Air Defense System Market Revenue to Attain USD 74.16 Bn by 2033

Air Defense System Market Revenue and Trends

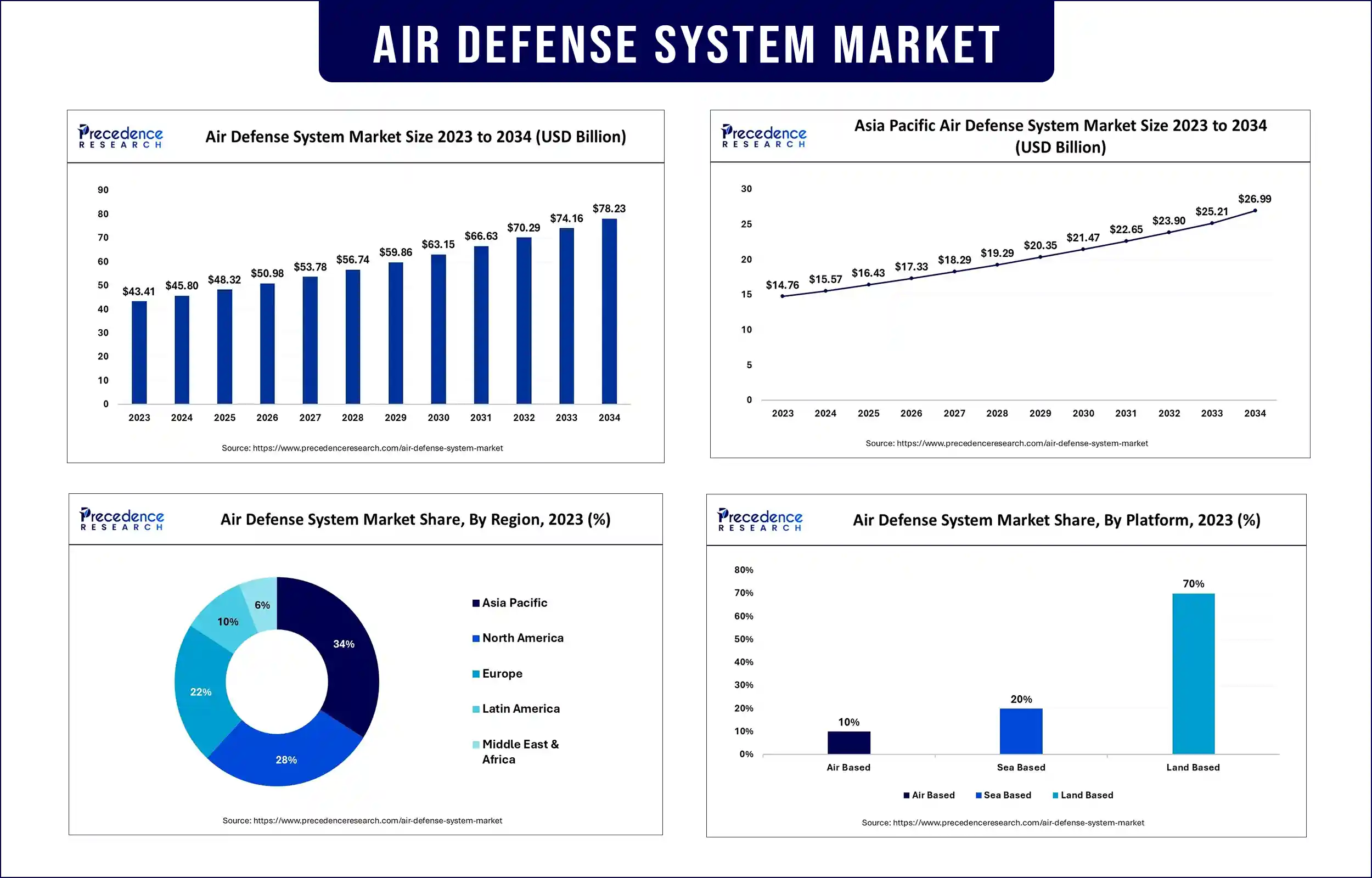

The global air defense system market revenue was valued at USD 45.80 billion in 2024 and is expected to attain around USD 74.16 billion by 2033, growing at a CAGR of 5.5% during the forecast period. The demand for air defense systems is increasing due to the rising geopolitical tensions between nations. The rising focus on the modernization of defense infrastructure leads to advanced air defense systems and strengthening deterrence capability against aerial threats of ballistic missiles, drone swarms, and combat aircraft, further boosting the market growth.

Market Overview

An air defense system refers to technologies and weapons designed to track and destroy aerial threats like missiles and aircraft. The defense system includes various radars, anti-craft guns, and anti-UAV weapons, which help to protect the country's territory from any attack. The air defense system market is growing efficiently due to the radars' exceptional capabilities, which help protect territory up to 300 km of distance. The system works by detecting and identifying threats. Various types of air defense systems, like static, mobile, and naval and airborne systems, work on different aspects, which makes their deployment necessary. The rising concerns about nation security further boosts the market growth.

Highlights of the Air Defense System Market Report

- Based on platform, the land-based segment dominated the market with the largest share in 2023. The dominance of the segment is attributed to the rising demand for land-based systems to protect ground stations and personnel from aerial threats. Moreover, the rising need to protect military bases where the threat is higher contributes to the segment’s dominance.

- On the basis of range, the medium range air defense (MRAD) system segment led the market in 2023. This is mainly due to the balanced coverage of medium range defense systems, which cover areas without the need for any additional need for specialized systems.

- Based on type, the missile defense system segment dominated the air defense system market in 2023 and is expected to continue its dominance throughout the forecast period. This is mainly due to its high usage during the war. Rising geopolitical tensions have led to increased demand for missile defense systems, boosting the segment.

- On the basis of component, the weapon system segment registered its dominance in 2023. The dominance of the segment is attributed to the rising need for protection systems from potential threats. The rising focus on modernization of missiles and advancements in military weapons further contributed to segmental growth.

Air Defense System Market Trends

- Technological Innovation in Air Defense Systems: The defense sector has experienced significant advancements in air defense systems over the past decade. Many government and private defense companies and research organizations have been working on novel air defense systems to modernize and advance air defense systems. Accuracy, stealth, maneuverability, cost-efficiency, lethality, and range are some of the prominent factors being worked upon for developing advanced air defense systems to counter emerging threats.

- Growing Defense Programs for Directed Energy Weapon Systems: Countries such as the U.S., the U.K., China, and Russia have embarked on various programs related to the design, development, integration, and deployment of directed energy weapon systems, such as high-power laser and microwave weapons, in defense forces through different platforms. Under the various programs, the prototype of directed energy weapons is currently in the testing and demonstration phase. Moreover, rising government funding to advance defense infrastructure boosts the market.

- Rise in global missile threats: Rising geopolitical tensions between countries are one of the major concerns, which boosts the demand for air defense systems for both offensive and defensive purposes. This threat further increased investments in developing advanced missiles, contributing to market expansion.

Regional Insights

Asia Pacific dominated the global air defense system market in 2023. The region's dominance is attributed to the rising defense expenditures of countries like China, India, South Korea, and Japan. Governments are investing heavily to deploy air defense systems that play a crucial role during war. In addition, rising geopolitical tensions, such as the India-China border conflict and China sea disputes, are contributing to regional market growth.

Europe is anticipated to be the fastest-growing market in the coming years. This is primarily due to the ongoing conflict between Russia and Ukraine, which has resulted in increased spending on defense systems. European countries also face a missile threat from Russia, which leads to the need for advanced air defense systems.

Air Defense System Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 45.80 Billion |

| Market Revenue by 2033 | USD 74.16 Billion |

| CAGR | 5.5% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In October 2024, amid escalating tensions with Iran, Israel requested the U.S. to send a second Terminal High-Altitude Area Defence (THAAD) battery to protect the country. The THAAD Battery will augment Israel’s integrated air defense system.

- In February 2024, amid growing missile threats from China and North Korea, countries like Japan, South Korea, and Australia are improving their missile defense capabilities through collaborative investments and integrated systems like THAAD, Patriot, and Sky Bow III.

Segments Covered in the Report

By Platform

- Land Based

- Sea Based

- Air Based

By Range

- Short Range Air Defense System

- Medium Range Air Defense System

- Long Range Air Defense System

By Type

- Missile Defense System

- Anti-Aircraft System

- Counter Rocket, Artillery, and Mortar (C-RAM) System

By Component

- Weapon System

- Turret Systems

- Missile Launching System

- Fire Control System

- Air Defense Radar

- Electro-Optic & Laser Range Finder

- Command and Control System

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1768

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344