What is Metformin Market Size?

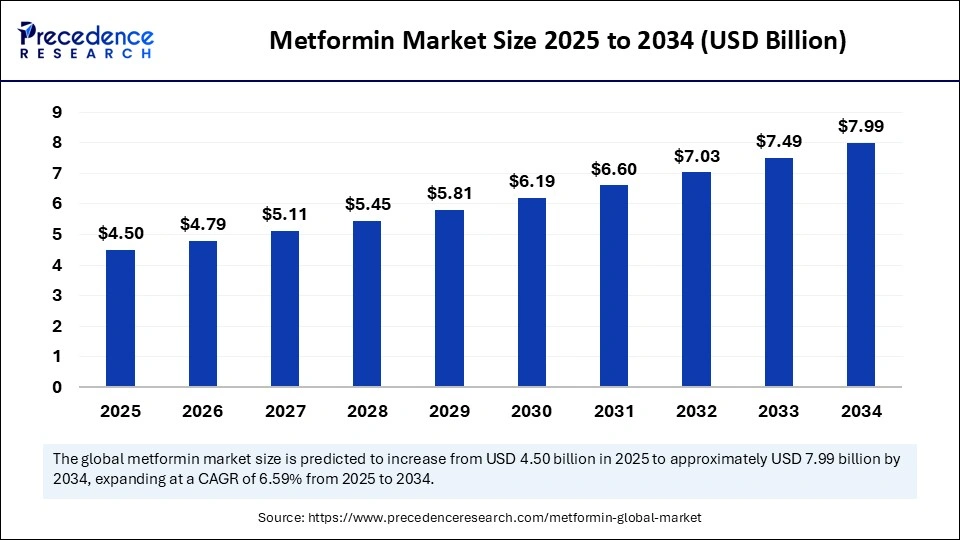

The global metformin market size is calculated at USD 4.50 billion in 2025 and is predicted to increase from USD 4.79 billion in 2026 to approximately USD 7.99 billion by 2034, expanding at a CAGR of 6.59% from 2025 to 2034. The market is driven by increasing prevalence of type 2 diabetes, growing aging population, rising awareness about diabetes management, and advancements in pharmaceutical inventions.

Market Highlights

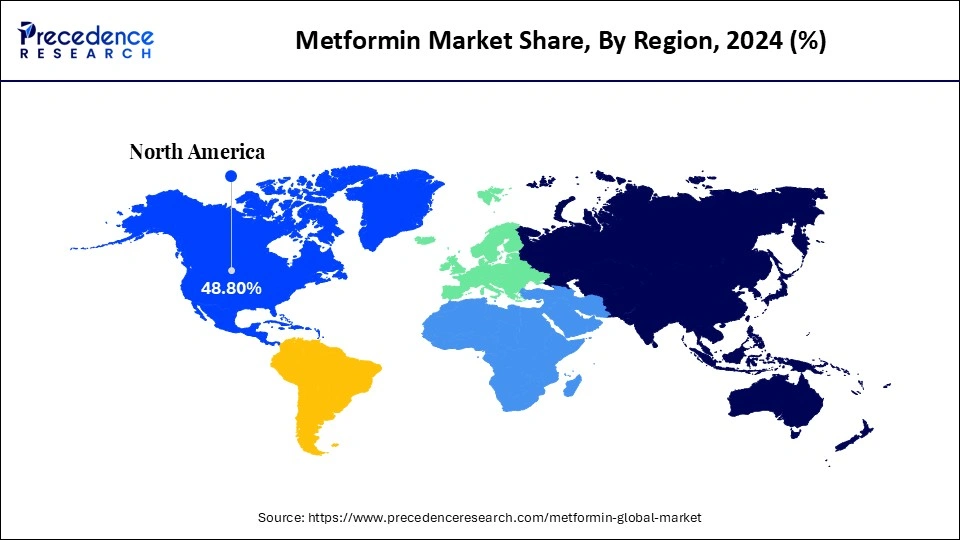

- North America led the metformin market with around 48.8% of share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 7.6% between 2025 and 2034.

- By product type, the immediate-release metformin segment contributed the biggest market share of 53.8% in 2024.

- By product type, the extended-release metformin segment is expected to grow at a 7.2% CAGR between 2025 and 2034.

- By application, the type 2 diabetes segment captured approximately 45.4% of the market share in 2024.

- By application, the polycystic ovary syndrome (PCOS) segment is expanding at a CAGR of 7.0% from 2025 to 2034.

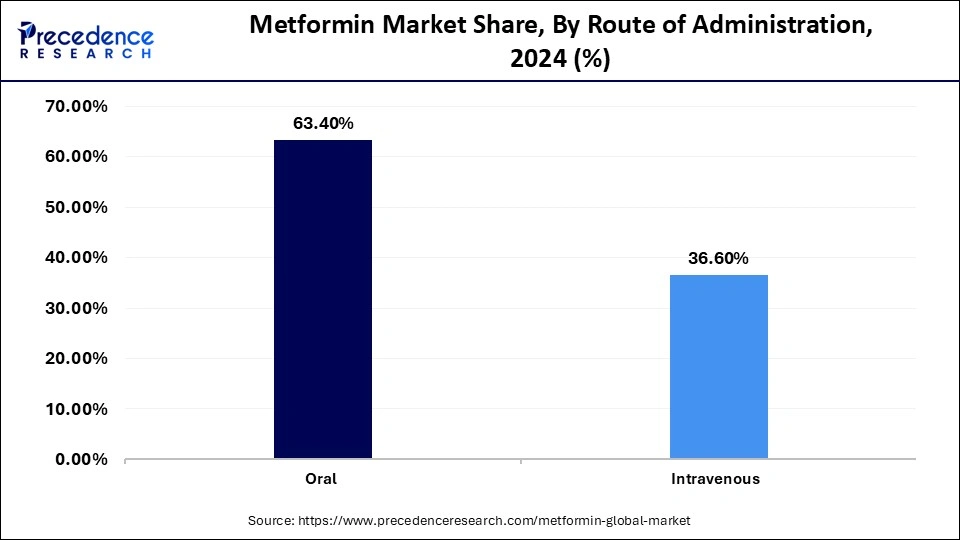

- By route of administration, the oral segment captured more than 63.4% of market share in 2024.

- By route of administration, the intravenous segment is expected to expand at a CAGR of 6.9% between 2025 and 2034.

- By dosage form, the tablets segment held approximately 54.5% market share in 2024.

- By dosage form, the capsules segment is growing at a solid CAGR of 7.2% between 2025 and 2034.

- By end user, the hospitals segment recorded more than 56.6% of the market share in 2024.

- By end user, the clinics segment is expected to expand at a CAGR of 7.0% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 4.50 Billion

- Market Size in 2026: USD 4.79 Billion

- Forecasted Market Size by 2034: USD 7.99 Billion

- CAGR (2025-2034): 6.59%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What Factors Contribute to the Growth of the Metformin Market?

The main factors fueling the growth of the metformin market include the rising incidence of type 2 diabetes and growing awareness about effective glucose management. As the first-line oral anti-hyperglycaemic agent,metformin helps to control blood sugar levels by reducing hepatic glucose production and increasing insulin sensitivity. The market is also being driven by an increase in demand for combination therapies as well as ongoing research to explore metformin's hypothetical benefits for other areas, such as polycystic ovary syndrome and cancer prevention.

The market includes pharmaceutical products containing metformin, a biguanide-class drug widely prescribed to manage type 2 diabetes by reducing hepatic glucose production and improving insulin sensitivity. It is available in various formulations, such as immediate-release and extended-release tablets, and is often used alone or in combination with other antidiabetic drugs. Increased patient compliance, widespread availability of generics, and expanding access to healthcare in emerging markets are also contributing to the drug's sustained global demand.

Metformin Market Outlook

- Market Growth Overview: The metformin market continues to grow steadily, driven by the rising global prevalence of type 2 diabetes and the increasing adoption of generic formulations. As access to healthcare improves in developing regions and global diabetes treatment guidelines consistently include Metformin, its therapeutic relevance and utilization are expanding.

- Global Expansion:Emerging countries in Asia Pacific and Latin America are playing a critical role in the market's expansion, both in terms of production and consumption. Government healthcare programs, local pharmaceutical manufacturing capabilities, and enhanced distribution networks are improving the global availability of metformin-based therapies.

- Research and Development:R&D initiatives are increasingly exploring Metformin's applications beyond diabetes, particularly in oncology, metabolic disorders, and longevity studies. A significant number of ongoing clinical trials indicate strong interest in drug repositioning and the development of extended therapeutic indications.

- Growth Drivers: Key growth catalysts include the rising incidence of diabetes, increased demand for affordable treatment options, and the widespread inclusion of metformin in national and international treatment protocols. Government-led early diagnosis programs and cost-containment strategies are further accelerating demand.

- Constraints: Market growth faces headwinds from regulatory scrutiny concerning product quality, particularly around nitrosamine impurities and manufacturing compliance. Moreover, intensified competition from other antidiabetic agents and pricing pressure from generics may impact profitability and limit future growth potential.

Next-Gen Metformin: Technological Advances in Diabetes Management

The metformin market is advancing through innovative drug delivery and formulation technologies aimed at improving bioavailability and patient adherence. Key developments include nanoparticle carriers, polymeric hydrogels, and fast-dissolving oral formulations designed for controlled release and reduced gastrointestinal side effects. Future innovations such as transdermal patches and microneedle systems integrated with biosensors may usher in smart, responsive therapies capable of delivering Metformin in real time based on glucose levels.

On the manufacturing front, technologies like continuous processing, terahertz-based quality control, and 3D printing are enhancing production consistency and enabling personalized dosing forms. Beyond its core application in diabetes management, Metformin is increasingly being explored for its metabolic modulation effects in oncology and anti-aging research. Collectively, these technological strides are repositioning Metformin from a conventional antidiabetic agent to a precision-driven, multifunctional therapeutic platform.

Trade Analysis of Metformin: Import & Export Statistics

- Globally, over 58,419 metformin import shipments were recorded between June 2024–May 2025, supplied by 1,138 exporters to 1,960 global buyers. India leads exports, followed by Germany and the U.S. Additionally World exported 48,079 shipments of metformin from Nov 2023 to Oct 2024. Top importers include the U.S., Singapore, and India.

- India exported 37,205 shipments of metformin to 169 countries (Nov 2023–Oct 2024). This is mainly exported to the U.S., Singapore, and Switzerland. These shipments are handled by 969 Exporters to 3,028 Buyers, making India the largest global supplier.

- Germany is the second largest country exporting metformin, recording 1,711 shipments (May 2024 to Apr 2025), importing to 25 Countries, 87 exporters, and distributed to 157 buyers, serving as a key EU pharmaceutical hub with high compliance standards.

- U.S. imported around 1,068 shipments (Nov 2023–Oct 2024). The U.S. leads the world in metformin imports with 12,904 shipments, followed by Singapore with 4,284 shipments, and India taking the third spot with 2,976 shipments, reflecting rising domestic production and supply diversification trends.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.50 Billion |

| Market Size in 2026 | USD 4.79 Billion |

| Market Size by 2034 | USD 132.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.59% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Applicaton,Route of Administration,Dosage Form, End User, and others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Value Chain Analysis of the Metformin Market

- Raw Material Sourcing:

The value chain begins with raw material acquisition, which consists of active pharmaceutical ingredients such as metformin hydrochloride and excipients, with emphasis on high purity and compliance with pharmaceutical-grade ingredients in the manufacturing of drugs.

- Manufacturing and Formulation:

Manufacturers process the raw materials through a rigorous quality control process to produce metformin tablets or extended-release products, which follow current Good Manufacturing Process (GMP) guidelines, as well as advanced synthesis and granulation processes.

- Packaging and Quality Control:

Once the formulation is complete, products undergo quality assurance testing, labeling, and will be packaged to ensure stability, contamination prevention, and adherence to international regulations.

- Distribution and Supply Chain:

The completed medications then enter the distribution process through wholesalers, pharmacies, or via online distribution methods. This will be completed with efficient logistics strategies to ensure success from both regional and global standpoints.

- End-User and After-Sales Services and Support:

Hospitals, clinics, and retail pharmacies serve as the end-user fields, coupled with post-marketing surveillance and patient compliance and education programs to ensure desired outcomes from the administration of drug therapies in general.

Segment Insights

Product Type Insights

Which Product Holds the Largest Share of the Metformin Market in 2024?

The immediate-release metformin segment dominated the market with a 53.8% share in 2024. This is because it has been the base therapy for type 2 diabetes for years. Immediate release products have been prescribed frequently because of their quick onset of effect, low cost, and approval through good clinical experience. The immediate-release metformin segment also consists of many generic versions of the product and has been favored through the reimbursement process, with high compliance and extensive use. Almost all hospitals worldwide dispense immediate-release metformin, as do retail pharmacies.

The extended-release metformin segment is expected to grow at a CAGR of 7.2% during the forecast period due to patient convenience and reduced side effects. An extended-release metformin provides a steady drug level effect in the patient that allows for once-a-day dosing to improve compliance of diabetes patients. Pharmaceutical companies are working on extended-release tablets with better bioavailability and controlled release mechanisms. Physicians are more frequently recommending extended-release products because of improved glycemic control and reduced gastrointestinal side effects that prolonged effects provide.

Application Insights

Why Did the Type 2 Diabetes Segment Dominate the Metformin Market in 2024?

The type 2 diabetes segment dominated the market by holding a 45.4% share in 2024. Metformin is the most commonly prescribed oral agent for addressing insulin resistance and lowering hepatic glucose output in patients with type 2 diabetes. Its low cost established clinical advantages, and position in worldwide diabetes management guidelines keep it at the forefront of provider recommendations. The continuing, worldwide increase in type 2 diabetes prevalence related to sedentary lifestyle and obesity continues to spur demand in this segment.

The polycystic ovary syndrome (PCOS) segment is rapidly growing at a CAGR of 7.0% due to increasing use of metformin for its ability to increase insulin sensitivity and regulate menstrual cycles in women with PCOS. Metformin decreases androgen production and is used for the treatment of related metabolic disturbances. The growing awareness of PCOS management and growing off-label indications for fertility treatment using metformin are contributing to growth in this indication. Ongoing clinical research to evaluate additional potential therapeutic benefits in the PCOS management further supports segmental growth.

Route of Administration Insights

How Does the Oral Route of Administration Dominate the Market?

The oral segment dominated the metformin market with a 63.4% share in 2024. Oral tablets are commonly used due to their convenience, cost-effective profile, and ease of use in chronic treatment. Patients with chronic diseases, such as type 2 diabetes, prefer oral treatment for its non-invasiveness and enhanced compliance. Furthermore, the availability of several strength and dosage formulations for oral administration facilitates wider access to oral metformin, helping it maintains its leading status for almost all segments of the population and various healthcare settings.

The intravenous segment is expected to grow at a 6.9% CAGR in the coming years, gaining traction in some hospital settings to acutely manage specific conditions like lactic acidosis or other clinical scenarios. While IV is still not frequently used, research studies continue to increase IV administration and parenteral usage for acute glycemic control in critically ill patients. Research studies promoting education, modified formulations, improved stability, and improved pharmacokinetics of IV medication support adoption for IV drug administration as an adjunct treatment regimen in some medical situations.

Dosage Form Insights

Which Dosage Form is Leading the Metformin Market?

The tablets segment held about 54.5% share in 2024. Tablets offer accurate dosing and are a convenient and accepted dosage form of metformin. Tablets are also widely accessible in the generic and branded space. Tablets are stable, have an acceptable cost, and are suited for a chronic disease-type patient. Diabetic patients have a strong preference for taking oral tablets, and tablets are further strengthened by continuing innovations such as film-coated and extended-release tablets in the pharmaceutical industry.

The capsules segment is expected to expand at a 7.2% CAGR over the projection period, as they are widely preferred for improved absorption and patient-friendliness. Capsules often provide better gastrointestinal tolerance for the patient as well as variable dosing. Pharmaceuticals have advanced to develop sustained-release capsule formulations that effectively maintain a stable plasma concentration level. The continued growth of the capsule segment is supported largely by patients who prefer capsules that are easier to swallow and the exciting incorporation of encapsulation technology that contributes to the stability of metformin bioavailability and therapeutic efficiency over traditional formulations.

End-User Insights

Which End-User Holds the Highest Market Share in 2024?

The hospitals segment held the largest share of 56.6% in 2024 due to the increased number of diabetic patients who are diagnosed and treated in hospitals. Hospitals serve as the primary distribution channels for both oral and injectable formulations, while providing total management of complications related to diabetes. The presence of trained healthcare personnel and the inclusion of metformin within standard treatment protocols contribute to the higher share of hospitals. Hospitals can also participate in clinical trials of newer metformin formulations that expand their indications for use.

The clinics segment is expected to grow at a 7.0% CAGR during the forecast period, as more patients consult with outpatient clinics for chronic metabolic disorders like diabetes and PCOS. As clinics are able to provide personalized, continuous care, they are often the preferred end-user for patients receiving prescriptions for metformin. The rise of specialty clinics in endocrinology and gynecology has also contributed to a higher utilization of metformin. The increased knowledge, availability, and growth of clinical services in emerging markets continue to drive the steady growth of this end-user's share.

Regional Insights

U.S. Metformin Market Size and Growth 2025 to 2034

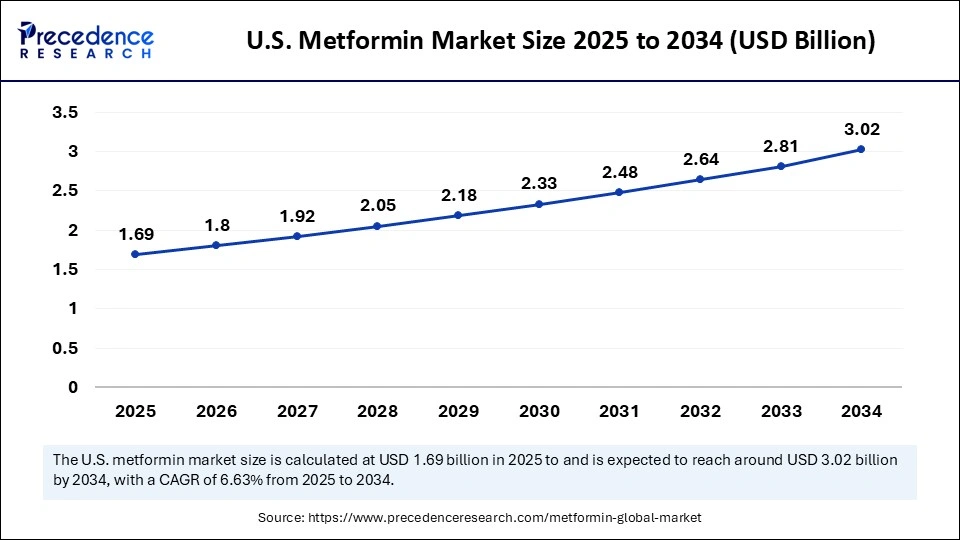

The U.S. metformin market size is exhibited at USD 1.69 billion in 2025 and is projected to be worth around USD 3.02 billion by 2034, growing at a CAGR of 6.63% from 2025 to 2034.

What Made North America the Dominant Region in the Metformin Market?

North America dominated the metformin market in 2024, accounting for a 48.8% share. This leading position is driven by a large population of diabetes patients receiving treatment, entrenched prescribing practices in primary care that favor metformin as a first-line therapy, and well-established retail pharmacy and reimbursement systems that support high prescription volumes and steady demand. Regulatory oversight, such as FDA guidance and accessible recall databases, has increased the importance of quality assurance and supply chain transparency. While this adds some cost, it also reinforces widespread clinical use, patient trust, and long-term payor support. Recent policy updates and safety communications have further aligned clinicians and payors in their continued endorsement of metformin, even as impurity concerns are monitored.

U.S. Metformin Market Analysis

The U.S. is a major player in the market. The U.S. has the highest absolute burden of diabetes globally, coupled with a complex formulary system and broad access to primary care. These factors contribute to the country's dominant uptake of metformin for managing type 2 diabetes. FDA public notices and recall databases influence procurement decisions made by hospital systems and pharmacy benefit managers (PBMs), encouraging manufacturers to prioritize supply to the U.S. market. The U.S. regulatory environment, shaped by FDA oversight, is both attractive and demanding for metformin suppliers. Additionally, pricing and supply trends of U.S.-listed active pharmaceutical ingredients (APIs) play a critical role in manufacturers' decisions regarding profit margins and sourcing strategies.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at a 7.6% CAGR in the coming years. This growth is driven by a rapidly increasing prevalence of diabetes, expanded primary care screening, and public-sector procurement programs that emphasize affordability of generic medicines. Together, these factors are generating strong incremental demand for oral antidiabetics, particularly metformin. Demographic shifts and urbanization are contributing to a rise in new patient initiations, while policy focus on essential medicine availability is boosting outpatient volumes for metformin across the region.

India Metformin Market Analysis

India plays a vital role in the regional and global metformin market, driven by a large domestic population living with diabetes and its position as the world's largest producer of generic medicines. Between November 2023 and October 2024, India was the leading exporter of metformin, with 37,205 shipments to 169 countries. Local manufacturers produce substantial volumes of metformin formulations to support domestic public health programs, as well as to supply countries across Africa and Asia. However, recent product recalls and batch-level actions have raised concerns about quality and supply chain reliability—key risks that buyers must monitor closely. As a result, commercial strategy is critical: suppliers must carefully balance participation in price-competitive tenders and public-sector contracts with the need to demonstrate strong GMP compliance and regulatory credibility.

Why is Europe Notably Growing in the Metformin Market?

Europe's market growth is driven by an aging population, evolving treatment guidelines, and increased public-sector healthcare procurement, especially as new screening initiatives expand. Following episodes of medicine shortages, the EU has placed greater emphasis on supply chain resilience and transparency. Audits and official reports have highlighted systemic risks to the availability of essential medicines, prompting pressure on member states to implement strategies such as increasing stockpiles and exercising tighter control over suppliers. These policy responses create business opportunities for reliable and compliant manufacturers, distributors, and logistics providers. However, they also raise barriers to entry, making market access more challenging for less-established or non-compliant suppliers.

Germany Metformin Market Analysis

As the largest pharmaceutical sector by spending in Europe and a key hub for manufacturing and regulatory activity, Germany combines strong primary care prescribing, mature reimbursement policies, and rigorous pharmaceutical oversight. Buyers in Germany prioritize stability, comprehensive quality documentation, and reliable suppliers. While some procurement thresholds are high, there is a general increase in both expectations and contract volumes for manufacturers that can meet Germany's pharmacovigilance and GMP standards. Additionally, regional pricing within the EU and trends in API costs are important factors influencing cross-border sourcing decisions in EU-wide tenders.

Top Key Players in the Metformin Market

|

Tier |

Companies |

Rationale / Roles |

Estimated Cumulative Share |

|

Tier I – Major Players |

USV Private Ltd. (India); Wanbury Ltd. (India); Shouguang Fukang Pharmaceutical Co. (China) |

These companies are among the largest producers and exporters of metformin API globally. USV alone holds ~21% of the global API share, with Wanbury and Shouguang contributing significant volumes. Their scale, compliance standards, and integration into both domestic and global supply chains place them at the top. |

~50% |

|

Tier II – Established Players |

Keyuan Pharmaceutical (China); Aarti Drugs Ltd. (India); Vistin Pharma ASA (Norway); Teva Pharmaceuticals; Sun Pharma; Dr. Reddy's Laboratories |

These companies are significant in either API manufacturing or finished dosage exports. They have notable presence in public tenders, institutional contracts, and global supply chains, though with more regional concentration or narrower portfolios than Tier I. |

~30–35% |

|

Tier III – Emerging / Niche / Regional Players |

Harman Finochem (India); Farmhispania (Spain); Shijiazhuang Polee (China); Alkem Laboratories; Cipla; Intas; Lupin; Apotex; Others |

These players operate at a smaller or regional scale. Some focus on emerging markets or local public programs, and others on niche formulations (e.g., extended release). While individually small, they collectively provide critical volume for lower-income regions or secondary procurement programs. |

~15–20% |

Recent Developments

- In March 2024, Lupin, a global pharmaceutical company, launched Ajaduo M Forte, a Triple Fixed-Dose Combination of Empagliflozin, Linagliptin, and metformin hydrochloride (extended release) for the management of type 2 diabetes mellitus in adults.

(Source: https://medicaldialogues.in) - In August 2025, Marksans Pharma Limited announced that its wholly-owned UK subsidiary, Relonchem Limited, received marketing authorization for three Metformin Hydrochloride prolonged-release tablet products (500 mg, 750 mg, and 1000 mg) key products from the UK Medicines and Healthcare products Regulatory Agency (MHRA).(Source: https://scanx.trade)

Experts Analysis:

The global metformin market continues to present a resilient and strategically attractive segment within the broader antidiabetic therapeutics landscape. As an entrenched first-line pharmacologic intervention for type 2 diabetes mellitus (T2DM), metformin benefits from robust clinical acceptance, deep formulary penetration, and policy alignment across both mature and emerging healthcare systems.

Despite its off-patent status and high genericization, the market demonstrates significant momentum, driven by macro-demographic shifts (aging populations, rapid urbanization), epidemiological trends (rising diabetes prevalence), and the reconfiguration of public procurement architectures favoring low-cost, essential medicines. In particular, Asia-Pacific is poised to deliver outsized contribution to volume expansion, underpinned by scaled public health initiatives, vertical integration of supply chains, and sustained investments in domestic manufacturing capabilities.

From a commercial perspective, the market is bifurcating. On one end, commoditized supply chains in high-volume, price-sensitive markets are pressuring margins, thereby accelerating consolidation among API and finished dosage manufacturers. On the other, regulatory tightening, especially across the U.S. and EU, has created a premium on supply chain reliability, GMP compliance, and pharmacovigilance, offering differentiation opportunities for quality-focused players.

Notably, the European Union's strategic shift toward medicines supply resilience and the U.S. FDA's increased scrutiny on nitrosamine impurities have catalyzed a structural realignment in sourcing strategies. This elevates the competitive position of firms able to meet enhanced audit and traceability expectations while participating in large-scale institutional contracts.

Furthermore, forward-looking manufacturers are leveraging metformin's ubiquity as a platform for fixed-dose combination (FDC) innovation, novel delivery mechanisms (e.g., extended-release formulations), and geographic portfolio expansion. These vectors present incremental revenue opportunities in both regulated and semi-regulated markets.

In sum, while the metformin market is mature, its underlying fundamentals, clinical indispensability, policy support, and global disease burden, create a durable demand curve. Players with vertically integrated capabilities, regulatory agility, and supply-side resilience are well-positioned to capitalize on evolving procurement paradigms and regional growth differentials.

Segments Covered in the Report

By Product Type

- Immediate-Release Metformin

- Extended-Release Metformin

- Combination Metformin Drugs

By Application

- Type 2 Diabetes

- Polycystic Ovary Syndrome (PCOS)

- Prediabetes

By Route of Administration

- Oral

- Intravenous

By Dosage Form

- Tablets

- Capsules

- Liquid Suspension

By End-User

- Hospitals

- Clinics

- Homecare Settings

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting