What is the Kidney Transplant Market Size?

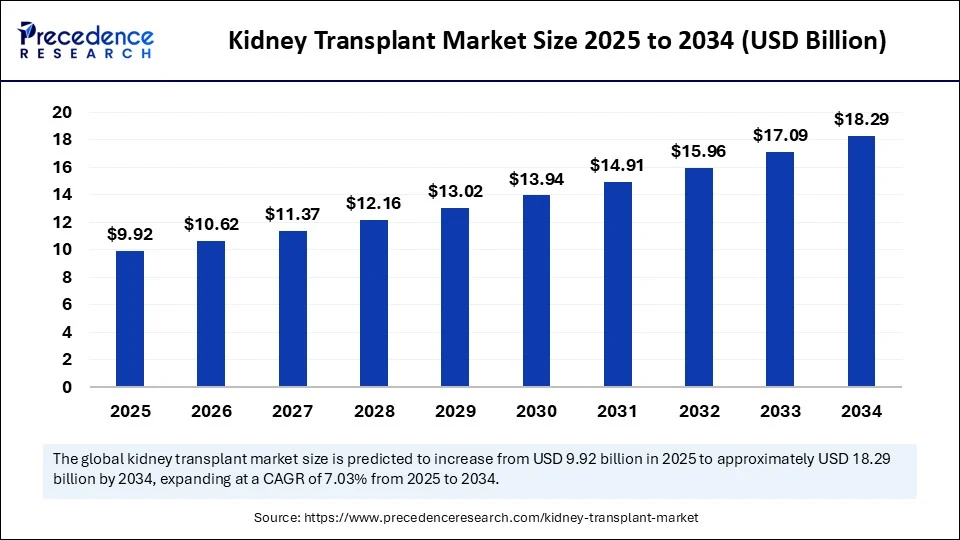

The global kidney transplant market size is accounted atUSD 9.92 billion in 2025 and is predicted to increase from USD 10.62 billion in 2026 to approximately USD 18.29 billion by 2034, expanding at a CAGR of 7.03% from 2025 to 2034. The market is witnessing significant growth because of the rising incidence of end-stage renal disease, increased success rates of transplant procedures, advances in immunosuppressive therapies, and improved surgical techniques. Additionally, rising organ donation programs are expected to support continued market expansion.

Kidney Transplant Market Key Takeaways

- In terms of revenue, the global kidney transplant market was valued at USD 9.27 billion in 2024.

- It is projected to reach USD 18.29 billion by 2034.

- The market is expected to grow at a CAGR of 7.03% from 2025 to 2034.

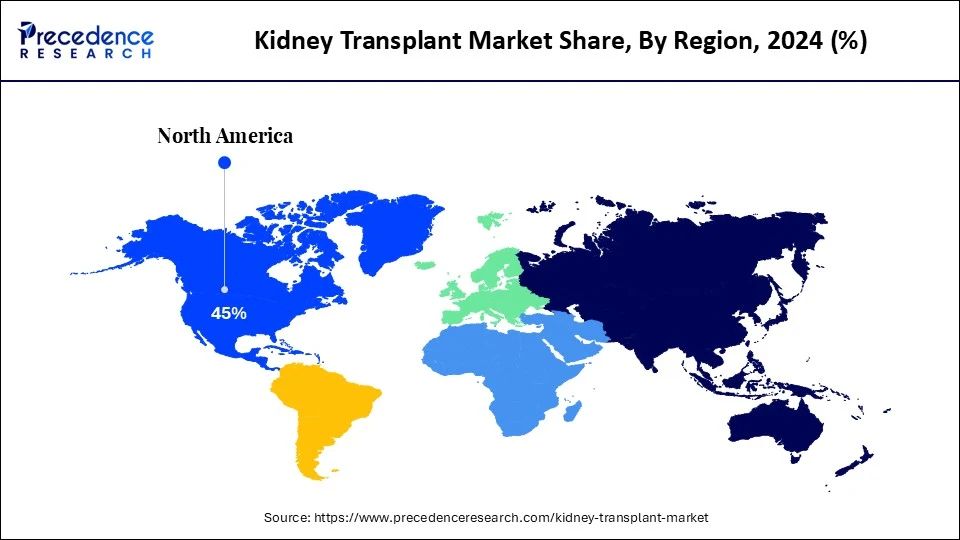

- North America dominated the global kidney transplant market with the largest share of 45% in 2024.

- Asia Pacific region is expected to grow at the fastest CAGR from 2025 to 2034.

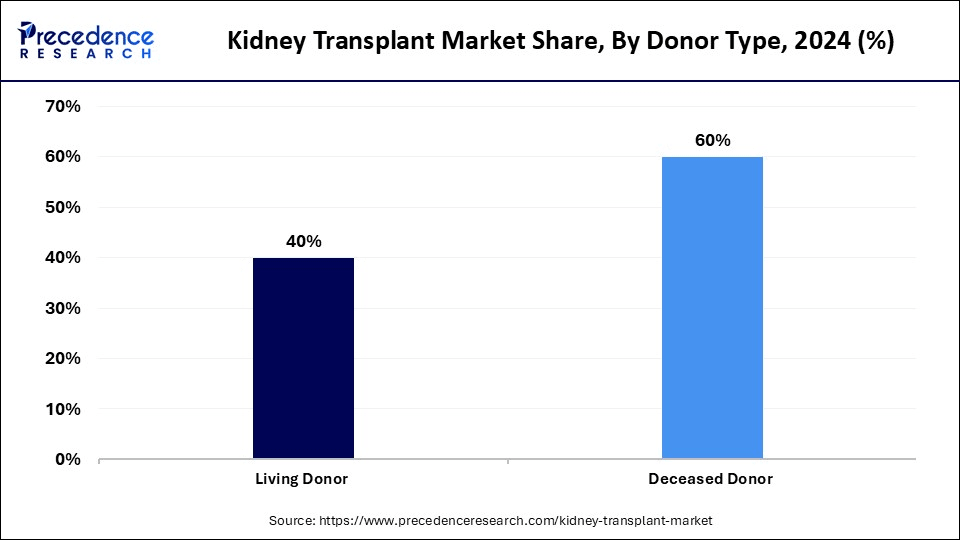

- By donor type, the deceased donor segment captured the biggest market share of 60% in 2024.

- By donor type, the living donor segment is expected to grow at a the fastest CAGR over the forecast period.

- By type of transplant, the non-preemptive kidney transplant segment contributed the largest market share of 70% in 2024.

- By type of transplant, the preemptive kidney transplant segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end user, the hospitals segment dominated the market, under which the public/teaching hospitals sub-segment held the largest share of 55% in 2024.

- By end user, the transplant clinics segment is expected to expand at a significant CAGR from 2025 to 2034.

- By immunosuppressive drug, the maintenance therapy segment led the market, under which the calcineurin inhibitors sub-segment generated the major share of 40% in2024.

- By immunosuppressive drug, the mTOR inhibitors sub-segment is projected to grow at a significant CAGR between 2025 and 2034.

- By organ preservation solution, the University of Wisconsin (UW) solution segment held the biggest market share of 50% in 2024.

- By organ preservation solution, the histidine-tryptophan-ketoglutarate (HTK) solution segment is experiencing rapid growth.

- By equipment/service type, the cross-matching and HLA typing services segment held a significant market share of 35% in 2024.

- By equipment/service type, the organ preservation and transport equipment segment is expected to grow at the fastest CAGR in the coming years.

Market Overview

The kidney transplant market encompasses the array of products, services, procedures, and therapeutics involved in transferring kidneys from donors to recipients with end-stage renal disease (ESRD) or chronic kidney failure. This market includes surgical services, immunosuppressive treatments, organ preservation solutions, devices used during transplants, donor-recipient matching technologies, and post-transplant monitoring solutions. It spans public and private healthcare systems, organ procurement organizations, transplant centers, and biopharmaceutical and device manufacturers. The growth of the market is driven by innovations in surgical techniques like robotic-assisted transplants, organ preservation methods, and immunosuppressive drugs, as well as increased awareness and government initiatives promoting organ donation.

How Can AI Impact the Kidney Transplant Market?

Artificial intelligence (AI) is transforming kidney transplantation by improving donor-recipient matching, predicting transplant outcomes, and optimizing immunosuppression. AI algorithms analyze extensive datasets, including genetic and clinical information, to enhance match accuracy and increase the success rate of transplants. AI models can forecast long-term allograft failure and complications, helping clinicians make better decisions and potentially improving patient outcomes. AI also enables the development of personalized immunosuppressant dosing, minimizing side effects and increasing drug effectiveness.

What are the Key Trends in the Kidney Transplant Market?

- Increased Demand for Immunosuppressive Drugs: Developments in immunosuppressant medications are crucial for preventing organ rejection after transplantation, improving graft survival rates, and enhancing the long-term quality of life for transplant recipients.

- Increased Awareness and Organ Donation:Public awareness campaigns and government initiatives aimed at promoting organ donation are helping to increase the number of available organs for transplantation.

- Innovations in Transplant Procedures:Innovations in surgical techniques like robotic-assisted and laparoscopic kidney transplants are making transplants less invasive, reducing recovery time, and potentially leading to fewer complications, improving the efficiency of the transplant system.

- Improved Organ Preservation:Techniques like normothermic machine perfusion (NMP) are extending the viability of donor kidneys, allowing for longer preservation times and reducing delayed graft function and rejection rates, potentially reducing wait times and improving the efficiency.

- Technological Advancements:Ongoing research and development in areas like 3D bioprinting of kidneys and the use of decellularized ECM scaffolds for bioink and immunosuppressants are improving transplant outcomes and patient survival by paving the way for potential future innovations in kidney transplantation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.29 Billion |

| Market Size in 2026 | USD 10.62 billion |

| Market Size in 2025 | USD 9.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Donor Type, Type of Transplant, End User, Immunosuppressive Drug Class, Organ Preservation Solution, Equipment/Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of End-Stage Kidney Disease and Chronic Kidney Disease

The main driver in the kidney transplant market is the increasing prevalence of end-stage kidney disease (ESKD) and chronic kidney disease (CKD). As these conditions become more common, the demand for kidney transplants as a life-saving treatment increases. An aging global population, along with risk factors like diabetes and hypertension, often linked to lifestyle choices, significantly contributes to this growing demand. Additionally, advances in organ preservation techniques, especially for kidneys, address the need to better preserve organs for transplantation, propelling the growth of the market.

Restraint

Shortage of Donor Organs

A key restraint in the kidney transplant market is the shortage of donor organs, stemming from a significant gap between the demand for kidneys and the limited supply from deceased and living donors. The number of available organs is far below the number of people on waiting lists. Factors include a lack of awareness about organ donation, religious and cultural beliefs, and medical eligibility criteria. This shortage results in longer wait times, higher mortality rates among dialysis patients, and a need for more complex, costly treatments like dialysis.

Opportunity

Xenotransplantation Approaches

Looking ahead, xenotransplantation, particularly using gene-edited pig kidneys and artificial or bioartificial kidneys, presents considerable opportunities in the market. These approaches are driven by the urgent need for more accessible and reliable transplant options, which involve the transplantation of animal organs into humans. The main challenges are the risks of rejection and disease transmission. Artificial and bioartificial kidneys, which can perform some or all of the kidney's functions, include implantable devices and those utilizing living cells. In addition to these, research continues to improve organ preservation solutions, explore strategies to induce immune tolerance, and develop stem cell therapies.

In March 2024, Massachusetts General Hospital (MGH) announced the world's first successful transplant of a genetically edited pig (porcine) kidney into a 62-year-old man with ESKD. Surgeons from the Mass General Transplant Center performed the four-hour procedure, marking a major milestone in increasing organ availability for patients within a respected academic medical system. (Source: https://www.massgeneral.org)

Segment Insights

Donor Type

What Made Deceased Donor the Dominant Segment in the Kidney Transplant Market in 2024?

The deceased donor segment dominated the market by capturing the largest share in 2024, mainly due to the larger organ supply from brain-dead and cardiac-dead donors, despite challenges such as delayed graft function. Advances in organ preservation and minimally invasive surgical techniques also contribute to their dominance. Innovations like the Kidney Pod, which maintains optimal cold temperature during transplantation, are improving graft survival and have earned FDA breakthrough designation for faster market approval. Additionally, genomic data analysis helps improve donor-recipient matching, reducing rejection risk and increasing success rates.

The living donor segment, especially the unrelated living donor sub-segment, is expected to experience the fastest growth in the coming years. This is due to better outcomes, shorter waiting times, and the possibility of pre-emptive transplantation. Living donor kidneys function better and last longer than deceased donor kidneys, with higher success rates and fewer complications such as delayed graft function. They can be scheduled in advance, eliminating long waiting periods, which is especially important for patients with rapidly declining kidney function, leading to improved long-term results.

Type of Transplant Insights

How Does the Non-Preemptive Kidney Transplant Segment Dominate the Kidney Transplant Market in 2024?

The non-preemptive kidney transplant segment dominated the market with a major revenue share in 2024, as this transplant is more feasible for a wider range of patients. In this process, patients begin dialysis before the transplant. This trend is driven by factors like late referrals to transplant centers, limited access to healthcare, and organ availability issues. The gap between organ supply and demand, particularly for deceased donors, means many patients must wait for transplants while on dialysis. Barriers like a lack of awareness and access in certain demographics and regions further delay transplantation. Although these transplants are generally safer and more effective, concerns about surgical risks and long-term immunosuppression effects sometimes lead patients to delay or avoid transplantation.

The pre-emptive kidney transplant segment is expected to grow at a rapid pace in the upcoming period due to its better outcomes compared to post-dialysis transplants. Patients avoid complications associated with dialysis, such as infections, cardiovascular problems, and dietary restrictions. Pre-emptive transplants typically result in lower rejection rates, longer-lasting grafts, and improved overall health, enhancing quality of life and potentially reducing treatment costs. This trend is further fostered by advancements in surgical techniques and a growing emphasis on early referral for transplant evaluation.

End User Insights

Why Did the Hospitals Segment Dominate the Kidney Transplant Market in 2024?

The hospitals segment dominated the market, under which the public/teaching hospitals sub-segment held the largest share in 2024. This is mainly because of lower costs, wider access, and strong infrastructure for complex procedures. Public hospitals often offer kidney transplants at significantly lower costs than private hospitals, making the procedure more accessible to a broader range of patients. Additionally, public hospitals, especially those in larger cities or regions, tend to have a bigger catchment area and serve a more diverse patient population, including those with limited financial resources. Many public hospitals are actively involved in organ donation and transplantation programs, which contribute to a higher volume of transplants.

The transplant clinics segment is expected to experience the fastest growth during the forecast period. This growth is driven mainly by the increasing prevalence of end-stage renal disease (ESRD) and advancements in transplant procedures, as more people require kidney transplants because of factors such as aging populations, diabetes, and hypertension. These clinics are often outfitted with advanced technologies, especially minimally invasive and robotic-assisted surgical equipment, making transplants safer and more attractive to patients. They have expertise in handling complexities in transplantation, attracting more patients. Furthermore, investments from the public and private sectors in organ donation awareness programs support segmental growth.

Immunosuppressive Drug Insights

What Made Maintenance Therapy the Dominant Segment in the Kidney Transplant Market in 2024?

The maintenance therapy segment dominated the market, under which the calcineurin inhibitors sub-segment captured the largest share in 2024. This is mainly due to the effectiveness of calcineurin inhibitors, especially tacrolimus and cyclosporine, in preventing acute rejection and improving graft survival. However, their use is linked to nephrotoxicity and other side effects, prompting strategies to minimize calcineurin inhibitor exposure. These drugs suppress the immune system by inhibiting calcineurin, a protein key to T-cell activation and cytokine production, making them a core part of immunosuppressive regimens due to their potency and proven clinical success. Tacrolimus is often preferred over cyclosporine because of its higher potency, lower occurrence of some side effects, and ability to reverse allograft rejection after cyclosporine treatment.

The mTOR inhibitors sub-segment is expected to grow at the highest CAGR over the projection period. This is mainly because of the potential of mTOR inhibitors, particularly sirolimus and everolimus, to reduce nephrotoxicity associated with traditional immunosuppressants like calcineurin inhibitors. They also offer benefits such as lowering the risk of certain cancers and viral infections. However, their use can cause side effects like hyperlipidemia and mucositis, requiring careful monitoring. Their ability to provide effective immunosuppression offers the potential to reduce or even eliminate the need for CNIs, further decreasing nephrotoxicity.

Organ Preservation Solution Insights

Why did the University of Wisconsin (UW) Solution Segment Dominate the Kidney Transplant Market in 2024?

The University of Wisconsin (UW) solution segment held the largest market share in 2024, due to its effectiveness in preserving organs, especially kidneys, livers, and pancreases, for longer periods. Its unique formula, which includes lactobionate and raffinose, helps reduce tissue damage and maintain organ function, leading to higher transplant success rates. Studies show that the UW solution can lower the rate of primary nonfunction, which occurs when a transplanted organ fails to function immediately after transplant. While UW remains a leading choice, newer solutions like IGL-1 are emerging, offering potential benefits such as reduced ischemia-reperfusion injury.

The histidine-tryptophan-ketoglutarate (HTK) solution segment is expected to grow at a rapid pace in the upcoming period. The HTK solution is valued for its unique composition and benefits in organ preservation, particularly for kidneys. It is a low-potassium, extracellular solution that uses histidine as a buffer, tryptophan to stabilize membranes, and ketoglutarate to support metabolism during preservation. Its low viscosity and ability to decrease primary dysfunction after liver transplants have boosted its usage. HTK has shown comparable patient and graft survival results to the standard UW solution, making it a viable alternative.

Equipment/Service Type Insights

How Does the Crossmatching and HLA Typing Services Segment Lead the Kidney Transplant Market in 2024?

The crossmatching and HLA typing services segment led the market with a significant share in 2024. This is mainly because they directly impact the success rate of transplants by minimizing the risk of rejection. Accurate HLA matching reduces the likelihood of graft-versus-host disease (GVHD), a serious complication where the donor's immune cells attack the recipient's body. The increased use of virtual crossmatching (VXM), an in-silico test, demonstrates the shift towards more efficient and accurate methods, especially beneficial for highly sensitized patients, further solidifying the importance of these services.

The organ preservation and transport equipment segment is likely to grow at the fastest CAGR, under which the hypothermic machine perfusion (HMP) sub-segment is expected to lead the charge. This growth is mainly due to its ability to improve kidney preservation and graft survival compared to traditional static cold storage (CS). These advantages, especially for kidneys from expanded criteria donors (ECDs) and donation after circulatory death (DCD) donors, are driving their adoption as a standard of care, promoting further growth.

Regional Insights

U.S. Kidney Transplant Market Size and Growth 2025 to 2034

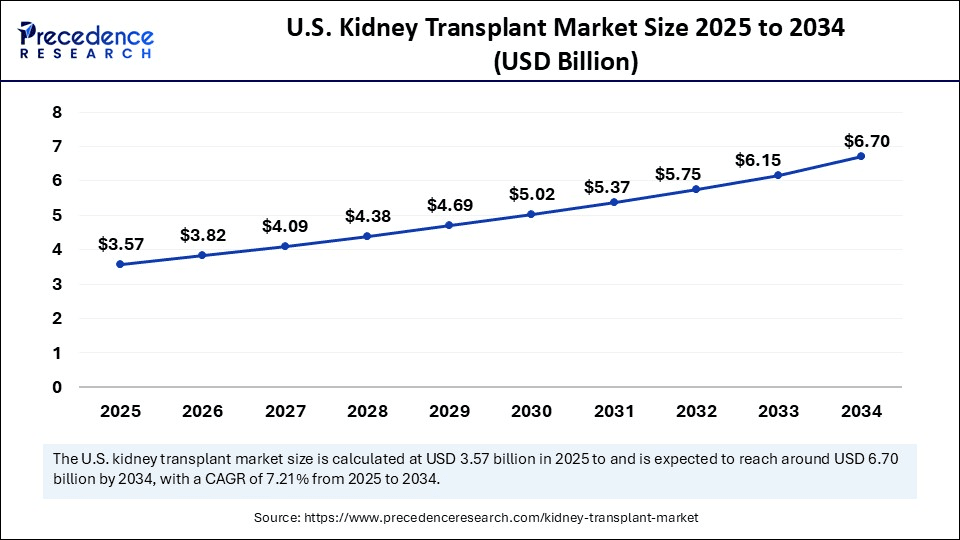

The U.S. kidney transplant market size is exhibited at USD 3.57 billion in 2025 and is projected to be worth around USD 6.70 billion by 2034, growing at a CAGR of 7.21% from 2025 to 2034.

What Made North America the Dominant Region in the Kidney Transplant Market in 2024?

North America dominated the kidney transplant market with the largest share in 2024. This is due to its well-developed healthcare infrastructure, high ESRD rates, and favorable reimbursement policies covering transplant costs. This region's focus on innovation and research has led to advancements in transplant techniques and post-transplant care, encouraging hospitals and healthcare providers to invest and expand their transplant programs. Ongoing research in North America focuses on improving transplant outcomes, developing new immunosuppressant drugs, and exploring innovative transplantation methods, pushing the boundaries of what is possible in transplantation and further solidifying the region's leadership in the field.

In December 2024, the Centers for Medicare & Medicaid Services (CMS) launched the Increasing Transplant Access (IOTA) Model to enhance access to kidney transplants. This model specifically targets transplant hospitals with a minimum transplant volume requirement. The IOTA Model aims to encourage greater use of available kidneys, facilitate more living donor transplants, and improve overall care quality by addressing social determinants of health and other barriers to access. (Source: https://www.hklaw.com)

U.S. Kidney Transplant Market Trends

The U.S. is a major contributor to the market, leading in terms of both transplants performed and the development of innovative technologies. Its advanced healthcare infrastructure, robust organ donation system, and substantial investments in research and development contribute to its prominence. However, challenges such as a persistent gap between organ supply and demand result in long waiting lists and reliance on organ imports. The country's Organ Procurement and Transplantation Network (OPTN) manages the donation and recovery process, ensuring a relatively efficient system.

What Makes Asia Pacific the Fastest-Growing Market for Kidney Transplant?

Asia Pacific is the fastest-growing market for kidney transplant. The growth of the market is driven by factors including a high prevalence of chronic kidney disease, rising healthcare expenditure, and increased investments in healthcare infrastructure. Additionally, government initiatives to promote organ donation and transplantation, along with technological advancements, have boosted the region's prominence. Governments of various Asian countries have implemented policies and programs to promote organ donation, streamline transplant procedures, and provide financial aid to transplant patients, further fueling market growth.

India Kidney Transplant Market Trends

India plays a vital role in the market within Asia Pacific, marked by both positive developments and ongoing challenges. The country has emerged as a significant player, attracting patients worldwide due to its affordable and high-quality kidney transplantation services. India ranks as the second-largest country globally for kidney transplants, primarily driven by living donations rather than cadaver donations, through measures such as promoting deceased donations via initiatives like Aadhaar-linked registries and public awareness campaigns, and enhancing infrastructure to improve access to transplantation services.

Why is Europe Consider a Notable Region for the Kidney Transplant Market?

Europe is expected to grow at a notable rate in the upcoming period, driven by the high prevalence of kidney disease, advancements in transplant technology, and a strong organ donation and transplantation infrastructure. Initiatives like European Donation Day and Kidney Exchange Programmes demonstrate a commitment to improving organ availability and transplant outcomes. Moreover, innovations in tissue typing and cross-matching techniques have increased the precision of donor-recipient matching, leading to better transplant success.

Germany Kidney Transplant Market Trends

Germany is a major contributor to the market due to growing policy momentum behind kidney exchange programs and expanded living donation options, driven by donor shortages and legal reforms. In July 2025, Germany reached a milestone with its 100,000th kidney transplant since the country's first procedure in 1963. Germany completed 33 years of developing and donating kidneys. In October 2025, the German government planned to make cross-kidney donations easier. The government also aimed to establish a national program to coordinate such transplants.

What Opportunities Exist in Latin America?

Latin America is a significantly growing region, mainly due to increased CKD prevalence, advances in transplantation procedures, and rising government efforts to improve access and infrastructure. While deceased donor transplants dominate, living donor transplants are growing faster, with Brazil expected to see the highest growth rate. Additionally, there is a growing focus on expanding transplant centers, training personnel, and adopting new technologies.

The regional market continues to expand thanks to international partnerships that improve care in specific areas and strengthen established national systems. Collaborations between non-governmental organizations and hospitals aim to boost local clinical capabilities.

Brazil Kidney Transplant Market Trends

The market in Brazil is expanding due to several initiatives. In October 2025, Brazil launched the national program to attract investments for ecological transformation. In August 2025, the global solutions-focused summit held at Stanford addressed expanding access to kidney transplantation, with healthcare practitioners, policymakers, and physicians coming together to explore research progress underway in Brazil.

What Factors Contribute to the Kidney Transplant Market Within the Middle East & Africa?

The market in Middle East & Africa is driven by the rising CKD and ESRD rates, improvements in healthcare infrastructure, and increased awareness of organ transplantation's importance. Recent collaborations and initiatives, particularly in the UAE and Saudi Arabia, include heavy investments in healthcare infrastructure, such as specialized transplant centers. The UAE has also established a national organ transplant program and collaborates with international experts and organizations to improve outcomes and increase transplants.

The market in the MEA continues to grow in the upcoming period, driven by collaboration between local medical professionals and specialists, improved diagnostic capabilities, and expanding transplant infrastructure. The government-supported kidney transplant programs are also fueling the market.

Saudi Arabia Kidney Transplant Market Trends

In Saudi Arabia, the market is growing as the national kidney exchange program expands, allowing donor-recipient “swaps” to overcome compatibility issues and increase transplant rates. In August 2024, the Saudi Center for Organ Transplantation (SCOT) launched a national family kidney exchange program to facilitate kidney swaps among families of individuals needing transplants. Additionally, government initiatives aim to significantly increase the rate of living kidney donations across the Kingdom, which supports market growth.

Kidney Transplant Market Companies

- Novartis AG

- Astellas Pharma Inc.

- Sanofi S.A.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Veloxis Pharmaceuticals, Inc.

- Bristol-Myers Squibb Company

- Thermo Fisher Scientific Inc.

- BioLife Solutions, Inc.

- OrganOx Limited

- TransMedics, Inc.

- Dr. Franz Köhler Chemie GmbH

- XVIVO Perfusion AB

- BioTime, Inc. (Lineage Cell Therapeutics)

- Teva Pharmaceutical Industries Ltd.

- AbbVie Inc.

- Medtronic plc

- Zimmer Biomet

- Bio-Rad Laboratories, Inc.

- Immucor, Inc.

Recent Developments

- In March 2025, Zydus Lifesciences launched ANVIMO (Letermovir) to prevent cytomegalovirus (CMV) in transplant patients, offering a safer and better-tolerated alternative to traditional treatments. Priced significantly lower, this new medication aims to improve transplant outcomes and increase accessibility for patients. Zydus' initiative marks a key milestone in making post-transplant care more affordable. (Source: https://economictimes.indiatimes.com)

- In November 2024, United Therapeutics Corporation performed the world's first transplant of a UKidney, an organ they developed, into a living patient. The transplant was approved under the FDA's expanded access program, also called compassionate use, and was carried out by surgeons at NYU Langone Health led by Dr. Robert Montgomery.

(Source: https://ir.unither.com)

Segments Covered in the Report

By Donor Type

- Living Donor

- Related Living Donor

- Unrelated Living Donor

- Deceased Donor

- Brain-dead Donor

- Cardiac-death Donor

By Type of Transplant

- Preemptive Kidney Transplant

- Non-Preemptive Kidney Transplant (Post Dialysis)

- Combined Kidney-Pancreas Transplant

- Re-transplantation

- Pediatric Transplant

- Others

By End User

- Hospitals

- Public/Teaching Hospitals

- Private Transplant Centers

- Transplant Clinics

- Dialysis Centers (Pre-Transplant Evaluation)

- Others (NGOs, Academic Institutes)

By Immunosuppressive Drug Class

- Induction Agents

- Basiliximab

- Antithymocyte Globulin (ATG)

- Alemtuzumab

- Others

- Maintenance Therapy

- Calcineurin Inhibitors (Tacrolimus, Cyclosporine)

- Antimetabolites (Mycophenolate Mofetil, Azathioprine)

- mTOR Inhibitors (Sirolimus, Everolimus)

- Corticosteroids

- Others

By Organ Preservation Solution

- University of Wisconsin (UW) Solution

- Histidine-Tryptophan-Ketoglutarate (HTK) Solution

- Celsior Solution

- Custodiol-N Solution

- Others

By Equipment/Service Type

- Organ Preservation and Transport Equipment

- Static Cold Storage

- Hypothermic Machine Perfusion

- Crossmatching & HLA Typing Services

- Molecular HLA Typing

- Serological Testing

- Transplant Surgical Instruments

- Post-Transplant Monitoring (Biomarkers, Biopsy tools)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting