What is the PET Scanners Market Size?

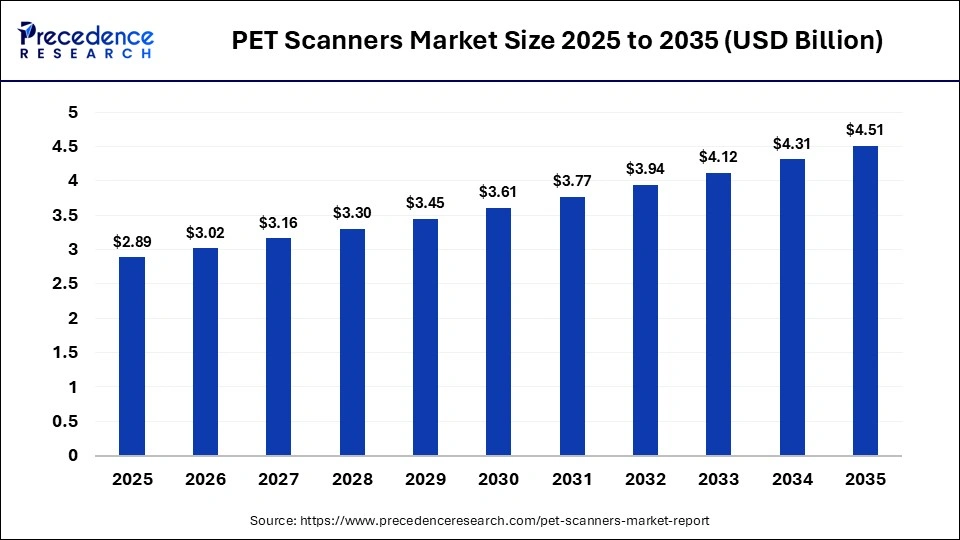

The global PET scanners market size was calculated at USD 2.89 billion in 2025 and is predicted to increase from USD 3.02 billion in 2026 to approximately USD 4.51 billion by 2035, expanding at a CAGR of 4.56% from 2026 to 2035.The PET scanners market is driven by the surging cases of breast cancer globally, coupled with the rapid investment by the diagnostics companies to deploy advanced scanners in their testing centers to enhance the scanning procedure. Also, numerous government initiatives aimed at strengthening the healthcare industry, as well as technological advancements in the neurology sector, are playing a vital role in shaping the industrial landscape.

Market Highlights

- North America led the market with a share of around 42% in 2025.

- Asia Pacific is expected to rise with the highest CAGR of 5% during the forecast period.

- By product/modality, the PET-CT systems (hybrid) segment held the largest share of the market with 82% in 2025.

- By product/modality, the PET/MRI systems segment is expected to grow with the fastest CAGR of 3.8% between 2026 and 2035.

- By application, the oncology segment dominated the market with a share of 55% in 2025.

- By application, the neurology segment is expected to rise with the highest CAGR of 4% during the forecast period.

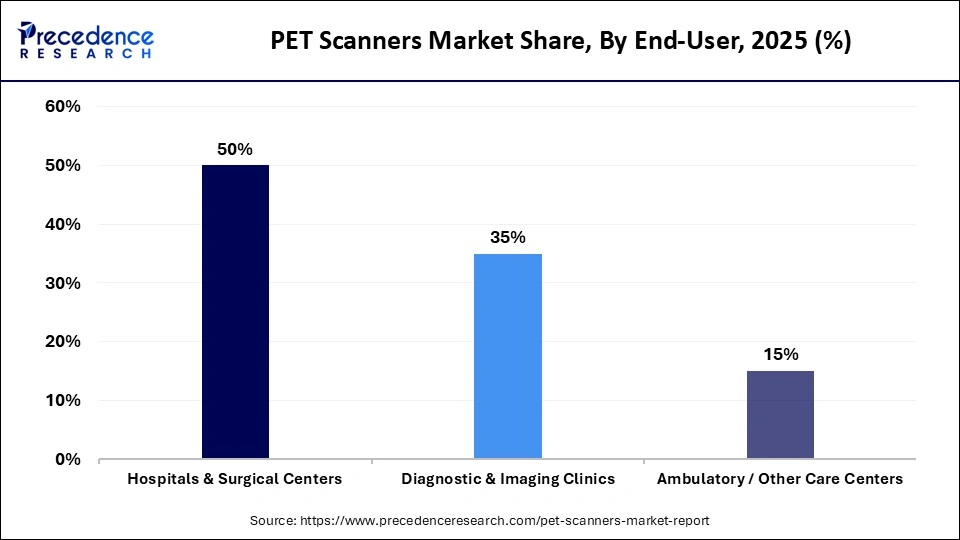

- By end-user, the hospitals & surgical centers segment held the largest share of 50% in the PET scanners industry.

- By end-user, the diagnostic & imaging clinics segment is expected to expand with the fastest growth rate of 4.2% during the forecast period.

What is the Current Scenario of the PET Scanners Industry?

The PET scanners industry is a prominent branch of the healthcare sector. This industry deals in the development and distribution of PET scanners in different parts of the world. The PET scanners market refers to the global industry for positron emission tomography (PET) imaging systems that are used in medical diagnostics to capture functional metabolic activity within the body. These systems are often combined with CT or MRI for early detection, staging, and treatment monitoring of diseases, including cancer, neurological disorders, and cardiovascular conditions. The growth of this market is driven by the rising prevalence of chronic diseases, technological advancements in the diagnostics sector, and increased adoption of advanced machines across hospitals and diagnostic centers globally.

In the United States, regulatory clearances by the Food and Drug Administration and reimbursement frameworks under the Centers for Medicare & Medicaid Services are supporting sustained procurement of PET-CT and PET-MRI systems by hospital networks. Public funding and clinical research programs backed by the National Institutes of Health continue to expand PET usage in oncology, neurology, and cardiology trials, reinforcing demand from academic medical centers. In Europe and Japan, national health systems are investing in hybrid imaging platforms to improve diagnostic accuracy and workflow efficiency. Manufacturers are also focusing on digital detector technology and AI-assisted image reconstruction to reduce scan time and improve throughput in high-volume diagnostic settings.

What Is the Role of AI in the PET Scanners Industry?

AI has significantly contributed to the development of the overall healthcare industry. In recent times, AI has been widely adopted by diagnostic centers for enhancing accuracy, analyzing complex data, identifying patterns, and personalizing treatment. Also, the PET scanner companies have started integrating AI in their products to enhance diagnostics by improving image quality, automating complex analysis, predicting treatment response, and streamlining workflows in the healthcare sector. Moreover, AI-enabled PET scanners help to speed up scans, reduce radiation, and improve diagnostic accuracy. Thus, AI is playing a prominent role in driving this industry.

In the United States, hospital networks deploying AI-assisted PET systems under Food and Drug Administration-cleared software frameworks are improving oncology throughput while maintaining compliance with clinical safety standards. Academic medical centers supported by National Institutes of Health imaging programs are using AI-driven reconstruction and quantification to enhance biomarker reliability in neurology and cardiology studies. Across Europe and Japan, public health systems are adopting AI-enabled PET platforms to standardize interpretation, reduce inter-reader variability, and optimize scanner utilization in high-volume diagnostic centers.

- In June 2025, S.L. Raheja Hospital launched an AI-enabled Digital PET CT unit. This unit is designed to deliver advanced diagnostics excellence and patient-centric care.

PET Scanners Market Trends

- Surging Cases of Cancer: The number of cancer cases has grown significantly in various countries, including the U.S., China, India, and the UK, which in turn has increased the demand for advanced PET scanners. According to Cancer.org, there were approximately 2,041,910 new cancer cases in the U.S. in 2025.

- Government Investments: The governments of several countries are investing heavily in strengthening the overall healthcare sector. For instance, in April 2025, the government of the UK announced an investment of US$ 764 million. This investment is made to strengthen the healthcare sector in this nation.

- Collaborations: Several healthcare organizations are collaborating with medical device companies to develop advanced PET scanners. For instance, in December 2025, SNMMI and EANM collaborated with ARTnet. This collaboration is done for developing an advanced PET scanner for the diagnostic centers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.89Billion |

| Market Size in 2026 | USD 3.02 Billion |

| Market Size by 2035 | USD 4.51Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product/Modality, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product/Modality Insights

Why Did the PET-CT Systems (Hybrid) Dominate the PET Scanners Market in 2025?

The PET-CT systems (hybrid) segment dominated the PET scanners market with a share of 82% in 2025, as the growing use of PET-CT systems (hybrid) in the diagnostics sector to precisely locate and assess diseases, including cancers, heart conditions, and brain disorders, has boosted the market expansion. The rapid deployment of these scanning solutions in modern hospitals to detect diseases at an early stage is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of these scanning solutions, such as precise staging, monitoring treatment response, early recurrence detection, and versatility, are expected to drive the market growth.

The PET/MRI systems segment is expected to expand with the fastest CAGR of 3.8% between 2026 and 2035 owing to the rising application of PET/MRI systems for superior diagnosis and treatment planning has driven the market growth. Also, the growing adoption of these machines in the neurological sector for several diseases, such as detecting epilepsy, tumors, and dementia, is positively contributing to the industry. Moreover, several benefits of these scanning systems, including enhanced diagnostic accuracy, low radiation exposure, improved oncology imaging, and cardiac assessment, are expected to boost the industry.

Application Insights

What Made the Oncology Segment Lead the PET Scanners Market in 2025?

The oncology segment led the PET scanners market with a share of 55% in 2025, due to the growing prevalence of cancers in different nations, including the U.S., Japan, China, Canada, and France, has increased the application of PET scanners, thereby driving the market expansion. Also, numerous government initiatives aimed at developing the oncology centers, along with the rapid deployment of MRI scanners in cancer hospitals, are positively contributing to the industry. Moreover, the surging investment by the healthcare organizations for advancing research and development of cancer treatment is expected to foster the industrial expansion.

The neurology segment is expected to expand with the highest CAGR of 4% during the forecast period, as the rising cases of neurological disorders in several countries, such as India, China, the U.S., France, and Germany, have increased the demand for advanced diagnostic solutions, thereby driving the market expansion. Additionally, the rapid investment by the governments of several nations in opening new neurological hospitals in developed nations, as well as technological advancements in the neurological centers, is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of brain-dedicated PET systems and advanced hybrid imaging devices in the neurology sector is expected to propel the growth of the PET scanners industry.

End-User Insights

Why did the Hospitals & Surgical Centers lead the PET Scanners Market during 2025?

The hospitals & surgical centers segment led the PET scanners market with a share of around 50%, due to the growing adoption of AI-enabled scanners by hospitals in several nations, such as China, the U.S., and France, which has boosted the market expansion. Additionally, the rapid investment by the governments of various countries in opening new cancer hospitals, as well as the rise in the number of surgical centers in developing nations, is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among hospital chains and PET scanner brands for deploying advanced scanning systems in modern hospitals are expected to boost the growth of the PET scanners industry.

The diagnostic & imaging clinics segment is expected to grow at the fastest rate of 4.2% during the forecast period, attributable to increasing adoption of PET-MRI scanners by the diagnostic centers to enhance the testing procedure has driven the market growth. Also, the surging focus of the government on deploying advanced scanning solutions in public clinics, as well as the rising preference of patients to visit imaging clinics on a regular basis, is positively contributing to the industry. Moreover, the growing proliferation of diagnostics startups in developing nations is expected to propel the market growth.

Regional Insights

How Big is the North America PET Scanners Market Size?

The North America pet scanners market size is estimated at USD 1.21 billion in 2025 and is projected to reach approximately USD 1.92 billion by 2035, with a 4.73% CAGR from 2026 to 2035.

Why Did North America Dominate the PET Scanners Market in 2025?

North America dominated the PET scanners market with a share of around 35–42% in 2025. The growing prevalence of prostate cancers in several nations, such as the U.S., Canada, and Mexico, has increased the demand for advanced diagnostic systems, thereby fostering the market growth. Also, the rapid investment by the governments for the digitalization of modern hospitals, as well as the rise in the number of diagnostic centers, is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players, including GE HealthCare, Positron Corporation, and PerkinElmer, is expected to propel the growth of the PET scanners industry in this region.

This regional leadership is reinforced by regulatory clearances and reimbursement pathways administered by the U.S. Food and Drug Administration and the Centers for Medicare & Medicaid Services, which support routine clinical adoption of PET-CT and PET-MRI systems. Federal research funding from the National Institutes of Health continues to expand PET utilization in oncology, neurology, and cardiology trials conducted at academic medical centers. In parallel, large hospital networks are upgrading imaging infrastructure to integrate digital PET scanners with enterprise radiology systems, increasing throughput and diagnostic precision.

According to the American Cancer Society, prostate cancer will represents approximately 30% of all male cancers in 2025 in the U.S.

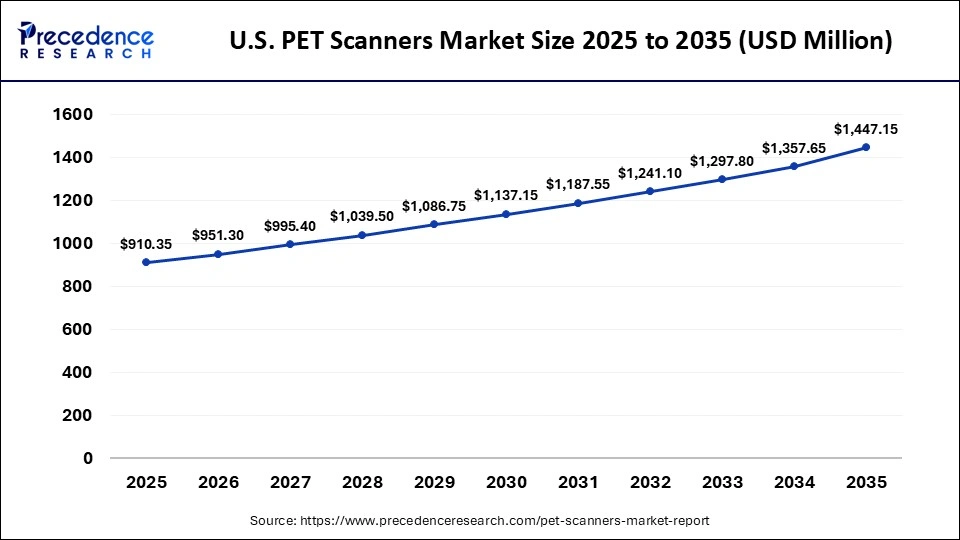

What is the Size of the U.S. PET Scanners Market?

The U.S. pet scanners market size is calculated at USD 910.35 billion in 2025 and is expected to reach nearly USD 1,1447.15 billion in 2035, accelerating at a strong CAGR of 4.74% between 2026 and 2035.

U.S. PET Scanners Industry Analysis

The growing emphasis of healthcare organizations to deploy AI-enabled scanning solutions in public hospitals, as well as the rapid investment by the diagnostics chains for purchasing advanced PET scanners, is playing a prominent role in shaping the industrial landscape. Additionally, technological advancements in cancer hospitals, as well as the rise in the number of healthcare startups, are driving the market expansion.

Why Is Asia Pacific Growing With the Highest CAGR in the PET Scanners Market?

Asia Pacific is expected to grow with the highest CAGR of 5% during the forecast period. The rising cases of Alzheimer's disease in several countries, including China, India, Japan, and South Korea, have boosted the market growth. Additionally, numerous government initiatives aimed at developing the healthcare sector, coupled with technological advancements in the diagnostic centers, are positively contributing to the industry. Moreover, the presence of several market players, such as Yangzhou Kindsway Biotech Co., Hitachi Healthcare, Shimadzu Corporation, and Minfound Medical Systems, is expected to accelerate the growth of the PET scanners industry in this region.

- In November 2025, the government of South Korea announced to invest around US$600 million. This investment is made to enhance medical device innovation in this nation.

India PET Scanners Industry Trends

The surging prevalence of heart diseases, along with the rapid investment by the government for strengthening the medical devices sector, has boosted the market expansion. Additionally, collaborations among healthcare providers and medical device manufacturers to launch new PET scanners are contributing to the industry in this nation.

Who are the Major Players in the Global PET Scanners Market?

The major players in the pet scanners market include Siemens Healthineers, GE Healthcare, Philips Healthcare, Bruker / small-animal PET (research niche), Telix Pharmaceuticals, Canon Medical Systems (Toshiba), United Imaging Healthcare, Hitachi Healthcare, Positron Corporation, Mediso Ltd., RefleXion (Rad Oncology focus), PETsys Electronics, Clarity Pharmaceuticals, PerkinElmer, Inc., Yangzhou Kindsway Biotech Co.

Recent Developments

- In August 2025, Auburn Community Hospital launched a PET/CT scanner. This scanner is designed for the diagnostic centers of the U.S. region.(Source: https://www.fingerlakes1.com)

- In July 2025, the University of British Columbia partnered with BC Cancer. This partnership is aimed at launching the Quadra PET/CT scanner in Canada.(Source: https://vancouver.citynews.ca)

- In February 2025, Positron launched NeuSight PET/CT scanners. These scanners are designed for enhancing the capabilities of heart imaging.(Source: https://www.auntminnie.com)

Segments Covered in the Report

By Product/Modality

- PET-CT Systems (Hybrid)

- PET/MRI Systems

- Standalone PET / Other

By Application

- Oncology

- Cardiology

- Neurology

- Other (research, others)

By End-User

- Hospitals & Surgical Centers

- Diagnostic & Imaging Clinics

- Ambulatory/Other Care Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content