What is the Precious Metal Market Size?

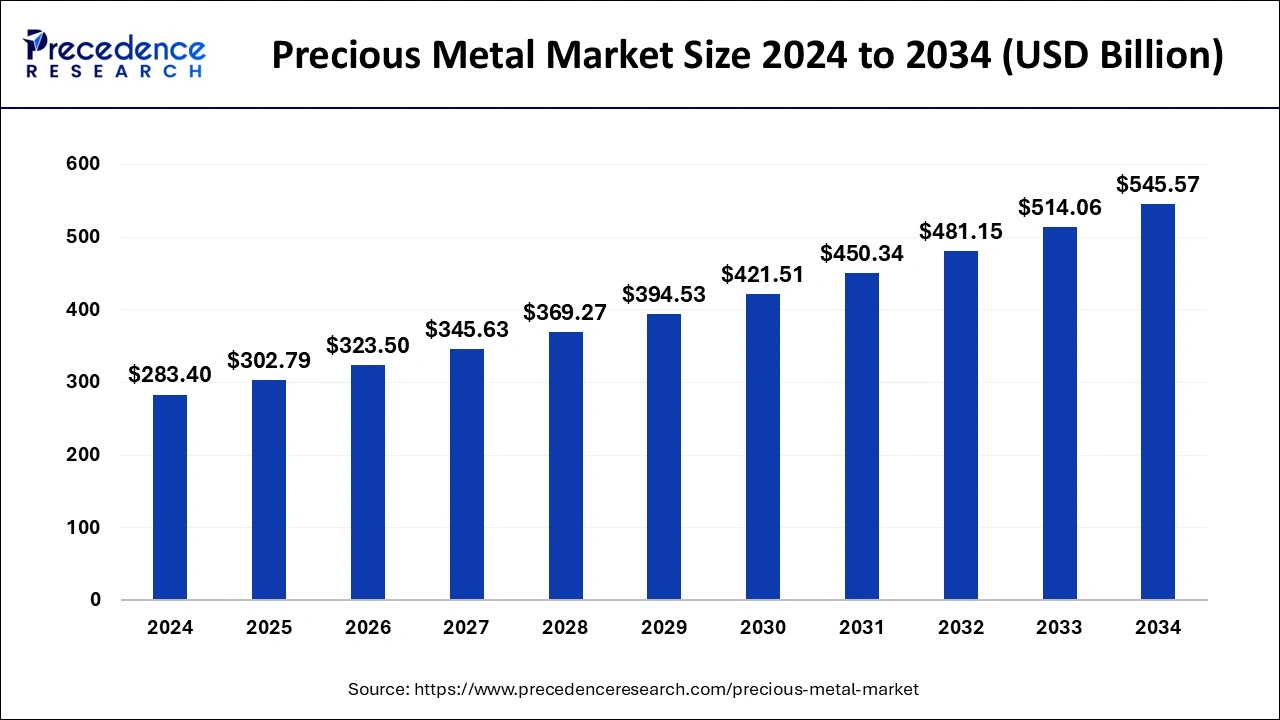

The global precious metal market size is estimated at USD 302.79 billion in 2025 and is predicted to increase from USD 545.57 billion in 2026 to approximately USD 545.57 billion by 2034, expanding at a CAGR of 6.77% from 2025 to 2034.

Market Highlights

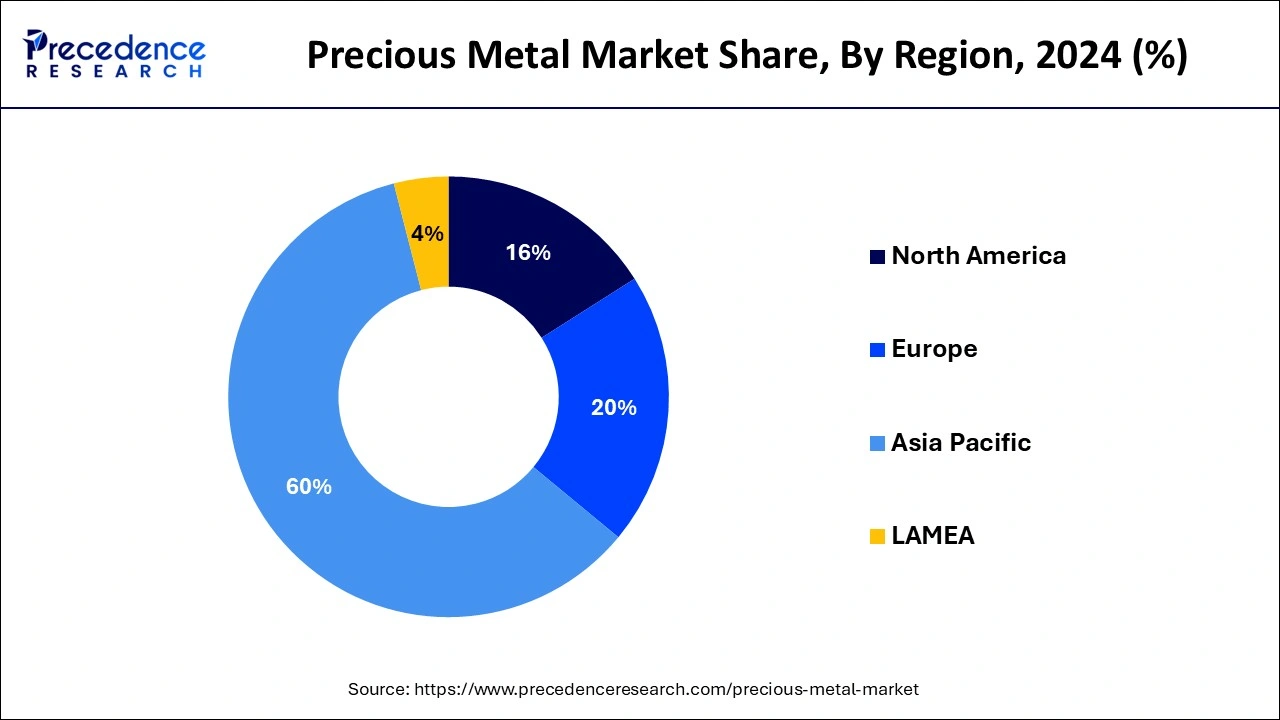

- Asia Pacific has held the largest market share of 60% in 2024.

- North America is also expected to gain a significant share of the market during the forecast period.

- By product, the gold segment dominated the market with the largest market share of 83% in 2024.

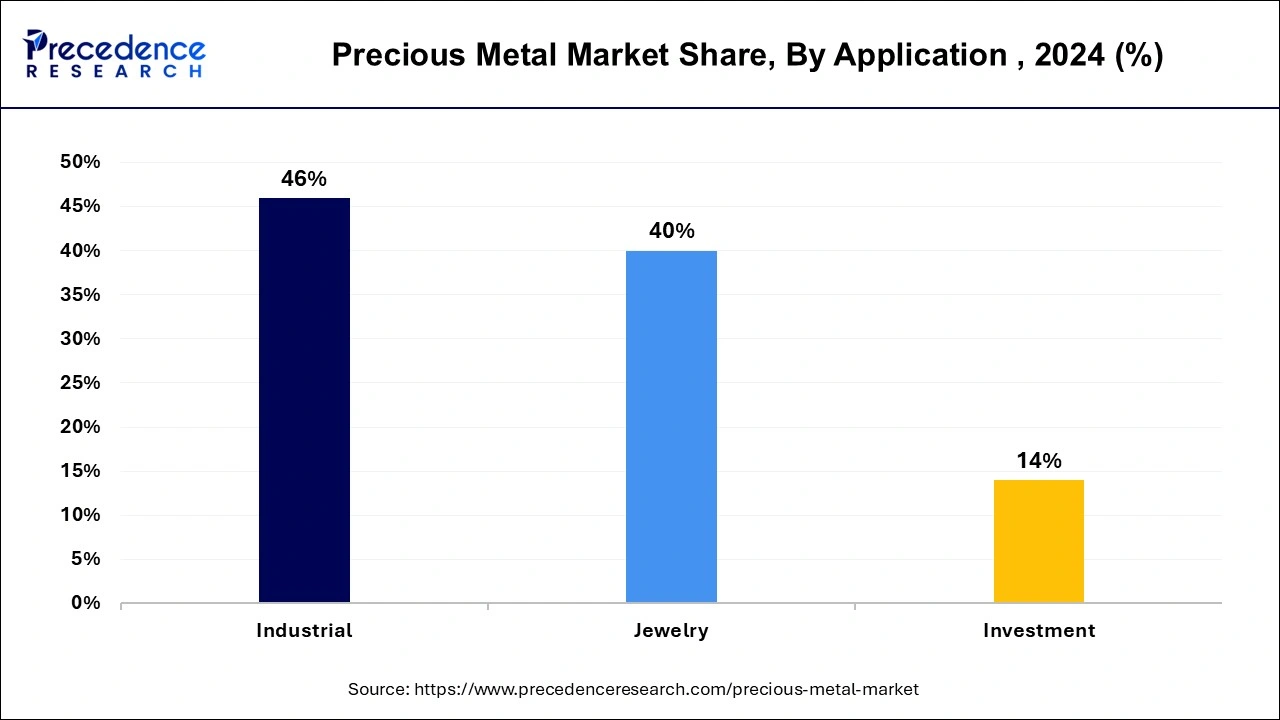

- By application, the industrial segment has contributed more than 46% of market share in 2024.

- By application, the jewelry segment is expected to witness the fastest CAGR in the market during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 302.79 Billion

- Market Size in 2026: USD 323.50 Billion

- Forecasted Market Size by 2034: USD 545.57 Billion

- CAGR (2025-2034): 6.77%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

Precious metals could be defined as metal elements mined from geographic structures and are valued for them for their significance in production or their intrinsic worth. These include platinum, gold, silver, palladium, etc., that may be traded either in their physical state or by way of futures and options contracts, bonds, mutual funds, mining, company stocks, or another instrument.

Numerous factors impact the precious metals market, such as geopolitical tensions, currency fluctuations, investor sentiment, and economic indices like GDP growth, inflation, and interest rates. Furthermore, developments in other markets, like bonds and stocks, may have an effect on precious metal prices.

- Due to its dual status as an industrial and precious metal, the price of silver is subject to fluctuations in the following areas: investor sentiment, economic conditions, and industrial demand. Similar to gold, silver prices fluctuated in 2021 but, on the whole, held steady in comparison to other years.

- The automotive sector is the main user of these metals, especially in catalytic converters. Consequently, the demand for automobiles and emissions laws, as well as other trends in the automotive industry, have a significant impact on their pricing.

- Although it is a less well-known valuable metal, rhodium is essential to catalytic converters, particularly those found in diesel cars. Due to a lack of supply and a rise in the demand for emission-control devices, its price has climbed recently. However, because of its tiny market size and restricted production, rhodium prices can be very erratic.

Precious Metal MarketGrowth Factors

- In uncertain economic times, precious metals such as gold, silver, and platinum sometimes serve as safe-haven investments. Investors frequently swarm to these assets as a hedge against inflation, currency depreciation, and geopolitical uncertainty.

- Interest rates and the price of precious metals are inversely connected. Gold and other non-interest-bearing assets have a lower opportunity cost when interest rates are low, which attracts investors to these assets. On the other hand, precious metal prices can decrease when interest rates rise.

- One common perception of precious metals is as an inflation hedge. When there is a lot of inflation, fiat currencies lose purchasing power, and investors look to gold and silver as safe havens for their money.

- The dynamics of supply and demand in the precious metal market have a big impact on their cost. Variables affecting supply and demand balances include mining output levels, changes in consumer preferences, and the impact of technology improvements on demand.

- Silver, platinum, and palladium are examples of precious metals with a wide range of industrial uses, including electronics, automotive, and healthcare. Prices may vary in response to modifications in consumer behavior or changes in industrial demand brought on by technical developments.

Which Regions are Contributing to the Growth Of The Precious Metal Market?

- In May 2025, Cygnus Metals, based in Perth, Western Australia, focused on the Chibougamau copper-gold project in Quebec, Canada, announced that Ernest Mast, president and managing director, will present live at the precious metals and critical minerals hybrid investor conference. (Source - https://investingnews.com)

- In May 2025, Russia's Krasnoyarsk territory announced its interest in cooperation with Belarus in processing precious metal scraps. The company wants to expand its market with this strategic alliance. (Source - https://eng.belta.by)

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.77% |

| Market Size by 2025 | USD 302.79 Billion |

| Market Size by 2034 | USD 545.57 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Safe haven investment

Precious metal investments can be viewed as a safe haven tactic, particularly in uncertain economic or volatile market times. Historically, in the precious metal market, compounds such as gold, silver, platinum, and palladium have been seen as safe havens against inflation and depreciation of currency. Compared to gold and silver, their values can fluctuate significantly, even though they have similar investment values. Palladium and platinum investors should keep a careful eye on the dynamics of supply and demand in the industrial sectors. Think about the expenses and practicalities of storage and security if you decide to invest in actual precious metals. A safe deposit box, a home safe, or outside storage services are your options. Regarding price, accessibility, and security, each choice offers advantages and disadvantages.

Restraint

Market speculation

Speculators keep a careful eye on a number of variables that might affect the price of precious metals, including changes in global supply and demand dynamics, inflation rates, central bank policies, economic data releases, and geopolitical tensions. Speculators predict future precious metal market changes by utilizing both technical and fundamental analysis. Technical analysis looks at past price charts and patterns to spot possible trends and entry/exit points, whereas fundamental analysis looks at the underlying causes influencing the supply and demand for precious metals. They can diversify their holdings, employ hedging tactics to balance possible losses in one position with profits in another or implement stop-loss orders to restrict prospective losses in order to control risk.

Opportunity

Supply and demand dynamics

In the precious metal market, mining is the main source of precious metals. The entire supply may be impacted by variations in mining output brought on by things like labor disputes, technical breakthroughs, geopolitical concerns, and environmental regulations. In important mining regions such as South Africa, Russia, and Australia, political instability, trade policies, and laws can cause disruptions to mining operations and have an impact on the precious metal supply. Interest rates and precious metals usually have the opposite connection. Gold and other non-interest-bearing assets are more appealing when interest rates are lower; the opposite is true when rates are higher. Precious metals demand can be influenced by a number of factors, including GDP growth, consumer confidence, job levels, and industrial and investment demand.

Technological Advancement

Technological advancements in the precious metal market feature data analytics, automation, and AI. The demand for precious metals in AI technologies is popular and effective for electricity conduction. In comparison to other materials, metals such as platinum, copper, silver, and gold contribute to electricity conduction more efficiently and effectively. The automation in the refining and metal recovery process improves operational tasks and supports sustainability. The process integrates the cycle from refining to trading.

The data analytics analyzes the calculative data of the operational process. It helps businesses explore insights into the market globally. The advancement leads to the development of the precious metal market.

Segments Insights

Product Insights

The gold segment held the largest share in the precious metal market. It is a highly sought-after asset for investment, jewelry, and industrial uses due to its scarcity, durability, and aesthetic appeal. In the precious metal market, gold items come in a variety of shapes and sizes, each meeting the needs of a certain market niche. This comprises gold coins and bars made by private refiners or government mints. Investors looking for a physical asset to protect themselves against inflation, unstable economies, or currency depreciation often buy these products. For generations, gold has been used as ornaments. Gold jewelry is available in a variety of karats (purity levels), patterns, and styles to suit a range of preferences and price points.

These financial instruments, which are exchanged on stock markets like shares of stock, follow the price of gold. This affects the dynamics of the precious metal market. Investors can track changes in the price of gold using gold exchange-traded funds (ETFs) without having to hold physical gold. While options contracts provide the buyer the freedom to buy or sell gold at a specific price within a predetermined window of time, futures contracts bind the customer to buy gold at a predetermined price on a future date. Investing in gold mining firms allows investors to obtain exposure to gold as well. These businesses investigate, develop, and extract gold from global mines.

Application Insights

The industrial segment held the largest share of 46% in the precious metal market. In the market, the industrial sector is quite important, especially when it comes to metals like gold, silver, platinum, and palladium. Although these metals are frequently linked to jewelry, investments, and financial reserves, their special qualities, such as conductivity, corrosion resistance, catalytic activity, and malleability, allow them to be used in a wide range of industrial applications.

Car catalytic converters employ platinum, palladium, and rhodium to cut down on harmful pollutants from exhaust gases. These metals aid in the transformation of hazardous pollutants like hydrocarbons, nitrogen oxides, and carbon monoxide into less dangerous forms. The electronics sector makes substantial use of precious metals, especially gold and silver, due to their superior conductivity and resistance to corrosion.

In many chemical reactions, such as those that produce polymers, medicines, and fertilizers, platinum and palladium are crucial catalysts. They make it possible for particular chemical reactions to happen more quickly and precisely. Due to its antibacterial qualities, silver is used in medical applications like surgical equipment, catheters, and wound dressings to help prevent infections. Furthermore, platinum-based medications are utilized in chemotherapy for cancer. Precious metals are used in aeronautical applications because of their high strength-to-weight ratio, ability to withstand corrosion, and dependability under harsh circumstances. They are utilized in turbines, aviation engines, and other vital parts. This further supports the growth of the precious metal market.

The jewelry segment is expected to witness the fastest growth in the market during the forecast period. The dynamic nature of the jewelry industry plays an important role in the demands in the precious metal market. Changing trends and price fluctuations influenced by financial situations and mining activities influence the growth of the segment. In countries in Asia Pacific, such as China and India, where gold and silver accessories are an integral part of their cultural identities, the market finds a substantial consumer base. Especially during the wedding season and other regional auspicious occasions, the jewelry segment experiences periodic surges in revenue generation.

Regional Insights

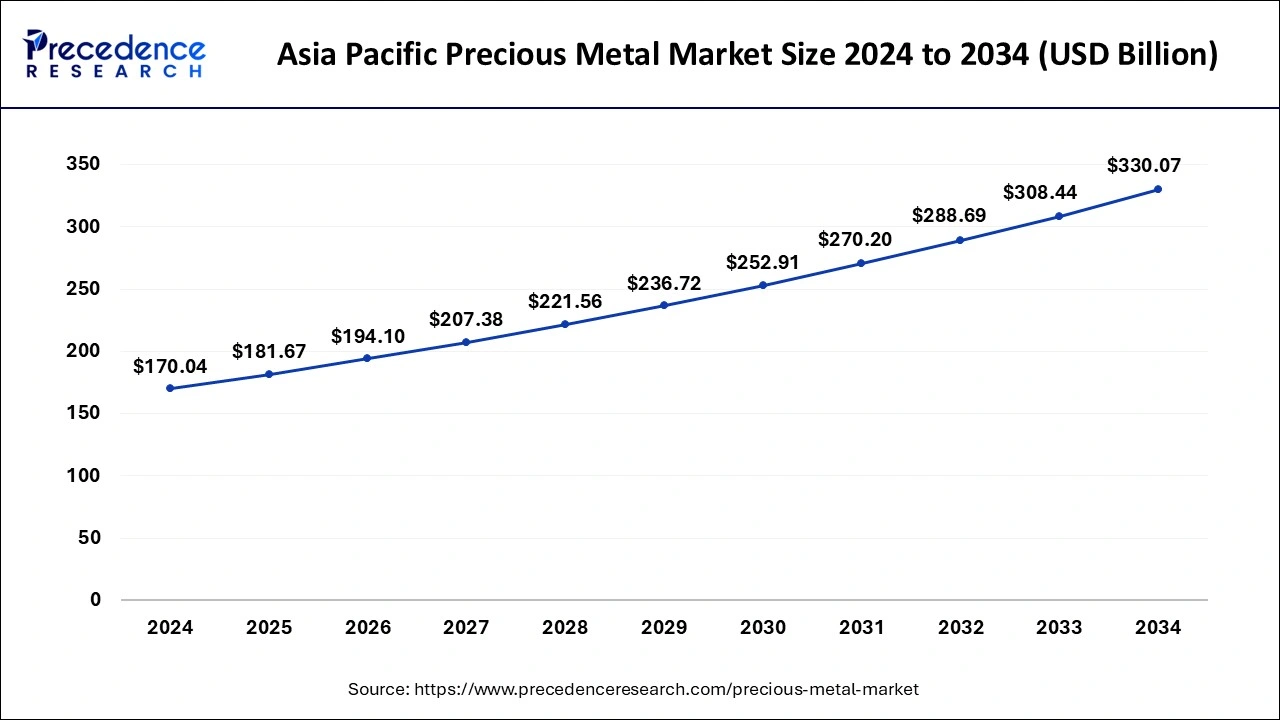

Asia PacificPrecious Metal Market Size and Growth 2025 to 2034

The Asia Pacific precious metal market size is estimated at USD 181.67 billion in 2025 and is projected to surpass around USD 330.07 billion by 2034 at a CAGR of 6.86% from 2025 to 2034.

Asia Pacific held the largest share of the precious metal market and is expected to lead the global market during the forecast period. Precious metals like gold and silver are traditionally in high demand throughout the Asia Pacific region, especially in nations like China and India. In addition to investment and jewelry objectives, cultural causes like weddings and festivals also drive this demand. In the Asia Pacific region, major hubs for precious metal trading are located in cities like Tokyo, Singapore, Hong Kong, and others.

Currently, Asia Pacific is dominating the precious metal market. The region holds the largest revenue share, exceeding 47% in 2024. The heavy investment and rising demand and requirement of precious metals in industrial applications accelerate the market. The increasing gold and silver purchase rate due to their cultural demand leads to the use of precious metals in the coating process, as a form of material. It's used in coin minting and jewelry.

For both domestic and foreign investors, these centers make trading, refining, and storage of precious metals easier. As their populations get wealthier and more interested in investing prospects, emerging economies in the Asia-Pacific area, like Vietnam and Indonesia, are also becoming bigger players in the precious metal market.

North America is also expected to gain a significant share of the precious metal market during the forecast period. Various factors, including industrial demand, investor mood, geopolitical events, economic conditions, and currency movements, impact the precious metal market in the region. Gold, silver, platinum, and palladium are the main precious metals traded in North America. Platinum is mostly employed in industrial applications, jewelry, and catalytic converters for the automobile industry. Because platinum is mostly mined in South Africa, supply dynamics, investor demand for precious metals, and automotive demand all have an impact on platinum prices. Due to supply limits (most palladium is produced in South Africa and Russia), investor attitude and automotive demand all affect palladium pricing.

Precious Metal Market Companies

- Freeport-McMoRan Inc.

- PJSC Polyus.

- Newmont Corporation.

- Gold Fields Limited.

- Randgold & Exploration Company Limited.

- Barrick Gold Corporation.

- AngloGold Ashanti Limited.

- Kinross Gold Corporation.

Recent Developments

- In May 2025, the Directorate General of Foreign Trade (DGFT) issued a notification aligning import regulations with the Union Budget 2025, targeting precious metals. The streamlining of the import of precious metals will form consistency between customs duties and import regulations. (Source - https://m.economictimes.com)

- In March 2024, together with his family business and longtime colleague Peter Grosskopf, billionaire investor Eric Sprott in precious metal miners and bullion is launching Argo Digital Gold Ltd., a platform that will allow a new generation of investors to own physical gold.

- In July 2023, Barrick Gold disclosed the extension of the mine life for its Tongon gold project in Côte d'Ivoire. This decision comes as a result of the ongoing positive outcomes from gold exploration activities within the Nielle mining permit area.

Segment Covered in the Report

By Product

- Gold

- Silver

- PGM

By Application

- Jewelry

- Industrial

- Investment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content