Kidney Stone Retrieval Devices Market Size and Forecast 2025 to 2034

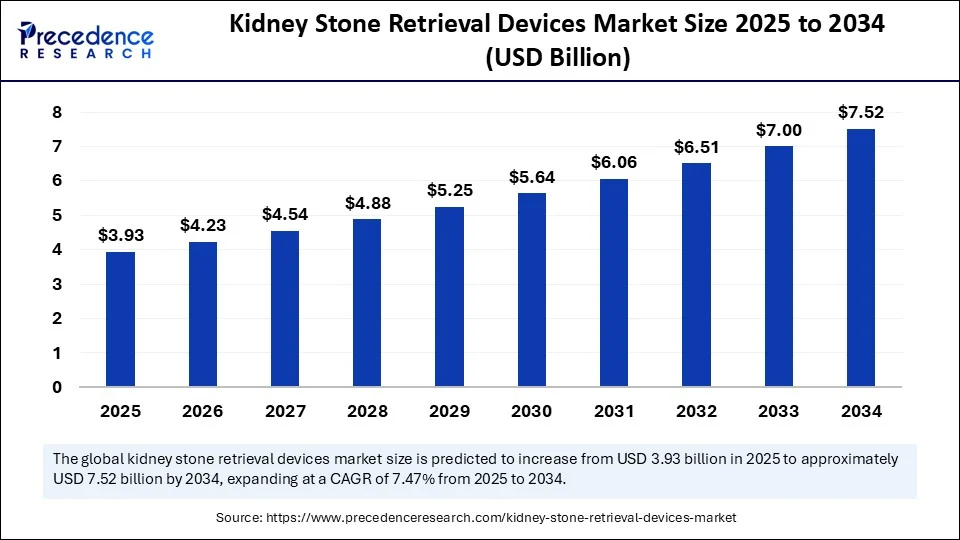

The global kidney stone retrieval devices market size accounted for USD 3.66 billion in 2024 and is predicted to increase from USD 3.93 billion in 2025 to approximately USD 7.52 billion by 2034, expanding at a CAGR of 7.47% from 2025 to 2034. The growth of the market is driven by the rising prevalence of kidney stone globally, which boosts the demand for efficient and technologically advanced retrieval solutions. Kidney stone retrieval devices are essential tools used in minimally invasive urological procedures to remove or break down kidney stones.

Kidney Stone Retrieval Devices MarketKey Takeaways

- In terms of revenue, the global kidney stone retrieval devices market was valued at USD 3.66 billion in 2024.

- It is projected to reach USD 7.52 billion by 2034.

- The market is expected to grow at a CAGR of 7.47% from 2025 to 2034.

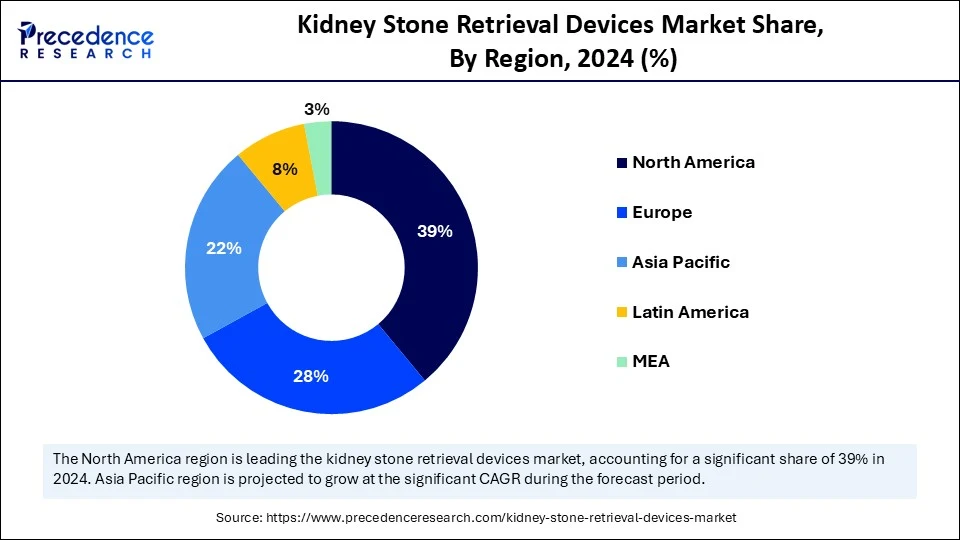

- North America dominated the kidney stone retrieval devices market with the largest market share of 39% in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the lithotripters segment held the biggest market share in 2024.

- By product type, the stone retrieval devices segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By treatment type, ureteroscopy held the highest market share of 46% in 2024.

- By treatment type, the percutaneous nephrolithotomy (PCNL) segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By stone type, the calcium oxalate stones segment held the largest market share of 58% in 2024.

- By stone type, the uric acid stones segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end use, the hospitals segment generated the major market share of 62% in 2024.

- By end use, the ASCs segment is expected to grow at a remarkable CAGR between 2025 and 2034.

How is AI Transforming the Kidney Stone Retrieval Procedures?

Artificial intelligence (AI) is redefining kidney stone retrieval procedures with smarter diagnostics, real-time surgical assistance, and personalized treatment planning. AI-powered imaging software enables urologists to detect stones with greater accuracy, even at early stages. Predictive algorithms now assist in identifying stone composition, guiding the optimal selection of retrieval tools. AI-integrated robotic systems enhance precision and reduce complications. Furthermore, machine learning aids in post-operative recovery tracking and recurrence risk assessments. These innovations are streamlining workflows, improving patient outcomes, and lowering healthcare costs across the board.

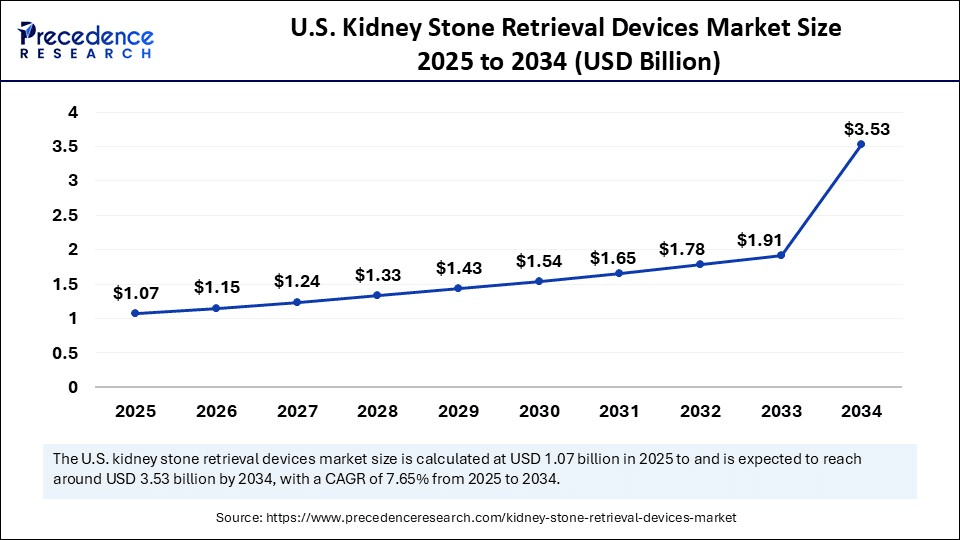

U.S. Kidney Stone Retrieval Devices Market Size and Growth 2025 to 2034

The U.S. kidney stone retrieval devices market size was exhibited at USD 1.00 billion in 2024 and is projected to be worth around USD 3.53 billion by 2034, growing at a CAGR of 7.65% from 2025 to 2034.

What Made North America the Dominant Region in the Kidney Stone Retrieval Devices Market in 2024?

North America dominated the market with the largest share in 2024, backed by advanced healthcare infrastructure and high awareness levels. The region experienced a high incidence of kidney stones, particularly in the U.S., where dietary habits and obesity rates contribute to disease prevalence. High adoption rates of AI-enabled and robotic-assisted devices further position North America as a leader in the market. Favorable reimbursement policies and frequent clinical trials also boost device penetration. Hospitals and ASCs are increasingly adopting minimally invasive devices, supporting market growth.

The U.S. is a major contributor to the market, due to the presence of a large number of major market players and early adoption of minimally invasive techniques. Canada is also contributing to the market growth by increasing its investment in public healthcare. Telemedicine integration in post-operative care is gaining momentum, improving patient compliance, and reducing recurrence. Education campaigns and early diagnostic programs are helping curb complications and support early intervention. The presence of urology centers of excellence has made North America a hub for training and innovation. Overall, the region remains a lucrative and mature market, characterized by high margins and strong R&D momentum.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for kidney stone retrieval devices due to the rising incidence of kidney stones and improving healthcare infrastructure. Countries like India and China are witnessing increasing adoption of urological devices due to higher disposable incomes and healthcare awareness. Government initiatives supporting domestic medical device manufacturing and digital health adoption are accelerating the market growth. The growing medical tourism industry is also boosting demand for high-end retrieval solutions. Local players are emerging rapidly, offering affordable alternatives to premium devices. With large patient pools and expanding hospital networks, the region is fertile ground for market growth.

India is a major player in the market. The rising training programs for urologists and the introduction of smart surgical tools are raising the standard of care in the country. The rise of adoption of portable devices in outpatient settings is transforming accessibility. As reimbursement models improve, the cost burden on patients is expected to be eased. Digital health platforms and AI-based diagnostics are gaining traction in mainstream urology practices. With the right investment in education and infrastructure, Asia Pacific is well-positioned to become a global innovation hub in kidney stone treatment.

Market Overview

The kidney stone retrieval devices market refers to the segment of the medical device industry focused on the tools and equipment used for the removal, extraction, or fragmentation of kidney stones (renal calculi) from the urinary tract. These devices play a crucial role in urological procedures such as ureteroscopy, percutaneous nephrolithotomy (PCNL), and other endoscopic or minimally invasive techniques. The market encompasses a wide array of devices, including stone baskets, retrieval forceps, lithotripters, guidewires, catheters, and ureteral access sheaths, among others.

These devices are used by urologists and healthcare professionals to manage kidney stones based on their size, composition, and anatomical location within the kidney or urinary tract. The growth of this market is driven by the increasing prevalence of kidney stones, advancements in endourology, minimally invasive techniques, and rising awareness and diagnosis rates.

The kidney stone retrieval devices market is experiencing robust growth, driven by the rising incidence of urolithiasis, increased adoption of minimally invasive procedures, and technological advancements. Products like ureteroscopes, lithotripters, and retrieval baskets are in high demand across both developed and emerging economies. Certain regions are observing the fastest growth due to improved healthcare access and rising awareness. Innovation in flexible ureteroscopy and disposable devices is further boosting adoption. Additionally, strategic collaborations between Medtech companies and hospitals are enhancing R&D and clinical integration. As the market expands, regulatory approvals and reimbursement policies will play a pivotal role in shaping its future trajectory.

Kidney Stone Retrieval Devices MarketTrends

- Rising adoption of minimally invasive procedures: Surge in demand for flexible ureteroscopes and laser lithotripsy is driving the shift towards less invasive stone removal methods.

- Integration of AI and robotics in urology: Advanced technologies are enhancing surgical accuracy and improving patient outcomes in real-time stone retrieval.

- Growth in disposable devices: Disposable retrieval baskets and ureteroscopes are gaining traction due to reduced infection risks and operational efficiency.

- Focus on patient-centric customization: Device manufacturers are investing in tailored tools based on patient anatomy and stone complexity.

- Expansion in emerging economies: Increasing healthcare spending and urology infrastructure in Asia Pacific are fueling market expansion.

- Collaborations and M&A activity: Strategic alliances between medtech firms and hospitals are accelerating innovation and global market penetration

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.52 Billion |

| Market Size in 2025 | USD 3.93 Billion |

| Market Size in 2024 | USD 3.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Treatment Type, Stone Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive procedures is one of the major factors driving the growth of the kidney stone retrieval devices market. With faster recovery times, lower complication rates, and reduced hospital stays, these producers offer immense benefits to patients. Advancements in endoscopic technology and laser systems have made stone fragmentation and removal safer and more efficient. Surgeons are now equipped with high-definition imaging and precision tools that enhance procedural success. Rising awareness and patient preferences for non-invasive options are fueling the shift from traditional open surgeries. This trend is significantly boosting the adoption of high-tech kidney stone retrieval devices across hospitals and specialty clinics.

Restraint

High Costs and Regulatory Hurdles

The high cost of advanced kidney stone retrieval devices can limit adoption, especially in low and middle-income regions. Regulatory complexities and approval delays often slow down market entry for innovation technologies. Moreover, a lack of skilled urologists trained in using cutting-edge tools hinders widespread adoption. Reimbursement limitations and inconsistent healthcare policies also add to the operational burden. Additionally, device malfunctions and post-operative complications can impact patient trust and outcomes. Addressing these barriers requires a combined effort in training, cost optimization, and regulatory reform.

Opportunity

Expansion into Emerging Markets

Emerging economies present untapped potential for the kidney stone retrieval devices market, due to a growing middle-class population and improving access to healthcare. In countries like India, China, and Brazil, the prevalence of kidney stones is on the rise due to dietary shifts and lifestyle changes. These regions are witnessing rapid expansion in healthcare infrastructure and diagnostics capabilities. Government support, foreign investments, and public-private partnerships are also creating a conducive environment for device manufacturers. Additionally, medical tourism is flourishing in third areas, further driving demand for advanced urological products. Tapping into these markets could unlock substantial long-term growth for global players.

Product Type Insights

Why Did the Lithotripters Segment Dominate the Kidney Stone Retrieval Devices Market in 2024?

The lithotripters segment dominated the market with the largest share in 2024. This is mainly due to their efficiency in fragmenting hard and large kidney stones. These devices use laser, pneumatic, or ultrasonic energy to break stones into extractable sizes. With increasing adoption of minimally invasive procedures, lithotripters are becoming central to effective stone management. Laser lithotripters, such as holmium YAG, have revolutionized intra-renal procedures due to their accuracy and adaptability. Surgeons increasingly prefer them for complex and multiple stone cases, driving their popularity. Compact, portable models are also making these tools accessible across a broader range of clinical applications.

Enhanced safety profiles, energy control, and reduced collateral damage make lithotripters ideal for precision procedures. Lithotripters also support faster recovery, lower hospitalization time, and minimal complications. Their utility in both ureteroscopy and PNCL producers adds versatility to their market appeal as urology moves toward less invasive and high-tech solutions.

The stone retrieval devices segment is expected to grow at the fastest CAGR during the forecast period. Stone retrieval devices, including baskets and forceps, remain the most widely used tools in the management of kidney stones. Their simple yet effective design allows clinicians to remove fragmented or whole stones with precision. These devices are essential across a variety of procedures, from ureteroscopy to percutaneous nephrolithotomy. Innovations in material flexibility and stone-gripping efficiency further support the demand. Reusable and disposable variants are available to suit the preferences of different healthcare settings. Their proven clinical value and ease of integration continue to make them the go-to solution.

The segment growth is also driven by their role in complete stone clearance, minimizing recurrence. Hospitals and surgical centers favor them due to their reliability and cost-effectiveness. Increasing incidences of smaller-sized calculi, which are ideal for retrieval via baskets, support their market growth. Additionally, improvements in endoscopic guidance have enhanced their precision. The growth in outpatient procedures ensures continued demand in both advanced and developing healthcare systems.

Treatment Type Insights

How Does the Ureteroscopy Segment Dominate the Market in 2024?

The ureteroscopy segment dominated the kidney stone retrieval devices market in 2024, due to its minimally invasive nature and wide applicability. It is especially effective for small to mid-sized stones in the ureter and kidney. The use of flexible and semi-rigid ureteroscopes allows precise navigation and stone targeting. Ureteroscopy involves little to no incisions, leading to faster patient recovery and shorter hospital stays. It is suitable for outpatient producers, making it cost-effective and convenient. Increasing physicians' familiarity and continuous technological upgrades are further expanding its usage.

High-resolution digital ureteroscopes, coupled with laser lithotripsy, have enhanced the effectiveness of ureteroscopy. Its versatility across age groups and patient profiles contributes to its dominance. The rising burden of urolithiasis and preference for day-care treatments are also fueling its demand. Enhanced visualization, smaller scope diameters, and integration with retrieval devices ensure better procedural outcomes. As disposable ureteroscopes gain popularity, infection control improves alongside procedural speed. Ureteroscopy continues to set the standard for modern, safe, and efficient stone management.

The percutaneous nephrolithotomy (PCNL) segment is expected to grow at the fastest CAGR during the projection period, as this producer is ideal for staghorn calculi and cases where other methods fail. With improvements in miniaturized instruments and guided imaging, PCNL is becoming safer and more accessible. Surgeons are increasingly trained in advanced PCNL techniques, boosting its adoption. Despite being slightly more invasive, its high success rate makes it popular in tertiary care centres.

Mini-PCNL and ultra-mini-PCNL are revolutionizing outcomes by reducing trauma and complications. Advances in navigation technologies have enhanced targeting and stone clearance. As patient confidence in this method grows, it is increasingly preferred for complicated cases. PCNL is also beneficial in patients with anatomical abnormalities or stone burden exceeding 2 cm. High success rates, combined with fewer retreatments, make it economically viable in the long run. With innovation driving down risk and recovery time, PCNL is poised for significant market expansion.

Stone Type Insights

What Made Calcium Oxalate Stones the Dominant Segment in the Kidney Stone Retrieval Devices Market in 2024?

The calcium oxalate stones segment dominated the market in 2024. These stones are primarily linked to dietary and metabolic factors, making them widespread across geographies. As a result, most retrieval devices and treatment protocols are optimized to manage this stone type. The need for effective detection, fragmentation, and removal tools remains consistently high. Recurrence rates are also higher with calcium oxalate stones, fueling demand for long-term management strategies. Their prevalence ensures continued innovation and funding for research.

Because these stones often form in multiple clusters, retrieval baskets and laser lithotripters are crucial for complete clearance. Nutritional counseling and preventive urology services are on the rise to manage the growing patient base. Diagnostic imaging advancements also aid in early detection, improving procedural outcomes. As lifestyle-related disorders rise globally, the burden of calcium oxalate stones is expected to grow. This stone type remains central to both current and future device innovations.

The uric acid stones segment is expected to grow at the fastest rate in the upcoming period, driven by dietary changes, dehydration, and metabolic syndromes. These stones are more prevalent in aging populations, diabetics, and those consuming high-purine diets. Advances in diagnostic imaging and chemical analysis have improved early identification. Uric acid stones are also more amenable to dissolution therapy and laser-based procedures, making treatment more accessible. The increasing adoption of precision medicine and customized treatment protocols is fueling their market share. Their rapid growth underscores the need for targeted intervention tools.

Their soft composition makes them suitable for non-invasive fragmentation, increasing the use of intracorporeal lithotripsy. Preventive screening is also being promoted to detect asymptomatic cases early. As awareness spreads, more patients are seeking timely care, supporting device demand. The overlap of uric acid stones with obesity and metabolic syndrome cases is raising their visibility. Hospitals are expanding their diagnostic and treatment offerings tailored for this group. With a growing patient base and therapeutic responsiveness, uric acid stones represent a significant opportunity segment.

End Use Insights

Why Did the Hospitals Segment Dominated the Market in 2024?

The hospitals segment dominated the kidney stone retrieval devices market in 2024, due to their extensive infrastructure, skilled specialists, and comprehensive service offerings. They perform most urological procedures, particularly complex cases requiring multidisciplinary care. High patient volumes ensure optimal utilization of advanced equipment. Hospitals also serve as testing grounds for new technologies and clinical trials. Their centralized systems support better postoperative monitoring and complication management. Institutional buying power allows for bulk procurement and integration of state-of-the-art devices.

Training and academic hospitals play a vital role in driving innovation and clinical adoption. These institutions often pioneer the use of new lithotripsy or retrieval technologies. Enhanced diagnostic tools, such as AI-assisted imaging, are more accessible in hospital settings. Hospitals also maintain better sterilization and safety protocols, crucial for urological procedures. Comprehensive insurance coverage and reimbursement schemes boost patient affordability. Overall, hospitals remain the cornerstone of kidney stone treatment worldwide.

The ambulatory surgical centers (ASCs) segment is likely to grow at a rapidly pace due to their streamlined workflows, shorter wait times, and reduced costs, attracting both patients and surgeons. With the increasing trend toward outpatient care, ASCs offer high efficiency and quicker recovery. Modern ASCs are well-equipped with digital ureteroscopes and laser lithotripsy systems. The rise of disposable instruments and portable imaging has enabled ASCs to perform advanced urological procedures. Favorable reimbursement models and patient preference for day-care surgery further fuel their growth.

Ambulatory surgical centers (ASCs) cater especially to patients with smaller or moderate stones needing ureteroscopy or simple lithotripsy. The environment encourages procedural specialization and rapid turnover. Physicians are increasingly affiliating with ASCs for greater flexibility and control. Their scalability and cost-effectiveness make them attractive for expansion in both urban and semi-urban areas. Patient satisfaction scores at ASCs are typically high, reinforcing their popularity. As minimally invasive technology advances, ASCs are poised to take a larger share of the kidney stone retrieval landscape.

Kidney Stone Retrieval Devices Market Companies

- Boston Scientific Corporation

- Olympus Corporation

- Cook Medical

- Karl Storz SE & Co. KG

- Richard Wolf GmbH

- Dornier MedTech GmbH

- Coloplast A/S

- Stryker Corporation

- EMS Electro Medical Systems S.A.

- Lumenis Ltd.

- Rocamed SAM

- Medi-Tate Ltd.

- Becton, Dickinson and Company (BD)

- Siemens Healthineers AG

- Allium Medical Solutions Ltd.

- Direx Group

- Quanta System S.p.A.

- HealthTronics, Inc.

- Potent Meditech

- Pusen Medical Technology Co., Ltd.

Recent Development

- In July 2025, in a significant medical achievement, Osmania General Hospital in Telangana has successfully treated kidney stones in 109 children using advanced scarless surgical techniques. These producers, known as mini PCNL and RIRS, were performed without any major incisions, ensuring minimal trauma and faster recovery. (Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Product Type

- Stone Retrieval Devices

- Nitinol Stone Retrieval Baskets

- Stainless Steel Stone Retrieval Baskets

- Graspers & Forceps

- Others (Alligator forceps, tweezers, etc.)

- Ureteral Access Devices

- Ureteral Access Sheaths

- Ureteral Dilators

- Guidewires

- Ureteroscopes (Rigid, Semi-rigid, Flexible)

- Lithotripters

- intracorporeal lithotripters

- laser lithotripters (Holmium:YAG, Thulium Fiber Laser)

- Ultrasonic Lithotripters

- Pneumatic Lithotripters

- Extracorporeal Shock Wave Lithotripters (ESWL)

- Catheters & Stents

- Ureteral Stents

- Nephrostomy Catheters

- Others (pigtail, double-J)

- Others

- Irrigation Devices

- Retrieval Kits

By Treatment Type

- Ureteroscopy

- percutaneous nephrolithotomy (PCNL)

- Extracorporeal Shock Wave Lithotripsy (ESWL)

- Open Surgery

- Others

By Stone Type

- Calcium Oxalate Stones

- Uric Acid Stones

- Struvite Stones

- Cystine Stones

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Others (Research Institutions, Academic Centers)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting