What is the Pharmaceutical Cartridges Market Size?

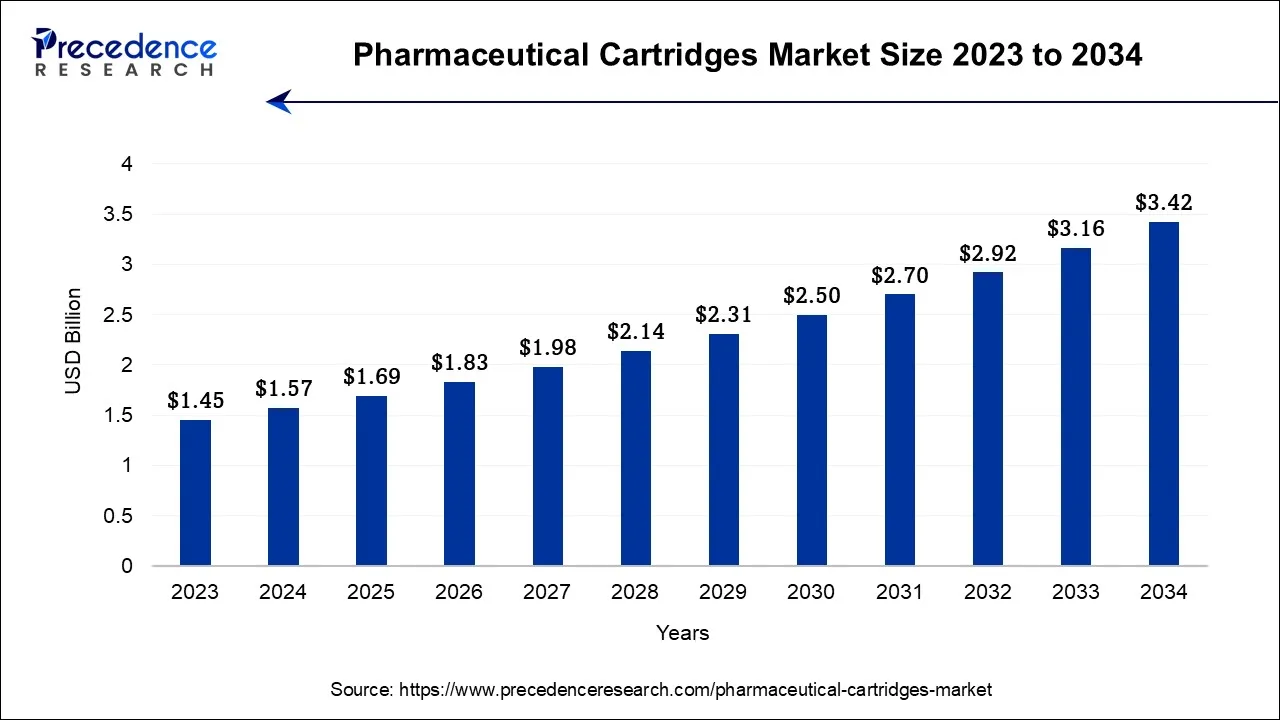

The global pharmaceutical cartridges market size is calculated at USD 1.69 billion in 2025 and is predicted to increase from USD 1.83 billion in 2026 to approximately USD 3.67 billion by 2035, expanding at a CAGR of 8.06% from 2026 to 2035.

Pharmaceutical Cartridges Market Key Takeaways

- North America dominated the market with the largest market share of 32% in 2025.

- Asia Pacific region is expected to expand at the fastest CAGR between 2026 and 2035.

- By Material Type, the glass segment dominated the market with the highest market share of 60% in 2025.

- By Size, the 3 ml segment dominated the market with the highest revenue of 37% in 2025.

- By Application, the pen injectors segment dominated the market with the highest market size in 2025.

- By End-use, the pharmaceutical segment contributed more than 44% of revenue share in 2025.

Market Overview

The pharmaceutical industry is one of the major growing industries across the globe. The pharmaceutical industry is expanding due to the rising awareness about precautionary treatments and growing chronic diseases in the population. Pharmaceutical cartridges are used for many medicinal uses such as the cartridge are used for dental local aesthetics and inside drug delivery devices for a variety of diseases. The cartridge is mainly used in pen injectors for diabetes patients. Selecting the quality and the right packaging for the medical component decides the quality of the product. Wearable injectors are one of the most recent trends in pharmaceutical cartridges. Wearable injectors are gaining popularity due to it allows patients to administer drugs in a home environment. Increasing demand for cartridges due to the rising medical cases in which patients are given parenteral medication when it is difficult to give medication orally.

Pharmaceutical Cartridges Market Growth Factors

The rise in the cases of diabetes and higher blood pressure among patient's results in a higher demand for medicines and apparently will result in a higher demand for quality packaging for ensuring the delivery of injectable medicines, which is benefitting the patients. Rising demand for medicines and injectable drugs for chronic diseases and demand from diabetics results in a higher demand for the pharmaceutical cartridge market. Parenteral treatment is generally preferred for chronic diseases such as diabetes, cancer, intestinal illness, renal failure, and hepatic failure. Increasing parenteral treatment results in a higher demand for the pharmaceutical cartridge market in the anticipated period. Prefilled syringes are the most common and preferable solution for healthcare practitioners, so it has concerns about the breakage of needles due to any kind of accident. The cartridge is user-friendly and does not have any risk of leakage or needle breakage, so it is shown that cartridges are the best solution for medicinal packaging and also positively affect the growth of the pharmaceutical cartridge market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.69Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size by 2035 | USD 3.67Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.06% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Forecast Period | By Material Type, By Size, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Suitability for multi-dose treatments

The suitability of pharmaceutical cartridges for multi-dose treatments addresses practical, convenience and safety considerations, making them an attractive option for both patients and healthcare providers. This factor contributes significantly to the demand and growth of the market. Cartridges that support multi-dose treatments can lead to more efficient use of resources. Cartridges can be pre-filled with the required amount of medication by reducing the risk of dosing errors. These cartridges are designed to maintain accurate dosing even when used multiple times, ensuring that patients receive the correct amount of medication each time they administer it. Thus, the suitability of multi-dose treatments is observed to act as a driver for the market.

Restraint

Environmental concerns

The environmental concerns associated with plastic waste, resource consumption, and hazardous materials pose a notable restraint for the market. As awareness grows, consumers and healthcare providers are pressuring the pharmaceutical industry to adopt more sustainable practices. This includes exploring alternative materials and improving recycling infrastructure. Furthermore, concerns arise when pharmaceutical cartridges contain hazardous materials or chemicals that can leach into the environment, over time, potentially harming the ecosystem. Thus, environmental concerns are observed to hinder the market's growth.

Opportunity

Development of wearable cartridges

The rise of wearable injectors is one trend that the pharmaceutical industry predicts. Wearable injectors are gaining popularity as medical equipment as they enable patients to deliver medication in home care settings. While considering this advancement and product innovation, well-known market players are anticipating the development of wearable cartridges in the upcoming years. Customers can find an appropriate cartridge application solution from the manufacturer's wide range of offers, whether it be for insulin, a dental product, or a higher-value biological medicine meant for a pen or wearable injector. Such product innovation and advancement are observed to open a set of lucrative opportunities for the market's expansion.

Segment Insights

Material Type Insights

The glass segment dominated the market with the largest market share in 2023. The growth of the segment is attributed to the higher resistance offered by glass material through the environment, temperature, and chemicals. The glass segment has the lowest degree of expansion and higher resistance to thermal stress. The glass material is mostly used by the pharmaceutical industry due to its durability against chemicals. While alternatives such as plastic and metal cartridges have emerged in recent years, glass material remains the most preferred choice due to its unmatched quality of preserving drugs.

Furthermore, glass cartridges provide superior visibility, enabling accurate visual inspection of the drug which minimizes dosing errors. This transparency also allows for easy detection of particulate matter or discoloration, ensuring product safety.

Size Insights

The 3 ml segment dominated the market in 2023. The growth of the segment is attributed to the increasing utilization of the 3 ml cartridges in insulin pencils for treating diabetes. The increasing number of patients with diabetes and other chronic diseases also promotes the use of cartridges with 3ml capacity. Factors such as ease of use, its optimized design and injection reliability, and multi-dose flexibility making it effective for the shift in self-injection. The 3 ml cartridge is designed for multiple therapies which need multiple dosages or frequent injections. Thereby, all these factors supplement the segment's growth.

Application Insights

The pen injector segment held the dominating share of the market, the segment is expected to grow at a notable rate during the forecast period. The rising cases of diabetes and presence of potential drug delivery methods for diabetes act as a major driving factor for the segment's growth. Rising preferences for self-administration is also supporting the segment's expansion. Pen injectors are widely used for diabetes patients that require continuous administration.

With the rising emphasis on sustainable production, the manufacturers of pen injectors are focused on the development of sustainable and eco-friendly pen injectors to stay competitive in the industry, this element presents a significant opportunity for the segment's growth.

End-user Insights

The pharmaceutical industry segment is expected to sustain its dominance throughout the forecast period. The growth of the segment is attributed to the advancements in the pharmaceutical packaging processes, increasing biological research, and drug development. The pharmaceutical industry generally seeks new and innovative drug packaging solutions and delivery methods for patient's convenience through their innovative strategies.

The dominance of the segment in the market is attributed to the reliance of the pharmaceutical industry on accurate and precise dosage delivery methods, which makes pharmaceutical cartridges an essential component for packaging and administering medications. These cartridges ensure controlled dispensing, minimizing errors and enhancing patient safety.

Cartridges are used for dental local anesthetics and internal drug delivery for numerous treatments. Continuous innovation and development in the cartridge for drug delivery by the pharmaceutical industry is driving the growth of the segment.

Regional Insights

What Made North America the Dominant Region in the Pharmaceutical Cartridges Market?

North America dominated the market by capturing the largest share in 2024. This is mainly due to high diabetes prevalence, advanced healthcare infrastructure, rapid adoption of self-injection devices, and robust R&D investment. Favorable regulatory frameworks, early uptake of wearable and pen injectors, and the strong presence of leading pharmaceutical packaging and device manufacturers further support market leadership.

U.S. Market Analysis

The U.S. dominates the North American pharmaceutical cartridges market due to its large diabetic and chronic disease population, strong biologics pipeline, and high adoption of pen and wearable injectors. Robust FDA regulatory oversight, advanced manufacturing capabilities, substantial R&D spending, and the presence of leading pharmaceutical, biotech, and packaging companies further accelerate market growth and innovation.

What Makes Asia Pacific the Fastest-Growing Region in the Pharmaceutical Cartridges Market?

Asia Pacific is expected to record the fastest CAGR during the forecast period due to rising chronic disease prevalence, expanding access to healthcare, and growing adoption of injectable therapies. Rapid pharmaceutical manufacturing expansion, increasing investments in biologics, cost-effective production, supportive government initiatives, and improving awareness of self-administration devices across countries like China and India further drive strong market growth.

India Market Analysis

In India, the market is growing due to its rapidly expanding diabetic and chronic disease population, increasing use of injectable therapies, and strong growth in domestic pharmaceutical manufacturing. Government healthcare initiatives, rising production of biologics, cost-effective packaging capabilities, and improving access to self-injection devices across urban and semi-urban areas further support accelerated market expansion.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate over the projection period due to increasing demand for biologics and biosimilars, strong regulatory focus on quality packaging, and rising adoption of self-injection and pen devices. Advanced pharmaceutical manufacturing, sustainability-driven innovations in cartridge materials, expanding home care treatments, and the presence of leading drug delivery and packaging companies further support steady market growth.

UK Market Analysis

The market in the UK is expected to grow at a lucrative rate due to the rising prevalence of chronic diseases, increasing use of injectable biologics, and a strong focus on home-based care. Supportive NHS initiatives, growing clinical research activity, adoption of advanced drug-delivery devices, and investments in pharmaceutical packaging innovation further drive demand for pharmaceutical cartridges during the forecast period.

Value Chain Analysis

- Raw Material Sourcing

This stage involves procuring high-quality materials such as glass, polymers, elastomers, and metals used to manufacture pharmaceutical cartridges.

Key players: Corning Inc., Schott AG, West Pharmaceutical Services, and Nipro Corporation. - Component Manufacturing & Processing

Raw materials are processed into cartridges, plungers, stoppers, and seals using precision molding, extrusion, and sterilization techniques.

Key players: West Pharmaceutical Services, Gerresheimer AG, and AptarGroup. - Cartridge Assembly & Filling

Components are assembled and filled with pharmaceutical formulations under sterile conditions.

Key players: Catalent, Lonza, Becton Dickinson (BD), and Vetter Pharma. - Quality Control & Regulatory Compliance

Finished cartridges undergo rigorous testing for leakage, sterility, compatibility, and labeling compliance.

Key players: SGS, Intertek, TÜV SÜD, and Bureau Veritas.

Pharmaceutical Cartridges Market Companies

- Stevanato Group:Provides glass and polymer pharmaceutical cartridges, prefillable syringes, and integrated drug delivery solutions for biologics and injectables.

- Nipro Corporation: Manufactures high-quality glass cartridges, syringes, and medical devices supporting insulin delivery, vaccines, and injectable pharmaceuticals worldwide.

- Gerresheimer AG: Offers pharmaceutical glass and plastic cartridges, prefillable systems, and drug delivery components, ensuring safety, precision, and regulatory compliance.

- West Pharmaceutical Services, Inc.: Specializes in elastomer closures, cartridge systems, and containment solutions, enhancing drug stability, compatibility, and injectable delivery performance.

- Schott AG: Develops advanced pharmaceutical glass cartridges and tubing with high chemical resistance for sensitive biologics and injectable drugs.

- Transcoject GmbH: Designs cartridge-based injection systems and pen injector technologies supporting accurate, patient-friendly self-administration of medications.

Other Major Key players

- Shandong Medicinal Glass Co., Ltd.

- Dätwyler Holding Inc.

- AptarGroup, Inc.

- Sonata Rubber

Recent Developments

- In January 2025, Aktiv Medical Systems partnered with a global pharmaceutical firm to jointly develop a large-dose, high-concentration autoinjector using its PenPal platform with a 5.5 mL glass cartridge.

(Source: prweb.com ) - In October 2024, BD partnered with Ypsomed to combine the Neopak XtraFlow syringe with the YpsoMate 2.25 autoinjector for delivering high-viscosity biologic drugs.

(Source: news.bd.com ) - In August 2023, India's pharma and medtech sector stated to gain Rs, 5000 crores plan to boost the pharmaceutical industry. Health Ministry is about to introduce a 5-year policy that helps to improve the research and development program in MedTech and the pharmaceutical industry.

- In July 2023, at the pharmaceutical trade fair Interphex in New York City, Scott Pharmaceutical launched the world's first cartridges specially made for the use of high-speed filling lines, the latest designs are manufactured for faster processing and reduce losses in overfilling.

- In July 2023, Procaps's Sofgen, the major provider of contract and development manufacturing services in advanced Softgel technologies for the nutraceutical and pharmaceutical industries, announced to launch its new website with the identity of the latest corporate brands that promote the transformation and innovation of the company.

- In July 2023, the latest Neo Toploading Cartoner was launched by Dividella, the launch of the machine is meet the market demand due to the product-flexible packaging machine and is capable of handling a pack of five, ten, or 100 products at high-level output.

Segments Covered in the Report

By Material Type

- Glass Cartridges

- Type 1

- Type 2

- Type 3

- Plastic Cartridges

- Polypropylene (PP)

- Cyclic Olefin Copolymer (COC)

- Cyclic Olefin Polymer (COP)

- Polyethylene

- Rubber

By Size

- 0.5 ml

- 1.8 ml

- 2ml to 2.5 ml

- 3 ml

- 5 ml

- More than 10 ml

By Application

- Pen Injectors

- Autoinjectors

- Wearable Injectors

- Dental Anesthesia

By End-user

- Pharmaceuticals

- Biotechnology

- Research Organizations

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting