What is Phosphoric Acid Market Size?

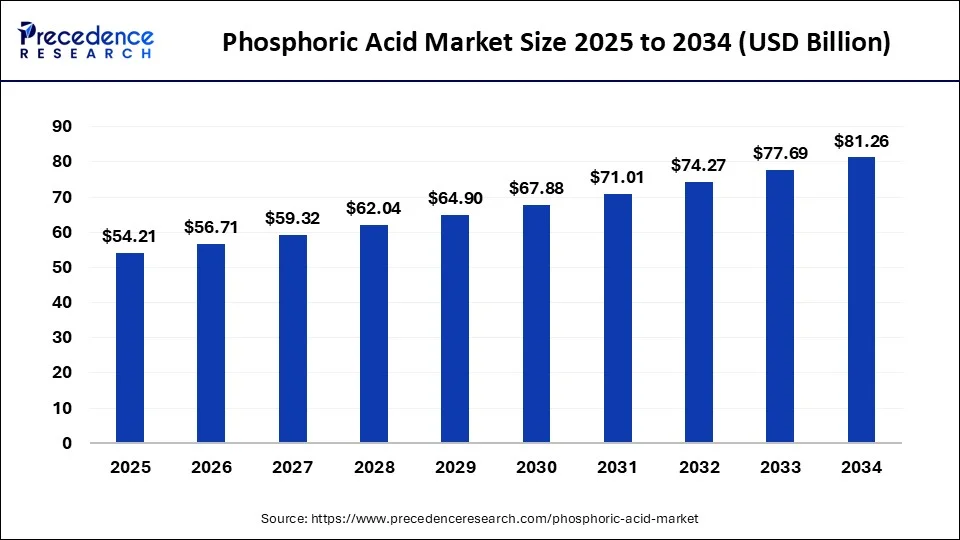

The global phosphoric acid market size is estimated at USD 54.21 billion in 2025, and projected to hit around USD 56.71 billion by 2026, and is anticipated to reach around USD 84.73 billion by 2035, growing at a CAGR of 4.57% from 2026 and 2035.

Market Highlights

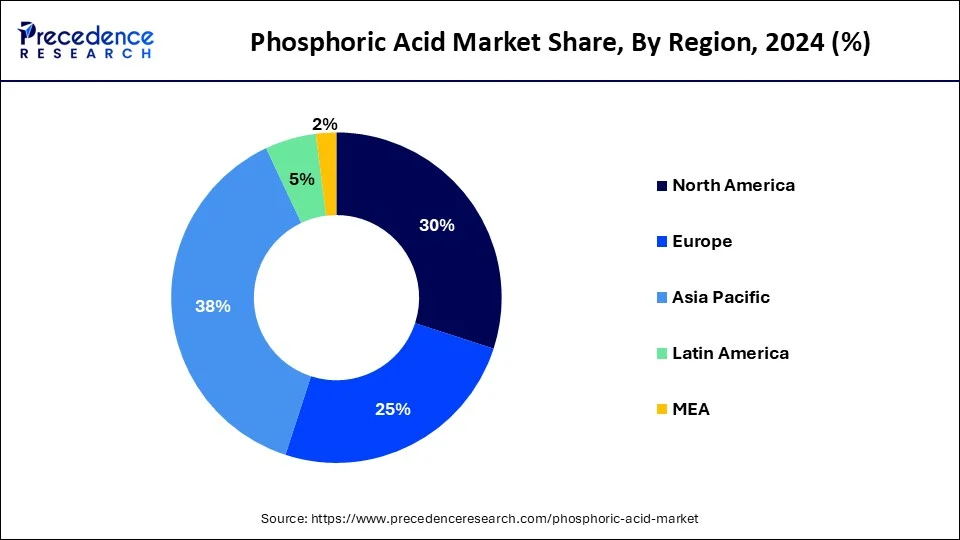

- Asia-Pacific has held the largest revenue share of 38% in 2025.

- Europe is estimated to observe the fastest expansion.

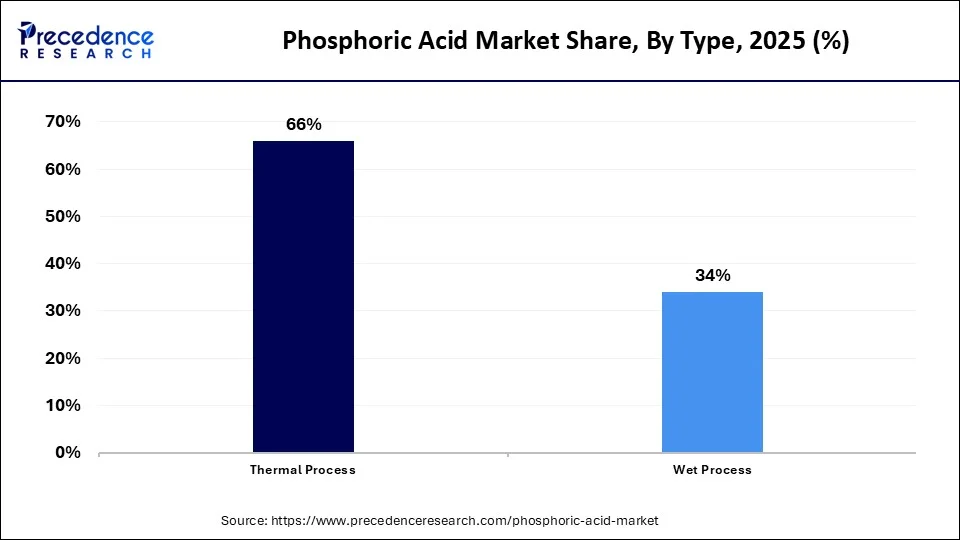

- By Process Type, the thermal process segment generated over 66% of revenue share in 2025.

- By Process Type, the wet process segment is anticipated to grow at a remarkable CAGR of 6.8% during the projected period.

- By Application, the fertilizer segment contributed the highest market share of 44% in 2025.

- By Application, the water treatment segment is expected to expand at the fastest CAGR over the projected period.

What are the Fundamental Applications of Phosphoric Acid?

The phosphoric acid market revolves around the manufacturing and distribution of phosphoric acid, an essential inorganic chemical compound widely applied in diverse industrial sectors. Its primary uses include serving as a vital component in fertilizer production, food and beverage additives, detergents, and as a corrosion inhibitor in the automotive industry.

This market's essence lies in supplying phosphoric acid as a fundamental ingredient for numerous industrial applications and processes across various sectors. Market dynamics are influenced by factors such as agriculture demands, food and beverage production, and industrial manufacturing needs.

The market's nature is characterized by its widespread use in diverse sectors, where phosphoric acid serves as a crucial component for various chemical processes and applications.

What is the Role of AI in the Phosphoric Acid Industry?

AI has major applications in production, which include predictive yield modelling, filtration optimization, predictive maintenance, and smart manufacturing. The yield of phosphoric acid is possibly predicted by Artificial Neural Networks (ANN) under varying operating parameters, such as slurry density and reactor temperature. Moreover, machine learning has great potential to analyze sensor data from reactors and pumps to predict potential failures.

Phosphoric Acid Market Growth Factors

- The phosphoric acid market centers on the production and distribution of phosphoric acid, a versatile inorganic compound widely used across various industrial applications. It serves as a critical ingredient in fertilizer production, food and beverage additives, and detergents, and functions as a rust inhibitor in the automotive industry. This market's significance lies in supplying a fundamental component essential for various chemical processes and industrial applications.

- Several key trends and growth drivers shape the phosphoric acid industry. Firstly, the agriculture sector's continuous demand for fertilizers fuels the market, driven by global food security concerns. Secondly, the food and beverage industry rely on phosphoric acid as an acidity regulator and flavor enhancer, contributing to its growth. Thirdly, the detergents and cleaning products segment benefits from its use as a cleaning agent, especially in household and industrial applications. Moreover, the automotive industry's need for rust inhibitors adds to phosphoric acid's market demand, driven by the growth of the automotive sector.

- Multiple factors propel growth in the phosphoric acid market. The global population's increasing food consumption necessitates higher agricultural yields, driving fertilizer demand. Additionally, rising awareness of food quality and safety encourages the use of food-grade phosphoric acid in the food industry. Moreover, expanding industrial and manufacturing activities boost the demand for cleaning products and rust inhibitors containing phosphoric acid.

- Furthermore, the market benefits from innovations in phosphoric acid production processes that enhance efficiency and reduce environmental impacts. Challenges in the Phosphoric Acid Market include environmental concerns related to phosphorus runoff and water pollution. Regulatory pressures and sustainability initiatives drive the need for eco-friendly production methods. Market players must also contend with price fluctuations in raw materials, impacting production costs and pricing. However, these challenges create opportunities for businesses to invest in sustainable and efficient phosphoric acid production methods, aligning with environmental regulations.

- Exploring new applications, such as phosphoric acid in batteries or as a source of renewable energy, can open doors to diversification and growth. Additionally, expanding into emerging markets with rising industrial and agricultural activities presents opportunities for market expansion.

Phosphoric Acid Market Outlook:

- Global Expansion: The emergence of accelerated demand from agriculture for fertilizers and the food and beverage industry for additives is impacting the complete progression.

- Major Investor: In May 2025, CIPL invested nearly $48 million (Rs 400 crore) to establish a 50,000 tons per annum integrated phosphoric acid facility in Southern India.

- Startup Ecosystem: Phos-Nano Labs (California, USA), a startup that develops plasma-purified phosphoric acid with sub-parts-per-billion (ppb) metal content.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.21 Billion |

| Market Size in 2026 | USD 56.71 Billion |

| Market Size by 2035 | USD 84.73Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.57% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Process Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Agricultural, food and beverage industry demand

Agricultural demand propels market demand in the phosphoric acid market as phosphoric acid plays a critical role in fertilizer production. With the world's growing population and the need to enhance agricultural yields, there is an escalating demand for efficient fertilizers containing phosphoric acid. This compound provides essential phosphorus to crops, ensuring optimal growth and yields. As global food security concerns persist, the agricultural sector's consistent reliance on phosphoric acid for fertilizer production continues to drive robust demand in the market. Moreover, the phosphoric acid market experiences a surge in demand due to the food and beverage industry's requirements.

Phosphoric acid serves as a crucial acidity regulator and flavor enhancer in various products, including carbonated beverages and processed foods. As consumer preferences for such products continue to rise globally, the need for phosphoric acid in food and beverage manufacturing grows substantially. This industry-driven demand underscores phosphoric acid's pivotal role in ensuring the desired taste and quality of a wide range of food and drink items, propelling market growth.

Restraints

Environmental concerns and safety regulations

Environmental concerns pose a restraint on the phosphoric acid industry by raising alarm over phosphorus runoff from agricultural applications. This runoff can lead to water pollution, ecosystem disruptions, and adverse environmental impacts. In response, regulators enforce stringent restrictions on the use of phosphoric acid. Concerns about its ecological footprint and potential harm to aquatic systems have heightened, creating challenges for the market as it strives to adopt more environmentally responsible production practices and mitigate its impact, which can lead to increased compliance costs and limited usage in certain regions.

Moreover, health and safety regulations serve as a restraint on the phosphoric acid market by imposing strict compliance requirements on the handling, transportation, and storage of phosphoric acid. These regulations are aimed at ensuring worker safety and preventing potential hazards associated with the chemical. Complying with these stringent standards can result in increased operational costs for manufacturers, necessitating the implementation of robust safety measures and training programs. The complexity of adhering to such regulations can pose logistical challenges and additional expenses, impacting the overall market demand and profitability.

Opportunities

Sustainable production and advanced technologies

Sustainable production practices drive market demand in the phosphoric acid market as environmental consciousness rises. Consumers and regulators increasingly favor eco-friendly and responsible production methods. Companies adopting sustainable techniques not only mitigate environmental concerns related to phosphoric acid production but also meet the growing demand for greener chemicals. This commitment to sustainability enhances the market's reputation, attracts environmentally-conscious consumers, and ensures compliance with evolving environmental regulations, ultimately boosting demand for phosphoric acid produced through eco-friendly processes.

Moreover, advanced technologies surge the demand in the phosphoric acid market by enhancing production processes. Innovations, such as more efficient extraction methods and automation, increase production capacity, reduce energy consumption, and improve cost-effectiveness. These technologies enable manufacturers to meet growing demand while maintaining competitive pricing. Moreover, advanced methods address environmental concerns, aligning with sustainability expectations. As the market embraces cutting-edge technologies, it gains efficiency, cost savings, and environmental benefits, driving increased demand for phosphoric acid across various industries.

Segments Insights

Process Type Insights

The thermal process segment has held 66 % revenue share in 2025. The thermal process in the phosphoric acid market refers to a manufacturing method where phosphate rock is subjected to high-temperature treatment, typically via combustion or smelting processes. This results in the production of phosphoric acid. Trends in the thermal process segment of the phosphoric acid market include a focus on improving energy efficiency and reducing environmental impact.

Manufacturers are investing in advanced technologies and cleaner combustion methods to enhance production sustainability. Additionally, efforts are being made to maximize phosphate rock utilization and minimize waste in the thermal process, aligning with the industry's growing emphasis on eco-friendly and resource-efficient production techniques.

The Wet Process is anticipated to expand at a significantly CAGR of 6.8% during the projected period. The wet process is a conventional method of producing phosphoric acid, involving the reaction of phosphate rock with sulfuric acid. This process yields a high-purity phosphoric acid suitable for various industrial applications, particularly in the production of fertilizers and food additives.

In the phosphoric acid market, the wet process remains a dominant production method due to its reliability and high-quality output. However, the industry is witnessing a trend toward adopting more sustainable practices and improving energy efficiency within the wet process to reduce environmental impacts and operating costs. These efforts align with the growing emphasis on sustainability and environmental responsibility in the chemical manufacturing sector.

Application Insights

The fertilizer segment held the largest market share of 44% in 2025. Within the phosphoric acid market, a prominent application area is fertilizers. These substances enhance soil fertility by supplying crucial nutrients to plants, with phosphoric acid being a pivotal ingredient. A significant trend in this sector is the escalating global need for fertilizers to enhance agricultural yields and ensure food security. Furthermore, there's a rising focus on environmentally friendly and sustainable fertilizers, spurring innovations in phosphoric acid-based fertilizer formulations. These innovations aim to reduce environmental footprints while maximizing crop productivity, in line with the broader sustainability objectives within modern agriculture.

The water treatment segment is projected to grow at the fastest rate over the projected period. Water treatment in the phosphoric acid market refers to the application of phosphoric acid as a corrosion inhibitor and pH adjuster in processes aimed at purifying and conditioning water for various industrial and municipal purposes. Trends in this segment include a growing emphasis on sustainable and environmentally friendly water treatment methods, which drive the demand for eco-friendly phosphoric acid formulations. Additionally, the increasing need for effective corrosion control in water systems and infrastructure maintenance further propels the utilization of phosphoric acid in water treatment processes.

Regional Insights

What is the Asia Pacific Phosphoric Acid Market Size?

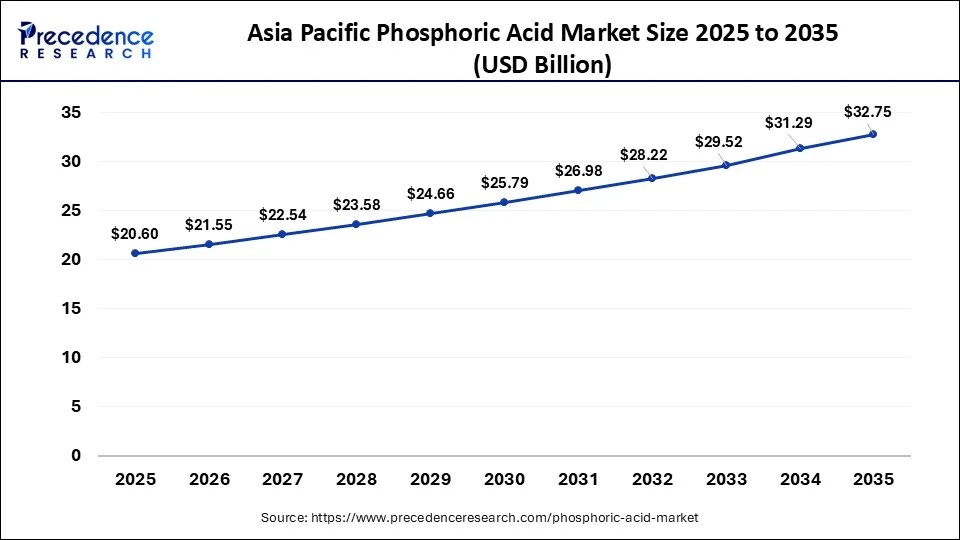

The Asia Pacific phosphoric acid market size accounted for USD 20.60 billion in 2025 and is estimated to reach around USD 32.75 billion by 2035. at a CAGR of 4.75% from 2026 to 2035.

What Made the Asia Pacific Dominant in the Market in 2025?

Asia-Pacific has held the largest revenue share of 38% in 2025. In the Asia-Pacific region, the phosphoric acid market is witnessing notable trends. The agricultural sector remains a key driver due to increasing food demand, leading to higher fertilizer production and phosphoric acid consumption. Additionally, the food and beverage industry's growth, driven by changing consumer preferences and urbanization, contributes to rising demand for food-grade phosphoric acid. Furthermore, the region's expanding industrial and manufacturing activities, especially in emerging economies, further boost the market. Sustainable production practices and technological advancements are also gaining prominence as Asia-Pacific aims to align with global environmental standards.

Persistent Rising Use in the Food & Beverage Industry is Fueling Europe

Europe is estimated to observe the fastest expansion. In Europe, the phosphoric acid market is marked by several trends. The region is experiencing a growing demand for sustainable and eco-friendly production methods, aligning with stringent environmental regulations. Additionally, the food and beverage industry is steadily increasing its usage of phosphoric acid as an acidity regulator and flavor enhancer in various products. As sustainability and food quality become paramount, Europe's phosphoric acid market is witnessing a shift towards cleaner production methods and a surge in applications in the food sector.

Immersive Regulatory Environment Supports North America

Moreover, in North America, the phosphoric acid market is characterized by several prominent trends. This emphasis is driven by both regulatory pressures and consumers' preferences for eco-friendly products. Furthermore, the region's food and beverage industry is actively exploring innovative applications for phosphoric acid, notably as an acidity regulator and flavor enhancer across a diverse spectrum of products. These trends reflect a concerted effort in North America to align with environmental standards and cater to evolving consumer demands in the food sector.

The market also benefits from advancements in production technologies, which enhance efficiency and reduce environmental impacts. Overall, North America's phosphoric acid market reflects a dynamic landscape responding to evolving industry and consumer demands.

What is the role of Latin America in the Market?

Latin America plays a significant role in the phosphoric acid market, particularly for fertilizer production. Brazil is the main driver of growth in the region, thanks to its robust agricultural sector and food processing industry. Phosphoric acid is crucial for producing phosphate fertilizers, such as Monoammonium Phosphate and Diammonium Phosphate, which enhance crop yields to meet global food demands. Other countries, including Argentina and Mexico, also contribute to the regional market. Investments in agricultural productivity and government initiatives aimed at reducing reliance on imported fertilizers further increase demand.

Brazil Phosphoric Acid Market Trends

Brazil experiences an increased demand for food-grade phosphoric acid used as a preservative and an acidulant in the food and beverage industry. Domestic consumption is supported by the need for key fertilizer products like diammonium hydrogen phosphate (DAP) and monommonium dihydrogen phosphate (MAP), while the country remains a leading regional market in Latin America.

How will the Middle East and Africa surge in the Market?

In the Middle East and Africa, the region is home to abundant phosphate rock reserves, with Morocco holding a significant portion of the world's total supply. Major producers in this area include OCP Group and ICL Group. The demand for phosphoric acid in the region is driven by agricultural growth and government efforts to enhance food security, particularly for fertilizers. Additionally, phosphoric acid is used in various industrial applications, such as food additives, metal treatment, and detergents, for continued growth in the phosphoric acid market.

Saudi Arabia Phosphoric Acid Market Trends

The integrated production hubs and vast natural reserves expand the Saudi Arabian market for phosphoric acid. The market is further driven by key fertilizer segments such as diammonium hydrogenphosphate (DAP) and monoammonium dihydrogenphosphate (MAP), with specialty phosphates gaining traction for high-value and precision agriculture applications. Strategic investments by major players in capacity expansion, sustainability practices, and downstream value addition are enhancing supply security and export potential.

Ongoing Developments in Domestic Capacity: Indian Market Trend

India held a major share of the ASAP market in 2024, with its broader efforts in enhancing domestic capacity, such as Coromandel International announced strategies for novel phosphoric and sulfuric acid plants in Kakinada, Andhra Pradesh, with an investment of approximately USD 116 million. Also, Gujarat Alkalies and Chemicals Ltd (GACL) unveiled a new Food Grade Phosphoric Acid plant in Dahej with a capacity of 33,870 metric tons per annum.

Focusing on Mandatory Phosphorus Recovery: German Market Trend

The prospective expansion of the German market is propelled by the escalating need for all German wastewater treatment plants (WWTPs) to recover phosphorus if the content in their sewage sludge exceeds 20 g/kg (dry weight) at the start of 2029. This regulation is a substantial catalyst for innovation in phosphorus recycling technologies and is estimated to enhance demand for recovering phosphorus from waste and wastewater.

Spurring High-Purity Production: U.S. Market Trend

In the U.S. & Europe, the reshoring of the semiconductor industry has accelerated demand for ultra-high-purity phosphoric acid.

For instance

In February 2025, Prayon announced the construction of a new electronic-grade phosphoric acid production unit in Bex, Switzerland, to double capacity, partly to highlight the surging demand in the U.S. market.

Phosphoric Acid Market: Value Chain Analysis

- Feedstock Procurement: This mainly comprises raw material sourcing, such as phosphate rock sourcing, sulfuric acid sourcing, transportation, and initial handling/preparation.

Key Players: OCP Group, The Mosaic Company, Nutrien Ltd., etc. - Chemical Synthesis and Processing: This includes the wet process, which reacts phosphate rock with sulfuric acid, and the thermal process, which burns elemental phosphorus to form phosphorus pentoxide, followed by hydration.

Key Players: Vinipul Inorganics Pvt. Ltd., Gujarat Alkalies & Chemicals Ltd., ICL Group, etc. - Regulatory Compliance and Safety Monitoring: The market involves developed exposure limits, stricter handling and storage procedures, particular transport protocols, and environmental discharge controls.

Key Players: OSHA, BIS, Freyr Solutions, Intertek, etc.

Top Companies and Their Offerings and Contributions in the Market

- OCP Group: The world's largest producer of phosphate-based fertilizers, OCP is a leading player in phosphoric acid, offering a wide range of products with extensive integration into fertilizers, feed additives, and industrial uses.

- The Mosaic Company: A top global producer of concentrated phosphate and potash, Mosaic has a strong market position centered on the North American market and manages a significant portion of global supply for agricultural crop nutrients and animal feed ingredients.

- Nutrien Ltd.: The world's largest provider of crop inputs and services, Nutrien produces and distributes the three key crop nutrients (potash, nitrogen, and phosphate) through a vast retail network, focusing heavily on agricultural applications.

- Israel Chemicals Ltd. (ICL): A dominant player in "new-generation" phosphoric acid, ICL provides products for a range of applications including fertilizers and specialty organic chemicals.

- Innophos Holdings, Inc.: This company focuses on specialty phosphates for food & beverage, health & nutrition, and industrial markets, providing high-purity, food-grade, and technical-grade phosphoric acid for applications beyond traditional agriculture, such as water treatment, metal finishing, and batteries.

Other Major Key Players

- OCP Group: Specialty acids, purified phosphoric acid, water-soluble fertilizers, animal feed phosphates, merchant grade phosphoric acid.

- Prayon Group: Merchant-grade acid, electronics-grade phosphoric acid, food and technical phosphates, animal feed phosphates, valuable co-products.

- Solvay S.A.: Electronic-grade phosphoric acid, phosphorus derivatives, potassium phosphate, sodium hypophosphite, etc.

- EuroChem Group AG: Nitrophosphoric acid, wet-process phosphoric acid, industrial & technical grade acid, phosphate feed products.

- Innophos Holdings, Inc.: Food Grade Phosphoric Acid, Technical Grade Phosphoric Acid, Battery Grade, etc.

- Wengfu Group: Sodium Acid Pyrophosphate, Sodium Tripolyphosphate, Potassium phosphates.

- Nutrien Ltd.: Diammonium Phosphate, monoammonium phosphate, downstream fertilizer, and industrial products.

- The Mosaic Company: Concentrated phosphate fertilizers, animal feed ingredients, diammonium phosphate, etc.

- Israel Chemicals Ltd.: White phosphoric acid, green phosphoric acid, polyphosphoric acid, Thermal Select™ phosphoric acid.

Other Major Key Players

- Prayon Group

- Solvay S.A.

- EuroChem Group AG

- PotashCorp (Potash Corporation of Saskatchewan Inc.)

- Jordan Phosphate Mines Company PLC

- Chemische Fabrik Budenheim KG

- Wengfu Group

- Yuntianhua Group Co., Ltd.

- Reade Advanced Materials

Leaders Announcements

- In July 2025, Mohammad Thneibat, Chairman of the Board of JPMC, and Erick Thohir, Indonesia's Minister of State-Owned Enterprises, agreed to establish a joint plant in Indonesia to produce 200,000 tonnes of phosphoric acid annually. This venture will double their existing output to 400,000 tonnes. They formed a joint technical committee to prepare project studies for board approval within two months and discussed strengthening cooperation in the fertilizer sector to meet Indonesia's market demands.

- In September 2024, OCI Co. became the first supplier of high-purity phosphoric acid to South Korean semiconductor manufacturers, including SK Hynix, after passing their quality tests. This achievement solidifies OCI's position in the ultrapure phosphoric acid market.

- In January 2024, Prayon acquired a majority stake in Febex, a leading producer of electronic-grade phosphoric acid in Europe. This acquisition enhances Prayon's position in phosphorus chemistry and opens up new opportunities in the electronics and pharmaceutical sectors. CEO Geoffrey Close expressed enthusiasm about collaborating with Febex's teams to explore growth opportunities.

Recent Developments

- In February 2025, Prayon announced the construction of a new electronic-grade phosphoric acid production unit in Bex, Switzerland. This investment will double production capacity in order to meet the growing demand for ultrapure phosphoric acid, notably linked to the reshoring of the fast-growing semiconductor market in Europe and the United States. Geoffrey Close, Prayon CEO, stated, “This electronics-grade phosphoric acid production unit will help secure our leadership in Europe while strengthening our position to meet growing demand in the United States.” (Source: http://prayon.com)

- In March 2024, EuroChem launched a state-of-the-art phosphate fertilizer complex in Brazil. With a total project investment of nearly USD 1 billion, the new phosphate mine and plant complex was constructed in record-breaking time and will have an annual production capacity of 1 million tonnes of advanced phosphate fertilizers, significantly increasing the reliability of domestic phosphate fertilizer supplies to Brazilian farmers. (Soruce: https://www.eurochemgroup.com)

- In August 2024, a consortium of nine Egyptian firms announced their plan to implement a phosphoric acid production project in the Abu Tartur area, with investments of USD 1.2 billion, a government official told Al Arabiya Business. The official pointed out that the project is set to be executed within almost 36 months, targeting a production capacity of up to 900,000 tons of phosphoric acid annually with a concentration of 54%. (Source: https://www.zawya.com)

- In 2021,ICL successfully acquired Fertiláqua, aiming to utilize its robust market presence and distribution capabilities to boost sales of organic and controlled-release fertilizers and specialty plant nutrition products in Brazil, a rapidly growing agricultural market.

- In 2020, OCP Group, in collaboration with German and Belgian partners Budenheim and Prayon, initiated the construction of a new purified phosphoric acid plant in Morocco. This strategic project aims to bolster phosphoric acid production and meet growing market demands.

- In 2018, The Agrium merge with PotashCorp resulting in the formation of Nutrien.The Nutrien boasts the industry's largest crop nutrient production portfolio and an extensive global retail distribution network comprising over 1,500 farm retail centers.

- In 2016, The Mosaic Company acquired Vale Fertilizantes, the fertilizer division of Vale S.A., which included phosphate assets and phosphoric acid production facilities. This acquisition expanded Mosaic's presence in the phosphoric acid market.

Segments Covered in the Report

By Process Type

- Wet Process

- Thermal Process

By Application

- Fertilizers

- Feed and Food Additives

- Detergents

- Water Treatment Chemicals

- Metal Treatments

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting