What is the Poultry Processing Equipment Market Size?

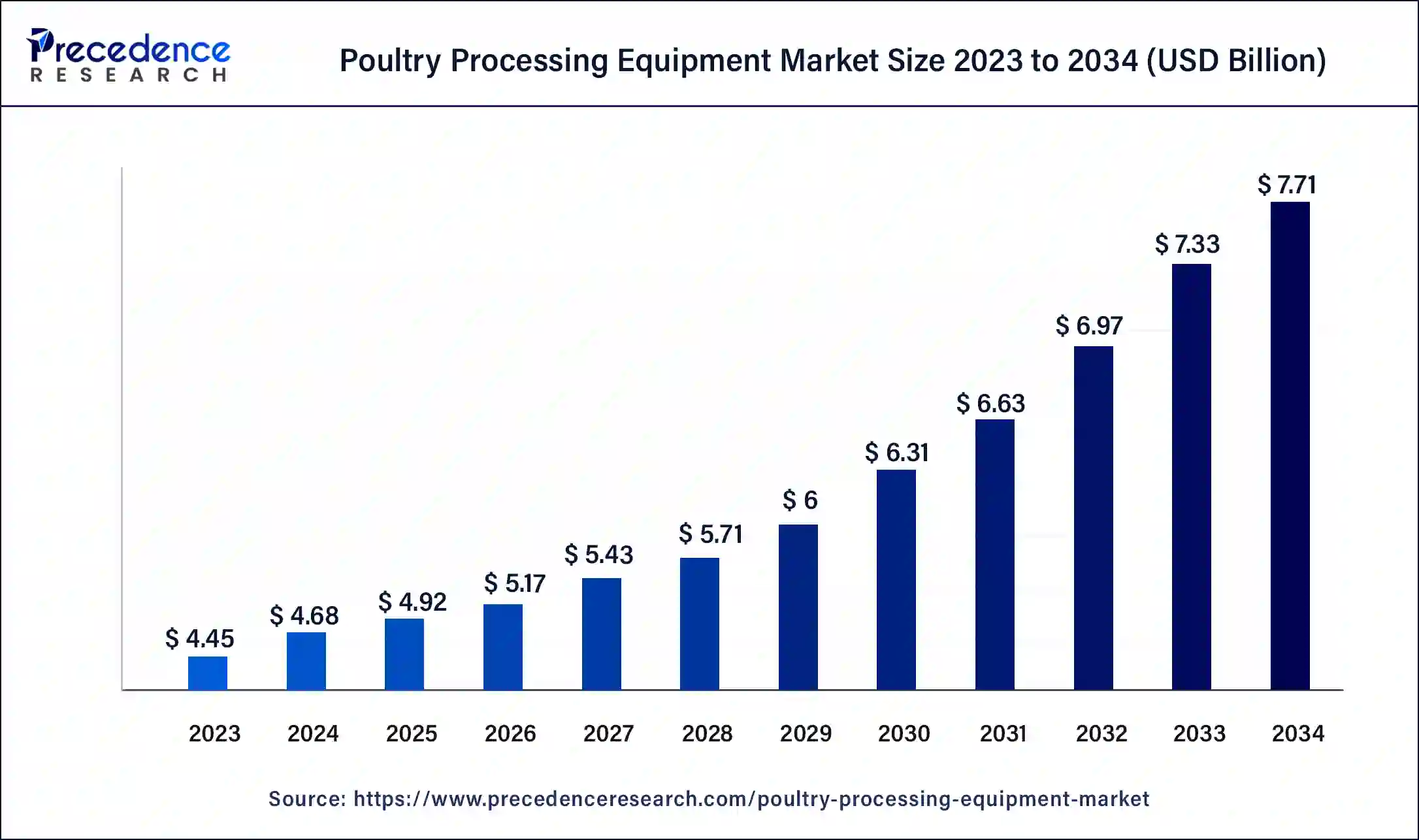

The global poultry processing equipment market size is valued at USD 4.92 billion in 2025 and is predicted to increase from USD 5.17 billion in 2026 to approximately USD 8.07 billion by 2035, expanding at a CAGR of 5.07% from 22026 to 2035. The growing production and consumption of poultry meat across the globe is a key factor driving the poultry processing equipment market growth.

Market Highlights

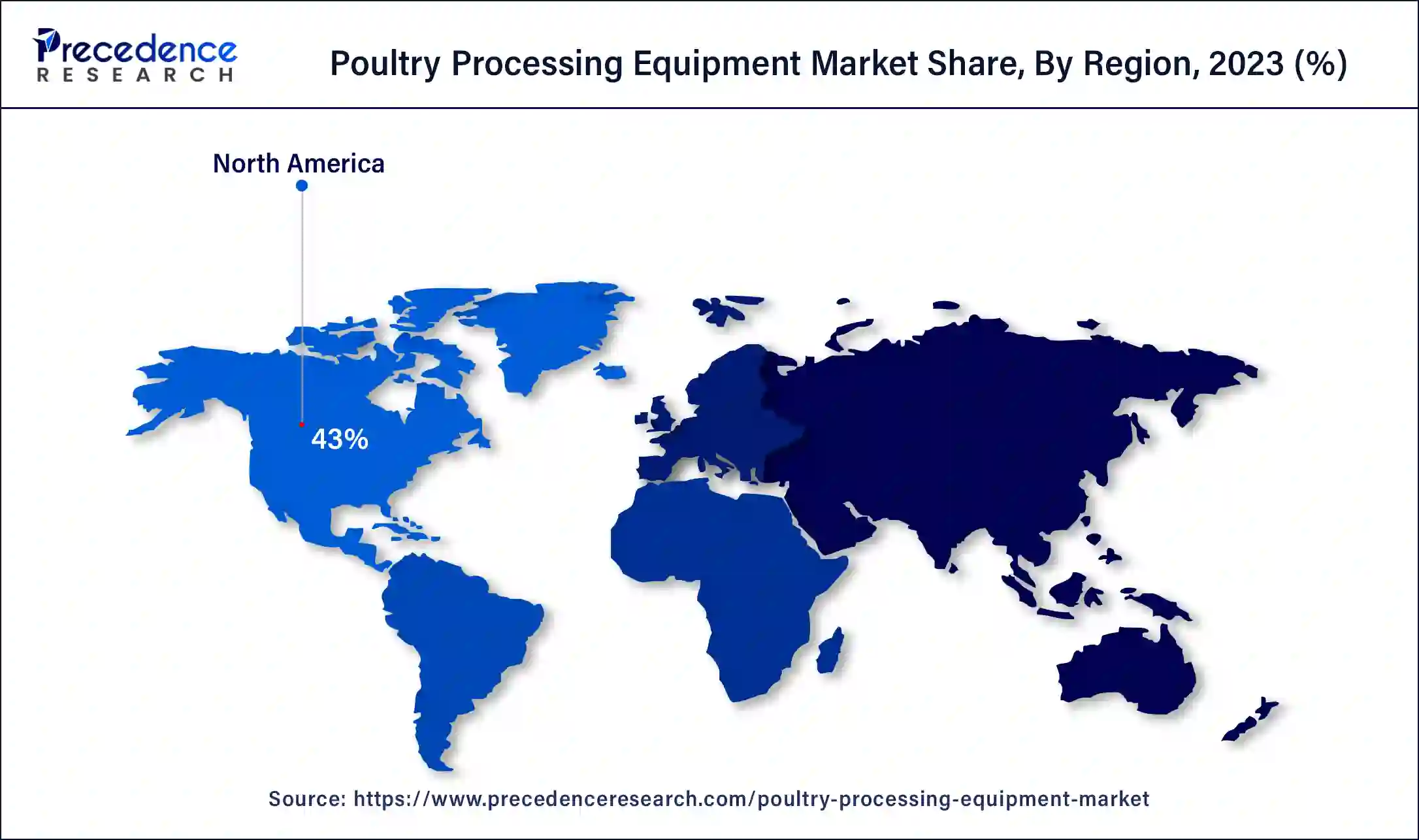

- North America dominated the poultry processing equipment market with the largest market share of 43% in 2025.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the projected period.

- By product type, the poultry slaughtering equipment segment dominated the market in 2025.

- By product type, the de-feathering equipment segment will show the fastest growth in the market over the projected period.

- By distribution channel, the offline segment dominated the market in 2025.

- By application, the chicken processing segment led the market in 2025.

- By application, the turkey processing segment is expected to grow at the fastest rate in the market during the forecast period.

What is Poultry Processing Equipment?

The global poultry processing equipment market is an industry that manages the production, manufacturing, and distribution of equipment utilized in the processing of poultry products. This instrument is also used to process different poultry products, like turkeys, ducks, chickens, and geese, which go from numerous steps of the e-processing cycle, from slaughtering to packaging and preservation. The market includes an extensive range of machinery, such as evisceration machines, slaughter equipment, de-feathering machines, and packaging equipment. The equipment utilized in poultry processing is created to maximize efficiency, safety, and hygiene throughout the processing of poultry products by maintaining the freshness and quality of the product as well.

What is the Role of AI in the Poultry Processing Equipment Market?

Artificial Intelligencecan help the poultry processing equipment market to adjust animal welfare, environmental impact, and production efficiency. AI can speed up breeding processes and automate tasks like controlling incubation and egg grading. Furthermore, AI algorithms analyze plenty of data gathered from poultry farms, which includes feed consumption, bird health metrics, environmental conditions, and production yields. By processing this data,artificial intelligence (AI) can detect anomalies, predict trends, and optimize different aspects of production for greater efficiency.

- In June 2024, Sanderson Farms introduced Sandy, the first-ever chicken chatbot tool, to answer just about any question as it relates to recipes and cooking tips. Affectionally known as ‘Sandy' and powered by OpenAI's API for ChatGPT, consumers can start a chat on the Sanderson Farms website for quick cooking tips, fast recipe finds, helpful serving suggestions, and more.

Poultry Processing Equipment Market Outlook

- Industry Growth Overview: The poultry processing equipment market is forecast to expand resiliently from 2025 to 2030 due to several factors, including increased poultry consumption and demand for automation, as well as more stringent food safety regulations. Although this period will see growth across all equipment categories, high-margin equipment such as deboning, chilling, and slicing systems is anticipated to experience faster market adoption in the Asia-Pacific region and North America because processors, particularly larger-scale poultry plants, are constantly looking for ways to grow their efficiency.

- Sustainability Trends: In recent years, sustainability has changed the demand for equipment types as processors demonstrated a preference for energy-efficient chilling systems, water-saving wash systems, and low-waste equipment solutions to reduce environmental impact. Equipment manufacturers are investing in R&D to develop hygienic designs for easy cleaning and recyclable materials in order to meet stricter environmental and safety standards that have developed across many areas, particularly in Europe.

- Global Expansion:Many large poultry processing equipment suppliers expanded into Southeast Asia, Eastern Europe, and Latin America to be close to growing poultry producers and benefit from more lenient investment policies. In particular, these suppliers strengthened their local manufacturing of equipment, service hubs, and regional processing capacity, such as Thailand and Brazil, to support growing exports as well as local capacity.

- Major Investors:Driven by strong demand, noticeable margins, and the essentiality of meat processing, private equity and strategic investors joined the space. This was particularly noticeable with the increased investment in automated cutting systems, robotics, and smart inspection. Major investment groups invested in companies with very precise machinery and optimized for hygiene compliance.

- Startup Ecosystem:The startup ecosystem in the market expanded due to significant innovation in robotic deboning, AI-based quality inspection, and low-waste processing. Early-stage startups in the U.S., Netherlands, and India gained growing VC interest by offering safer, faster, and more sustainable alternatives to traditional poultry processing technologies.

What are the Growth Factors in the Poultry Processing Equipment Market?

- Growing demand for poultry meat products globally is expected to drive the growth of the poultry processing equipment market soon.

- The increasing need to improve meat quality along with its capacity can drive market growth further in the future.

- Rising demand for high-nutritional food products globally can fuel the poultry processing equipment market growth in the upcoming years

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.92 Billion |

| Market Size in 2026 | USD 5.17 Billion |

| Market Size by 2035 | USD 8.07 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.07% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing preference for flavored products

Customers' rising preference for umami-flavored products is anticipated to boost market growth in the upcoming years. Customers' rising health awareness is linked to their willingness to eat a high-quality meat meal containing antibiotics and growth hormones, which is estimated to drive the sales of poultry products. Additionally, the various health advantages associated with the consumption of these products can propel the growth of the poultry processing equipment market further.

In February 2024, a Canadian-owned QSR chain, Mary Brown's (MB) Chicken, launched in the UK market, with plans for rapid expansion with a select group of franchise partners. The chain is known for its Signature Chicken, Taters, Big Mary chicken sandwich, and its popular Tater Poutine, which combines hand-cut, breaded, and fried potatoes smothered in gravy and cheese.

Restraint

Lack of technological awareness

Developing economies where costly processing equipment is hard to obtain can play a key market restriction factor. The advancements in the processing equipment market are anticipated to be constrained by a lack of technological awareness and advances in the local market. Moreover, increasing raw material prices can further affect the poultry processing equipment market expansion.

Opportunity

Technological advances in meat and poultry processing equipment

The food industry's shifts towards more organized supermarkets and hypermarkets have substantially impacted the poultry processing equipment market. Tumbling and evisceration machinery are also essential for poultry. Meat quality is a key priority in the industry, and this can lead to the increased use of automated processing machines. Poultry slaughtering, de-feathering, de-boning, and cut-up machines are important machinery in this field. Also, the trends in the HoReCa sector veganism can impact market expansion further.

- In December 2023, Eagle Product Inspection launched its latest innovative solution for the poultry processing industry, MAXIMIZER RMI. Hygienically constructed with a commitment to enhancing bone detection and reducing labor related to product rejects, this solution is designed to maximize product throughput and profitability while ensuring the highest level of safety standards are met.

Segment Insight

Product Type Insights

The poultry slaughtering equipment segment dominated the poultry processing equipment market in 2024. The growth of the segment can be linked to the growing adoption of these machines across industries. Also, the requirements for semi-automated slaughtering equipment are ready to increase as they are advantageous for many small slaughterhouses by making faster and more precise deliveries. Slaughtering equipment improves the quality, appearance, and marketability of the product, which can help further expand the segment.

- In April 2023, Ontario launched the Centre for Meat Innovation and Technology. A new Canadian meat processing hub, the Centre for Meat Innovation and Technology (CMIT), will advance and strengthen new technology and advance employee skills in the segment. This center will ultimately help both processors and meat and poultry producers.

The de-feathering equipment segment will show the fastest growth in the poultry processing equipment market over the projected period. This equipment is increasingly used to slaughter and de-feather chickens, ducks, and turkeys. These machines also help key players to increase productivity and lessen the risk of injuries to workers. These factors collectively can contribute to the segment's expansion during the forecast period.

Distribution Channel Insights

The offline segment dominated the poultry processing equipment market in 2024. The expanding food service industry is the key factor driving the segment's growth. Many consumers across the globe have started trying new foods that have been invented and tested by various offline channels. Moreover, the presence of a wide range of poultry products in offline channels gives freedom of choice to the consumers, which can directly affect the growth of the segment.

Application Insights

The chicken processing segment led the poultry processing equipment market in 2024. The growth of the segment is attributed to the rising demand for chicken meat along with the necessity for efficient and cheap poultry processing equipment. Chicken is a common poultry type consumed across the globe due to its high nutritional content and low cost. It is also utilized to make different types of dishes. Also, chicken meat has its unique versatility, flavor, and texture. Which can fuel the segment's growth shortly.

Top Chicken Consumers Country in 2022

| Country | Chicken Consumption 2022 (metric Tonnes) |

| China | 24,436 |

| United States | 18,111 |

| Brazil | 10,131 |

| Russia | 4,953 |

| Mexico | 4,950 |

| India | 4,946 |

| Indonesia | 4,077 |

| Japan | 3,458 |

| Egypt | 2,64 |

| United Kingdom | 2,397 |

- In May 2023, The Kudumbashree opened a poultry processing plant at Kadhinamkulam in the district to give a boost to its Kerala Chicken project. In the first phase, quality products under the brand ‘Kudumbashree Kerala Chicken' will be marketed through supermarkets.

The turkey processing segment is expected to grow at the fastest rate in the poultry processing equipment market during the forecast period. The growing need for flavored and standard food products, such as sausages, can drive the segment's growth. However, the increasing demand for a protein-based diet with a growing number of meat eaters across the globe are key factors driving the segment's growth throughout the forecast period.

Regional Insights

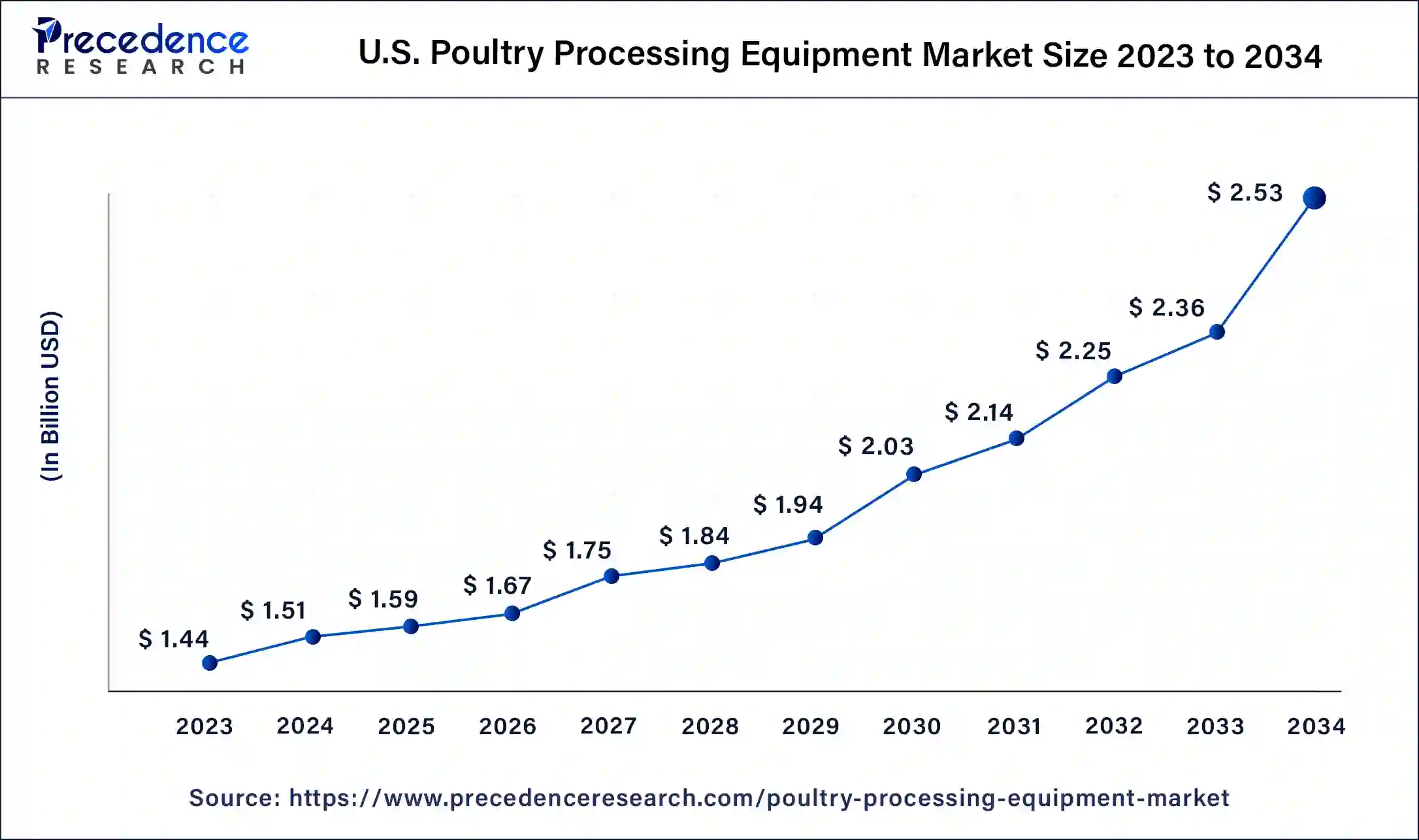

U.S. Poultry Processing Equipment Market Size and Growth 2026 to 2035

The U.S. poultry processing equipment market size is exhibited at USD 1.59 billion in 2025 and is projected to be worth around USD 2.66 billion by 2035, poised to grow at a CAGR of 5.28% from 2026 to 2035.

North America dominated the poultry processing equipment market in 2024. The rise in government support for the growth of the market in the region shows the strong influence on the North America poultry processing equipment market. The United States holds the largest market share in this region. This is due to the growing need for processed chicken products and the presence of top poultry processing equipment producers. Moreover, changing lifestyles and dieting habits in the U.S. have also led to growing consumption of processed chicken products in the region.

- In June 2022, Amlan International introduced a new portfolio of products for the United States market, and for international markets, Amlan is bringing forward a range of natural solutions that will help producers meet that challenge, still producing poultry very efficiently with great economics, but also improving the sustainability of production and allowing customers to remove some of the drugs and other non-natural products they currently have in their diets.

North America: U.S. Poultry Processing Equipment Market Trends

The U.S. market is increasingly shifting toward automation, with robotics and AI-enabled inspection systems helping processors boost throughput and reduce labor dependency. There's growing use of vision based quality control tools to detect contaminants and ensure consistency in cuts. High-speed deboning and cut up lines are being deployed to cater to rising demand for ready to cook and value added poultry products.

Asia Pacific is anticipated to grow at the fastest rate in the poultry processing equipment market during the projected period. In the region, China shows the fastest growth because of the increasing manufacturing and consumption of poultry meat products, government support, and the growing adoption rate of innovative processing technologies. Furthermore, the population of China is expanding at a rapid pace. Which directly affects the demand for poultry products in the region.

- In September 2023, Major Japanese engineering company Hitachi Zosen will start selling synthetic protein to artificial meat producers as soon as 2025, Nikkei has learned, using a process that reduces production costs by about 90%. The artificial meat protein will be made using a method developed by NUProtein, a startup based in Tokushima City, Japan.

Asia Pacific: China Poultry Processing Equipment Market Trends

China's market is being driven by a push for modernization under national food security policies, which is prompting processors to adopt more integrated and automated systems. Increased demand for hygienic, ready-to-cook poultry products is encouraging upgrades in chilling, portioning, and contaminant detection technologies. Local equipment manufacturers are investing in IoT, sensors, and analytics to reduce dependence on imported machinery and improve efficiency.

Why did the European Region Grow Steadily in the Poultry Processing Equipment Market?

The European region's growth occurred steadily due to effective food safety regulations, advanced processing technologies, and a growing interest in packaged poultry. Many processors have adopted clean and automated processing operations that minimize opportunities for contamination and reduce energy and water use. Additionally, the region began investing in robotics and digital monitoring technologies that improved operational efficiency. New opportunities emerged in the form of sustainable technologies, advanced precision cutting systems, and solutions to support strict EU food-safety hygiene standards.

Germany Poultry Processing Equipment Market Trends

Germany was a leader in the region as it was equipped with modern, energy-efficient, hygienic food processing plants. Moreover, strict EU food safety regulations led food processors in Germany to invest in advanced cutting, deboning, and inspection equipment. Germany's robust engineering industry produced world-class food processing machinery. The increase in demand for packaged poultry led processors in Germany to innovate, including the adoption of digital and robotic systems.

Why did the Latin American Region Grow Rapidly in the Poultry Processing Equipment Market?

Latin America exhibited impressive growth due to an increase in poultry production and processors becoming more reliant on automated machinery. Countries began investing in modern slaughtering, chilling, and packaging systems to meet ever-increasing international export and animal welfare requirements. The continued upward trajectory of domestic demand for poultry at affordable prices helped spur upgrades in equipment.

There remained opportunities for more mid-range automation, energy efficiency, and technology to help mitigate waste. The combination of favorable governmental policies and increasing levels of integration among poultry companies, designed to control the temperature and/or shelf life of cuts of poultry, helped to drive increases in modernity across the region.

Brazil Poultry Processing Equipment Market Trends

Brazil was the primary leader in the region, given that it has one of the largest poultry industries in the world and an extensive export network. Companies invested in machinery such as automated cutting, deboning, and chilling to help meet standards, which are largely internationally based. The increasing desire to produce in high volumes also incentivized greater use of advanced machinery.

The rapid growth in local markets for processed poultry segments also pressured processors to modernize. Brazil's strong industrial base helped with producing equipment and sourcing spare parts as needed.

Why did the Middle East & African Region Grow Significantly in the Poultry Processing Equipment Market?

The Middle East and Africa saw growth in demand for poultry products, supported by a growing population and urban incomes. Countries planned to use modern slaughtering and processing plants to offset import costs and boost domestic production. Automated slaughtering, cutting, and chilling systems were all in high demand. There were also some opportunities for affordable automation, small plant systems, and hygienic-focused systems for processing.

Saudi Arabia Poultry Processing Equipment Market Trends

Saudi Arabia was the leader in expanding its domestic poultry production and processing to lessen its reliance on imports, increasing demand for products. The country made investments in specialized and advanced slaughtering, deboning, and chilling systems to serve the increased demand for poultry. Strong government support for local food security projects encouraged poultry processors to invest in modernized processing systems. Larger integrated poultry processing companies invested in automation and specialized processing to increase scale and reduce labor costs while maintaining needed standards for hygiene.

Poultry Processing Equipment Market Companies

- Marel hf

- John Bean Technologies Corporation

- GEA Group AG

- CTB, Inc.

- Meyn Food Processing Technology B.V.

- Baader Group

- Key Technology Inc.

- Bayle SA

- Prime Equipment Group, Inc.

- Brower Equipment Sales, LLC

- Stork Food & Dairy Systems B.V.

- Linco Food Systems A/S

- PSS SVIDNIK a.s.

- Foodmate BV

Recent Developments

- In January 2023, JPG Resources, a food and beverage innovation and commercialization group, acquired the research and development team of RodeoCPG, a Brooklyn, NY-based strategic sales agency focused on supporting consumer brands at retail.

- In December 2022, NY. Baked beans maker Bush Brothers & Co., Knoxville, Tenn., acquired the Westbrae Natural brand of The Hain Celestial Group, Inc. Financial terms of the acquisition were not disclosed.

- In May 2022, Neogen Corporation added a new insect control solution for poultry producers to its Prozap product line. Prozap Gamma-Defense is a micro-encapsulated, slow-release pesticide used to eliminate litter beetles, flies, fleas, ticks, and other specified pests in and around poultry and other animal housing, buildings, and structures.

Segments Covered in the Report

By Product Type

- Poultry Slaughtering Equipment

- De-Feathering Equipment

- De-Boning Equipment

- Cut-Up Machine

- Evisceration Equipment

- Tumbling Equipment

- Marinating Equipment

By Application

- Chicken Processing

- Turkey Processing

- Duck Processing

By Distribution Channel

- Online

- Offline

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting