Patient Temperature Monitoring Market Size and Forecast 2025 to 2034

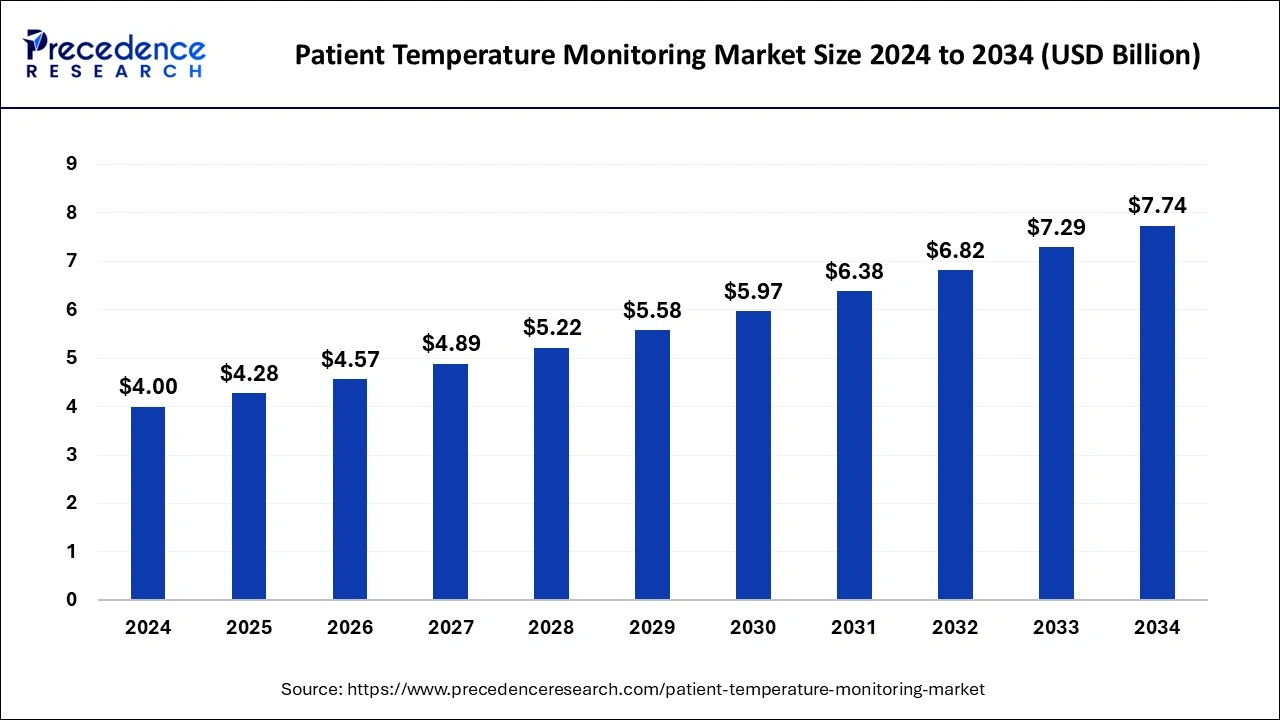

The global patient temperature monitoring market size accounted for USD 4.00 billion in 2024 and is expected to exceed around USD 7.74 billion by 2034, growing at a CAGR of 6.82% from 2025 to 2034.

Patient Temperature Monitoring Market Key Takeaways

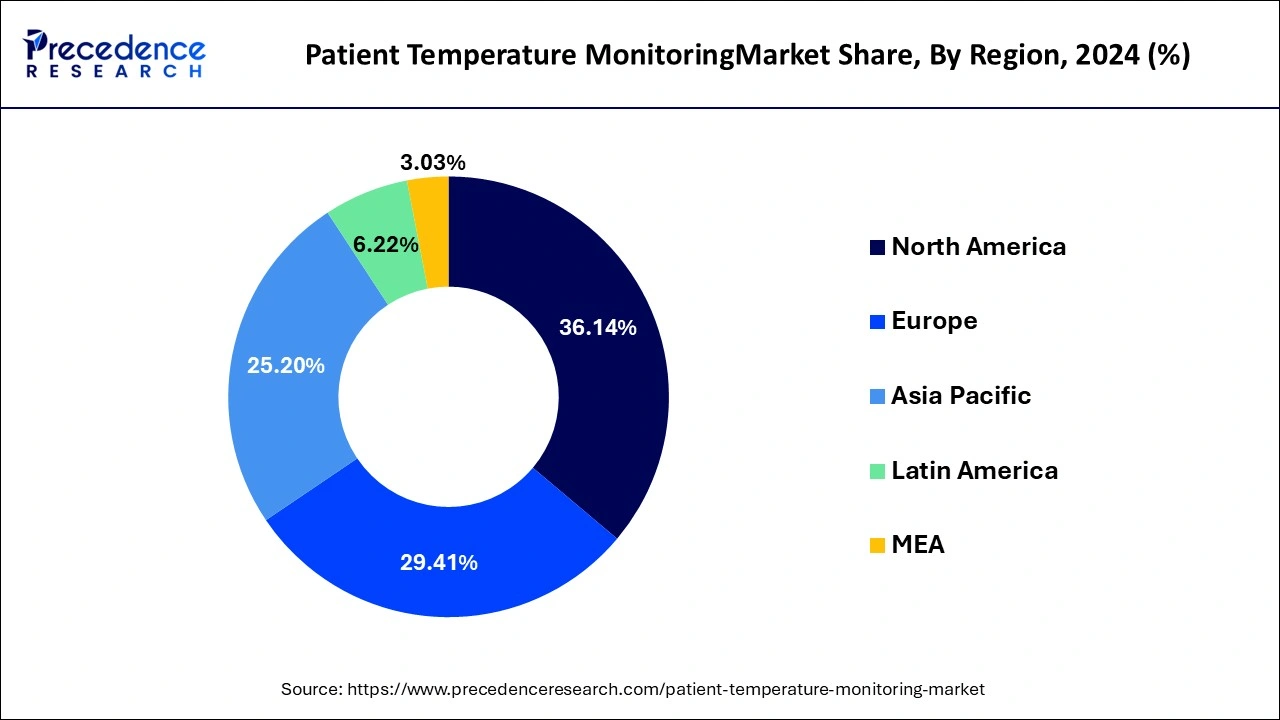

- The North America region accounted for 36.14% of revenue share in 2024.

- By product, the handheld temperature monitoring devices segment has captured a 36.5% revenue share in 2024.

- By application, the pyrexia/fever category has held the biggest share of about 31.7% in 2024.

- By end user, the hospitals segment accounted for 45% of the total revenue share in 2024.

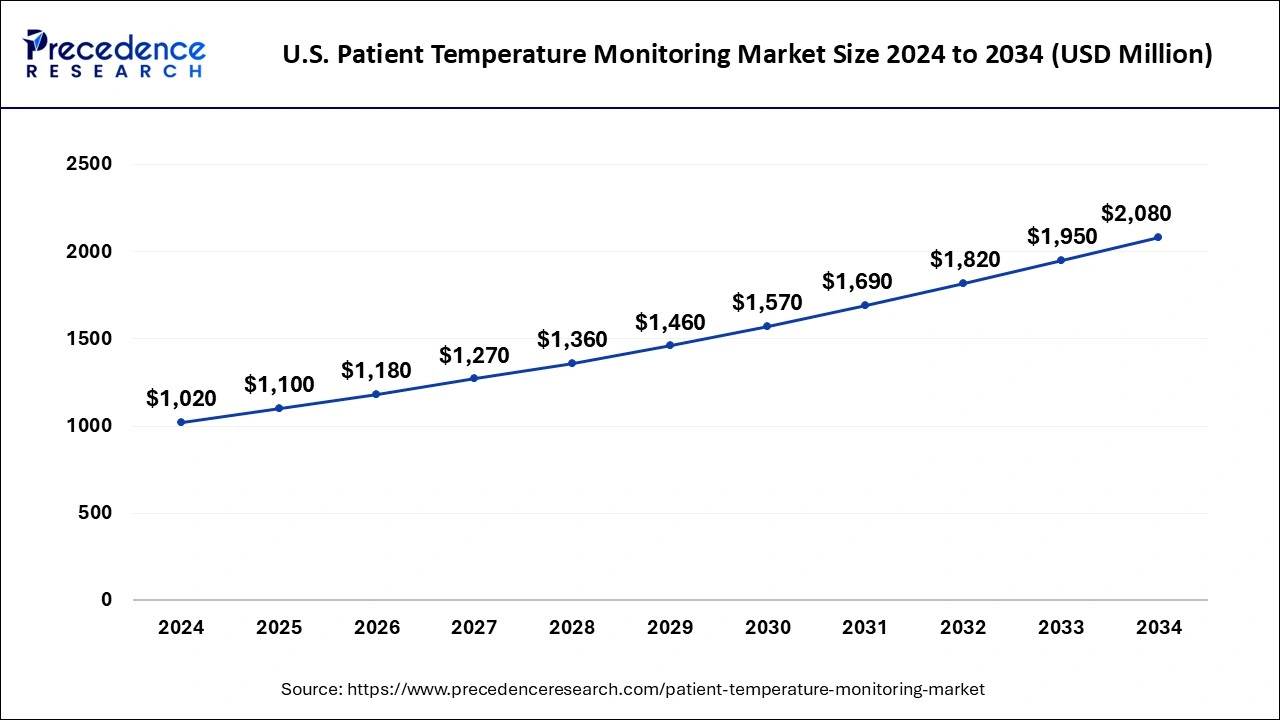

U.S. Patient Temperature Monitoring Market Size and Growth 2024 to 2033

The U.S. patient temperature monitoring market size was exhibited at USD 1,020 million in 2024 and is projected to be worth around USD 2,080 million by 2034, growing at a CAGR of 7.39% from 2025 to 2034.

The North America region's domination is due to the rising incidence of infectious diseases including COVID-19, influenza, and other illnesses, which has boosted the use of temperature monitoring systems. For instance, 3.8 million confirmed cases of COVID-19 were recorded in the United States in July 2020, according to the Centers for Disease Control and Prevention. Additionally, the existence of major businesses working in this area will increase sales of temperature monitoring systems. The market in Europe is expected to expand significantly as a result of increased financing for digital thermometer clinical studies. Due to rising public awareness of the need of temperature control during the coronavirus pandemic and the penetration of businesses to meet the market's unmet demands, the Asia Pacific market is predicted to have a higher CAGR. For instance, Secureye introduced a non-contact thermometer as part of their MediSec product line in India in June 2020.

Due to the relatively lower adoption of the devices, Latin America, the Middle East, and Africa are predicted to hold a smaller market share for temperature monitoring systems.

Market Overview

An essential factor in illness diagnosis is the rise in temperature, which is a frequently seen indicator during viral infection or many other serious health disorders. Increased frequency of infectious and chronic diseases and growing public awareness of the value of temperature monitoring are two factors driving the patient temperature monitoring market. In the upcoming years, it is also projected that an increase in technological and distribution collaborations would fuel market expansion.

The market's expansion is being hampered by emerging nations' high prices for sophisticated temperature monitoring equipment. The expanding healthcare sector's infrastructure and the incorporation of cutting-edge technology platforms into procedures for temperature monitoring present profitable business chances to market participants. Changes in a patient's body temperature are a result of circumstances specific to that patient's condition. To preserve its built-in defenses, the human body regulates its interior temperature. Other clinical signs such as hyperthermia or hypothermia, the presence of an infection, and the analysis of antimicrobial drugs serve to emphasize the importance of continuous temperature monitoring. These benefits are expected to speed up the use of thermometers throughout the forecast timeframe. The majority of people are quickly switching from traditional treatment to preventative care in both developed and developing nations.

Healthcare organizations and individuals all over the world are embracing the idea of preventative care and a holistic wellness strategy to address problems related to health. This state-of-the-art strategy for preventative care includes regular doctor visits, immunizations, prescription medications, and testing. The continual observation of patient temperature is one of the main elements of preventative medicine. Additionally, government representatives focus on implementing these preventative measures in order to slow or halt the spread of disease. For instance, to maintain track of these important body vital signs, the Centers for Disease Control and Prevention advise all corporate units to check the employees' body temperatures each day. It is widely anticipated that the market expansion during the forecast period would be driven by the increasing emphasis on preventative care and ongoing temperature monitoring.

The majority of people are quickly switching from traditional treatment to preventative care in both developed and developing nations. The notion of preventative care and a holistic wellness approach is being adopted by healthcare organizations and individuals worldwide to manage illnesses connected to health. This cutting-edge approach to preventative care involves scheduled medical visits, prescription drugs, vaccinations, and tests. For instance, to maintain track of these important body vital sign, the Centers for Disease Control and Prevention advise all corporate units to check the employees' body temperatures each day. It is widely anticipated that the market expansion during the forecast period would be driven by the increasing emphasis on preventative care and ongoing temperature monitoring.

Patient Temperature Monitoring Market Growth Factors

Increased frequency of infectious and chronic diseases and growing public awareness of the value of temperature monitoring are two factors driving the patient temperature monitoring market. In the upcoming years, it is also projected that an increase in technological and distribution collaborations would fuel market expansion. The market's expansion is being hampered by emerging nations' high prices for sophisticated temperature monitoring equipment. The expanding healthcare sector's infrastructure and the incorporation of cutting-edge technology platforms into procedures for temperature monitoring present profitable business chances to market participants.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.28 Billion |

| Market Size in 2024 | USD 4.00 Billion |

| Market Size by 2034 | USD 7.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Application, and End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increasing demand for noncontact sensor-based thermometer

- One of the main drivers of market expansion is technical progress, such as the creation of the Bluetooth non-contact infrared thermometer. A number of industry players are introducing Bluetooth non-contact infrared thermometers, which is expected to fuel market growth. The company developed a low-cost, high-performance wall mount for a non-contact infrared thermometer. The market for patient temperature monitoring is therefore anticipated to benefit from this trend during the course of the forecast period.

Increasing population and growing prevalence of infectious diseases

- The population of the globe is now expanding quickly, at a pace of about 1.03% year. Increased human density is associated with population expansion, which promotes the transmission of infectious illnesses and viruses. Tuberculosis (TB), SARS-COVID, malaria, dengue, pneumonia, whooping cough, and HIV are now the most common infectious illnesses in the world as of 2021, and their prevalence is predicted to rise globally. The people most at risk for these illnesses are the elderly and children. Fluctuations in body temperature are common symptoms of several viral disorders. As a consequence, prompt temperature monitoring can lead to effective illness diagnosis and treatment.

Key Market Challenges

- Lack of knowledge about non-invasive and continuous temperature monitoring devices - The main barriers to their adoption are a lack of knowledge among physicians and other healthcare professionals about advancements made by manufacturers and a shortage of skilled workers who can process and operate these devices.

Key Market Opportunities

- Growth chances in emerging markets - It is anticipated that companies in the patient temperature monitoring market would have considerable development possibilities in developing markets in nations like India, Brazil, and Mexico. Numerous manufacturers are concentrating on various acquisitions and partnerships with domestic companies for product delivery and production in order to address the rising demand for temperature monitoring in growing countries. Additionally, the fiercer competition in established countries will force firms to concentrate more on developing markets in Asia Pacific and America.

- Increase prevalence of the Covid-19 pandemic - The globe has been severely affected by the sly new coronavirus disease (COVID-19) pandemic, which has killed hundreds of thousands of people and caused great suffering in its wake. Temperature checks have become more popular as a non-invasive method of quickly screening people for raised body temperatures as one typical tactic to avoid transmission (i.e., fever). That stop the spread of SARS-CoV-2, several large infrared fever screening systems, no-contact temperature screening at building and hospital entryways, and wearable gadgets to continually monitor individual temperatures have all been used. The worldwide containment effort also includes temperature screening for SARS-CoV-2.

Product Insights

The market is split into analog temperature monitoring devices and digital temperature monitoring devices based on the kind of product. In 2023, the category of digital temperature monitoring devices is in the lead. Timely product approvals are to blame for the market segment's good position. Additionally, because of social distance limits put in place to reduce infection rates, the rise in demand for gadgets during the pandemic led to the increased sales volume of digital systems.

Due to the shift in people's preference for embracing digital systems, analog temperature monitoring devices are predicted to expand more slowly than digital devices. Additionally, it is projected that the digital thermometer would continue to dominate during the projection period and post a higher CAGR. For instance, DetelPro announced the introduction of its digital thermometer in June 2020. In light of the epidemic, the corporation introduced this device to hasten the spread of digital thermometers to every family.

Type Insights

During the projection period, the non-invasive temperature monitoring sector is anticipated to have a profitable growth rate. This is a result of the growing collaboration between different businesses to produce these products. For instance, in May 2020, TCL and Segun Life, a well-known manufacturer of wearables and medical products, will introduce infrared digital thermometers to support the fight against COVID-19 in India.

The sector for invasive temperature monitoring is predicted to rise significantly over the course of the projection period, mostly as a result of the rising incidence of COVID-19 cases and the severe social segregation and home security measures that have resulted. As a result, the segment is projected to rise as more people embrace thermometers for prompt monitoring of body temperature.

End-User Insights

Due to the increased usage of thermometers with a goal to maximize patient care during the COVID-19 pandemic, the healthcare facilities segment is anticipated to have a fantastic growth rate over the projection period. For instance, demand for infrared thermometers reached its high in March 2020 as a result of the abrupt onset of COVID-19 illness. Additionally, rising hospital patient visits are predicted to accelerate the segment's growth during the anticipated time period. Due to the increased use of thermometers by individuals for personal use during the pandemic, the home care environment is predicted to experience considerable growth throughout the projection period. This was supported by the government's implementation of the social estrangement standards.

Recent Developments

- Exrgen Corporation introduces the TAT-2000 Temporal Artery Thermometer, a brand-new, reasonably priced thermometer that uses cutting-edge infrared technology to measure temperature precisely.

- Drager created TcoreTM, which uses a special dual-sensor heat flux technology, has a quick ramp-up time, and continually and precisely determines core body temperature. All that is needed is a straightforward, self-adhesive sensor applied to the patient's forehead.

Patient Temperature Monitoring Market Companies

- Cardinal Health Inc. (US)

- 3M (US)

- Koninklijke Philips N.V. (Netherlands)

- Drägerwerk (Germany)

- Hill-Rom Holdings, Inc. (US)

- Becton, Dickinson and Company (US)

- Omron Healthcare Inc. (Japan)

- Masimo Corporation

- (US), Braun GmbH (Germany)

- Terumo Corporation (Japan)

- Paul Hartmann AG

- (Germany), Beurer GmbH (Germany)

- Microlife (Taiwan)

- Omega Engineering (US)

- iHealth (US)

- Briggs Healthcare (US)

Segments Covered in the Report

By Product

- Smart Temperature Monitoring Patches

- Table-Top Temperature Monitoring Devices

- Non-invasive Vital Sign Monitoring Devices

- Continuous Core Body Temperature Monitoring Devices

- Wearable Continuous Monitoring Sensors

- Handheld Temperature Monitoring Devices

- Mercury Thermometers

- Digital Thermometer

- Infrared Thermometer

- Invasive Temperature Monitoring Devices

By Type

- Non-invasive Temperature Monitoring

- Tympanic Membrane Temperature Monitoring

- Oral Temperature Monitoring

- Axillary and Temporal Artery Temperature Monitoring

- Invasive Temperature Monitoring

- Rectal Temperature Monitoring

- Esophageal Temperature Monitoring

- Nasopharynx Temperature Monitoring

- Urinary Bladder Temperature Monitoring

By Application

- Blood Transfusion

- Hypothermia

- Anesthesia

- Pyrexia/Fever

- Others

By End-User

- Hospitals

- Emergency Rooms

- Intensive Care Units

- Operating Rooms

- Ambulatory Care Centres

- Nursing Facilities

- Home Care Settings

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting