What is the Pet Herbal Supplements Market Size?

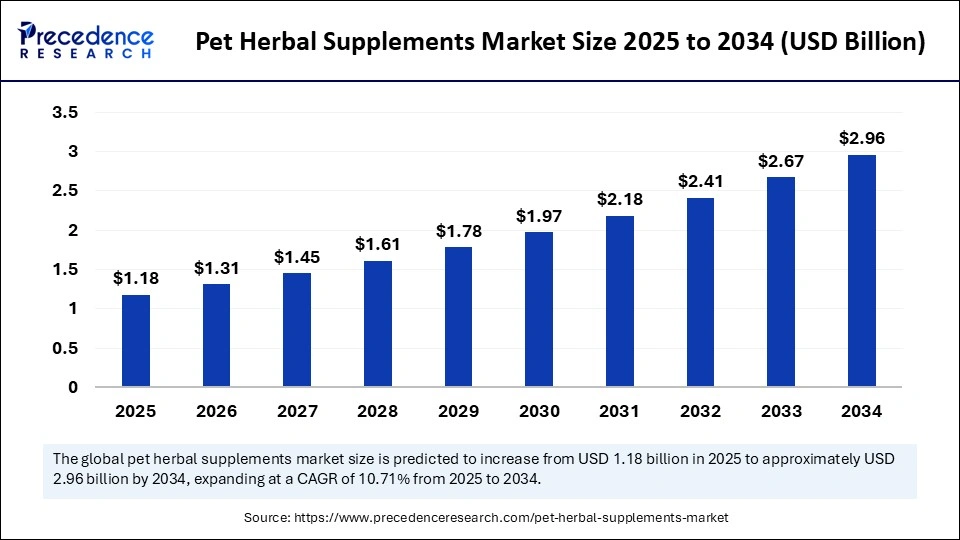

The global pet herbal supplements market size is estimated at USD 1.18 billion in 2025 and is predicted to increase from USD 1.31 billion in 2026 to approximately USD 3.23 billion by 2035, expanding at a CAGR of 10.59% from 2026 to 2035. The growth of the market is driven by increasing awareness among pet owners about natural and holistic health solutions for their pets.

Market Highlights

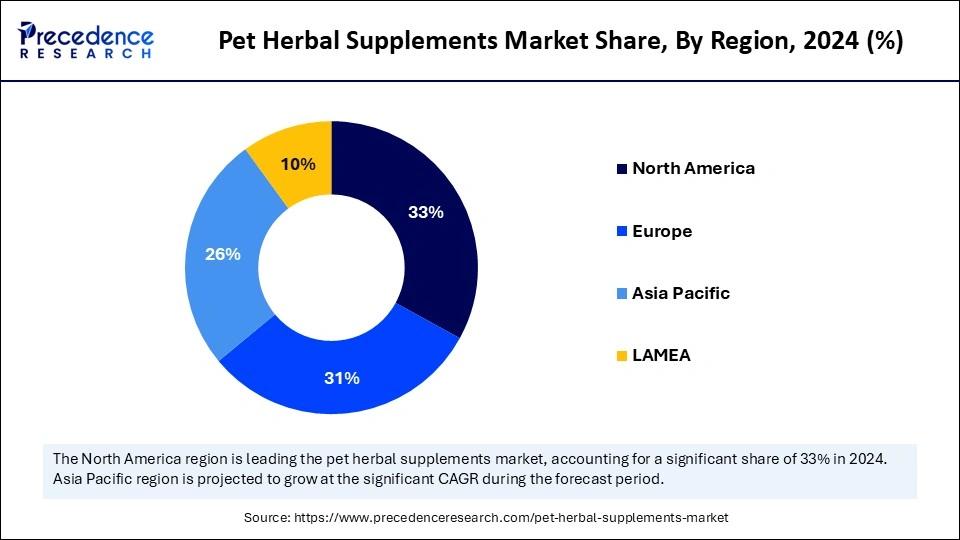

- North America dominated the market with the largest share of 33% in 2025

- Asia Pacific is expected to grow at the fastest CAGR of 12% during the forecast period.

- By product type, the multivitamins & minerals segment held the largest share of the market in 2025 .

- By product type, the CBD segment is growing at a CAGR of 11.3% between 2026 to 2035

- By application, the joint health support segment contributed the biggest market share of 25% in 2025

- By animal type, the dogs segment dominated the market in 2025

- By animal type, the cat segment is expected to grow at a CAGR of 10.4% in the coming years.

- By dosage form, the gummies and chewable segment held the major share of 34% in 2025.

- By dosage form, the powders segment is anticipated to expand at a significant rate in the upcoming period.

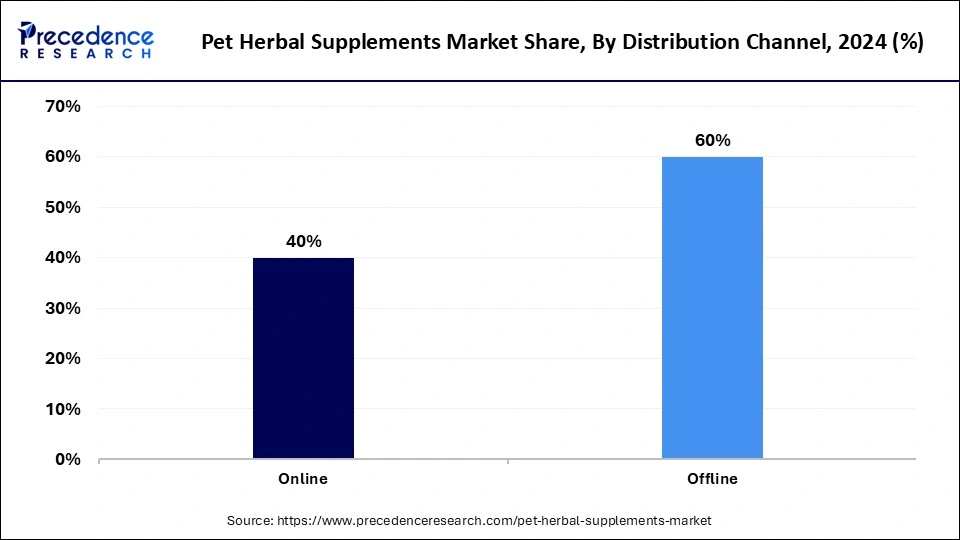

- By distribution channel, the offline segment accounted for the highest market share of 60% in 2025

- By distribution channel, the online segment is projected to grow at the fastest rate during the forecast period.

How does AI Impact the Pet Herbal Supplements Market?

Artificial intelligence (AI) is revolutionizing the market for pet herbal supplements by improving personalization and product development. AI tools like data analytics and machine learning help supplement manufacturers better understand pet health issues, which makes it possible to create customized supplement formulas. For example, manufacturers are employing AI to examine pet owners' feedback and pets' health records to create more potent herbal remedies for particular pet ailments like digestion, joint health, and anxiety. AI also speeds up the research and development process, lowering the time it takes for new products to reach the market. AI algorithms can predict the efficacy of different herbal ingredients.

AI is transforming marketing tactics and consumer interaction. Brands can provide pet owners with tailored product recommendations based on individual pet health profiles by leveraging AI-powered technologies, like chatbots and predictive analytics. To track customer behavior and provide individualized supplements such as Pro Plan that caters to pet breeds and life stages, Purina has integrated AI-driven systems. Since pet owners are increasingly searching for products that specifically address their pet's needs, this degree of personalization not only increases customer satisfaction but also fosters brand loyalty. The pet herbal supplements industry is well-positioned for continued expansion and greater integration of technology-driven solutions due to AI's expanding role in product innovation.

Market Overview

The pet herbal supplements market is experiencing rapid growth as more pet owners prioritize the health and well-being of their animals. Pet owners are increasingly using herbal remedies to support immunity, digestion, anxiety relief, joint health, and general wellness because of growing concerns about the long-term effects of synthetic medications and chemicals. This change has also been influenced by the increasing trend of humanizing pets as pet owners look for premium, all-natural remedies that are comparable to those they would use for themselves.

Market players are continuously launching new products to satisfy pet owners' varying demands. NaturVet, for instance, provides a large selection of herbal supplements for dogs and cats that address issues like digestive support, skin and coat health, and relaxation. HempMyPet also specializes in organic products that contain hemp and are meant to alleviate pain and anxiety. Strong competitors in this market include Pet Wellbeing, which blends veterinary science and traditional herbal medicine, and Animal Essentials, which is well-known for its tinctures and herbal blends. The growing consumer confidence in herbal products and the desire for ingredient lists that are clearer and more transparent are being leveraged by these businesses.

Pet Herbal Supplements Market Growth Factors

- Humanization of pets: Owners increasingly treat pets as family members, seeking premium, natural healthcare options similar to those used for humans.

- Rising awareness of natural alternatives: Concerns over side effects of synthetic medications are pushing the demand for herbal, plant-based solutions.

- Increase in pet health issues: Growing cases of anxiety, obesity, and joint problems in pets have led owners to explore holistic treatment options.

- Expansion of e-commerce and DTC brands: Online platforms make herbal supplements more accessible, with brands offering detailed product education and customer support.

- Veterinary endorsements and R&D: More vets and researchers are promoting the use of herbal supplements, adding credibility and driving adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.18 Billion |

| Market Size in 2026 | USD 1.31 Billion |

| Market Size by 2035 | USD 3.23 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.59% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Animal Type, Dosage Form, Distribution channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing Preference for Natural and Holistic Pet Care

Concerned about the negative effects of synthetic medications, pet owners are increasingly choosing natural solutions to manage their pets' health, which is a key factor driving the growth of the herbal pet supplements market. Herbal supplements are becoming more and more popular as pet owners look for plant-based solutions for common pet health conditions like joint pain, anxiety, and digestive disorders. This trend is in line with the larger human wellness movement, which favors non-toxic and organic products for both people and their pets. The rising product innovations further drive the market's growth.

- In March 2023, HempMy Pet introduced a high-potency CBD tincture with organic calendula and turmeric, aimed at reducing pain and supporting joint health in older dogs.

- In October 2022, NaturVet launched its "Quiet Moments+" line of advanced herbal calming aids, combining hemp seed oil, melatonin, and L-tryptophan to support pets with separation anxiety and stress. The brand continuously expands its product range to cater to the growing consumer interest in natural supplements.

Rising Incidence of Pet Health Issues

Pets are increasingly experiencing skin allergies, digestive problems, joint pain, and anxiety. Herbal supplements are becoming more popular among pet owners as a natural and preventative approach to managing their animals' health as these issues become more prevalent. Because of their proven ability to effectively manage chronic conditions, herbal ingredients such as chamomile, turmeric, and valerian root are in high demand in the pet care industry.

- In January 2024, Pet Wellbeing launched “Adrenal Harmony Gold,” a supplement designed to manage adrenal health in dogs suffering from Cushing's syndrome, featuring herbs like Rehmannia and holy basil.

Restraints

Lack of Scientific Evidence

The lack of scientific evidence about the efficacy of herbal supplements for pets is a key factor restraining the growth of the herbal pet supplements market. The effectiveness of herbal supplements is still questioned by some veterinarians, particularly due to the lack of comprehensive clinical trials. Since conventional treatments have established clinical evidence and regulatory oversight, many veterinarians prefer to recommend them. Because pet owners frequently rely on their veterinarian's advice when choosing health products for their pets, this resistance may limit the adoption of herbal supplements. Moreover, some veterinarians might be concerned that advocating for herbal substitutes could result in issues or inadequate treatment, especially when dealing with severe illnesses.

- In June 2024, PetMD, a widely recognized pet health brand, worked with integrative veterinarians to promote their new herbal line. However, they still encountered resistance from traditional veterinarians who were hesitant to incorporate these products into their practices, citing the need for more clinical trials to establish long-term benefits.

Supply Chain and Ingredient Sourcing Challenges

Depending on the time and the location, herbal ingredients can vary significantly in quality and availability. The quality and availability of pet supplements may be impacted by fluctuating ingredient prices and erratic supply chains, which can present difficulties for producers. Consumers are also calling for greater transparency about the sources and methods of ingredient procurement, which is contributing to the rise in ethical sourcing and sustainability issues. Companies may be more susceptible to supply chain interruptions that impact their production schedules if they depend on herbal suppliers.

- In January 2024, The Honest Kitchen faced supply chain disruptions, affecting its organic herbal ingredients sourced from international suppliers. The company responded by diversifying its sourcing channels and partnering with sustainable farmers to ensure steady ingredient availability.

- In April 2023, NuLeaf Naturals encountered sourcing difficulties with its key hemp ingredients for CBD supplements. To mitigate the risk, the company invested in developing local partnerships with hemp farmers in Colorado to reduce dependency on foreign suppliers and ensure sustainable production practices.

Opportunities

Growing Demand for Natural and Organic Pet Products

More and more pet owners are looking for organic and natural substitutes for traditional pet supplies, creating opportunities in the pet herbal supplements market. The growing demand for holistic pet care, especially among pet owners in Generation Z and Millennials, is the major factor of this change. By increasing their selection of herbal supplements and being open and honest about the quality of ingredients and their sourcing, businesses can take advantage of this trend. The demand for chemical-free products is also being driven by growing awareness of pet allergies, digestive problems, and chemical sensitivities. Customers are influenced by the herbal remedies they use for themselves and want to give their pets the same treatment. Pet owners are also drawn to eco-friendly packaging and sustainable sourcing.

Collaborations with Veterinarians and Pet Care Professionals

Companies can establish partnerships with veterinarians and pet care experts to build credibility and inform consumers and veterinarians about the effectiveness of their products. Herbal supplements may become more widely recognized as a good alternative to traditional therapies as a result. Additionally, veterinarians are coming to see the benefits of integrative approaches to pet health, which combine traditional care with herbal remedies. A brand's position in a crowded market is further strengthened by clinical trials and marketing supported by veterinarians.

- Recently, VetriScience Laboratories partnered with veterinary clinics across the U.S. to launch an educational campaign aimed at encouraging vets to recommend herbal supplements as complementary care options. The campaign included a focus on joint health and digestive support for pets.

Segment Insights

Product Type Insights

The multivitamins & minerals segment dominated the pet herbal supplements market with the largest share in 2024 because of their wide range of applications in enhancing general pet health. As a mainstay for pet owners looking for preventive care, these supplements are widely used to support immunity, coat health, and energy levels. Companies such as NaturVet and Zesty Paws continue to launch varied multivitamin blends that are suited to age, breed, and health requirements. The increased awareness among pet owners about the importance of multivitamins further increased their adoption.

The CBD segment is expected to grow at a rapid pace throughout the forecast period, driven by growing interest in all-natural treatments for inflammation, chronic pain, stress, and anxiety. CBD supplements containing relaxing herbs like valerian root or chamomile have become more popular as pet owners search for holistic substitutes. Rapid innovation is being demonstrated by companies like Charlotte's Web and HolistaPet, which are launching targeted CBD solutions with herbal blends for a range of ailments. Growing consumer awareness and ongoing research confirming CBD's therapeutic potential for pets are further driving the segment's growth.

The calming and anxiety relief segment is expected to grow at a CAGR of 11.60% during the forecast period. The segment promotes pet-emotional health-centric kind of therapy. The products for calm and anxiety have positively impacted the pet owners' choice of supplements, preferring their pet's emotional health condition. The passionflower, chamomile, and valerian root a natural essences in the pet herbal supplement products that are fueling demand as the want for organic satisfaction seems to have accelerated in the product market as well.

Application Insights

The joint health support segment dominated the pet herbal supplements market with the largest share in 2024. This is mainly due to the increased prevalence of mobility problems among elderly pets. This significantly increased the demand for supplements that usually contain natural ingredients with anti-inflammatory and cartilage-supporting qualities, like glucosamine, MSM, and turmeric. The segment is likely to grow at a steady growth rate in the near future. With the increasing concerns among pet owners about mobility issues, the demand for herbal joint formulas that address mobility issues and pain relief keeps rising.

The joint and bone health segment held the largest share of 23.60% in the 2024 global pet herbal supplements market. Pet herbal supplements are essential for joint and bone health. The structural ingredients, antioxidants, and natural anti-inflammatory promotes relief from dysplasia and arthritis. The herbal supplements sector is rising due to their natural support of the skeletal system in cats and dogs. The key benefits, such as bone strength, mobility, less inflammation, and pain, stimulate the pet's overall physical health.

The anxiety and stress relief segment is expected to grow at a CAGR of 11.20% during the forecast period. The pet herbal supplement specifically for anxiety and stress involves hemp seed oil, ashwagandha, CBD, and brahmi that calms and diminishes stress regarding behaviour. The supplements are becoming convenient and approachable with their numerous forms like sprays, tablets, or oils.

Animal Type Insights

The dogs segment led the pet herbal supplements market with the largest share in 2024. This is mainly due to the increased dog ownership worldwide. In comparison to other pets, dogs have a larger population. As more dogs are being diagnosed with digestive, anxiety, and mobility problems, their owners are turning to natural solutions for both preventative and therapeutic care. Herbal supplements for gut support, joint health, and stress reduction are therefore highly sought after. Prominent companies like Zesty Paws, Pet Honesty, and NaturVet have strengthened their position in the market by creating broad product lines of herbal products that are especially suited to dogs of various breeds.

The cat segment is expected to grow at the fastest rate in the coming years because more cat owners are shifting toward herbal options due to increased product palatability and growing awareness of health issues in felines. Hairball control, urinary tract support, and stress management supplements are becoming more and more popular. These supplements frequently contain herbs like cranberry, valerian root, and slippery elm. Companies such as Herbsmith and Vets Best have started to diversify their product lines for cats, offering formulations that address both therapeutic and preventive health issues. The growing awareness of feline wellness further supports the segment's growth.

Dosage Form Insights

The gummies & chewable segments held the largest share of the pet herbal supplements market in 2024. Gummies and chewable are highly preferred because they are easily administered, taste good, and are well-liked by pets, particularly dogs. These formats are now a popular option for pet parents due to their calming effects, digestive health benefits, and joint support. Strong product lines centered around chewable products have been developed by businesses like Zesty Paws and Pet Honesty, earning the trust and repeat business of many customers

- In June 2024, HempMy Pet released “Zen Bites,” soft chews infused with valerian root and passionflower, targeting stress and anxiety in pets during travel or loud noises.

The powders segment is likely to grow at a significant rate over the studied years because of their ease of mixing with the food and sustainability for picky eaters. Powdered supplements are becoming more and more popular. For pets that don't respond well to pills or chews, pet owners are increasingly choosing these substitutes. Recently, NarurVet and Herbsmith have launched herbal powders that address problems like immune support, energy, and digestion. These innovative formats are rapidly being adopted by a variety of pet owner demographics as the need for individualized, simple-to-implement solutions increases.

Distribution Channel Insights

The offline segment led the pet herbal supplements market with the largest share in 2024 because veterinary clinics, pet shops, and pharmacies provide individualized services and prompt product availability. Many pet owners prefer to buy products in-store so they can physically inspect them and receive professional advice. Established clientele and impulsive purchases are also advantageous to retail establishments, particularly for new or seasonal herbal products. Through partnerships with major pet retail chains like PetSmart and Petco, several brands have managed to maintain a strong offline presence while guaranteeing broad consumer reach and visibility.

The online segment is projected to grow at the fastest rate during the forecast period. Online stores provide easy doorstep delivery, subscription services, and easier access to a wider range of products. It is now simpler for pet parents to investigate, evaluate, and buy herbal supplements based on the health requirements of their pets, thanks to the growth of e-commerce platforms like Amazon and direct-to-consumer brand websites. AI-powered recommendations and loyalty programs such as Pet Honesty and Zesty Paws have prospered online. The rise of health commerce and telehealth further supports the growth of the segment.

Product form Insights

The chewables and soft chews held the largest share of 38.20% in the 2024 global pet herbal supplements market. Among chewables and soft chews, the multivitamin plus soft chews are a quality supplement produced to boost the well-being and health of dogs. The segment is emerging due to the heavy demand for organic turmeric, probiotics, and vitamins to ensure health benefits. The pet owners largely prefer soft chews supplements for their pets' convenience, taste, and easy intake.

The liquid drops and tinctures segment is expected to grow at a CAGR of 10.10% during the forecast period. The segment is emerging with the need for plant nutrients to the pet's system with ease. The ease of proportionate dosing via a dropper gives accurate major health benefits. It is better than capsules and tablets, as pets find it hard to consume or accept the offering. Consuming herbal extract in tincture form proves the best way to offer plant nutrients.

Application/health benefit Insights

The joint and bone health segment held the largest share of 23.60% in the 2024 global pet herbal supplements market. Pet herbal supplements are essential for joint and bone health. The structural ingredients, antioxidants, and natural anti-inflammatory promotes relief from dysplasia and arthritis. The herbal supplements sector is rising due to their natural support of the skeletal system in cats and dogs. The key benefits, such as bone strength, mobility, less inflammation, and pain, stimulate the pet's overall physical health.

The anxiety and stress relief segment is expected to grow at a CAGR of 11.20% during the forecast period. The pet herbal supplement specifically for anxiety and stress involves hemp seed oil, ashwagandha, CBD, and brahmi that calms and diminishes stress regarding behaviour. The supplements are becoming convenient and approachable with their numerous forms like sprays, tablets, or oils.

Ingredient type Insights

The turmeric (curcumin) segment held the largest share of 21.40% in the 2024 global pet herbal supplements market. Turmeric has a longstanding benefit and is considered a most essential ingredient in improving and treating bone joint alignment conditions. Both humans and pets can rely on this traditional, turned modern ingredient now in supplements, serving as a main source of relief from pain. The segment has a popular growth identity to expand largely in the food and supplement market for all living beings.

The hemp (CBD/Hemp seed oil) segment is expected to grow at a CAGR of 12.50% during the forecast period. The segment is highly lifted by the increasing demand for anxiety and stress relief supplements. The pet owners' concern has gained traction in the segment, steadily promoting global pet herbal supplements. There has been a lack of quality of care for mental stress in pets that goes unheard. This segment in the pet herbal supplement stresses on rethinking of the pet's mental state.

Regional Insights

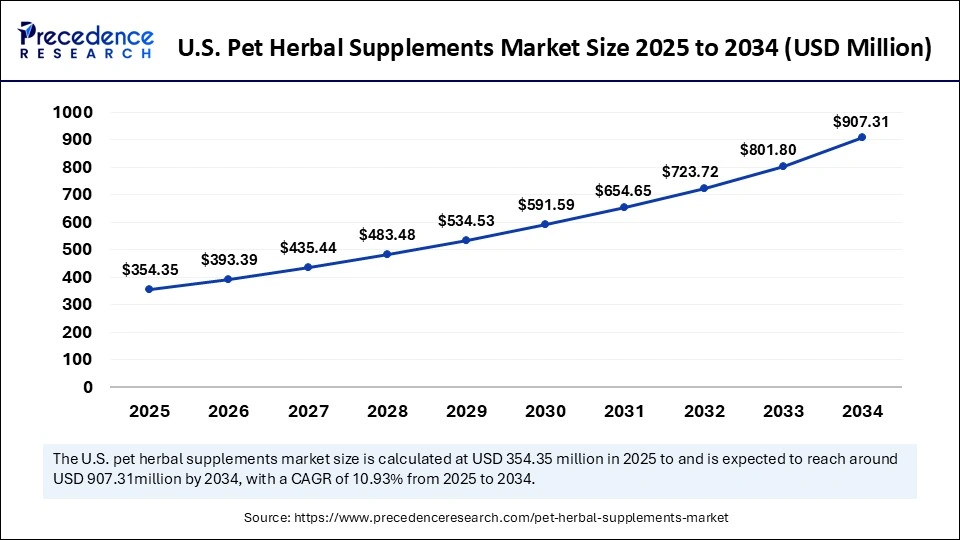

U.S. Pet Herbal Supplements Market Size and Growth 2026 to 2035

The U.S. pet herbal supplements market size is evaluated at USD 354.35 million in 2025 and is projected to be worth around USD 994.50 million by 2035, growing at a CAGR of 10.87% from 2026 to 2035

North America dominated the pet herbal supplements market in 2024 by holding the largest share. This is mainly due to the increased pet humanization. The increased awareness among pet owners about the health and wellness of pets shifted their preference toward holistic, natural, and organic pet care products. The increased disposable incomes and high pet ownership further bolstered the market's growth in the region. According to a survey report, approximately 66% of North American households own a pet, with dogs being the most popular pet, followed by cats. Millennials make up the largest percentage of current pet owners.

Asia Pacific is expected to witness the fastest growth in the upcoming years, driven by an increase in pet ownership, especially in nations like China and India. Consumers' preferences in the area are shifting toward sustainable and natural pet supplies. Premium pet products, including herbal supplements, are in high demand due to the rising disposable income. A large number of pet owners are looking for natural substitutes over conventional medications because of growing awareness of pet health and wellness. The rise of e-commerce has increased the accessibility to natural pet care products, supporting the long-term growth of the market.

Europe is observed to grow at a considerable growth rate in the upcoming period. The growth of the herbal pet supplements market in Europe can be attributed to the rising concerns among pet owners about the health and wellness of their pets. There is a high demand for natural pet care products. A large number of pet owners are preferring supplements that support long-term health and disease prevention. Consumer confidence in herbal supplements is increasing in the European market due to strict regulations regarding safety and quality control in pet care products.

Pet Herbal Supplements Market Companies

- Blackmores

- NaturVet (The Garmon Corp.)

- Natural Dog Company Inc.

- AdvaCare Pharma

- Pet Natural Remedies

- Dorwest Herbs Ltd.

- Only Natural Pet LLC

- AMORVET

- Rockwell Pets Pro

- Nutri-Pet Research, Inc.

- Health Extension.

Recent Developments

- In March 2024, Pet Releaf debuted its first non-CBD product line at Global Pet Expo, including a Postbiotic and Fish-Free omega-3 supplement. These plant-based, daily-use formulas target gut and skin health. This launch helps the brand broaden its audience and enter non-CBD retail markets.

- In March 2024, Fera Pets introduced three new items: Whole Food Multivitamin, Postbiotics Plus, and Collagen Plus, a pet balm. Focused on gut, joint, and skin health, these products feature clean ingredients. The launch of these products strengthens Fera's position in functional pet wellness.

- In March 2023, Banyan Botanicals expanded its outreach to the holistic veterinary community to foster more acceptance of their herbal supplements. They focused on educating veterinarians about the efficacy of their products for managing chronic conditions in pets, including anxiety and arthritis.

Segments Covered in the Report

By Pet Type

- Dogs

- Large breeds

- Small & medium breeds

- Cats

- Indoor cats

- Outdoor cats

- Other Companion Animals

- Rabbits

- Guinea pigs

- Small mammals (ferrets, hamsters)

- Birds

By Product Form

- Chewables & Soft Chews

- Powders

- Tablets & Capsules

- Liquid Drops & Tinctures

- Topical Applications (balms, sprays, oils)

By Application/Health Benefit

- Joint & Bone Health

- Digestive Health

- Skin & Coat Health

- Immune Support

- Anxiety & Stress Relief

- Cognitive Support

- Urinary & Kidney Health

- Liver Detox & Cleansing

By Ingredient Type (Herbal Actives)

- Turmeric (Curcumin)

- Chamomile

- Milk Thistle

- Valerian Root

- Ashwagandha

- Ginger

- Peppermint

- Licorice Root

- Echinacea

- Hemp (CBD/Hemp Seed Oil) (where legal)

By Product Type

- Multivitamins & Minerals

- Omega & Fatty Acids (e.g., Flaxseed oil, Hemp oil)

- Probiotics & Prebiotics (e.g., Chicory root, Slippery elm)

- Joint & Mobility Support (e.g., Turmeric, Boswellia, Yucca)

- Calming & Anxiety Relief (e.g., Valerian root, Chamomile, Passionflower)

- Liver & Kidney Support (e.g., Milk thistle, Dandelion root)

- Digestive Support (e.g., Ginger, Licorice root, Fennel)

- Skin & Coat Care (e.g., Neem, Calendula, Coconut)

- Immune System Support (e.g., Echinacea, Astragalus, Medicinal mushrooms)

- Other Specialized Supplements

- Cognitive support (e.g., Ginkgo biloba)

- Vision health (e.g., Bilberry)

- Senior pet support

By Distribution Channel

- Online Retail

- Brand DTC websites

- Global e-commerce platforms (Amazon, AliExpress)

- Offline Retail

- Pet specialty chains (PetSmart, Pets at Home)

- Veterinary clinics & hospitals

- Natural health stores

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting