner Onboarding & Enablement

- Sales Performance Management

- Channel Marketing & Co-Branding

- Training & Certification

- Deal & Lead Management

- Contract & Legal Compliance

- Relationship & Communication Management

- Incentive & Loyalty Program Management

- Forecasting & Pipeline Visibility

- Multi-Tier Partner Management

By Industry Vertical

- IT & Telecom

- Banking, Financial Services & Insurance (BFSI)

- Automotive

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Education

- Media & Entertainment

- Travel & Hospitality

- Logistics & Transportation

- Construction & Real Estate

- Professional Services (including Wealth Management, Consulting)

- Public Sector & Government

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting