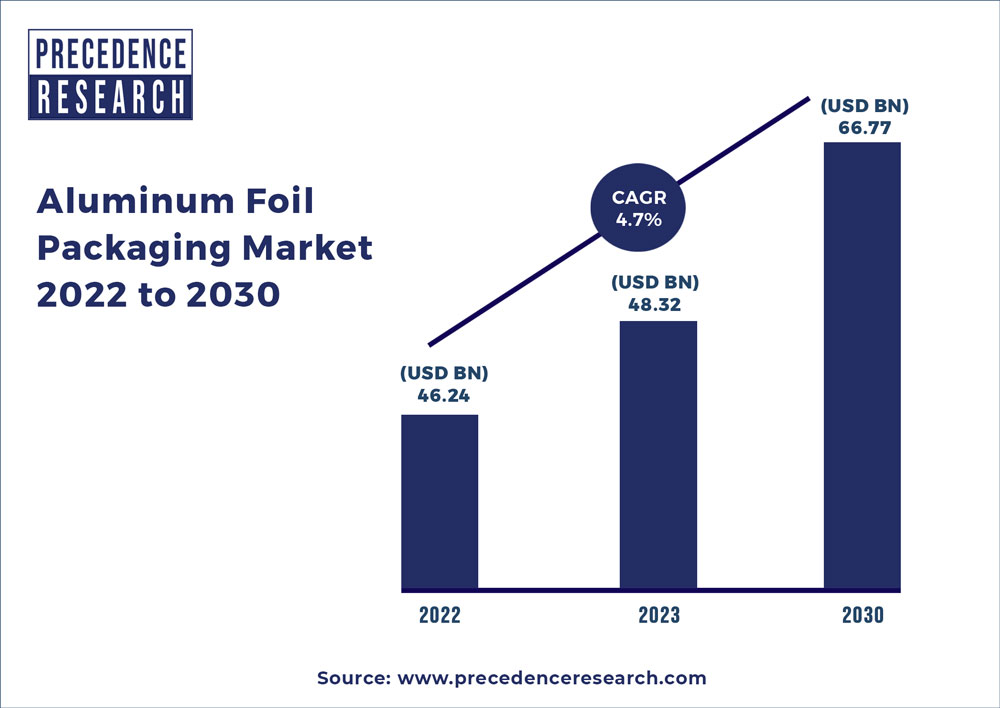

Aluminum Foil Packaging Market Size To Hit USD 66.77 Bn By 2030

The global aluminum foil packaging market size accounted for USD 46.24 billion in 2022 and is expected to hit around USD 66.77 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030.

Aluminum foil is a lightweight and versatile packaging material produced from aluminum sheets. Many products are wrapped in aluminum foil for packaging. The food and beverage industry, as well as the pharmaceutical industry, is a big user of aluminum foil packaging. Aluminum foil is a type of packaging that helps to preserve food, beverages, cosmetics, and medications while also reducing waste. Aluminum foil is hygienic, chemically neutral, corrosion-resistant, non-toxic, and non-toxic. Customers can directly freeze or heat the food packed in aluminum foil, which has many advantages for the food and packaging businesses. Aluminum foil wrap is made by cold rolling and general casting, and it's easy to wrap around anything for packaging. These foils are widely utilized in the food and beverage industry.

Aluminum Foil Packaging Market Report Scope

| Report Coverage | Details |

| Market Size In 2022 | USD 46.24 billion |

| Market Size By 2030 | USD 66.77 billion |

| Growth Rate from 2022 to 2030 |

CAGR of 4.7% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered |

|

| Regions Covered |

|

Report Highlights

- Based on the product, the foil wraps segment is the fastest-growing segment in the global aluminum foil packaging market. Other types of packaging materials cannot match the features of aluminum foil wrap. During the projection period, the tobacco, food, and cosmetics industries are likely to be the primary drivers of the aluminum foil warp expansion.

- Based on the end user, the food and beverage segment is the fastest-growing segment in the global aluminum foil packaging market. During the forecast period, rising demand for aluminum foil from the food and beverage packaging industry is likely to increase the overall growth of the aluminum foil packaging market.

Regional Snapshot

Europe is the largest segment of the aluminum foil packaging market in terms of region. Due to improving lifestyles and rising spending power, packaged goods are in more demand in Europe. People are spending more money on pharmaceuticals these days, which is helping to boost the growth of the aluminum foil packaging market.

Asia-Pacific region is the fastest-growing region in the aluminum foil packaging market. The developing economies of the Asia-Pacific region are expected to dominate the market. These countries’ purchasing habits have shifted with a greater emphasis on acquiring packaged items.

Market Dynamics

Drivers: Surge in demand for environmentally friendly foil

Consumer preferences, as well as changing regulatory laws, are two of the most important variables influencing the food and beverage industry's numerous features, such as packaging, ingredients, and product information. Consumers nowadays are increasingly expecting environmental sustainability from a variety of industries, and the food packaging industry is following suit. Food packaging has evolved into a multibillion-dollar industry, resulting in the introduction of creative, cost-effective, and environmentally friendly products and concepts. Aluminum foils have grown in popularity over the last decade as a result of their outstanding capacity to protect food from external influences such as moisture, oxygen, and germs, among others. Thus, surge in demand for environmentally friendly foil is expected to drive the growth of the aluminum foil packaging market.

Restraints: Adverse effects of aluminum foil packaging on food items

In acidic and liquid food solutions is substantially more likely to leach into food and at a higher quantity, than in those containing alcohol or salt. When a spice is added to meals cooked in aluminum foil, the leaching levels increase even more. Any acidic substance initiates a particularly aggressive process that removes layers of aluminum from food. Other health hazards are associated with the use of aluminum. The high aluminum intake may be detrimental to some patients with bone disorders or renal impairment. It also slows downs the proliferation of human brain cells. Thus, this factor is hampering the market growth.

Opportunities: Rising utilization of aluminum foil in the food and beverage industry

During the forecast period, rising demand for aluminum foil from the food packaging industry is likely to increase the aluminum foil packaging market's overall prospects. Aluminum foil's strong demand can be due to a variety of advantages, including excellent thermal insulation, flexible packaging, and desirable physical qualities. Furthermore, aluminum packaging has grown in popularity in recent years because of its non-toxic, chemically neutral, and corrosion-resistant properties. As a result, the rising utilization of aluminum foil in the food and beverage industry is creating lucrative opportunities for market growth.

Challenges: Long process times

The manufacturing of aluminum foil requires a good amount of time and resources. Aluminum is a metal that requires a lot of pressure and force to convert it into the foil. The manufacturing process of aluminum foil needs land, human resource, and machinery. This also requires a good amount of investment. As a result, the long process time is a huge challenge for market growth.

Key Players in the Report

- China Hongqiao Group Limited

- Amcor Ltd.

- United Company RUSAL PLC.

- Ess Dee Aluminum Ltd

- Novelis Inc.

- Alcoa Corporation

- Penny Plate LLC

- Wyda Packaging Ltd.

- Nicholi Food Packaging

- Alufoil Products Pvt. Ltd

Market Segmentation

By Product

- Foil Wraps

- Pouches

- Blisters

- Containers

- Others

By End Use

- Food & Beverage

- Tobacco

- Pharmaceuticals

- Cosmetic

- Others

By Packaging Type

- Rigid

- Flexible

- Semi-Rigid

By Foil Type

- Printed

- Unprinted

By Thickness

- 0.007 mm – 0.09 mm

- 0.09 mm – 0.2 mm

- 0.2 mm – 0.4 mm

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1608

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333