What is the Prediabetes Market Size?

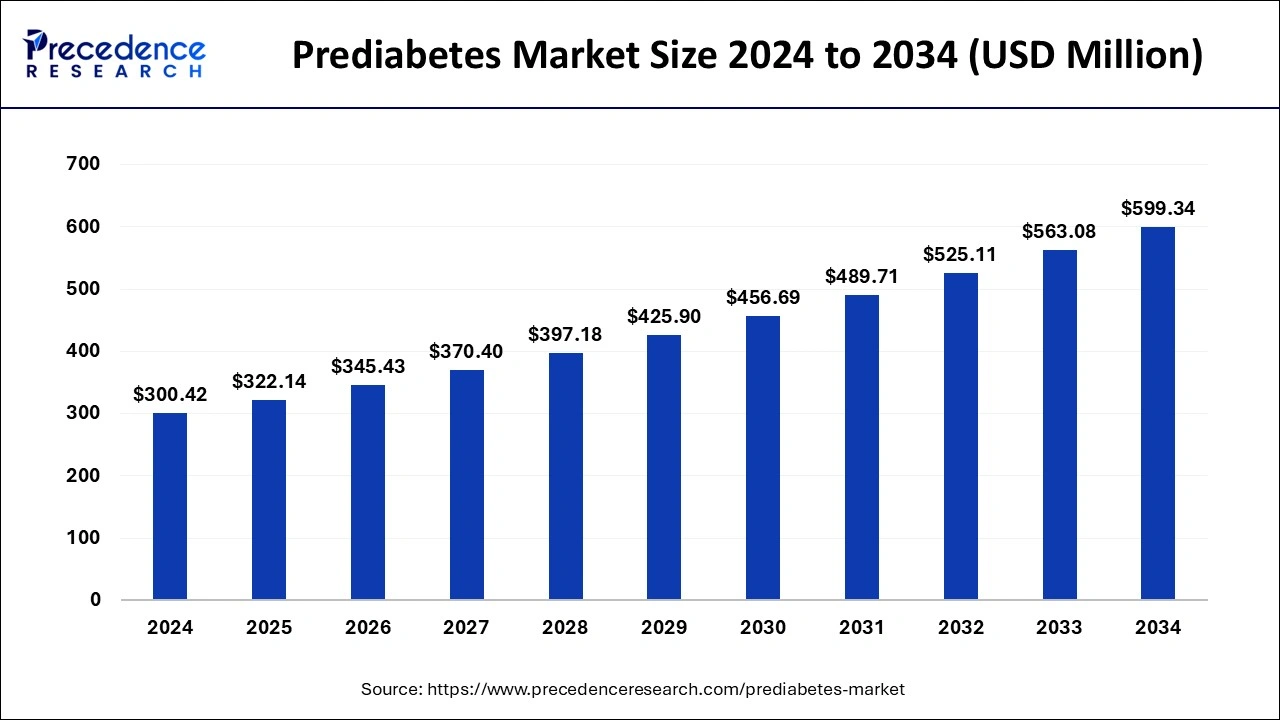

The global prediabetes market size is estimated at USD 322.14 million in 2025 and is predicted to increase from USD 345.43 million in 2026 to approximately USD 599.34 million by 2034, expanding at a CAGR of 7.15% from 2025 to 2034.

Prediabetes MarketKey Takeaways

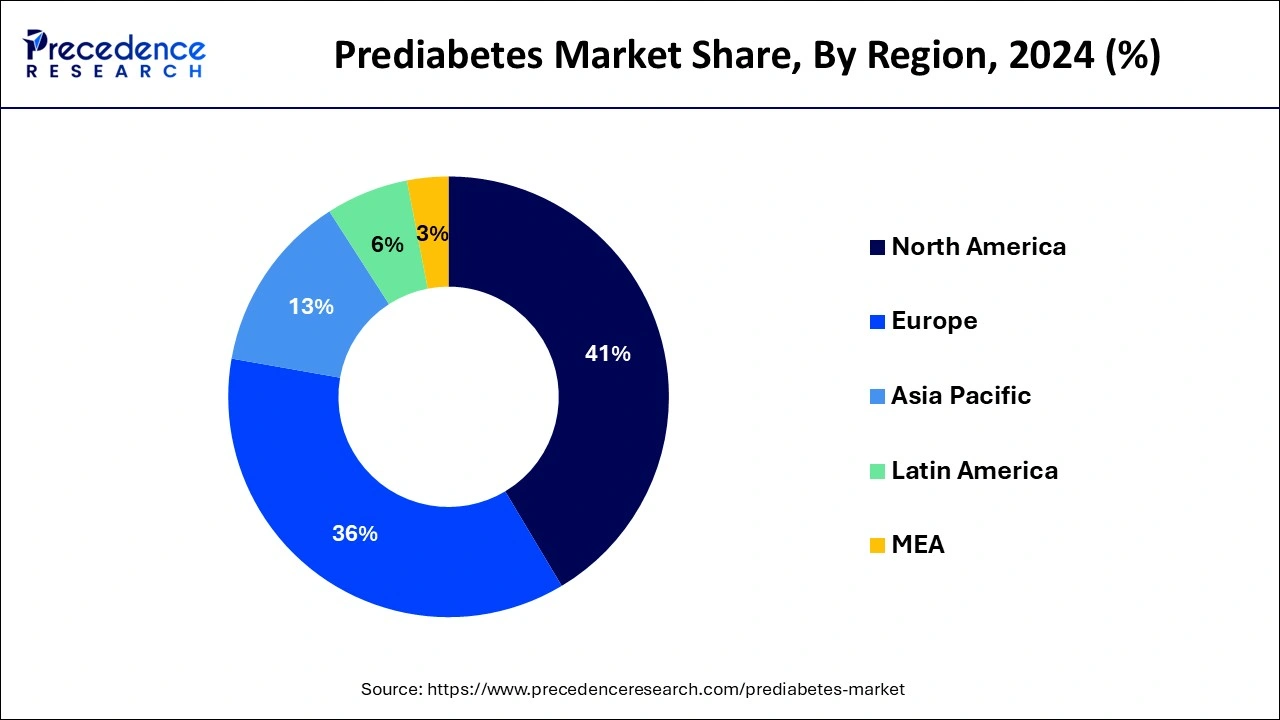

- North America dominated the market with the largest revenue share of 42% in 2024.

- Asia Pacific is projected to expand at a rapid pace during the forecast period.

- By drug class, the diguanide segment accounted for the highest revenue share of 85% in 2024.

- By drug class, the SGLT2 Inhibitors segment is expected to witness significant growth during the forecast period.

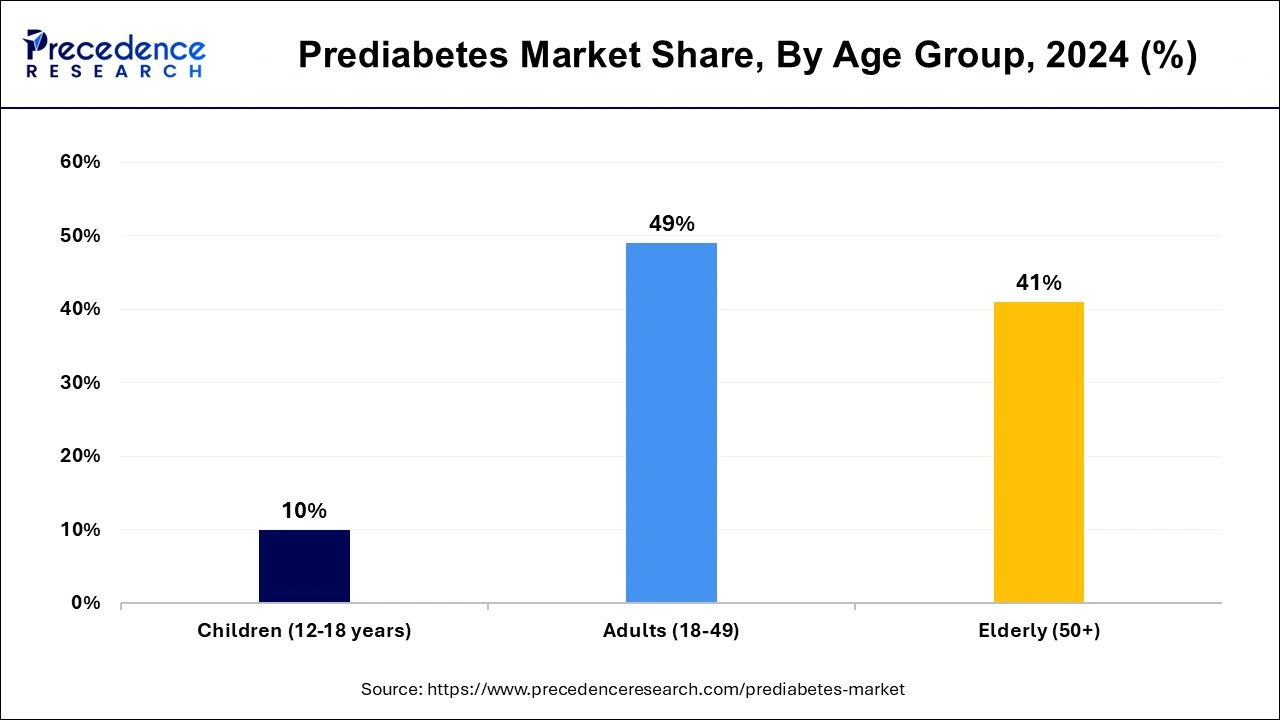

- By age group, the adults (18-49) segment has held a major revenue share of 49% in 2024.

- By age group, the elderly (50+) segment is expected to expand robustly during the forecast period.

What are Prediabetes?

In prediabetes, blood sugar levels are higher than normal but not high enough to be considered as type 2 diabetes. The timely precaution and treatment for prediabetes can prevent several severe health conditions, such as type 2 diabetes and various related diseases in the heart, kidneys, and blood vessels. In prediabetes, eating healthy and natural foods, doing regular exercise as a part of their daily routine, and maintaining a healthy weight can assist in bringing the blood glucose level back to normal.

Prediabetes Market Outlook

- Industry Growth Overview: The prediabetes market is anticipated to develop rapidly between 2025 and 2030, resulting primarily from increases in worldwide obesity, inactivity, and screening at early stages. Demand increased as patients transitioned to preventive care services, making use of digital health tools and tailoring nutrition consultations, particularly in the Asia-Pacific and North America.

- Sustainability Trends: The sustainability of healthcare has impacted the market, with providers focusing on long-term disease prevention to decrease the burden on the healthcare system. Interest in plant-based diets, low-GI foods, and eco-friendly wellness programs increased. Companies began expanding their research and development into sustainable nutrition, and companies started to develop green-approach manufacturing for diagnostic devices in an era of potentially stricter regulatory guidance.

- Global Expansion:Major companies are expanding regions predicting an increase in prediabetes, mainly Southeast Asia, Eastern Europe, and the LATAM region. Partnerships were built with clinics and digital health platforms to improve access and the continuum of care. Many companies also expanded their remote monitoring programs in the Asia-Pacific region to keep up with the number of patients.

- Major Investors: Strategic investors and private equity were active due to growth potential from recurring revenues from preventive therapies, diagnostics, and lifestyle management applications. Investors have accelerated their deployment of capital into blood glucose monitoring devices, metabolic health platforms, and digital coaching platforms.

- Startup Ecosystem: The startup ecosystem deepened the trends in areas such as AI-based risk prediction, continuous glucose monitoring, and metabolic wellness solutions. Companies like Levels (USA) and Ultrahuman (India) received robust VC financing for their real-time metabolic tracking and personalized tools aimed at preventing diabetes progression.

What are Prediabetes?

- The rising adoption of wearable gadgets for continuously tracking glucose levels and the rising use of mobile health applications for prediabetes management is anticipated to drive the growth of the global prediabetes market during the forecast period.

- The increasing demand for anti-diabetic medications and the rise in the obese population is projected to offer significant opportunities for the market's expansion.

- The presence of sophisticated healthcare infrastructure coupled with the increasing demand for continuous glucose monitoring (CGM) devices is expected to fuel the growth of the prediabetes market.

- Supportive government programs and initiatives regarding the prevention and treatment of early symptoms of diabetes are anticipated to accelerate the market's expansion.

- The rapid advancement in diagnostics tools for accurately, quickly, and precisely detecting blood glucose (sugar) levels, which aids in timely precaution and preventing type 2 diabetes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 322.14 Million |

| Market Size in 2026 | USD 345.43 Million |

| Market Size by 2034 | USD 599.34 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Age Group, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of prediabetes

The rising incidence of prediabetes across the globe is anticipated to fuel the growth of the global prediabetes market during the forecast period. Diabetes is becoming a very common and lifelong disease. Prediabetes serves as a warning sign that an individual is at risk of developing diabetes if appropriate preventive measures are not taken on time.

Before developing type 2 diabetes, an individual suffers from prediabetes. Prediabetes is also commonly known as borderline diabetes. It is considered a serious health problem and requires early action to reverse prediabetes or prevent type 2 diabetes. In this health condition, the blood sugar level is higher than normal but not high enough to define diabetes.

Obesity is considered a significant risk factor for developing prediabetes and is often associated with the consumption of junk food, poor diet, and sedentary lifestyles. People with prediabetes are advised by doctors to manage body weight, maintain a healthy diet, and regular exercise. In some cases, people with prediabetes often have a genetic link in which their family members are diagnosed with type 2 diabetes.

Additionally, the Government and several NGOs are spreading awareness through public health campaigns and educating people that prediabetes can be reversed by early detection and preventive measures. Thus, the prediabetic population and their expenses on glucose monitoring devices are also growing significantly, which is anticipated to propel the growth of the prediabetes market.

Restraint

Lack of awareness

The lack of awareness is anticipated to hamper the growth of the market. The less awareness regarding timely precautions and changes in lifestyle in underdeveloped countries may result in serious health conditions. Several middle and lower-income countries lack advanced diagnostic infrastructure, which is likely to restrict the expansion of the prediabetes market.

Opportunity

Rising geriatric population

The growing aging population is projected to offer a significant opportunity for the growth of the global prediabetes market in the coming years. The rising aging population is highly susceptible to diabetes. Glucose monitoring devices are becoming increasingly popular among the geriatric population to prevent diabetes with a healthy diet and yoga or exercise. Therefore, a rapid surge in the aging population globally is expected to contribute to the growth of the prediabetes market.

- In 2022, the American Diabetes Association (ADA) lowered the diabetes screening age to 35 years from 45 years. The ADA advises diabetes screening before age 35 if an individual is overweight or has additional risk factors for prediabetes or type 2 diabetes.

- According to the report published by the IHME in June 2023, Diabetes was mostly prevalent in people 65 and above in every country and recorded a prevalence rate of more than 20 percent globally. The highest rate was 24.4 percent for those between ages 75-79. The rising incidence of diabetes in the geriatric population increases the demand for diabetes management and monitoring tools.

Segmental Insight

Drug Class Insights

The diguanide segment accounted for the dominating share of the prediabetes market in 2024. The growth of the segment is driven by the rising adoption of metformin for effectively managing prediabetes and type 2 diabetes health conditions. Metformin is classified as a biguanide drug and is a widely used drug for prediabetes treatment and slowing down the progression of prediabetes. It reduces blood glucose levels by decreasing glucose production and enhances insulin sensitivity.

The SGLT2 Inhibitors segment is expected to witness significant growth in the prediabetes market during the forecast period owing to the increasing cases of prediabetes. SGLT2 Inhibitors are extensively used for the treatment of prediabetes and diabetes. SGLT2 inhibitors are a class of drugs prescribed to lower blood sugar by causing the kidneys to remove an increased amount of blood sugar from the body through urine and reduce the blood sugar level.

Age Group Insights

The adults (18-49) segment held the largest share of the prediabetes market in 2024. The individuals belonging to these age groups have the highest prevalence of prediabetes due to their unhealthy diet and sedentary lifestyles. Such factors drive the growth of the segment during the forecast period.

- According to the National Diabetes Statistics Report by the CDC in 2024, An estimated 97.6 million adults aged 18 years or older had prediabetes in 2021. Among U.S. adults aged 18 years or older, crude estimates for 2017–2020 were that 38% of all U.S. adults had prediabetes based on their fasting glucose or A1C level.

The elderly (50+) segment is expected to expand robustly in the prediabetes market during the forecast period. This age group of people is prone to age-prevalent illnesses such as type 2 diabetes. Furthermore, the surge in the geriatric population globally led to an increasing demand for prediabetes medication. Thereby bolstering the segment's growth.

- According to the Centers for Disease Control and Prevention (CDC), 27.2 million people aged 65 years or older (48.8%) have prediabetes in the United States as per 2021 estimates. In older adults, the body becomes resistant to insulin, which causes type 2 diabetes.

Regional Insight

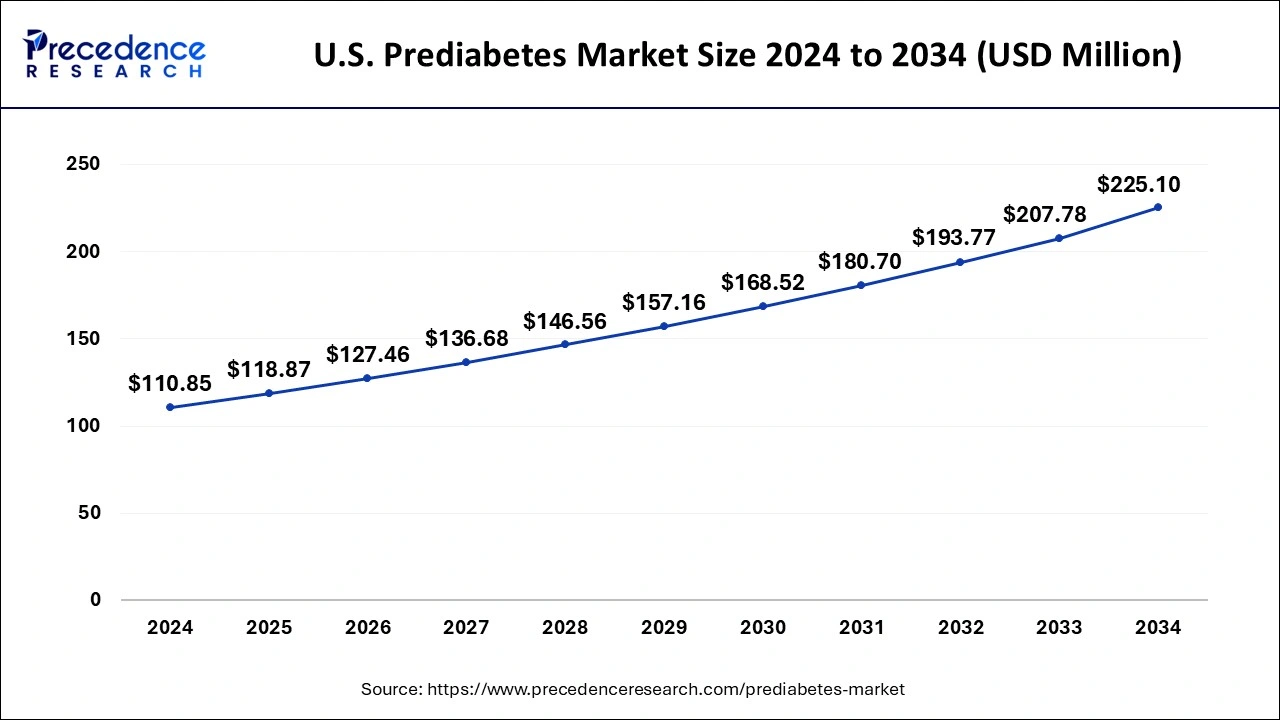

U.S. Prediabetes Market Size and Growth 2025 to 2034

The U.S. prediabetes market size surpassed USD 118.87 million in 2025 and is projected to attain around USD 225.10 million by 2034, poised to grow at a CAGR of 7.34% from 2025 to 2034.

North America held the dominant share of the prediabetes market in 2024. The growth of the region is attributed to the presence of advanced diagnostics centers, rising adoption of sedentary lifestyles, rising aging population, increasing consumption of packed & junk foods, rising research & development activities, increasing prevalence of prediabetes, and favorable healthcare policies and initiatives of government focused on addressing prediabetes risk factors.

The rapid advancement in technology, including wearable devices and digital health platforms, is revolutionizing the prediabetes market by constant monitoring and personalized interventions. Moreover, there is growing awareness among healthcare providers and individuals regarding the significance of early detection and intervention of prediabetes. Furthermore, the surge in the cases of genetic predisposition & obesity are the major factors contributing to the growth of the market during the forecast period.

- According to the data provided by the Centers for Disease Control and Prevention in 2024, 1 in 3 U.S. adults has Prediabetes. The United States has about 98 million adults who have prediabetes. There are usually no signs or symptoms of prediabetes, which is why 81 percent of people don't know they have it.

- In May 2022, The U.S. Food and Drug Administration (FDA) approved Mounjaro (tirzepatide) injection, Eli Lilly and Company's once-weekly GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes.

Asia Pacific is projected to expand at a rapid pace in the prediabetes market during the forecast period. The growth of the region is driven by the rising demand for diagnostic tests and screening services, the growing aging population, supporting government initiatives to prevent type diabetes, the rising adoption of inactive lifestyles, increasing cases of obesity, and rapid advancement in diagnostic technologies and therapeutic alternatives.

- In June 2023, A study published by the Madras Diabetes Research Foundation and Indian Council of Medical Research estimated that 101.3 million people in India, or 11.4 percent of the population, have diabetes, and it also stated that 136 million people in India, or 15.3 percent of the population are likely to be living with pre-diabetes.

- As per the data provided by Science Direct in March 2023, nearly one-third of the Chinese population has prediabetes.

- In August 2022, the International Diabetes Federation South East Asia launched the Beat Prediabetes initiative for India in Mumbai as a big step towards scaling up the fight against diabetes.

Why did Europe experience significant growth in the prediabetes market?

Europe grew significantly due to an aging population, rising obesity rates, and a strong emphasis on preventive healthcare. Governments backed early screenings to lower long-term health expenses. People started using digital health tools, following healthy diet plans, and joining fitness programs. Hospitals implemented modern testing devices and promoted lifestyle changes. The region provided opportunities for companies working on digital coaching platforms, personalized diet plans, and wellness programs. Increased awareness, robust healthcare systems, and supportive policies helped Europe progress steadily.

Germany Prediabetes Market Trends

Germany led Europe because of its strong healthcare infrastructure and high awareness of lifestyle diseases. Doctors promoted early testing, and people frequently visited clinics for health check-ups. The government supported prevention programs and encouraged balanced diets. Digital tools have become increasingly popular, with many people using apps and devices to monitor their health daily. Germany welcomed high-quality diagnostic devices, nutrition services, and wellness plans. Companies invested in technology that allowed people to track their blood sugar easily.

Why did the Latin America region experience significant growth in the prediabetes market?

Latin America experienced significant growth due to rising obesity rates, poor dietary habits, and limited physical activity. Urbanization led to increased reliance on fast food, which raised health risks. Governments promoted awareness campaigns and early screening programs. More people visited clinics to check their blood sugar levels. The region needed low-cost testing kits, nutrition programs, and digital health tools. Private companies entered the market with affordable solutions. Countries in Latin America adopted mobile health apps and community wellness programs.

Brazil Prediabetes Market Trends

Brazil led Latin America because it had a large population and an increasing case of lifestyle-related conditions. More people participated in health programs and early screening activities. Hospitals promoted wellness programs that focused on diet and physical activity. Digital health tools became popular, especially among younger individuals. The government supported awareness campaigns and encouraged prevention. Brazil needed affordable testing kits, nutrition counseling, and digital coaching platforms.

Why did the Middle East and Africa experience significant growth in the prediabetes market?

The Middle East and Africa experienced significant growth as many people faced changes in their lifestyles, decreased physical activity, and rising obesity rates. In earlier years, limited awareness contributed to health risks, but governments started promoting early testing and preventive care. There was an increase in investments in healthcare centers and community programs. The region required affordable devices, digital tools, and educational programs to support early detection. The rise in smartphone use allowed more people to access health apps.

Saudi Arabia Prediabetes Market Trends

Saudi Arabia led the Middle East and Africa because it had high rates of lifestyle diseases related to diet, stress, and limited exercise. The government launched extensive health awareness campaigns and invested in clinics that provided early screening. People began using digital tools and health apps to track their daily habits. Hospitals adopted modern testing devices and encouraged preventive care. The country needed new diagnostic technologies, nutrition programs, and wellness centers.

Prediabetes Market Companies

- SciMar

- Boston Therapeutics

- Valbiotis

- RESVERLOGIX

- Caelus Health

- Aphaia Pharma

- AstraZeneca

- Bristol-Myers Squibb

Recent Developments

- In October 2023, UAE launched free screening at workplaces in a new campaign targeting prediabetic residents titled ‘Show the Red Card to Diabetes.' The health authorities in the country have joined hands with private entities for the one-year battle to prevent diabetes from occurring in prediabetic individuals by conducting mass-free screening programs at workplaces followed by intervention through lifestyle modification to reduce the risk factors for diabetes.

- In November 2023, Valbiotis unveiled the success of the TOTUM 63 mode of action clinical study against prediabetes and the early stages of type 2 diabetes.

- In April 2023, Aphaia Pharma announced the dosing of the first patient in its phase 2 trial evaluating its lead candidate APH-012 for prediabetes.

- In February 2024, Know Labs announced the launch of KnowU, its latest wearable non-invasive continuous glucose monitor (CGM). The device enhances the user experience with features such as a rechargeable battery and a companion mobile app. The KnowU can be attached to the body using an adhesive patch or worn on the wrist with sensors that use radio waves to gauge the body's glucose levels.

Segments Covered in the Report

By Drug Class

- Diguanide

- Thiazolidinediones

- Glucagon-like Peptide-1 Agonists (GLP-1)

- SGLT2 Inhibitors

- DPP-4 Inhibitors

- Others

By Age Group

- Children (12-18 years)

- Adults (18-49)

- Elderly (50+)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting