What is PCR-Based Transplant Diagnostics Market Size?

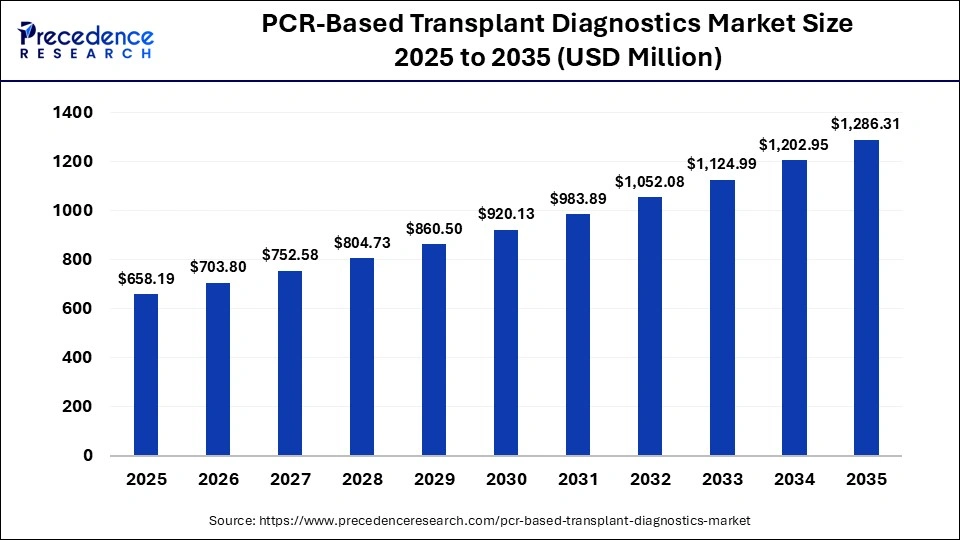

The global PCR-based transplant diagnostics market size was calculated at USD 658.19 million in 2025 and is predicted to increase from USD 703.8 million in 2026 to approximately USD 1,286.31 million by 2035, expanding at a CAGR of 6.93% from 2026 to 2035. The market is expanding due to rising organ transplant procedures, demand for rapid infection detection, and technological improvements in PCR assays, enhancing patient outcomes and reducing post-transplant complications.

Market Highlights

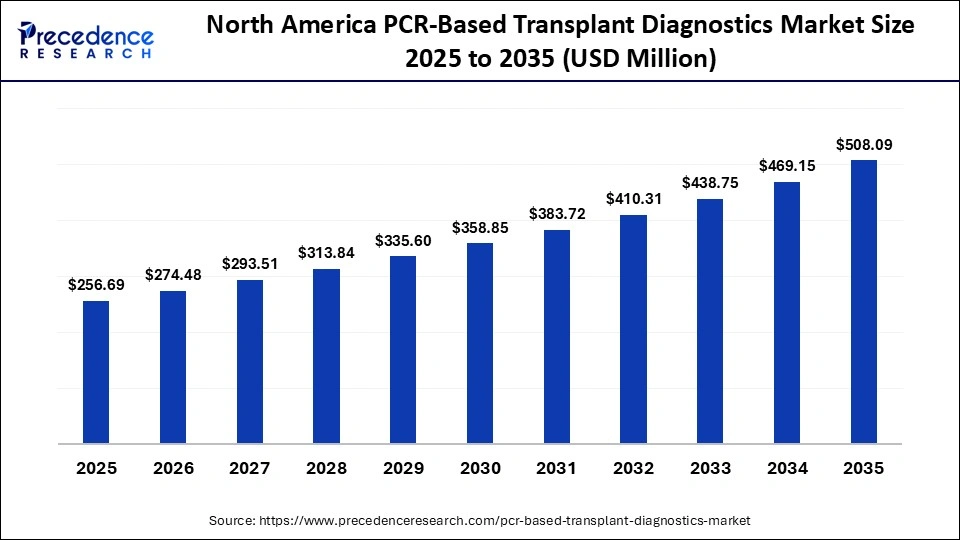

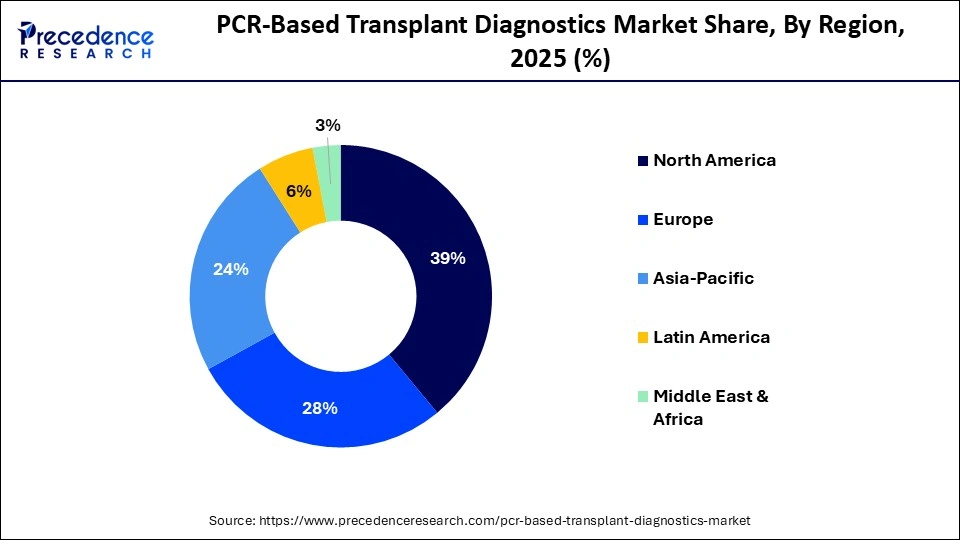

- North America led the PCR-based transplant diagnostics market with approximately 39% market share in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR in the market between 2026 and 2035.

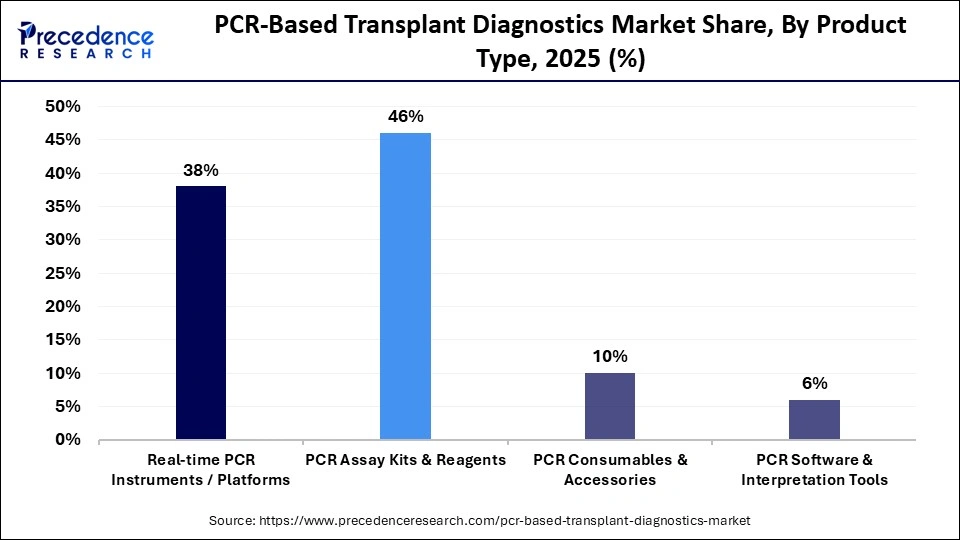

- By product type, the PCR assay kits & reagents segment dominated the market with approximately 46% market share in 2025.

- By product type, the PCR software & interpretation tools segment is expected to grow at a strong CAGR during 2026 and 2035.

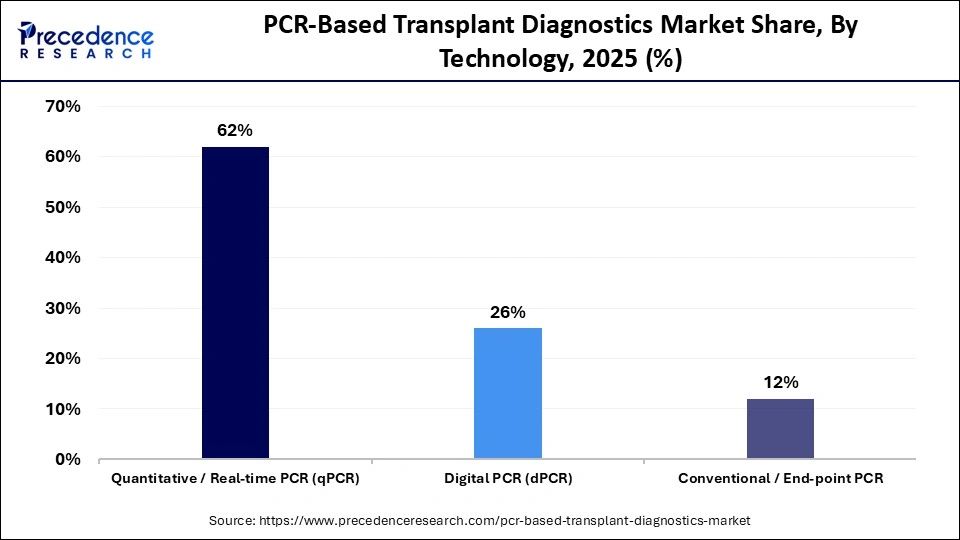

- By technology, the quantitative/real-time PCR (qPCR) segment captured the largest revenue share of approximately 62% in 2025.

- By technology, the digital PCR (dPCR) segment is expected to expand at the highest CAGR during the forecast period.

- By diagnostic application, the infection monitoring & surveillance segment led the market with a share of approximately 36% in 2025.

- By diagnostic application, the post-transplant monitoring segment is expected to grow at a solid CAGR between 2026 and 2035.

- By end-user, the hospitals & transplant centers segment accounted for the highest market share of approximately 48% in 2025.

- By end-user, the reference & specialized labs segment is expected to expand rapidly from 2026 to 2035.

Why are PCR-Based Transplant Diagnostics Gaining Significance?

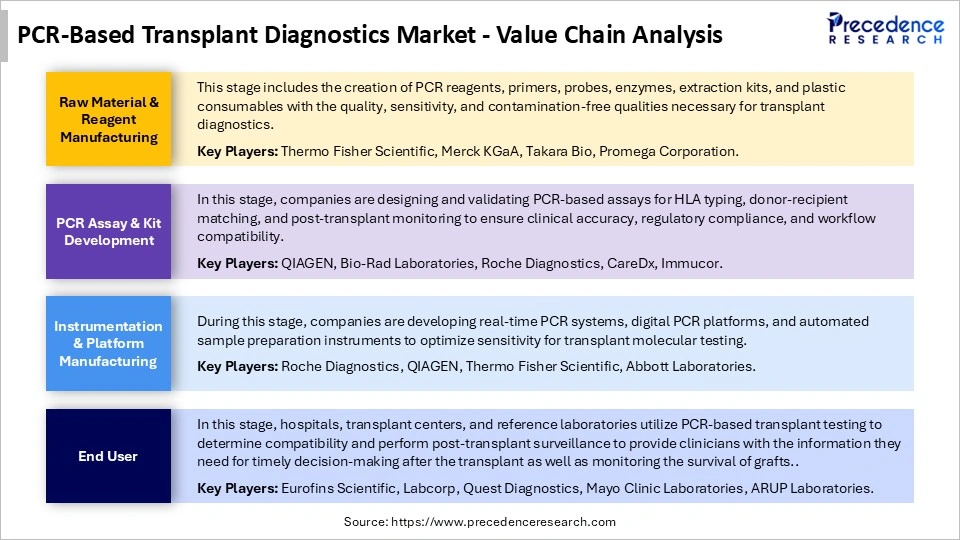

The global PCR-based transplant diagnostics market comprises polymerase chain reaction (PCR)–based instruments, assay kits, reagents, software, and services used to detect, quantify, and monitor infections, donor/recipient compatibility markers, graft rejection signals, and other molecular indicators across pre- and post-transplant workflows. Applications include HLA/compatibility testing, viral load monitoring (CMV, BK), chimerism analysis, pharmacogenomic guidance, and longitudinal graft surveillance.

The market growth can be attributed to many factors, including the increasing number of transplants performed, increased knowledge regarding antibody-mediated rejection, and the move towards personalized care for transplant recipients. The adoption of PCR-based diagnostic tests by transplant centers is increasing because they offer faster turnaround times and are more accurately and reliably standardized than traditional methods.

Advances in technology, such as real-time PCR, digital PCR, and automated technology, are also providing additional accuracy in testing and improving workflow efficiency. In addition, the increase in transplant programs that are expanding in developing countries and the increasing emphasis on monitoring the long-term success of grafts will continue to drive market growth in the future.

AI-Driven Innovation Reshapes PCR-Based Transplant Diagnostics Market

Artificial intelligence (AI) is revolutionizing the market for PCR-based transplant diagnostics by increasing speed, accuracy, and operational effectiveness, all vital factors for timely organ rejection, detection, and patient care. AI-supported platforms currently provide real-time, machine-learning-accelerated interpretation of PCR results with enhanced transparency to satisfy regulatory requirements, thereby increasing regulatory confidence and ensuring compliance.

- In January 2026, Thermo Fisher's AI development partnership with NVIDIA to support laboratory automation and predictive analytics enabled companies to differentiate themselves through scalable, data-driven solutions.

From a business standpoint, these advances not only create improved reliability of diagnostics and increased efficiency of laboratory workflow processes but also create substantial new revenue opportunities in the personalized monitoring of transplants and subsequently position AI as one of the pivotal competitive drivers within the molecular diagnostics marketplace.

Key Trends Driving the PCR-Based Transplant Diagnostics Market

- Automation and New Technologies - Automated molecular diagnostic technologies and real-time PCR assays increase the speeds and sensitivities of detection of infectious and post-transplant complications, thus improving clinical decision-making and workflow productivity within the transplant diagnostic arena.

- Increasing Utilization of Molecular Diagnostics- There is an increased utilization of PCR with next-generation molecular diagnostics, which results in increased accuracy for HLA typing and immune monitoring, allowing for improved personalized organ transplant care and greater success rates of transplanted tissue.

- Less Invasive Monitoring - The increasing development of less invasive methods for monitoring transplant recipients using PCR and other molecular technologies enables more frequent low-risk monitoring of transplant recipients; thus reducing the need for invasive diagnostic procedures and increasing patient comfort.

- Connecting PCR Diagnostics to Digital Systems- The connection of PCR diagnostic systems to lab information systems/electronic medical records through digital dashboard technologies supports the timely flow of clinical information, the timely interpretation of clinical information, and predictive analytics relating to transplants and transplant-related clinical workflows.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 658.19 Million |

| Market Size in 2026 | USD 703.8 Million |

| Market Size by 2035 | USD 1,286.31 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.93% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology, Diagnostic Application, End User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

How the PCR Assay Kits & Reagents Segment Dominated the Market?

The PCR assay kits and reagents segment held a dominant position in the PCR-based transplant diagnostics market with a share of approximately 46% in 2025, because of their continuous use for research purposes. Assay kits & reagents have established a consistent presence in the regular use of routine testing in transplant procedures to track potential infections before and after transplants, track viral loads before and after transplants, and help to assess the risk of transplant rejection.

The PCR software tools & interpretation tools segment is expected to grow at the fastest CAGR in the market between 2026 and 2035 due to the rapid move towards automated transplant diagnostic methods with data analysis capabilities. New data analytics, standardized interpretation of results, and integration of laboratory information systems are driving rapid adoption of these products by many of the larger volume transplant laboratories.

Technology Insights

Which Technology Segment Dominated the Market?

The quantitative/real-time PCR (qPCR) segment held a major revenue share of approximately 62% in the PCR-based transplant diagnostics market in 2025, because of its reliability, speed, and the extent to which it is clinically used in transplant laboratories. It has many valuable applications, including infection monitoring, measuring viral loads, and determining compatibility between donors and recipients, where both rapid turnaround times and reproducibility are critical. In addition, there are many existing clinical guidelines for its use, and it is included in almost every assay, making it the most cost-effective technology for routine transplant diagnostic workflows.

The digital PCR (dPCR) is expected to grow with the highest CAGR in the market during the studied years, with its ability to detect low copies of nucleic acid with high sensitivity and precision. Thus, it is very useful for assessing graft rejection at the earliest stages after transplantation, detecting the presence of minimal residual disease, and accurately measuring viral loads. As transplant protocols evolve to focus on earlier interventions and personalized risk assessment. There will be an increasing number of laboratories that make use of digital PCR technology, especially in advanced or research-based transplant programs.

Diagnostic Application Insights

Which Diagnostic Application Segment Led the PCR-Based Transplant Diagnostics Market?

The infection monitoring & surveillance segment led the market with a share of approximately 36% in 2025 because transplant patients are especially susceptible to opportunistic infections. Therefore, PCR technology helps detect viruses like CMV, BK virus, and EBV quickly so that timely treatment can occur. Ongoing monitoring will also allow patients who have been recently transplanted to have access to a continued source of testing through their entire recovery from transplantation and will be a critical part of transplant patient care protocols.

The post-transplant monitoring segment is expected to expand rapidly in the market in the coming years, as physicians move toward a greater focus on the long-term viability of grafts and patient-specific management. The ability to perform PCR chimerism analysis and to monitor viral loads allows physicians to identify complications early, before clinical symptoms develop. With improvements in assay sensitivity and an increase in transplantation survival rates, the demand for ongoing molecular monitoring will continue to expand beyond the early post-surgery period.

End User Insights

Which End User Segment Dominated the Market in 2025?

The hospitals & transplant centers segment accounted for the highest revenue share of approximately 48% in the PCR-based transplant diagnostic market in 2025 because of their active participation in organ transplantation procedures. Hospitals/transplant centers have immediate involvement in making diagnostic decisions and need access to rapid, on-site PCR testing to provide prompt support for matching donors with recipients, screening potential donors for infection, and detecting early rejection. Integrated laboratory infrastructure and multidisciplinary transplant teams have given hospitals/transplant centers an additional impetus to adopt PCR-based diagnostic solutions in-house.

The reference & specialty labs segment is expected to gain the highest market share between 2026 and 2035 as the trend toward increasing test complexity and outsourcing has increased. These labs process a large number of high-precision assays, perform many sophisticated progressive molecular tests, process large amounts of tests from multiple hospitals, and increasingly rely on experts at a central location for expertise, cost optimization, and to meet the demand for highly sensitive post-transplant monitoring assays. These factors are the primary drivers behind the strong growth in this category of user groups.

Regional Insights

How Big is the North America PCR-Based Transplant Diagnostics Market Size?

The North America PCR-based transplant diagnostics market size is estimated at USD 256.69 million in 2025 and is projected to reach approximately USD 508.09 million by 2035, with a 7.07% CAGR from 2026 to 2035.

Why North America Dominated the PCR-Based Transplant Diagnostics Market?

North America dominated the global market in 2025. With strong clinical infrastructure, high adoption of molecular testing, and increasing integration of precision medicine within transplant care, PCR diagnostics are routinely used by healthcare institutions looking to perform the earliest possible detection of graft rejection or infectious complications using highly sensitive PCR assays.

Both clinicians and patients have high levels of awareness regarding the importance of obtaining timely diagnostic insights when managing transplant recipients, and, as such, there is a high volume of use. Collaborative research efforts between biotechnology companies and clinical centers also help to maintain and accelerate innovation. Established reimbursement models exist for diagnostic test technologies, and regulations are broad-based and supportive toward diagnostic test technologies, leading to rapid clinical adoption.

What is the Size of the U.S. PCR-Based Transplant Diagnostics Market?

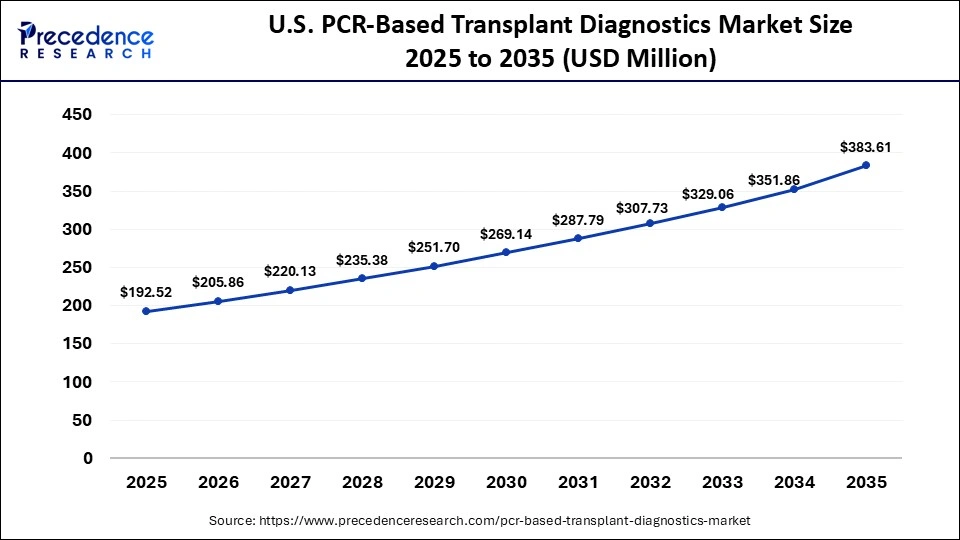

The U.S. PCR-based transplant diagnostics market size is calculated at USD 192.52 million in 2025 and is expected to reach nearly USD 383.61 million in 2035, accelerating at a strong CAGR of 7.14% between 2026 to 2035.

U.S. PCR-Based Transplant Diagnostics Market Trends

The U.S. leads in North America as a result of its large number of transplant centers and broad history of developing and validating diagnostic assays. The U.S. healthcare system is also based upon the principles of providing state-of-the-art patient care by utilizing the most advanced molecular diagnostic technology to provide routine use of PCR-based assays within transplant medicine.

Academic hospitals and clinical research institutions collaborate extensively in developing and optimizing PCR protocols and procedures for transplantation, which serve as the applicable standard for transplant medicine globally. The U.S. is home to an extensive biotechnology industry that supports the continual development and marketing of new PCR diagnostics and reagents, thereby contributing to improved clinical outcomes for patients and further solidifying the U.S. preeminence in transplant diagnostics.

How is Asia-Pacific Growing in the PCR-based Transplant Diagnostics Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. This growth is being driven by improvements in healthcare access, an increase in the prevalence of chronic diseases, and a growing number of organ transplants performed. Significant investments in healthcare infrastructure and laboratory capabilities have led to rapid improvements for major economies. Both governmental and private healthcare providers are investing in existing and new diagnostic technologies to keep pace with increasing clinical demand.

The establishment of strategic initiatives targeted at expanding the laboratory network and introducing advanced PCR diagnostic technologies is a key contributor to the rapid growth of transplant diagnostic products. There is a diverse patient population with unmet medical needs within the region that provides a conducive environment for the expansion of transplant diagnostic solutions.

China PCR-Based Transplant Diagnostics Market Trends

China has emerged as a dominant player in the region, with significant upgrades of hospital diagnostic facilities and research institutions, positioning the country well for growth. The large population in China and the increasing number of transplant procedures being performed have created a strong demand for reliable diagnostic tools. Biotech companies within China are providing PCR kits for transplant diagnostics, and there is a movement toward standardizing molecular testing amongst clinical centers. Collaborative efforts between public health organizations and clinicians are helping to promote the use of best practices, positioning China to lead the Asia Pacific region in transplant diagnostic advancements.

PCR-Based Transplant Diagnostics Market Value Chain Analysis

Who are the Major Players in the Global PCR-Based Transplant Diagnostics Market?

The major players in the PCR-based transplant diagnostics market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Eurofins Viracor, LLC., F. Hoffmann-La Roche Ltd., Quest Diagnostics Inc., CareDx, Inc., QIAGEN N.V., Becton, Dickinson and Company, Illumina, Inc., Luminex Corporation, Adaptive Biotechnologies Corporation, GenDx, and Hologic Inc.

Recent Developments in the PCR-Based Transplant Diagnostics Market

- In September 2024, QIAGEN introduced the QIAcuityDx digital PCR system for clinical oncology testing, offering precise absolute quantitation and efficient workflows for liquid biopsies and cancer monitoring in clinical labs across North America and the EU. (Source: https://corporate.qiagen.com)

- In June 2024, Omixon announced the launch of HoloGRAFT ONE, a research-use-only donor-derived cell-free DNA kit and software for post-transplant monitoring, simplifying digital PCR workflows and enhancing the detection of donor DNA in transplant recipients. (Source: https://www.omixon.com)

Segments Covered in the Report

By Product Type

- Real-time PCR Instruments/Platforms

- PCR Assay Kits & Reagents

- PCR Consumables & Accessories

- PCR Software & Interpretation Tools

By Technology

- Quantitative/Real-time PCR (qPCR)

- Digital PCR (dPCR)

- Conventional/End-point PCR

By Diagnostic Application

- Pre-transplant Compatibility Testing

- HLA matching, ABO checks

- Infection Monitoring & Surveillance

- CMV, BK virus, EBV, other opportunistic pathogens

- Graft Rejection Risk Assessment

- Post-Transplant Monitoring (chimerism, viral load quantitation)

- Other Applications

By End-User

- Hospitals & Transplant Centers

- Clinical & Diagnostic Laboratories

- Reference & Specialized Labs

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting