Pass-by Noise Testing Market Size and Forecast 2025 to 2034

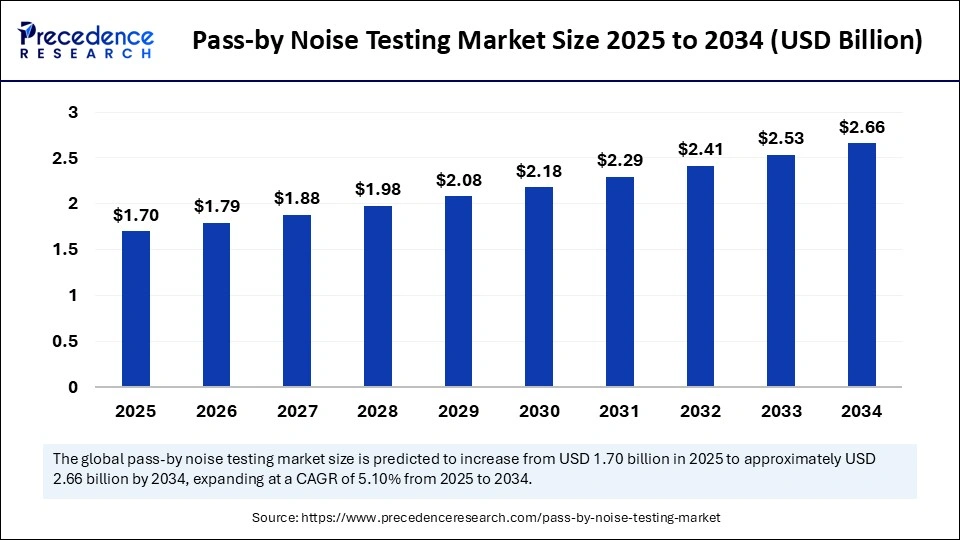

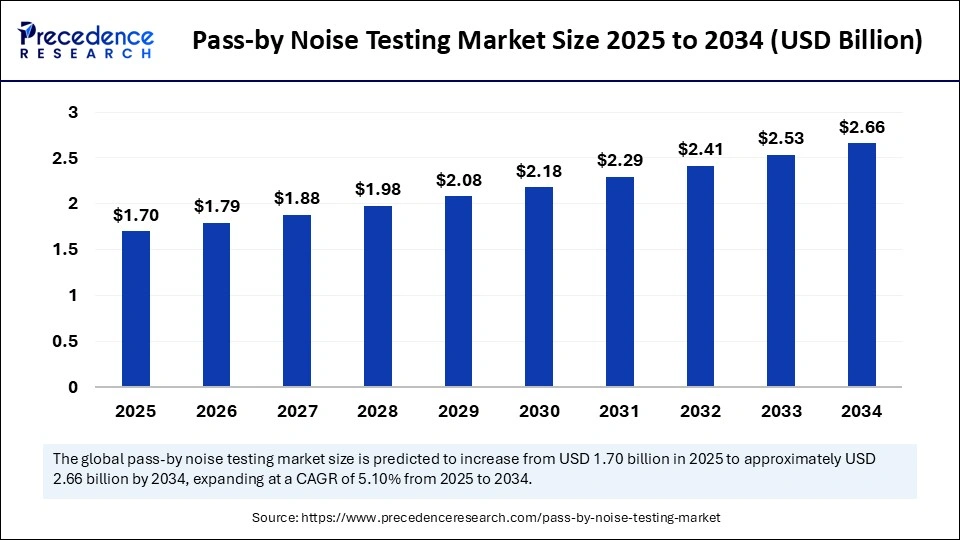

The global pass-by noise testing market size accounted for USD 1.62 billion in 2024 and is predicted to increase from USD 1.70 billion in 2025 to approximately USD 2.66 billion by 2034, expanding at a CAGR of 5.10% from 2025 to 2034. The growth of the market is driven by the rising focus on lowering noise pollution. Moreover, stringent regulations imposed by governments to reduce noise from vehicles are likely to contribute to the growth of the market.

Pass-by Noise Testing Market Key Takeaways

- In terms of revenue, the pass-by noise testing market is valued at $1.70 billion in 2025.

- It is projected to reach $2.66 billion by 2034.

- The market is expected to grow at a CAGR of 5.10% from 2025 to 2034.

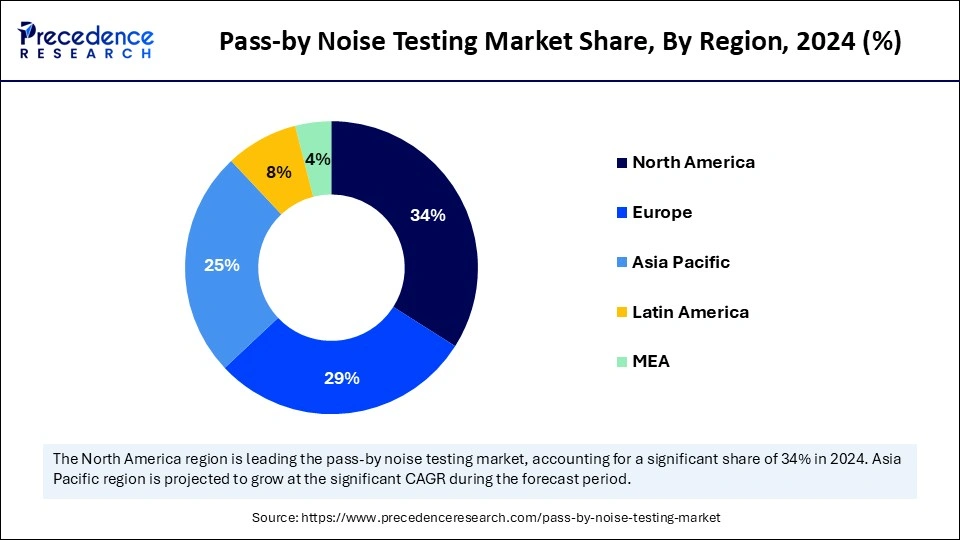

- North America held the major market share of 34% in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the upcoming period.

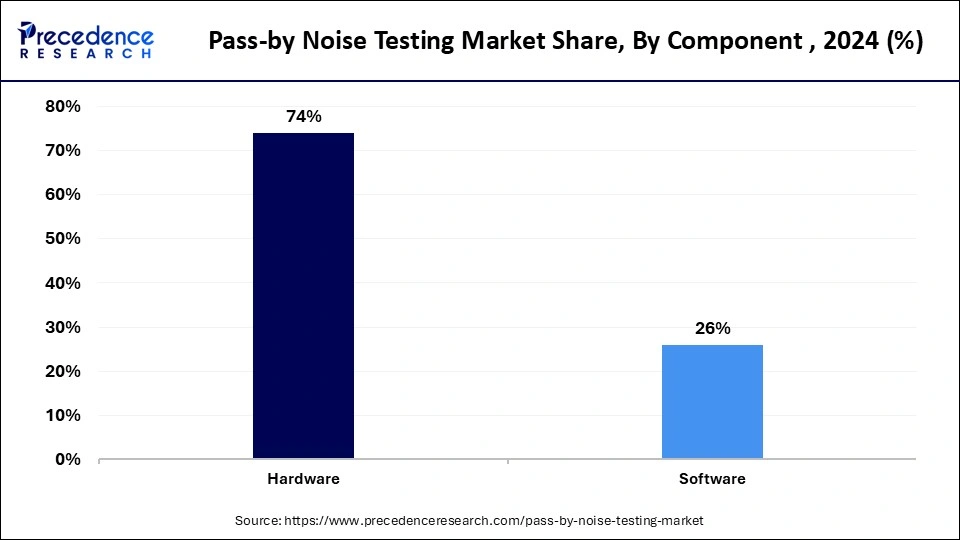

- By component, the hardware segment led the market in 2024.

- By component, the software segment is likely to grow at the fastest rate between 2025 and 2034.

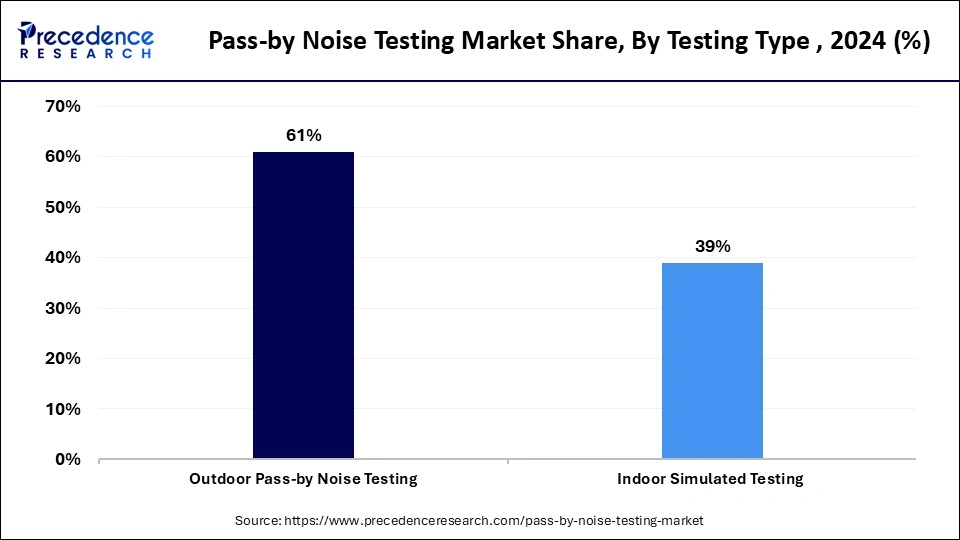

- By testing type, the outdoor pass-by noise testing segment contributed the biggest market share of 61% in 2024.

- By testing type, the indoor simulated testing segment is projected to grow at a solid CAGR during the forecast period.

- By end-use industry, the automotive & transportation segment dominated the market with the largest share in 2024.

- By end-use industry, the aerospace & defense segment is projected to grow at the fastest rate in the coming years.

How does AI Impact the Pass-by Noise Testing Market?

Artificial intelligence (AI) is likely to revolutionize the market for pass-by noise testing by enhancing automation and data analysis. AI algorithms analyze huge amounts of data to identify noise patterns. They also automate various aspects of testing, such as data collection and processing, reducing human intervention and enhancing efficiency. AI-driven microphones and sensors identify sound waves, distinguish between the various types of sounds, and identify patterns and anomalies in sound data that are difficult for humans to recognize. This means that the data collected by AI-powered sensors and microphones is much more precise and reliable. AI enables real-time noise monitoring, accurate noise source identification, proactive noise reduction strategies, and improved compliance with environmental regulations. It also facilitates data-driven decision-making and enhances community relations.

U.S. Pass-by Noise Testing Market Size and Growth 2025 to 2034

The U.S. pass-by noise testing market size was exhibited at USD 413.1 million in 2024 and is projected to be worth around USD 692.86 million by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

The North America region accounted for the highest market share of 74% in 2024. This is mainly due to its robust automotive industry, with the increased adoption of electric vehicles. Governments around the region have imposed stringent noise emission regulations. This significantly increased the need for regular testing and validation of vehicle noise levels. The region has a robust industrial base, with the growth of the aerospace, defense, and transportation industries contributing to noise pollution. The increased concerns regarding noise pollution further bolstered the growth of the market in the region.

The U.S. leads the market for pass-by noise testing. There is a strong emphasis on integrating cutting-edge technologies and reducing noise emissions from vehicles. The increasing noise pollution and the rising adoption of vehicles further bolster the growth of the market.

Asia Pacific is expected to witness significant growth during the forecast period. With rapid urbanization and industrialization, noise pollution is rising in the region. As a result, governments of various Asian countries have imposed regulations on industries to reduce noise. This, in turn, boosts the demand for pass-by noise testing. China is expected to have a stronghold on the pass-by noise testing market. The increasing vehicle production in the country is a key factor boosting the demand for pass-by noise testing. India is emerging as a major player. The burgeoning volume of traffic on the roads, rising construction activities, and the growth of manufacturing plants in the country are contributing to the growth of the market.

Market Overview

Pass-by-noise testing is an outdoor test that is used for both vehicle development and certification. Pass-by noise testing includes acceleration tests, constant speed tests, and static tests for a standstill vehicle on a dedicated test track. In automotive production, pass-by measurements are used to confirm that manufactured vehicles meet specific standards of noise and quality. Automobile manufacturers and researchers quantify the pass-by noise of vehicles to collect data about the noise profile of vehicles. This supports detecting and addressing challenges related to undesirable vibrations or noise. The pass-by noise testing market is witnessing significant growth due to strict norms imposed by governments and regulatory bodies on the automotive industry to reduce noise emissions.

Pass-by Noise Testing Market Growth Factors

- Increasing concerns regarding noise pollution are a major factor boosting the growth of the market. Noise pollution disturbs ecosystems and affects the behavior of wildlife. This leads to habitat loss, lowers biodiversity, and increases stress levels in fauna. To address such challenges, the demand for pass-by noise testing is increasing.

- Rising vehicle production is expected to boost the growth of the market. As the production of vehicles rises, so does the need for testing to comply with regulatory standards. This, in turn, boosts the demand for pass-by noise testing.

- Technological advancements in testing equipment and methodologies further contribute to the growth of the pass-by noise testing market. Innovations such as advanced sensors significantly enhance the accuracy of pass-by noise testing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.66 Billion |

| Market Size in 2025 | USD 1.70 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Testing Type, End Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Regulatory Compliance and High Acceptance in the Automotive Industry

With the increased traffic noise, concerns regarding public health issues in urban areas have arisen. Traffic noise may lead to ailments like sleep disorders, headaches, elevated blood pressure, and cardiovascular disease. In response, governments around the world have implemented stringent regulations on the automotive industry, mandating pass-by noise testing for vehicle noise certification. For instance, the European Union's "Pass-By" noise regulations aimed at reducing noise pollution from vehicles by setting maximum noise levels. These regulations are part of the EU's broader strategy to reduce noise pollution across member states. Such regulations encouraged automotive manufacturers to integrate pass-by noise testing. This testing not only ensures compliance with regulations but also provides a comprehensive assessment of vehicle performance and safety. As a result, the need for precise and reliable noise testing is increasing in the automotive industry.

Restraint

High Costs and Technical Complexities

Establishing a pass-by noise testing facility requires significant investments in testing equipment and infrastructure. This test requires sophisticated instruments such as sound level meters, telemetry radios, data loggers, and trigger systems like laser light barriers or GPS data loggers. However, these instruments are costlier, creating barriers for small-scale testing companies. Moreover, pass-by noise testing is a complex procedure, requiring expertise with detailed knowledge. This may limit the growth of the market.

Opportunity

ASQ Technique Unlocks Advanced Capabilities

The increasing adoption of Airborne Source Quantification (ASQ) creates a significant opportunity in the pass-by noise testing market. ASQ allows precise pass-by noise analysis through the separation of individual noise sources in vehicles. This modern technique offers critical insights into the acoustic loads of each sub-system by leveraging operational microphone signals placed near noise sources and applying robust matrix inversion technology based on local noise transfer functions. By providing precise quantification of airborne noise contributions, ASQ increases diagnostic capabilities, supports regulatory compliance, and empowers OEMs and testing facilities to optimize vehicle noise performance.

Component Insights

The hardware segment held the largest market share of 74% in 2024. Hardware components such as sound level meters, microphones, sensors, GPS data loggers, transducers, and signal conditioners are essential in accurately measuring and recording the emission of noise during passing tests. The hardware system is designed to enable automatic operation of a complete active noise control system. Hardware provides solutions and tools to decrease and manage undesirable sound. Advancements in sensor technology led to the development of sophisticated pass-by noise testing instruments, bolstering segmental growth.

The software segment is likely to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to the rising need for automation in testing. Software helps in the analysis of acoustic data, identifying noise patterns. It automates various tasks such as data collection and processing, reducing human errors. Software significantly enhances the precision and accuracy of pass-by noise testing.

Testing Type Insights

The outdoor testing segment dominated the pass-by noise testing market by holding more than 61% in 2024, as it transforms environmental noise assessment. Outdoor pass-by noise testing integrates sophisticated technology with consumer-friendly features, making it an important tool. It has the ability to simulate real-world conditions. It is suitable for testing a wide range of vehicles. It is used to measure traffic noise. The increased concerns about traffic noise bolstered the growth of the segment.

The indoor simulated testing segment is expected to expand at a rapid pace during the forecast period. This noise testing helps mitigate noise and confirm compliance with stringent regulations. It simulates noise measurements in a controlled environment, preventing disturbance to nearby residences. Schools, nursing homes, and hospitals can benefit from indoor noise testing to maintain a quiet and conducive environment for patients, residents, and students. The growing demand for a quieter workplace further boosts the growth of the segment.

End-Use Industry Insights

The automotive & transportation segment held the largest share of the pass-by noise testing market in 2024. Automobile manufacturers can measure the pass-by noise of vehicles to gather information about a vehicle's noise profile. This helps in identifying and addressing issues related to unwanted noise or vibrations. Pass-by noise regulations are instrumental in mitigating the environmental impact of vehicle noise pollution, specifically in densely populated urban regions. Pass-by noise testing also ensures vehicle safety and performance by measuring velocity, engine RPM, and maximum vehicle exterior noise. The increased production and sales of electric vehicles contributed to segmental growth.

The aerospace & defense segment is projected to grow at the fastest rate in the coming years. The increasing need to reduce cabin noise and enhance passenger experience is boosting the demand for pass-by noise testing in the aerospace industry. This testing is important for analyzing noise levels of aircraft and confirming compliance with noise regulations. It is also essential in the defense sector to measure noise and ensure military vehicles function effectively in noisy environments.

Recent Development

- In December 2024, PIMIC unveiled the Clarity NC100, a Deep Neural Network (DNN)-based Environmental Noise Cancellation (ENC) chip that sets a new benchmark for performance and edge AI compute efficiency. Working in partnership with Taiwan-based MEMS microphone developer ZillTek, at CES 2025 the Californian company will present an integrated edge AI chip and digital microphone designed to address noise cancellation challenges in a single package.

Pass-by Noise Testing Market Companies

- m+p international Mess- und Rechnertechnik GmbH (Germany)

- Anthony Best Dynamics Limited (UK)

- National Instruments Corp. (U.S.)

- Brüel & Kjær (Denmark)

- Siemens (Germany)

- HEAD Acoustics GmbH (Germany)

- IMC Test & Measurement GmbH (Germany)

- Prosig Ltd. (UK)

- GRAS Sound & Vibration (Denmark)

- Dewesoft d.o.o. (Slovenia)

- Benstone Instruments USA (U.S.)

- ESI Group (France)

- Thermotron Industries (U.S.)

- Kistler Group (Switzerland)

- IMV Corporation (Japan)

- Econ Technologies, Inc. (U.S.)

- Polytec GmbH (Germany)

Segments Covered in the Report

By Component

- Hardware

- Sensors & transducers

- Analyzers

- Meters

- Data acquisition systems

- Signal conditioners

- Shakers & controllers

- Software

By Testing Type

- Outdoor Pass-by Noise Testing

- Indoor Simulated Testing

By End Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Power Generation

- Consumer Electronics

- Construction

- Industrial Equipment

- Mining & Metallurgy

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting