What is Polyurea Coating Market Size?

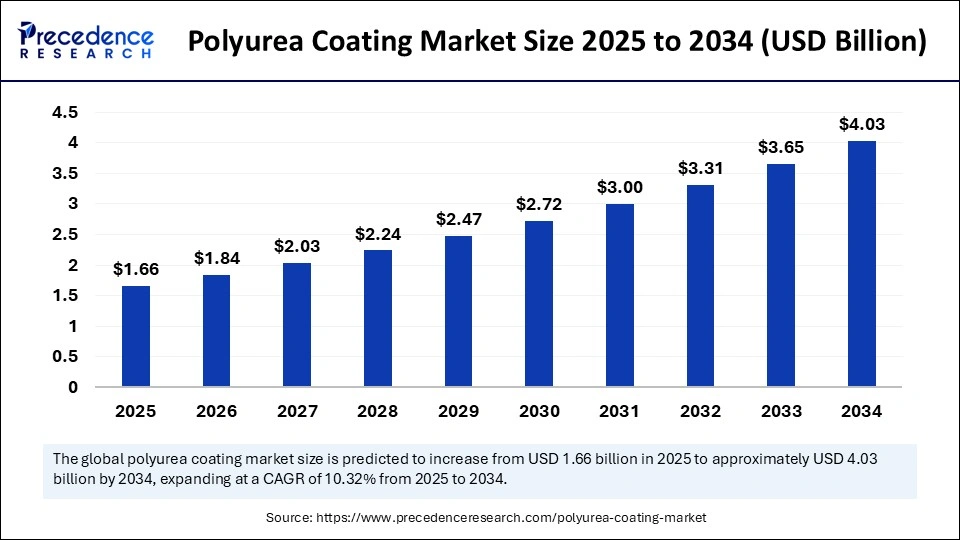

The global polyurea coating market size accounted for USD 1.66 billion in 2025 and is predicted to increase from USD 1.84 billion in 2026 to approximately USD 4.03 billion by 2034, expanding at a CAGR of 10.32% from 2025 to 2034. The increasing demand for slip-resistant, eco-friendly, and high-performance coatings is driving the growth of the market.

Market Highlights

- North America accounted for the largest share of the polyurea coating market in 2024.

- Asia Pacific is growing at a significant CAGR during the forecast period.

- By raw material, the aromatic segment held a significant share of the market in 2024.

- By raw material, the aliphatic segment is expected to grow at a significant CAGR in the upcoming period.

- By product, the hybrid segment dominated the largest share of the market in 2024.

- By product, the pure segment is projected to witness the fastest growth in the market over the projection period.

- By technology, the spraying segment held a significant share of the market in 2024.

- By technology, the pouring segment is anticipated to grow at a rapid pace between 2025 and 2034.

- By application, the building & construction segment dominated the market in 2024.

- By application, the transportation segment is expected to grow at the fastest rate during the forecast period.

“Polyurea Coatings: Transforming Surface Protection”

Polyurea coatings are complex protective materials that are formed through amines and isocyanates, which yield a flexible, strong, elastic finish. Due to their fast drying abilities and excellence in extreme environments, these polyurea coatings address many scenarios. Polyurea coatings are widely used in the construction, transportation, oil & gas, and automotive industries for waterproofing, corrosion prevention, and hardwearing flooring.

The global polyurea coatings industry is witnessing robust growth, driven by the increasing need for high-performance coatings in the automotive, infrastructure, and construction industries. The curing, flexible, and durable, chemically corrosion and weather-resistant properties of polyurea make it suitable for a wide range of applications. Increased interest in polyurea coatings that can meet green requirements was caused by the government policies that supported low VOC and sustainable options.

Intelligent Formulations Materialize: AI Leads to the Next Generation of Polyurea Coatings

The polyurea coating business is being quietly transformed by artificial intelligence. In March 2025, Covestro opened a completely automated laboratory, equipped with robotics and artificial intelligence, and capable of conducting tens of thousands of formulation tests each year. The lab employs machine-learning algorithms to evaluate data and proactively recommend new formulations for polyurea or polyaspartic formulations, streamlining the innovation process.

At the same time, artificial intelligence's role in manufacturing continues to grow predictive models are helping to identify application failures in real time and optimize spray-gun performance using intelligent IoT-enabled systems. All of this demonstrates a new paradigm polyurea coatings are not just chemically advanced, now they are also digitally smart.

Growth Factors of the Polyurea Coating Market

- Rising Demand for High-Performance Coatings: The demand for durable, flexible, and chemical-resistant coatings is rising to fulfill the demand of the automotive as well as construction industries. There is a rising adoption of polyurea coatings as a result of the ever-increasing need for industry and commercial uses for protective coatings.

- Increasing Infrastructure Development: There is a surge in investments in infrastructure development, especially road networks, bridges, and public spaces. This, in turn, boosts the need for polyurea coating in construction and maintenance.

- Emphasis on Eco-Friendly Solutions: Eco-friendly practices are being influenced by awakening environmental awareness and stringent regulations to lower levels of VOCs in manufacturing usage. This concomitance with global goals of sustainability makes polyurea more enticing than conventional coatings, which boosts the growth of the market.

- Technological Advancements and Product Innovation: Advancements in production technology and modes of application, from new spray techniques to hybrid coatings, are gradually optimizing the application and versatility of polyurea coating.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.66 Billion |

| Market Size in 2026 | USD 1.84 Billion |

| Market Size by 2034 | USD 4.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Product, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Use of Polyurea Coatings in Medical Facilities

The rising use of polyurea coatings in medical facilities drives the growth of the polyurea coating market. Polyurea coatings can successfully meet significant challenges due to their almost impermeable, unbroken, and chemically strong microbial barrier characteristics that are essential for hospital sterility. In critical units such as operation theaters and laboratories where serious risks are induced through spillage and contamination, polyurea coatings offer unbeatable performance. Polyurea coatings are also impact and scratch-resistant, making them ideal for heavy medical equipment use. The benefits of polyurea coatings, such as hygiene and efficiency, durability, and appearance, render them suitable for the medical environment and account for the dominant market position of polyurea coatings.

Restraint

High Health Risk from Toxic Fumes

Since polyurea coatings release harmful fumes, their adoption is limited in some applications, restraining the growth of the market. Tooth isocyanates and amines applied in polyurea applications emit hazardous fumes if the coating is sprayed or applied on surfaces. The emission of strong vapors and odors contributes to the hazardous and uncomfortable work environment. Extended exposure to these detrimental vapors creates respiratory problems, skin rashes, headaches, and health threats to workers as well as to individuals living near the factories. As a result, concerns about exposure to harmful fumes, along with fulfilling compliance requirements of environmental regulations, are severely limiting the growth of the polyurea coating market.

Opportunity

Environmental Regulations

Environmental regulations aimed at minimizing VOC emissions create immense opportunities for manufacturers to create low-VOC polyurea coatings. Regulatory bodies are proposing legislation that mandates the industries, such as building and automotive, to use sustainable products with low emissions. With very low VOC levels and low environmental impact, polyurea coatings are set to meet these standards. Due to these regulations, many industries are boosting the demand for low-VOC coatings to meet stringent environmental regulations.

Segment Insights

Raw Material Insights

The aromatic segment led the polyurea coating market with the largest share in 2024. The superior abrasion, chemical, and water resistance of aromatic polyurea coatings are a perfect match to several applications in industries such as manufacturing, automotive, and construction. The isocyanates that are commonly used in producing these coatings are toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI). These aromatic polyurea coatings undergo degradation when exposed to sunlight (UV). The product formulations have improved, and there have been some successful formulations that are resistant to UV attack, and they have become dependable for assorted environments.

The aliphatic segment is expected to grow at a significant rate in the upcoming period. Polyurea, derived from aliphatic isocyanates, is used to provide long-term protective cover against sunlight, moisture, and varying temperatures. Perfect for the outdoors, these coatings preserve bright colors, are resistant to UV, and are essential in such industries as construction, auto, and infrastructure. These coatings are highly applied in outdoor environments such as in domestic architecture, bridge building, and other exposed infrastructure projects. Due to their impressive strength and UV damage resistance, aliphatic polyurea coatings offer enhanced service life, performance, and excellent coatings for outdoor usage.

Product Insights

The hybrid segment held the largest share of the polyurea coating in 2024. The superior performance of hybrid coatings in resisting abrasion, corrosion, and exposure to chemicals makes them suitable for industrial use. Stringent environmental regulations have further boosted their adoption. Due to the rising demand for high-performance and low-VOC coatings, the demand for hybrid polyurea coatings continues to rise.

The pure segment is projected to witness the fastest growth in the market over the projection period. Pure polyurea coatings are used extensively by the construction, manufacturing, and infrastructure industries as they provide essential long-lasting coverage that is necessary in these vital industries. The pure polyurea coatings are the most effective for membrane-forming applications such as flooring systems, waterproofing, and impermeable industrial lining materials. Pure polyurea coatings are used in applications where resistance to corrosion and extreme temperature as well as wear is important.

Technology Insights

The spraying segment led the polyurea coating market with the largest share in 2024. Spraying polyurea coatings is a preferred choice at major applications in industries like construction, infrastructure, and manufacturing, because it enables efficient spraying over surfaces that are complex and large. Through the use of the spraying method, businesses can save significantly on costs and time, making spraying the preferred choice. Moreover, spray systems require less maintenance. The spraying method allows the use of polyurea in thicker applications and provides superior protection. The ease of usability and flexible deployment make spraying the industry standard.

The pouring segment is anticipated to grow at a rapid pace during the projection period. This ability of pouring technology to create robust, even coatings that show good attachment to substrates is particularly beneficial within industries where coating strength and dependability are important. Pouring equipment is portable and suitable for small as well as large volume applications. Flexibility in the technology for pouring makes it able to accommodate many uses, thus raising demand in various industries.

Application Insights

The building & construction segment contributed the largest share in 2024. Polyurea coatings are suited for demanding field work such as roofing and flooring. These coatings are used to protect structures due to their toughness, chemical resistance, and waterproof properties. The extensive use of aromatic isocyanate-based polyurea coatings in construction applications is likely to sustain the long-term growth of the segment. The increasing need to protect structures from harsh environmental conditions boosts the demand for polyurea coating.

The transportation segment is expected to grow at a significant rate in the coming years. The rising demand for corrosion-proof and cost-effective coatings in the transportation sector significantly influences the market. There is a high need to protect various vehicle components. However, polyurea coatings offer benefits like corrosion and abrasion resistance, making them ideal for protecting vehicles from damage.

Region Insights

North America held the dominant share of the polyurea coating market in 2024. The increased construction activities boosted the need for high-performance coatings. The outstanding toughness, flexibility, and resistance to abrasion, chemical, and weather make these coatings highly sought after in the construction industry. The U.S. is a major market for polyurea coating. This is mainly due to the rising investments in infrastructure development and maintenance projects. Stringent environmental regulations and the rising construction of bridges, roads, and public spaces are creating the need for polyurea coatings.

U.S. Polyurea Coating Market Trend

The U.S. Polyurea market is growing because of the enhancement of infrastructures and infrastructure, such as industrial coatings and increasing utilization of polyurea in the construction and automotive markets. Continued growth is seen as a result of polyurea's enhanced penetration into protective coatings, its quick cure ability, and application in waterproofing. The expansion of spray-applied polyurea technology and focus on durable, chemical resistant materials also positively influence growth as the United States becomes one of the largest and most innovative markets for polyurea application within North America.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The rapid industrialization is influencing the market. With the growing urbanization in countries like India and China, construction of buildings is rising. This, in turn, creates the need to protect structures from harsh environmental conditions, opening up avenues for polyurea coatings. Governments of various nations are investing heavily in infrastructure development projects, which significantly drives the growth of the market.

Europe is considered to be a significantly growing area. The growth of the polyurea coating market in the region can be driven by the presence of well-established automotive and construction sectors, which are major adopters of polyurea coatings. Due to the growing focus on sustainable practices, there is a high demand for low-VOC coatings, especially in countries like Germany, the UK, France, Italy, and Spain. This creates the need for low-VOC polyurea coatings.

China Polyurea Coating Market Trend

China is one of the fastest growing polyurea markets in the world with its rapidly changing construction, industrial infrastructure, and sustained growth of automotive production. The growing popularity of polyurea in protective coatings, waterproofing, and rapid cure applications also support growth. Investment in more advanced technologies for manufacturing polyurea and education on durable, corrosion resistant application of polyurea also support market adoption while establishing China as a rapidly growing market for polyurea solutions.

Germany Polyurea Coating Market Trend

Leading polyurea adoption in Europe is Germany, having advanced in industrial applications and environmental restrictions. Germany's investments in eco-friendly sustainable coatings and protective solutions for infrastructure and automotive applications, estimates the region as a market leader with innovations.

Is the Middle East Polyurea Coating Market Rapidly Growing?

The Middle East continues to show significant growth in polyurea applications with large-scale infrastructure construction and strategic oil development activity and increasing industrial construction. Even with harsh environmental conditions, the demand for longer-lasting protective coatings is still growing. Governments want cost- effective long-lasting solutions. The fast-cure, waterproofing and chemical resistance of polyurea is increasing popularity in the region.

Saudi Arabia: Polyurea Coating Market Trend

Saudi Arabia currently leads the regional market with an increased number of infrastructure and oil investment. High-impact developments like NEOM and Red Sea development increases the use of polyurea for corrosion resistant coatings in pipelines and industrial floors.

Polyurea Coating Market Companies

- Pearl Polyurethane Systems LLC

- American Polymers Corp.(Polycoat Products)

- Teknos Group Oy

- PPG Industries, Inc.

- Rhino Linings Corporation

- BASF SE

- Huntsman Corporation

- Covestro AG

- Sika AG

- Sherwin-Williams Company

Recent Developments

- In February 2025, Sprayroq announced the launch of its latest innovation, Polyurea AR-3400. This new polyurea product is engineered specifically for structures that demand high levels of corrosion resistance and flexibility.

- In October 2023, Everest Systems announced its EverMax Polyurea, a very tough and highly flexible coating to be applied in commercial roofs. This coating has been designed with minimal shrinkage, spectacular flexibility, and impressive resistance to mechanical impacts.

Industry Leader's Announcement

- In July 2024, DELTA Coatings announced plans to establish a new state-of-the-art manufacturing plant at Dubai Industrial City (DIC). The eco-friendly facility will be powered in part by renewable energy, driving the firm towards its sustainability and decarbonization goals. Belvin Marx, DELTA Coatings' GM, said, “Our new facility will enable us to demonstrate the numerous benefits of polyurea-based liquid coating, lining and membrane solutions, as well as waterproofing systems, to our customers and even more applicators.”

Segments Covered in the Report

By Raw Material

- Aromatic

- Aliphatic

By Product

- Pure

- Hybrid

By Technology

- Spraying

- Pouring

By Application

- Building & construction

- Transportation

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting