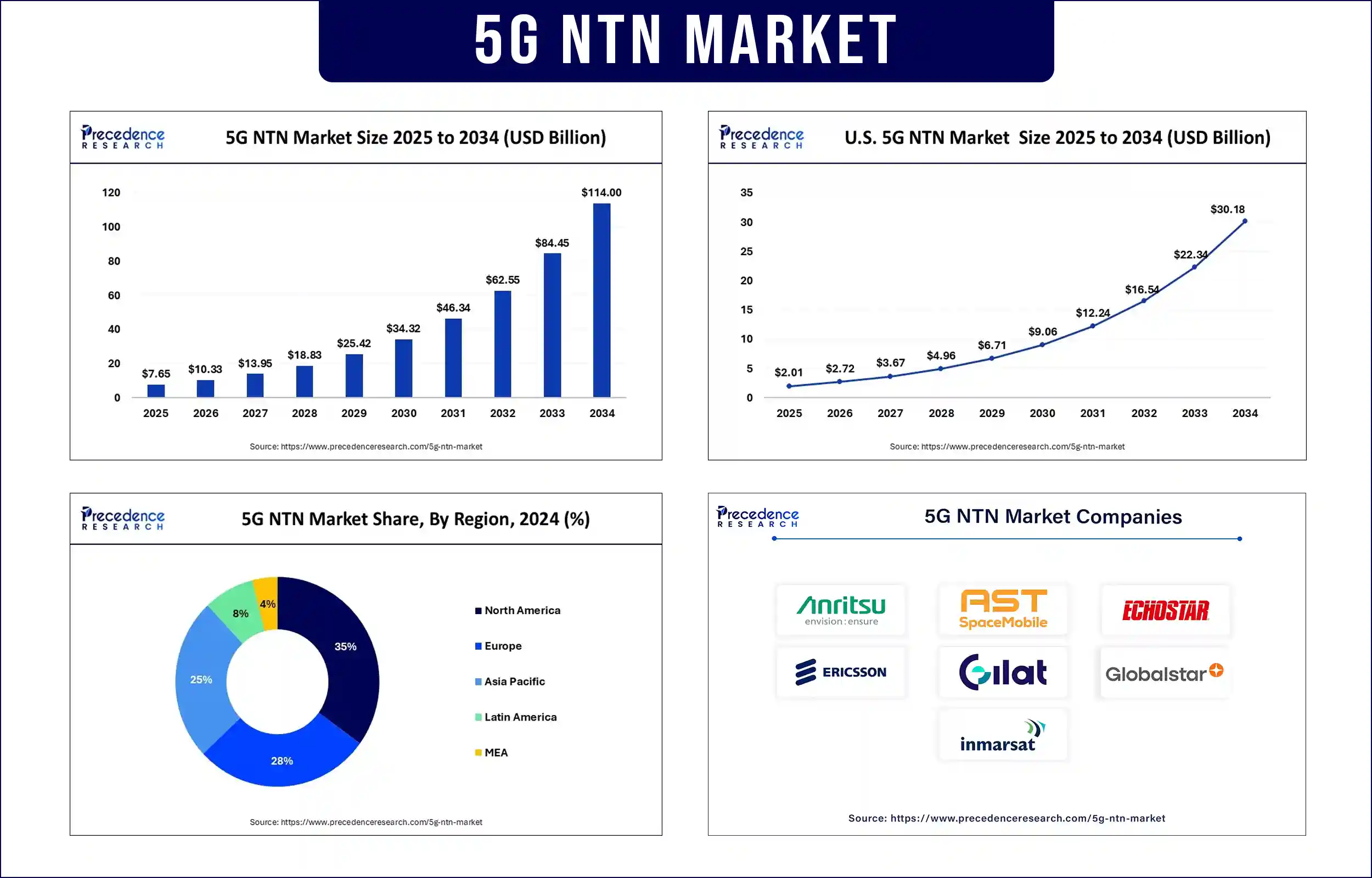

5G NTN Market Revenue to Attain USD 84.45 Bn by 2033

Author: Precedence Research

5G NTN Market Revenue and Trends 2025 to 2033

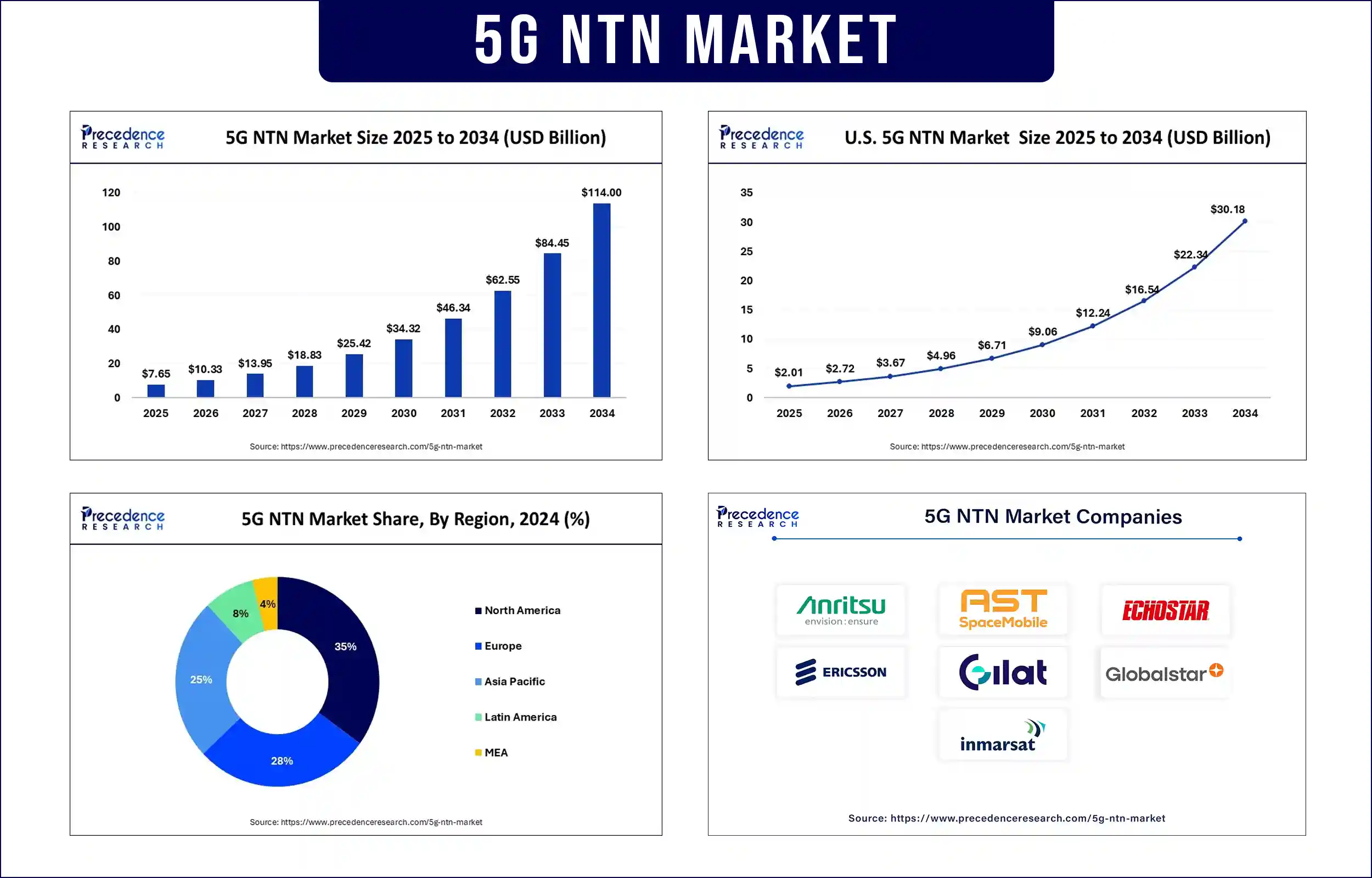

The global 5G NTN market revenue is calculated at USD 7.65 billion in 2025 and is predicted to attain around USD 84.45 billion by 2033, growing at a CAGR of 35%. The growth of the 5G NTN market is driven by rising demand for ubiquitous coverage, increasing government-backed space communication programs, and growing IoT integration in remote areas.

Market Overview

The 5G NTN market consists of communication systems that integrate satellite-based and airborne installations with terrestrial 5G establishment. These systems provide connectivity over rural, oceanic, and remote territory. The market has been witnessing significant growth due to the increased demand for broadband access in remote areas and increased investment by government and space agencies in Low Earth Orbit (LEO) satellite technology. The estimates featured in the International Telecommunication Union’s (ITU) Facts and Figures 2024 show that connectivity continues to increase worldwide. Furthermore, industry stakeholders are working to provide resilient, ultra-low-latency solutions to overcome commercial and humanitarian connectivity challenges.

Key Trends in the 5G NTN Market

Rising Connectivity Demand in Remote Areas

Global connectivity disparity is a key factor that influences the growth of the market. According to the ITU, rural and remote zones are less likely to be connected to mobile broadband than their urban counterparts. NTN solutions can bridge this gap and provide constant coverage that improves access to education, health services, and commerce to prosper in these areas. Moreover, NTN platforms are robust platforms for real-time public health response and emergency preparedness. Therefore, the demand for connectivity is rising, especially in remote areas.

Integration of Satellites into 5G Standards

The 3GPP release 17 represents an important step in incorporating satellite communication into 5G networks as a way of ensuring that the networks are interoperable across terrestrial and non-terrestrial networks. Satellite manufacturers and mobile network operators (MNOs) are performing trials using LEO and Geostationary satellites to confirm seamless connectivity. Furthermore, the SCaN (Space Communications and Navigation) office of NASA partnered with private

aerospace companies in 2024 to assess and choose terrestrial satellite 5G links for space-to-ground radio linkages. Such developments indicate the convergence of satellite and mobile systems worldwide to form a seamless, rugged 5G NTN architecture for commercial purposes.

Advances in LEO Satellite Technology

Continuous miniaturization and cost reduction of LEO satellites render large-scale deployments financially tenable. The FCC licensed over 7,500 Gen2 satellites from SpaceX in 2022 to increase Starlink services. Such actions are a show of the ease with which NTN systems can scale quickly. The new satellites feature inter-satellite laser links and AI-powered traffic routing, which increase data throughputs and lower latency, vital where 5 G-grade services are concerned. ESA initiated new payload validation missions in 2024, through its ARTES program, in order to experiment with next-generation LEO hardware for 5G NTN operations. Furthermore, such efforts show worldwide interest in LEO systems as cornerstones of a scalable, non-terrestrial 5G infrastructure that is resilient.

Defense and Disaster Preparedness Applications

Governments are increasingly turning to 5G NTN strategic defense and emergency communication technologies. The U.S. Department of Defense (DoD) is spending on resilient communications from 5G satellites for battlefield and logistics support. The Japan Aerospace Exploration Agency (JAXA) conducted a trial in 2024 to advance aerial NTN coverage in cases of tsunami and earthquake disaster communication. Such efforts exemplify the multi-dimensional functionality of NTNs. ESA’s deployment of IRIS² secure satellite infrastructure in 2024 supports encrypted 5G services for crisis management in Europe. The International Telecommunication Union (ITU) cooperated with the United Nations Office for Outer Space Affairs (UNOOSA) to design satellite-enabled early warning systems for climate induced disasters. These collaborative deployments display the essential role of NTNs for military and also the benefit for civilian security, disaster resilience, and immediate national security operations.

Report Highlights of the 5G NTN Market

Component Insights

The hardware segment led the market in 2024 due to the rapid deployment of satellite payloads, user terminals, and ground infrastructure, which are essential for NTN operations. The increase in launches of LEO constellations and ground station development boosted the demand for transceivers, satellite modems, phased array antennas, and onboard processing units.

Application Insights

The eMBB segment dominated the market with the largest share in 2024. This is mainly due to the increased demand for high-speed internet access in underserved and remote areas. 5G NTN networks extend enhanced Mobile Broadband’s (eMBB) capabilities to areas lacking fiber or terrestrial infrastructure, ensuring seamless

video streaming, cloud connectivity, and mobile broadband for users in air, sea, and rural locations.

End-Use Insights

The aerospace and defense segment dominated the market in 2024. This is mainly due to the increased demand for secure and resilient communication systems across military, surveillance, and logistics operations. Governments globally are integrating 5G NTN capabilities into defense strategies to enable autonomous systems and uninterrupted battlefield communication.

Regional Insights

North America dominated the 5G NTN market with the largest share in 2024. North America remains a leader in 5G NTN adoption owing to heavy investment from commercial satellite operators, regulatory support from the FCC, and high data demand in underserved regions. Starlink, Amazon’s Project Kuiper, and AST SpaceMobile are scaling commercial NTN services to the enterprise and the individual. The research into hybrid 5G satellite-terrestrial networks is funded by NASA and the DoD. In 2024, the FCC introduced a structure for SCS (supplemental coverage from space) that would permit integration of the direct-to-device satellite service to existing mobile networks. Under the department’s 5G-to-Next G umbrella, the U.S. Department of Defense unveiled fresh pilot programs in 2024 to determine NTN dependability for defense logistics and field communications. These factors are expected to strengthen North America’s leadership in building standardized, secure, and scalable 5G NTN systems, supporting both public and private sectors.

Asia Pacific is expected to witness the fastest growth, driven by initiatives taken by China, Japan, and India to expand national coverage through space-based networks. India’s Department of

Telecommunications is planning pilot projects with LEO satellite providers to enhance rural broadband. Recently, China announced a plan to launch over 300 satellites by 2025 to expand its space-based infrastructure and support the integration of 5G technology and broadband access. Japan is also making efforts to increase connectivity in rural and hard-to-reach parts of the country. The Japanese government’s space policy, released in 2024, has eyes on extending the satellite-based communications services to enhance connectivity, especially in areas prone to disasters. Furthermore, the growing adoption of 5G telecommunication technology is expected to fuel the market growth in this region.

5G NTN Market Coverage

| Report Attribute |

Key Statistics |

| Market Revenue in 2025 |

USD 7.65 Billion |

| Market Revenue by 2033 |

USD 84.45 Billion |

| CAGR from 2025 to 2033 |

35% |

| Quantitative Units |

Revenue in USD million/billion, Volume in units |

| Largest Market |

North America |

| Base Year |

2024 |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

5G NTN Market News

- In March 2025, The Industrial Technology Research Institute (ITRI) conducted a joint trial with Eutelsat, MediaTek, and Airbus, utilizing operational in-orbit LEO satellites to validate 5G NTN capabilities. The demonstration implemented 3GPP Release 17 specifications, where a MediaTek NR-NTN chipset terminal connected to ITRI’s NTN gNB via a Ku-band Eutelsat OneWeb satellite, successfully exchanging live traffic through a satellite developed by Airbus. This trial highlights global collaboration in accelerating real-world NTN integration.

- In February 2025, Eutelsat Group, in collaboration with MediaTek Inc. and Airbus Defence and Space, announced the successful completion of the world’s first 5G Non-Terrestrial Network (NTN) trial over Eutelsat OneWeb’s low Earth orbit (LEO) satellite constellation. This milestone trial demonstrated seamless satellite-to-terrestrial interoperability using the 3GPP Release 17 standard. The breakthrough is expected to reduce access costs and broaden global satellite broadband availability for standard 5G devices.

- In February 2025, AccelerComm, a leader in high-performance physical layer IP for 5G and beyond, unveiled its latest 5G NR NTN solution for LEO satellite systems. The release supports data rates of up to 6Gbps, 128 beams, and 4,096 users per chipset, delivering a 30x performance improvement over previous versions. The company’s roadmap targets over a 400x increase, underscoring its commitment to enabling scalable and resilient satellite-based 5G networks.

5G NTN Market Key Players

- Anritsu

- Ast Spacemobile

- Echostar

- Ericsson

- Gatehouse

- Gilat Satellite Networks

- Globalstar

- Inmarsat

- Intelsat

- Keysight Technologies

- Mediatek

- Nelco

Market Segmentation

By Component

- Hardware

- Solutions

- Services

By End-Use

- Maritime

- Aerospace And Defense

- Government

- Mining

By Application

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@https://www.precedenceresearch.com/sample/2685

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com+1 804 441 9344