What is Wellness Supplements Market Size?

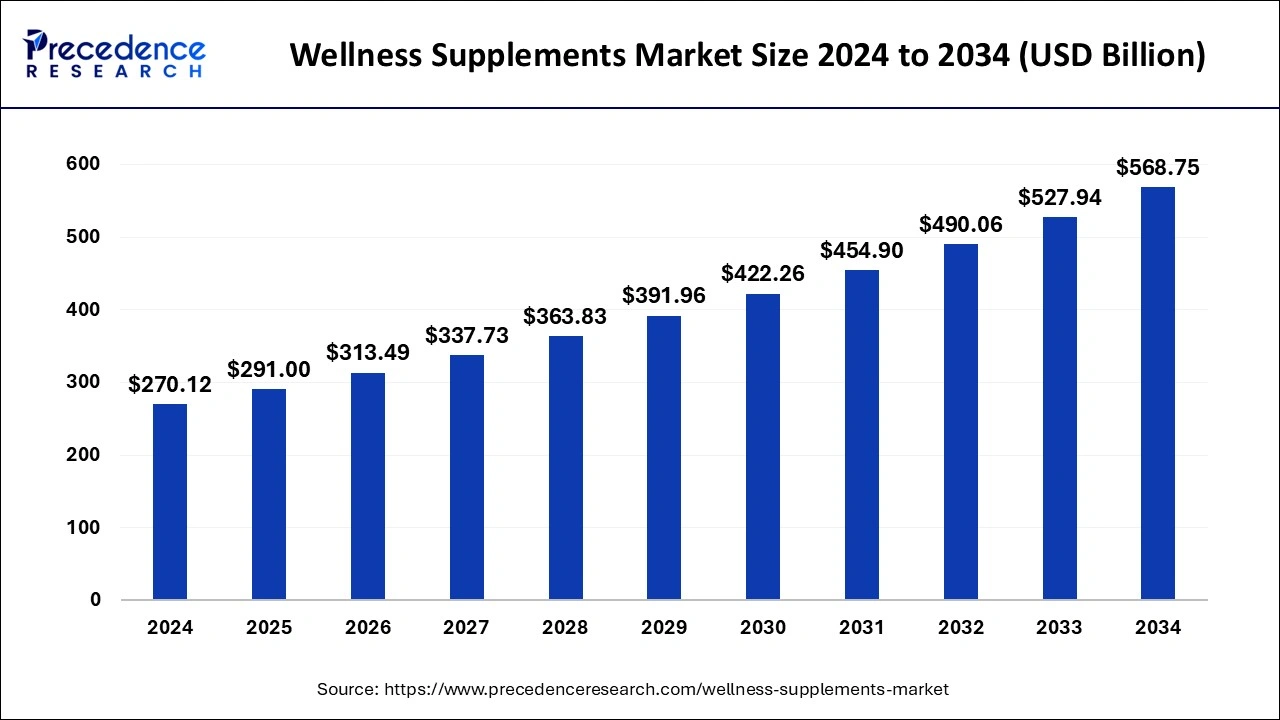

The global wellness supplements market size is estimated at USD 291.00 million in 2025 and is anticipated to reach around USD 568.75 million by 2034, expanding at a CAGR of 7.73% from 2025 to 2034. Consumer lifestyle changes and growing demand for vitamin and mineral deficiencies among populations in emerging economies is leading to expansion of the wellness supplements market

Market Highlights

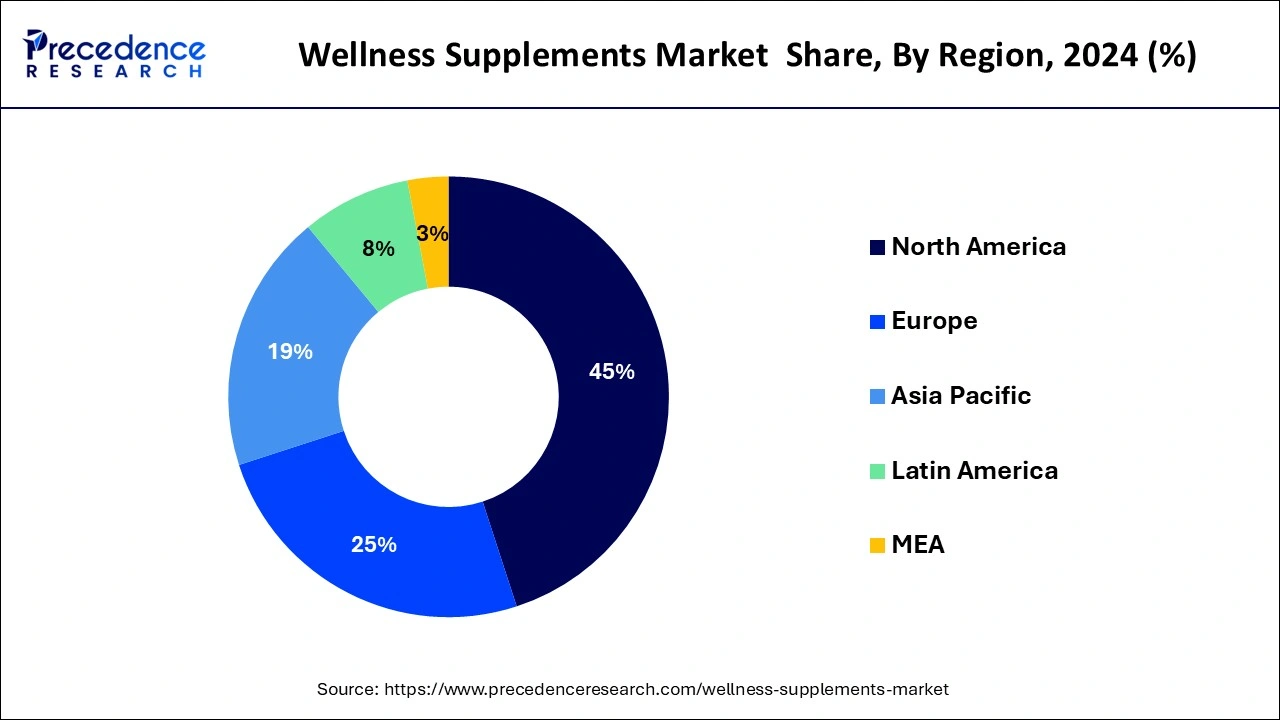

- North America dominated the global market with the largest market share of 45% in 2024.

- Asia Pacific is projected to expand at the notable CAGR during the forecast period.

- By dietary supplements, the Vitamin wellness segment contributed the highest market share in 2024.

- By dietary supplements, the protein segments is estimated to be the fastest-growing segment during the forecast period.

- By functional food and beverages, the hospital segment captured the biggest market share in 2024.

- By functional food and beverages, the Infant formula segment is expected to grow at a significant CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 291.00 Million

- Market Size in 2026: USD 313.49 Million

- Forecasted Market Size by 2034: USD 568.75 Million

- CAGR (2025-2034): 7.73%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

How is AI Changing Wellness Supplements?

Artificial intelligence (AI) tools will improve supply chain management, ensuring timely procurement of raw materials, improving inventory levels, and predicting demand more accurately. AI helps to boost nutrition, well-being, and health. It also helps to stay consistent and accountable, preventive healthcare with AI, manage chronic conditions, optimize your sleep, support mental health, custom workout routines, and personalized nutrition which help the growth of the wellness supplements market.

Wellness Supplements Market Growth Factors

- Wellness supplements are also known as substances that are likely to have additional nutritional value which are essential to add to in diet for enhanced health. Further, wellness supplements are vital for supporting a healthy lifestyle.

- Also, these supplements comprise all the minerals in significant amounts in order to meet the daily requirements for the sustainability of a healthy lifestyle.

- Food supplements gradually comprise folic acid, calcium, vitamin b12, and vitamin D.

- In addition, major factors that are likely to boost the market growth of wellness supplements during the forecast period are the surge in attention toward healthy lifestyles and the rising elderly population.

Wellness Supplements Market Outlook

- Industry Growth Overview:The wellness supplements market is poised for rapid growth from 2025 to 2030, due to increasing health awareness, preventive healthcare trends, and personalized nutrition. The market is seeing an increase in demand for plant-based, clean-label, and functional supplements, especially in Asia-Pacific and North America, as consumers increasingly seek holistic health and immunity-boosting products.

- Sustainability Trends: Sustainability is changing wellness supplements through clean sourcing, biodegradable packaging, and carbon-neutral production. Companies are improving their supply chains to be more sustainable and shifting to natural ingredients. For example, Nestlé Health Science and Herbalife are investing in renewable sourcing and plant-based formulations to help align with global sustainability and transparency objectives.

- Global Expansion: Key players are expanding into emerging economies in the Asia-Pacific, Latin America, and Eastern Europe to tap new consumer segments. GNC and Amway are ramping up localized production and distribution and utilizing regional consumer insights and greater regulatory relaxation to improve accessibility and increase market share.

- Key Investors: A lot of money is being invested by private equity and institutional investors into high-growth areas such as personalized vitamins, gut health supplements, and adaptogens. For example, KKR and Sequoia Capital are funding digital-first wellness brands selling subscriptions to nutrition solutions with strong ESG alignment and scalable models.

- Startup Ecosystem: The wellness supplement startup ecosystem is thriving as companies emerge to create AI-based nutrition, clean label attributes, and biotechnology-based nutraceuticals. Well-funded startups such as Rootine (USA) and HealthKart (India) are receiving VC investment attention for their data-driven, personalized, and sustainable approaches in wellness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 291.00 Million |

| Market Size in 2026 | USD 313.49 Million |

| Market Size by 2034 | USD 568.75 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.73% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Dietary Supplements, Functional Food & Beverages, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Dietary Supplements Insights

Vitamin wellness supplements segment has generated a revenue share of more than 30% and dominated the global wellness supplements market in 2022. The rapid growth in the adoption of supplements has offered a huge growth opportunity to the wellness supplements brands that has fostered the growth of the vitamin segment.

The protein segment is expected to be the fastest-growing segment during the forecast period. With growth in number of elderly population, the demand for supplements like additional wellness nutritional is rising, as the consumers are looking for enhanced sources in order to enable the body to obtain complete nourishment. In addition, rise in spending over these products especially among baby boomers predominantly drives the market growth of the proteins wellness supplements.

Functional Food & Beverages Insights

Sports drink is the dominating market segment. In addition, sports drinks that contain protein helps maintain lean muscles in athletes, and promote building of new muscles in bodybuilders and while products containing electrolytes, minerals, carbohydrates, and other types of nutrients help provide, hydration, energy, and nutrition to the body.

Infant formula is the fastest growing segment, change in lifestyle, rise in middle class population, growth in disposable income in emerging economies such as Indonesia, India, China, and increase in awareness about high nutritional content in the infant formula turns it to be the fastest growing segment of the market.

Regional Insights

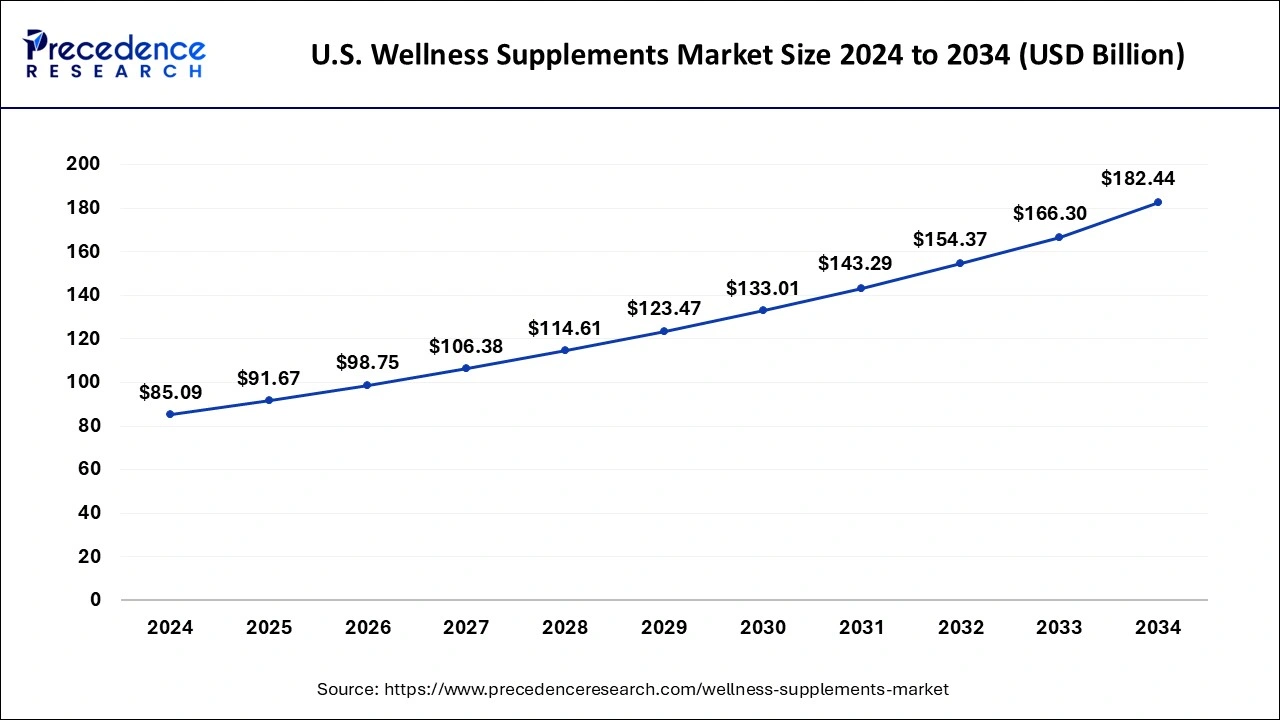

U.S. Wellness Supplements Market Size and Growth 2025 to 2034

The U.S. wellness supplements market size is evaluated at USD 91.67 million in 2025 and is predicted to be worth around USD 182.78 million by 2034, rising at a CAGR of 7.93% from 2025 to 2034.

The United States was the leading country in terms of high market demand for fitness supplements and immune supplement demand. High sales generated by e-commerce and strong investment in nutraceutical research and development supported its dominance in the wellness market. Consumers were also shifting toward clean-label and organic wellness products in the United States.

What made North America Dominate the Wellness Supplements Market in 2025?

North America dominated the global wellness supplements market, stimulated by increasing health consciousness, higher disposable income, and established retail channels. Consumers desired supplements for preventive healthcare and natural ingredients. The region provided ample opportunity for innovation, particularly in personalized supplements and plant-based supplements.

North America dominates the wellness supplements market due to the rise in the aging population. In addition, the rising health consciousness and awareness among consumers is likely to further propel the wellness supplements market growth in the region during the forecast period. Also, Asia-Pacific is likely to have significant growth rate in the market of wellness supplements owing to the dynamic attention of the customers towards healthier and fit lifestyles. Furthermore, the growing awareness regarding wellness products and rise in the purchasing power is further anticipated to boost the wellness supplements market growth in the region.

On the other hand Asia Pacific is expected to register a healthy pace of growth during the forecast period. The growth of the region is largely complemented by the shifting focus of the consumer towards healthier lifestyles along with the rising awareness and acceptance regarding wellness products. The rising consumer disposable income is further propelling the uptake of wellness supplements in the region

The Fastest Growing Region in the Market – Asia-Pacific

The Asia-Pacific region saw the fastest growth in the global wellness supplements market as disposable income rose, lifestyles adapted, and health awareness increased. There were immense opportunities in herbal, traditional, and functional supplements as online retail continued to expand and governments encouraged changes in their nutrition policies.

China led the Asia-Pacific region with growing demand for herbal and traditional supplements. Increased fitness trends, urbanization, and the growth of manufacturers in the nutraceutical space have made China a key sourcing, development, and exporting area for wellness products.

Europe – The Epicenter of Clean and Conscious Wellness

With a robust consumer preference for natural and organic products, Europe is expected to grow rapidly in the global wellness supplements market. The aging population, coupled with strict health regulations and an emphasis on preventive nutrition, contributed to the stability of the market and increased innovation opportunities within sustainable supplement formulations.

Engineering the Future of Supplements in the German Market

Among the European Nations, Germany, with its robust healthcare system, significant awareness around nutrition, and solid supplement manufacturing base, was at the forefront of the wellness supplements market. Strong demand for vitamins and mineral supplements, derived from plants, was trending among older adults and health-conscious younger consumers.

Latin America – The Next Frontier of Functional Wellness

Latin America displayed steady growth, propelled by rising income levels and growing consumer awareness in preventive healthcare. Shifting consumer preferences toward natural and herbal supplements opened the door for local and international brands to extend product lines across several markets.

Consumers in Brazil were leading the market in the region by shopping for fitness and energy supplements. The rising gym culture, increased access to retail channels, and an expanding young population increased the consumption of vitamins, proteins, and herbal wellness supplements.

Middle East & Africa – Emerging Region in the Wellness Revolution

The global wellness supplements market in the Middle East & Africa has been evolving slowly with the changes in the geopolitical economy, urbanization, consumers entering the middle class, and a heightened awareness of preventive involvement toward healthcare. It has been beneficial that the heightened awareness toward lifestyle diseases has opened new space for supplement producers and investments by global brands.

The UAE leads the region, with its progress in fitness culture, wealthy consumers, and retail infrastructure. The consumer demand for sports nutrition products and multivitamin products increased, as consumers place more emphasis on wellness and healthy lifestyles.

Wellness Supplements Market Companies

- Nestle S.A.

- Abbott Laboratories

- Amway

- Otsuka Holdings Co., Ltd.

- Herbalife Ltd.

- Archer Daniels Midland Company

- Glanbia plc

- NBTY, Inc.

- GNC Holdings Inc

- Nu Skin Enterprises, Inc.

Latest Announcement by Industry Leaders

- In June 2024, innovative glp-1nutrition.com, a web platform designed to support individuals on their weight management journey was launched by Nestle Health Science. The product categories offered on glp-1nutrition.com target crucial aspects of the weight management journey. “This innovative platform represents a significant step forward in our mission,” said Anna Mohl, CEO of Nestlé Health Science. “We are excited to offer personalized nutritional solutions and enhance the quality of life for those seeking effective weight management strategies.”

Recent Developments

- In August 2024, ‘HUSHPURR' India's first exclusive women's secret wellness products was launched in Hyderabad by Heravi Pink Store Pvt Ltd Chennai. The Founder, MD and CEO of Heravi Pink Store Pvt Ltd Mr. Radhakrishnan brings significant experience to the role and a thorough understanding of the industry, leveraging expertise in launching wellness products in India.

- In December 2024, the IM8 brand with health, and wellness supplement products was launched by Prenetics, Beckham. IM8 Daily Ultimate Longevity is a one-a-day capsule aimed to target cellular rejuvenation and healthy ageing. IM8 Daily Ultimate Essentials is an all-in-one-flavoured powder that works as a comprehensive daily nutrient supplement, including 16 daily supplements that supports heart health, and supports the joints and muscles.?

Segments Covered in the Report

By Dietary Supplements

- Vitamin

- Mineral

- Botanical

- Probiotics

- Fatty Acid

- Protein

- Others

By Functional Food & Beverages

- Functional Bakery and Confectionary

- Functional Dairy

- Energy Drink

- Sports Drink

- Infant Formula and Baby Food

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting