Plastic Transistors Market Size and Forecast 2025 to 2034

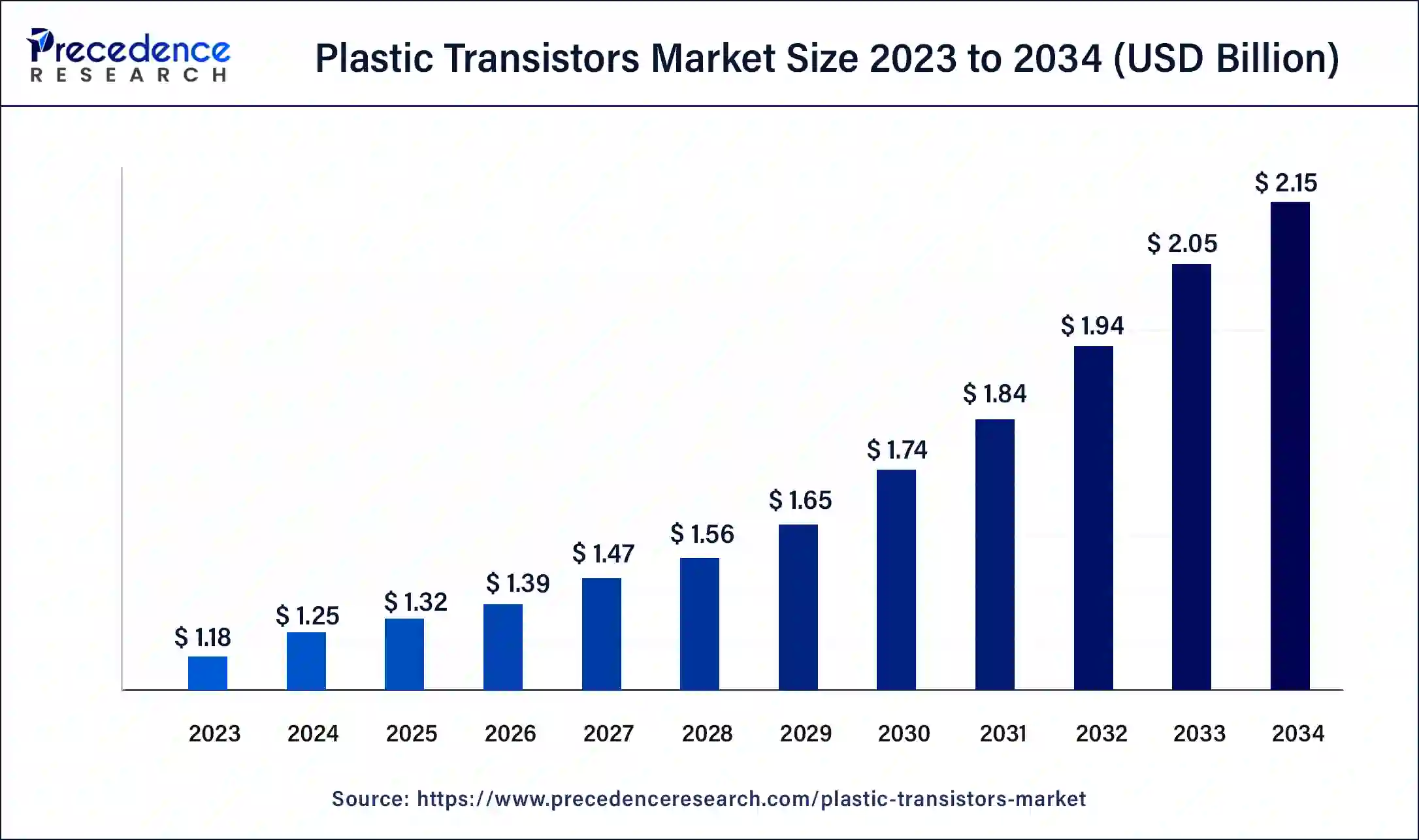

The global plastic transistors market size accounted at USD 1.25 billion in 2024 and is anticipated to reach around USD 2.15 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034.

Plastic Transistors Market Key Takeaways

- The global plastic transistors market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 2.15 billion by 2034.

- The plastic transistors market is expected to grow at a CAGR of 5.57% from 2025 to 2034.

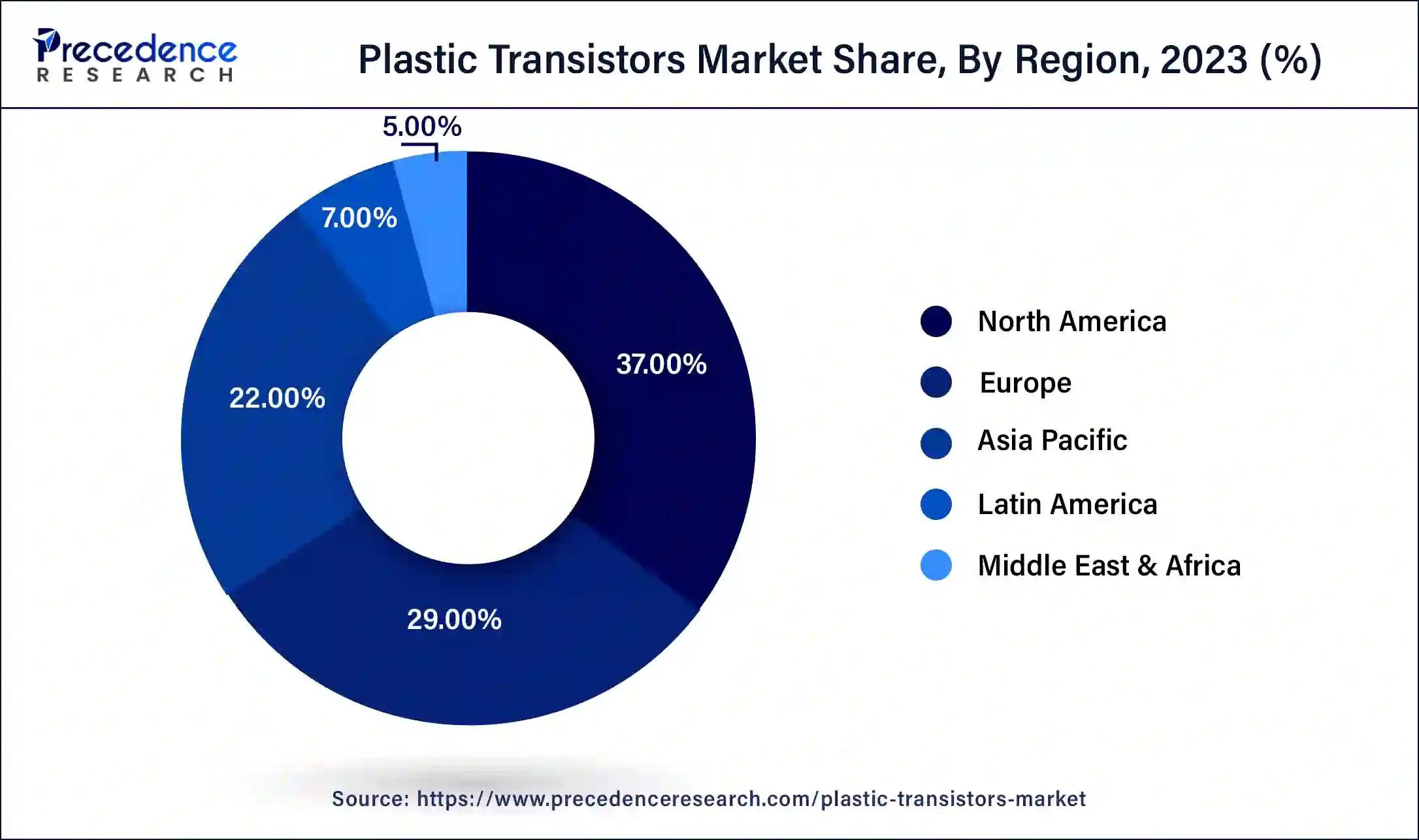

- North America contributed more than 37% market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the 3-alkythiophene semiconducting layer segment has held the largest market share of 42% in 2024.

- By type, the two silver electrodes segment is anticipated to grow at a remarkable CAGR of 6.2% between 2025 and 2034.

- By application, the plastic displays segment generated over 36% of the market share in 2024.

- By application, the OLED segment is expected to expand at the fastest CAGR over the projected period.

U.S. Plastic Transistors Market Size and Growth 2025 To 2034

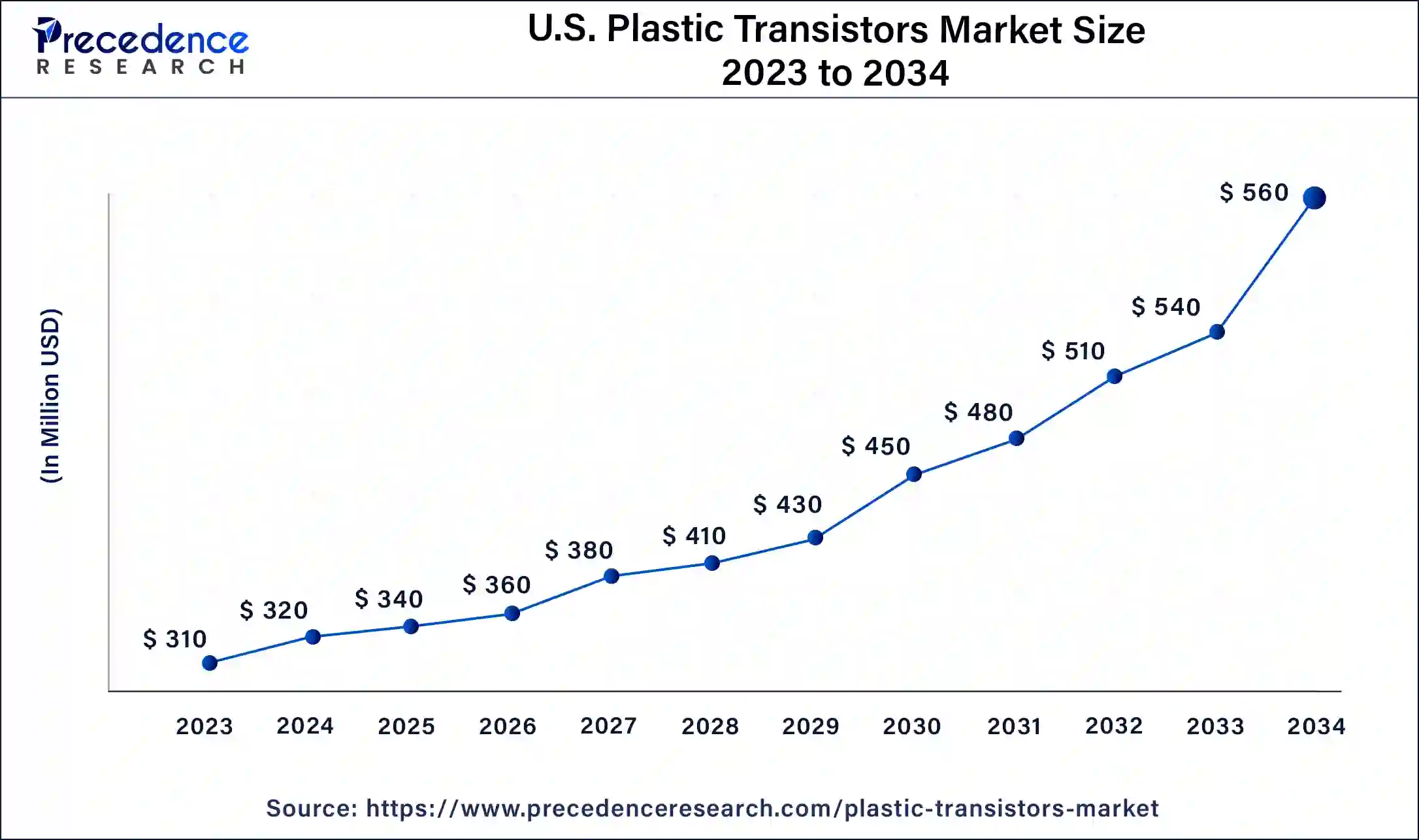

The U.S. plastic transistors market size was valued at USD 320 million in 2024 and is expected to be worth around USD 560 million by 2034, at a CAGR of 5.76% from 2025 to 2034.

North America has held the largest revenue share of 37% in 2024. North America holds a major share in the plastic transistors market due to a robust demand for advanced electronics, coupled with significant investments in research and development. The region's thriving consumer electronics industry, emphasis on innovation, and collaboration between academic institutions and industry players contribute to the market's growth. Additionally, the presence of key technology companies and a supportive regulatory environment fosters the adoption of plastic transistors, particularly in applications such as flexible displays, IoT devices, and wearable technology, consolidating North America's prominent position in the market.

Asia-Pacific is estimated to witness the highest growth. Asia-Pacific commands a significant share in the plastic transistors market due to a confluence of factors. The region is a hub for electronics manufacturing, with countries like China, Japan, and South Korea leading in innovation and production. Rapid technological advancements, a burgeoning consumer electronics market, and increased adoption of flexible and lightweight devices contribute to the dominance. Additionally, favorable government initiatives, robust research and development activities, and a vast consumer base further propel Asia-Pacific's major stake in the plastic transistors market.

Market Overview

Plastic transistors represent a distinct category of electronic components that utilize organic or polymer materials instead of the more conventional silicon semiconductors. Noteworthy for their flexibility and lightweight nature, these transistors are crafted on plastic or paper substrates through cost-effective printing methods, in contrast to the rigid silicon wafer production of traditional counterparts.

The use of plastic materials brings about advantages such as mechanical flexibility, cost-effectiveness, and the capacity to manufacture expansive and pliable electronics. This adaptability opens the door to exciting applications like flexible displays, wearable technology, and electronic interfaces. Plastic transistors hold the potential to redefine electronic device design, offering innovative, lightweight solutions adaptable to unconventional shapes. Ongoing research seeks to refine the performance of plastic transistors, paving the way for advanced electronic devices characterized by heightened flexibility and adaptability.

Plastic Transistors Market Growth Factors

- Rising Demand for Bendable Tech: The need for gadgets that can flex and bend fuels the growth of plastic transistors, making them crucial for creating gadgets with flexible screens and wearable tech.

- Budget-Friendly Production: Plastic transistors bring affordability to the table by being made through cost-effective printing on flexible materials, providing a wallet-friendly alternative to traditional semiconductor manufacturing.

- Embracing Lightweight Designs: The shift toward lighter electronic devices propels the popularity of plastic transistors, offering a lightweight and flexible option compared to the heavier silicon-based ones.

- Wearable Tech Takeover: The surge in wearable devices like smartwatches and fitness trackers drives the demand for plastic transistors, key players in crafting compact and flexible wearable electronics.

- Boom in Electronic Skins: The market for plastic transistors expands as they find applications in electronic skins, meeting the growing interest in human-machine interfaces, robotics, and prosthetics.

- Printed Electronics Advancements: Ongoing advancements in printed electronics, particularly in the field of flexible transistors, contribute to the growth of the plastic transistors market by improving production efficiency and performance.

- Internet of Things (IoT) Expansion: The proliferation of IoT devices and sensors, which often require flexible and lightweight components, fuels the demand for plastic transistors in various IoT applications.

- Medical Wearables: The healthcare sector's adoption of wearable devices for patient monitoring and diagnostics is a growth driver for plastic transistors, as they facilitate the development of comfortable and conformable medical wearables.

- Automotive Electronics Evolution: The automotive industry's focus on lightweight and flexible electronic components in vehicle design contributes to the growth of the plastic transistors market.

- Energy Harvesting Technologies: Plastic transistors play a role in energy harvesting devices, capitalizing on ambient energy sources, and their adoption is growing in line with the increasing interest in sustainable and energy-efficient technologies.

- Rapid Prototyping in Research: Plastic transistors facilitate rapid prototyping in research and development, fostering innovation and contributing to market growth as researchers explore novel applications.

- Consumer Electronics Miniaturization: The trend toward miniaturization in consumer electronics, including smartphones and tablets, boosts the demand for compact and flexible electronic components like plastic transistors.

- Enhanced Durability: The durability and resilience of plastic transistors in various environmental conditions make them attractive for applications requiring robust and reliable electronics.

- Supply Chain Resilience: Plastic transistors offer advantages in terms of supply chain resilience, as they can be produced using diverse manufacturing processes and materials, reducing dependency on specific resources.

- Collaboration in Research: Collaborative efforts and partnerships in research and development contribute to the growth of the plastic transistors market by pooling expertise and resources for technological advancements.

- Education and Skill Development: Increased focus on education and skill development in the field of organic electronics and plastic transistors contributes to a more skilled workforce, fostering market growth.

- Government Initiatives: Supportive government initiatives and funding for research and development in the field of flexible electronics positively impact the plastic transistors market.

- Advancements in Material Science: Continuous advancements in material science, particularly in the development of new organic and polymer materials, drive improvements in the performance and capabilities of plastic transistors.

- Digital Transformation: The ongoing digital transformation across industries increases the demand for innovative electronic components, with plastic transistors playing a role in the development of next-generation digital solutions.

- Environmental Sustainability: The eco-friendly nature of plastic transistors, coupled with the increasing emphasis on environmental sustainability, contributes to market growth as industries seek greener alternatives in electronic manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.15 Billion |

| Market Size in 2025 | USD 1.32 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Lightweight design trends and cost-effective manufacturing

Lightweight design trends and cost-effective manufacturing processes are pivotal drivers propelling the demand for plastic transistors in the market. As the electronics industry shifts towards creating more portable and lightweight devices, plastic transistors offer a transformative solution by providing flexibility and bendability. This feature is especially critical in the development of next-generation gadgets, such as flexible displays and wearable technology, where traditional, rigid components may fall short.

The cost-effectiveness of manufacturing plastic transistors significantly contributes to market surge. Utilizing printing processes on flexible substrates, these transistors offer an economical alternative to conventional semiconductor manufacturing, making them more accessible for mass production. This affordability aligns with industry needs, opening avenues for widespread integration of plastic transistors in various electronic applications, from consumer electronics to industrial and healthcare devices, ultimately driving their increased market demand.

Restraint

Performance challenges and durability concerns

Performance challenges and durability concerns act as significant restraints for the market demand of plastic transistors. Despite their flexibility and lightweight characteristics, plastic transistors may lag in terms of speed and efficiency compared to traditional silicon alternatives. This limitation hampers their adoption in high-performance applications where swift and reliable electronic operations are critical.

Moreover, durability concerns present a notable obstacle. Plastic materials, while offering flexibility, may face challenges in harsh environmental conditions, potentially leading to wear and degradation over time. This limitation impacts the reliability of plastic transistors, limiting their application in industries requiring robust and long-lasting electronic components.

Overcoming these performance and durability hurdles is essential for plastic transistors to gain broader market acceptance, especially in sectors where stringent performance standards and environmental conditions are paramount. Ongoing research and development efforts will be pivotal in addressing these challenges and enhancing the overall competitiveness of plastic transistors in the electronics market.

Opportunity

Wearable electronics and healthcare devices

The burgeoning market for wearable electronics and healthcare devices is creating significant opportunities for plastic transistors. Wearable technology, encompassing smartwatches, fitness trackers, and electronic textiles, demands components that are not only compact but also flexible for user comfort and device conformity. Plastic transistors, with their lightweight and bendable characteristics, are poised to play a pivotal role in this space, offering a solution for the development of flexible and adaptable electronic components crucial for wearable applications. In the healthcare sector, the demand for innovative medical devices is escalating.

Plastic transistors present opportunities for crafting flexible and comfortable healthcare devices, including patient monitoring systems, diagnostics, and electronic skin applications. The adaptability of plastic transistors to conform to the human body's contours makes them suitable for integration into wearable healthcare solutions, contributing to the advancement of patient-centric and non-intrusive medical technologies. As the intersection of electronics and healthcare continues to expand, plastic transistors stand poised to enable breakthroughs in wearable and medical device innovations, addressing the evolving needs of both industries.

Type Insights

In 2024, the 3-alkythiophene semiconducting layer segment held the highest market share of 42% on the basis of the type. The 3-alkylthiophene semiconducting layer in plastic transistors refers to a specific type of organic semiconductor material crucial for creating thin-film transistors. This segment is characterized by the use of 3-alkylthiophene compounds in the fabrication of semiconducting layers, enhancing the transistor's electrical conductivity and performance. The trend in the plastic transistor market involving 3-alkylthiophene semiconducting layers includes ongoing research and development efforts to optimize the performance of these materials, aiming to achieve higher efficiency, improved stability, and greater compatibility with flexible and bendable electronic applications.

The two silver electrodes segment is anticipated to witness the highest growth at a significant CAGR of 6.2% during the projected period. The "silver electrodes" segment in the Plastic Transistors market refers to the utilization of silver-based materials for electrode components within plastic transistor technology. This segment is witnessing a notable trend in the incorporation of silver as a preferred material for its excellent conductivity, stability, and compatibility with flexible substrates. Silver electrodes contribute to enhanced performance and reliability in plastic transistors, aligning with the market's demand for efficient and flexible electronic components, particularly in applications like flexible displays, wearable devices, and electronic skins.

Application Insights

According to the application, the plastic displays segment has held 36% market share in 2024. In the realm of plastic transistors, the plastic displays segment refers to the integration of plastic transistors in the creation of flexible and lightweight display technologies. This application finds use in products such as bendable screens for smartphones, tablets, and wearable devices. The trend in plastic displays is characterized by a growing demand for innovative, foldable, and rollable electronic screens, driven by the consumer preference for portable, adaptable, and visually striking electronic devices. This trend is steering the development of plastic transistors to meet the evolving needs of the dynamic and flexible display market.

The OLED segment is anticipated to witness the highest growth over the projected period. In the plastic transistors market, the Organic Light-Emitting Diode (OLED) segment refers to the use of plastic transistors in the fabrication of flexible OLED displays. This application allows for the creation of lightweight, bendable screens in devices like smartphones, TVs, and wearable electronics. A key trend in the OLED segment involves continuous advancements in plastic transistor technology, enhancing the performance and efficiency of flexible OLED displays. This trend is driving the adoption of plastic transistors in the OLED segment, catering to the growing demand for flexible and visually striking display solutions.

Plastic Transistors Market Companies

- Polyera Corporation

- Thin Film Electronics ASA

- E Ink Holdings Inc.

- PARC (Palo Alto Research Center Incorporated)

- Acreo Swedish ICT AB

- Imprint Energy Inc.

- AU Optronics Corp.

- Plastic Logic Germany

- Eurecat Technology Center

- ENrG Inc.

- PragmatIC Printing Ltd.

- AGC Inc.

- Solvay SA

- Evonik Industries AG

- Merck KgaA

Recent Developments

- The acquisition of Microsemi by Microchip Technology in May 2019 significantly impacted the transistor market. Microchip Technology, based in the United States, now has an expanded portfolio of transistors, further strengthening its position in the industry. This strategic move enhances the company's ability to meet diverse market demands and positions it for future growth and innovation in the rapidly evolving semiconductor landscape.

Segments Covered in the Report

By Type

- 3-alkythiophene semiconducting layer

- Polyimide dielectric layer

- Two silver electrodes

By Application

- Plastic Displays

- Bendable Sensors

- OLED

- Wearable Electronics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting