What is the Aluminum Foil Packaging Market Size?

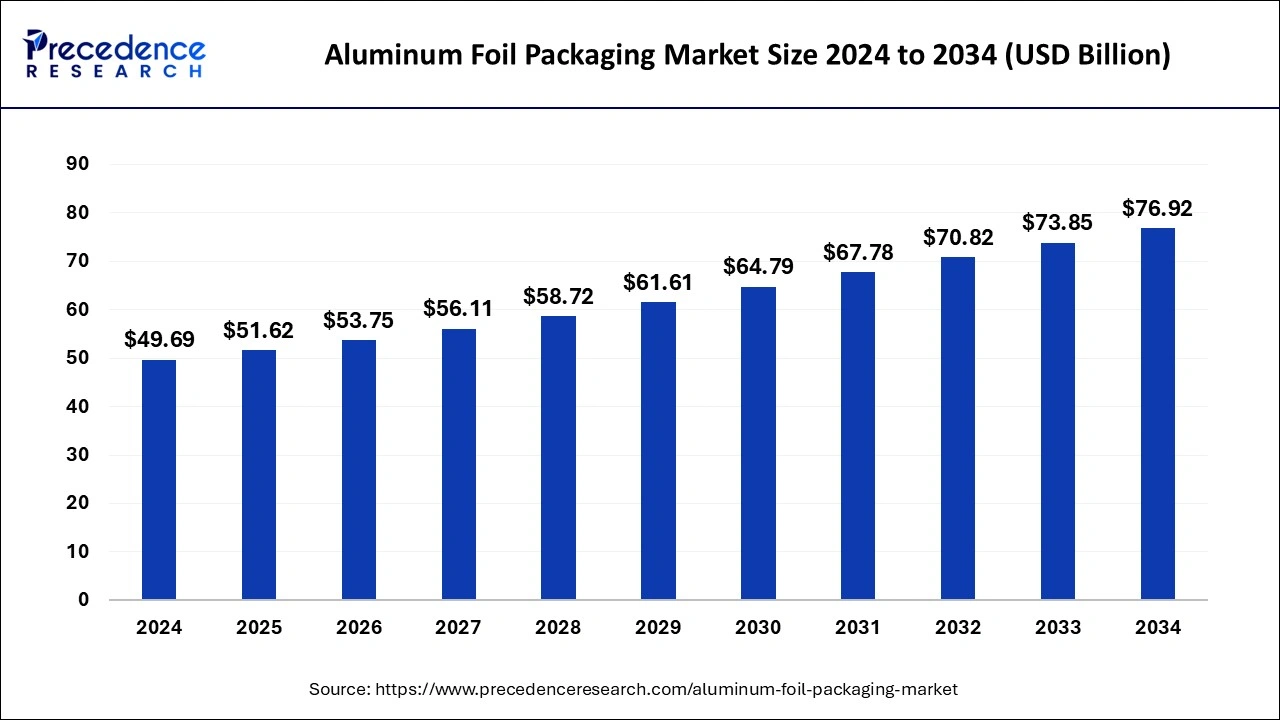

The global aluminum foil packaging market size is calculated at USD 51.62 billion in 2025 and is predicted to increase from USD 53.75 billion in 2026 to approximately USD 76.92 billion by 2034, expanding at a CAGR of 4.47% from 2025 to 2034.

Aluminum Foil Packaging Market Key Takeaways

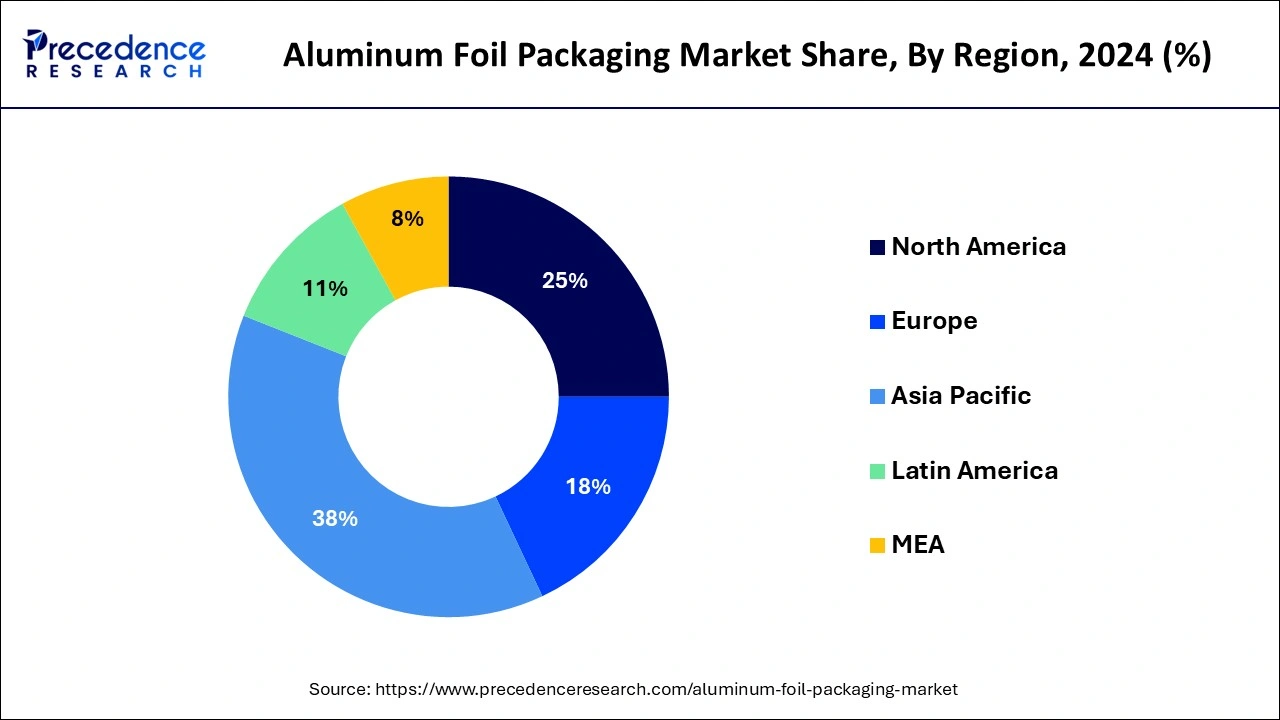

- Asia Pacific region generated more than 38% of the revenue share in 2024.

- By packaging type, the pouches segment leads the aluminum foil packaging market and has the most substantial share of the revenue.

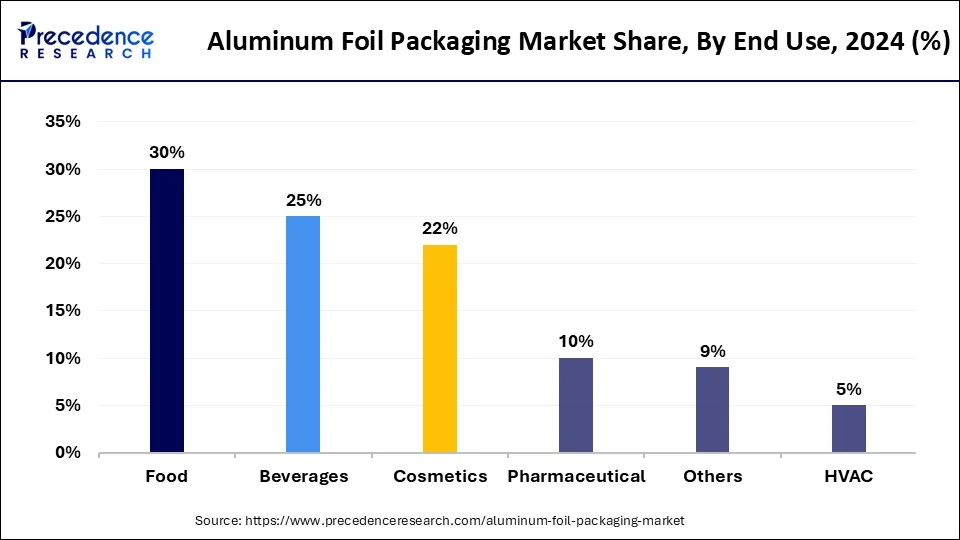

- By end-use, the food segment captured the highest revenue share of 30% in 2024.

- By thickness, the 0.09mm - 0.2 mm segment captured the biggest revenue share of 58% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 51.62 Billion

- Market Size in 2026: USD 53.75 Billion

- Forecasted Market Size by 2034: USD 76.92 Billion

- CAGR (2025-2034): 4.47%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

The Foil Frontier: Innovations in Aluminum Packaging

The aluminum foil packaging market refers to the industry involved in the production and distribution of packaging materials that are made of aluminum foil. The global market encompasses a wide range of products and industries. Due to its exceptional malleability, aluminum is used in packaging because it is simple to transform into thin sheets that may be folded, rolled, or boxed. Aluminum foils aid in long-term food storage due to their excellent water and water vapor impermeability. Additionally, because of this superb quality, aluminum helps keep food fresh.

Aluminum foil is widely used in pharmaceutical and food packaging, such as long-life packs for drinks and dairy products that allow storage without refrigeration. It is a total barrier to light, oxygen, odors, flavors, humidity, and germs. Pies are baked and packed in aluminum foil trays and containers and are also used for takeout food, convenience snacks, and long-lasting pet food.

Smart Foil: The AI Revolution in Aluminum Foil Packaging

ArtificialIntelligence-enabledaluminum foils find manifestations in manufacturing and supply chains by ensuring efficiency and sustainability. Predictive maintenance enhances the production process by lessening downtimes, and smart automation will, for example, bring precision to rolling or cutting. Then comes machine vision for real-time quality control through defect identification, while AI is used for supply chain optimization through demand forecasting and inventory control, thereby reducing waste and energy consumption and fast-tracking the development in smart packaging, such as sensors for product quality monitoring. On the whole, AI is enough for operational efficiency, product integrity, and sustainability that give the market edge.

Aluminum Foil Packaging Market Outlook

- Industry Growth Overview: The market is projected to experience substantial growth between 2025 and 2034, driven by rising demand from the food and beverage, pharmaceutical, and e-commerce sectors. Key growth areas include wraps and rolls, foil containers, and blister packaging. Demand is further propelled by urbanization, changing consumer lifestyles, and the need for convenient, non-toxic packaging.

- Sustainability Trends:The market is increasingly influenced by sustainability, with a strong focus on enhancing recyclability and reducing environmental impact. This includes innovations in ultra-thin, high-strength foils that reduce material usage and energy-efficient production methods.

- Global Expansion: Leading companies are expanding into high-growth regions like Asia-Pacific, Latin America, and Eastern Europe to leverage burgeoning consumer markets and industrial growth. The Asia-Pacific region, led by China and India, remains the largest and fastest-growing market, driven by rising disposable incomes and expanding food and pharmaceutical industries.

- Major Investors: Significant investment from large tech companies and venture capital firms is flowing into the sector. Major players such as Amcor, Hindalco Industries, and Constantia Flexibles are engaging in acquisitions, capacity expansions, and R&D to strengthen their market positions.

Aluminum Foil Packaging Growth Factors

The growth of aluminum foil used in food packaging is mainly due to the high recycling rate of aluminum containers and the growing popularity of cans and drinks due to their environmental friendliness compared to plastic packaging. In addition, the need for alternative packaging solutions is increasing as consumers become aware of the adverse environmental effects of plastic, which is good news for the aluminum packaging business. Aluminum packaging has grown significantly in recent years and is expected to continue. Government rules on food safety and quality standards drive manufacturers to create efficient packaging solutions that avoid food contamination, contributing to expanding the domestic aluminum foil business.

The aluminum foil is a common component of composites and has a variety of uses in food packaging. It has a better resistance to oxygen and moisture than any of the plastic composite material. Due to the rise of the pharmaceutical and food and beverage sectors, the aluminum foil packaging market has seen a significant increase in demand. The aluminum is abundant and entirely biodegradable on the planet. The food and beverage demand from online food retailers and the drug companies has fueled the sector's expansion to a considerable extent. The aluminum is an excellent material for packaging because of its versatility. The aluminum foil has number of characteristics including strength, flexibility, and portability, which allows it to be molded into the desired shape. It also shields the product from moisture and sunlight, preventing deterioration. The aluminum foil packaging market has shown significant growth in recent years and is likely to continue to develop during the forecast period.

The government rules affecting food quality and safety standards encourage market players to produce effective packaging solutions that avoid contamination of food, which aids the expansion of the aluminum foil packaging market. The aluminum foil packaging market in Asia-Pacific is predicted to grow rapidly due to rising demand for fast moving consumer products and a growing economy. To manufacture light weight containers, aluminum foil is increasingly being used with flexible materials.

During the forecast period, strong economic expansion, combined with an increasing affluent population and rising personal disposable income, is expected to accelerate the growth of the global aluminum foil packaging market. The shift in lifestyle, which includes a shift in eating habits, has resulted in an increase in packaging demand. Furthermore, strong demand for aluminum foil packaging in the snack and confectionary industries is boosting the global market for aluminum foil packaging over the projection period.

As the global aluminum foil packaging market is mostly driven by customer convenience, suppliers must focus on consumer-friendly packaging designs such as ready to cook packaging, easy to open, and resealable packaging. Furthermore, as customers become more conscious of the environmental impact of materials used in packaging and products, more people are prioritizing environmentally friendly products.

The aluminum foil packaging is becoming more popular in the market because to its versatility, recyclability, and ease of use. The aluminum foil is one of the most widely used aluminum products globally. The moisture, light, air, and germs can all pass-through aluminum foil packaging, making it ideal for food and beverage, personal care, pharmaceuticals, and cosmetics packaging. As aluminum foils are largely utilized in packaging, industrialized economies are the biggest users of this material.

The aluminum foil packaging market is likely to be driven in the near future by the quick and busy lifestyle, simplicity of purchasing through e-commerce channels and the ability to choose from a variety of eateries. During the projection period, prominent market drivers are expected to be the food and pharmaceutical sectors. Alternative packaging materials such as plastic, glass, and paperboard are likely to pose a challenge to the aluminum foil packaging market.

Furthermore, the current invasive mining processes necessary for metal production, which have a severe impact on the environment, prevent the metal from being recycled during the manufacturing process. As a result, discontent is projected in the aluminum foil packaging market in the upcoming years.

The aluminum bags, pouches, and bags are produced and used mostly throughout the Asia-Pacific region. The aluminum foil demand is increasing as a result of a rise in demand for healthy lifestyles and consumption habits in these areas. The population growth in emerging nations, there is a growing demand for aluminum foil packaging in the industry. In many nations, there is growing demand for aluminum packaging to promote green consumption, assure food safety, conserve food, and follow the ideals of environmental sustainability.

- Environmental Awareness: Environmental considerations and the preference for recyclable materials over plastics raise the demand for aluminum foil packaging.

- Food & Beverage Expansion: Consumption of ready meals, snacks, and beverages has tremendously supported a growth in aluminum foil packaging.

- Pharmaceutical & Healthcare Demand: With a demand for water-resistant, sterile, tamper-evident packaging for pharmaceutical products and healthcare supplies, it sustains the increased demand.

- Convenience Packaging: Lifestyle-bolstering convenience, online food retailing, and portable consumption trends aid in boosting aluminum foil wraps, pouches, and containers.

- Government Regulations: Food safety and quality standards may increase innovation rates by manufacturers for aluminum-based packaging formats resistant to contamination and environmentally friendly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 76.92 Billion |

| Market Size in 2026 | USD 53.75 Billion |

| Market Size in 2025 | USD 51.62 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.47% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, End-User, and Thickness |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising adoption by the food industry across the globe

The rising adoption of aluminum foils in the food industry is observed to act as a major driver for the growth of the market. Aluminum foil offers excellent barrier properties, including moisture resistance and light protection. These elements make aluminum an ideal material to carry food materials. Aluminum foil packaging provides convenience and portability to consumers. The heat conductivity offered by aluminum foils adds value to food packaging solutions. As online food delivery services boost, the demand for aluminum foil packaging solutions will also increase.

Moreover, the rising emphasis on packaged food products increases the demand for aluminum foil packaging solutions from the food industry. All these elements collectively act as a drivers for the growth of the aluminum foil packaging market.

Restraint

Adverse health effects of aluminum foil

The production of aluminum foil involves mining bauxite ore, which has a significant environmental impact, including habitat destruction and soil erosion. Additionally, the manufacturing process requires large amounts of energy, contributing to greenhouse gas emissions and climate change. Growing environmental awareness and regulations aimed at reducing carbon footprints and promoting sustainable practices may affect the growth of industries that have substantial environmental impacts, including the aluminum foil market.

There have been concerns about the potential health risks associated with using aluminum foil for cooking or food storage. Aluminum is a metal that can leach into food, especially when it comes into contact with acidic or salty foods, high temperatures, or prolonged storage. High levels of aluminum ingestion have been linked to health issues such as Alzheimer's disease, respiratory problems, and certain types of cancer. These concerns could potentially impact consumer perception and demand for aluminum foil.

Opportunity

Rising emphasis on sustainability

The demand for sustainable packaging materials has been on the rise due to environmental concerns. Aluminum foil, being a highly recyclable material, aligns well with the sustainability goals of consumers and businesses. Manufacturers can leverage this opportunity by promoting the recyclability and reusability of aluminum foil packaging. Additionally, exploring alternative materials that have a lower environmental impact, such as bio-based or compostable films, can further enhance the sustainability profile of aluminum foil packaging.

Sustainability in the aluminum foil packaging market also encompasses the manufacturing processes. By adopting energy-efficient practices, such as using renewable energy sources, optimizing production lines, and implementing waste heat recovery systems, manufacturers can reduce greenhouse gas emissions and improve the overall environmental footprint. Emphasizing energy efficiency and sustainable manufacturing practices can appeal to environmentally conscious consumers and businesses.

Packaging Type Insights

The pouches segment held the largest share of the market with 21% in 2024. Pouches made from aluminum foil are highly versatile and adaptable to a wide range of products and packaging requirements. They come in various shapes, sizes, and configurations, making them suitable for packaging a diverse array of food and non-food items, including snacks, beverages, pet food, pharmaceuticals, personal care products, and more.

Aluminum foil pouches are lightweight and portable, offering convenience for both manufacturers and consumers. They are easy to handle, transport, and store, reducing shipping costs and storage space requirements. Additionally, their compact and flexible design makes them suitable for on-the-go consumption, contributing to their popularity in the snack and convenience food markets.

On the other hand, the blister pack segment is observed to witness the fastest rate of expansion at a CAGR of 4.75% during the forecast period. Blister packaging provide excellent protection and preservation for packaged items. The aluminum foil layer acts as a barrier against moisture, oxygen, light, and other external factors that can degrade product quality, extend shelf life, and maintain product integrity. Blister packs are tamper-resistant, providing an added layer of security and safety for packaged products. The heat-sealed or cold-formed blister cavities prevent tampering and unauthorized access to the contents, ensuring product authenticity and consumer confidence.

Thickness Insights

The 0.09 mm- 0.3mm segment held the dominating share of 58% in 2024. Aluminum foil in this thickness range provides excellent barrier properties against moisture, oxygen, light, and contaminants. It helps to preserve the freshness, flavor, and aroma of packaged products while protecting them from external factors that could degrade the quality or shelf life.

End User Insights

The food segment dominated the aluminum foil packaging market with the largest share of 30% in 2024. Aluminum foil packaging is lightweight and portable, making it an ideal choice for on-the-go consumption and convenience-oriented food products. Foil pouches and containers are easy to transport, handle, and store, making them popular options for single-serve snacks, pre-packaged meals, and travel-friendly food items. Aluminum foil packaging is highly versatile and adaptable to different food packaging requirements. It can be easily molded, shaped, and sealed to accommodate various food products, including irregularly shaped items and those requiring customized packaging solutions. Foil pouches, trays, wraps, and containers are commonly used for packaging a wide range of food items, from snacks and confectionery to takeout meals and catering services.

The cosmetics segment is observed to witness the fastest rate of growth with a CAGR of 5.17% during the forecast period. Aluminum foil offers excellent barrier properties against moisture, light, oxygen, and contaminants, making it ideal for preserving the freshness, aroma, and quality of a wide range of products. This makes it suitable for packaging perishable items, pharmaceuticals, food products, and other sensitive materials. Aluminum foil packaging provides durability and protection against external factors such as temperature fluctuations, mechanical damage, and tampering. It helps extend the shelf life of products and ensures product integrity during storage, transportation, and handling.

Regional Insights

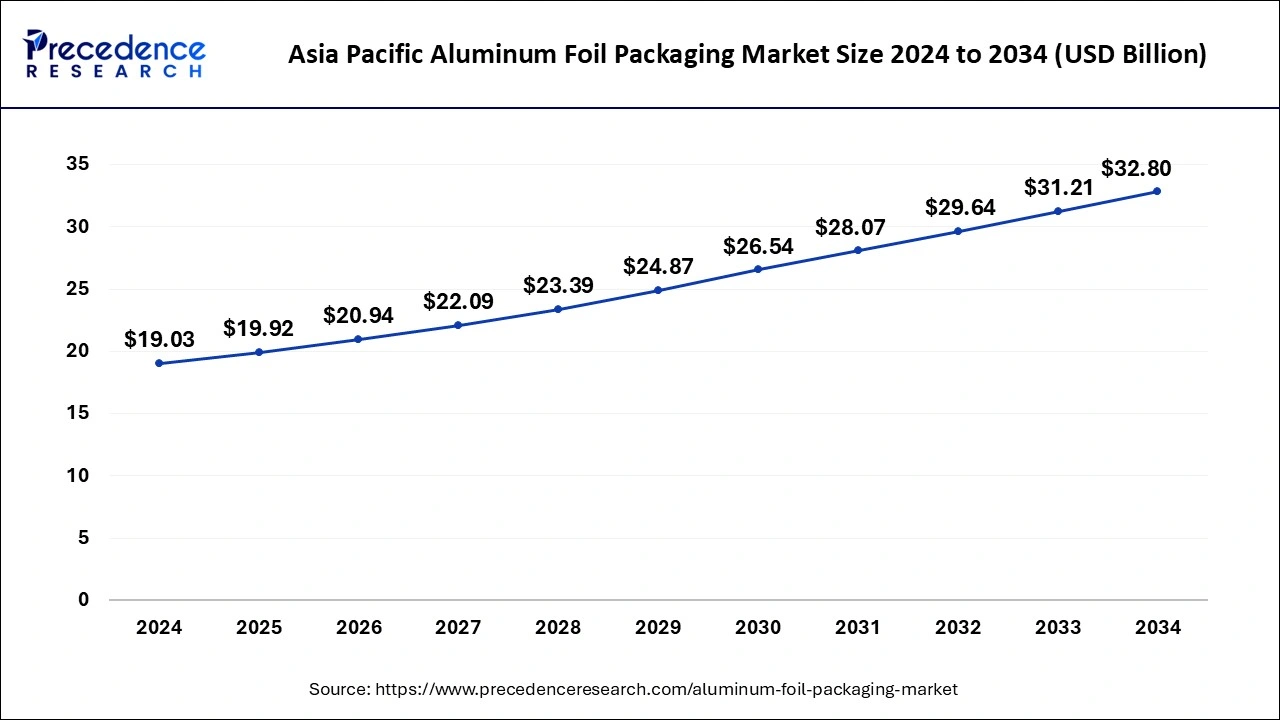

Asia Pacific Aluminum Foil Packaging Market Size and Growth 2025 to 2034

The Asia Pacific aluminum foil packaging market size is evaluated at USD 19.92 billion in 2025 and is projected to be worth around USD 32.80 billion by 2034, growing at a CAGR of 5.60% from 2025 to 2034.

Asia Pacific dominated the global aluminum foil packaging market with a revenue share of 38% in 2024, the region will continue to sustain its position during the forecast period. The rising demand for aluminum foils from the food and beverage industry is expected to fuel the growth of the market.

India is observed as the most attractive marketplace for the manufacturing and distributing aluminum foils. The presence of major key players for the production of aluminum packaging solutions in the country plays a significant role in the market's growth. Myra Foils, MK Foils Private Ltd., Gujarat Foils Ltd., Alufoil Private Ltd and Miraj Foils are a few of top leading manufacturers of aluminum foils in India. These companies offer packaging solutions in the form of aluminum foils, double laminated foils, containers, lids and foil-lined bags for multiple end-users.

China is the leading region towards aluminum foil packaging growth in the Asia Pacific region through its huge-sized manufacturing and exporting capacity, which simultaneously supports the increase in national demand. The growth of food delivery services and continued development of pharmaceutical applications, urban migration and environmental regulations are together promoting recyclable usage in the region and leading to China's growth as a leading foil packaging top contributor in the market.

North America holds a significant share of the market and is expected to maintain its position during the forecast period. The region is known for its rapid adoption of advanced technologies. The adoption of advanced packaging technologies by the overall packaging industry in the region has been supporting the development of the market.

Moreover, the rising demand for packaged food products and food delivery services in the region acts as a significant growth factor for the market in North America. The expansion of end-user industries in the region will propel the growth of the market during the forecast period. Along with the food industry, aluminum foils are widely being used in pharmaceutical and beauty & cosmetics sectors, this element is expected to offer significant opportunities for the market to grow in the upcoming years.

The United States is the largest contributor to the aluminum foil packaging business in the North America region due to the high amount of foil packaging used in the food, pharmaceutical, and cosmetic industries. The increasing demand for more convenient, lightweight, and environmentally sustainable packaging solutions is driving foil manufacturers to move towards recyclable aluminum materials. The United States has a developed aluminum foil production infrastructure and strong retail industry facilitates major market developments.

The aluminum foil packaging market in Europe continues to expand steadily, driven by the increased demand for sustainable and recyclable packaging throughout food, pharmaceutical, and cosmetic uses. The developing region benefits from good environmental regulations that encourage manufacturers to use sustainable materials and processes. Convenience, extended shelf life, and e-commerce all contribute to increasing demand.

Germany is well established as the dominant market amongst European countries because of its advanced production capabilities, existing recycling regime, and strong push towards innovation and quality. Germany's packaging industry has sustainability and efficiency at its forefront, which makes it the center of aluminum foil production and advancements within the European region.

How is the Opportunistic Rise of Latin America in the Aluminum Foil Packaging Market?

Latin America plays an evolving role in the aluminum foil packaging market. The regional market is driven by increasing urbanization, rising disposable incomes, and changing consumer lifestyles that favor convenience and packaged foods. The food and beverage sector is the primary consumer, utilizing aluminum's barrier properties to extend shelf life and ensure product safety, and is adopting modern, sustainable packaging solutions and expanding e-commerce to ensure secure, protective packaging during transit.

Brazil Aluminum Foil Packaging Market Trends

Brazil is the leading market in Latin America, driven by high demand for convenient, ready-to-eat food options and rising agricultural commodity exports. The market benefits from aluminum foil's lightweight, protective, and recyclable properties, which align with growing consumer environmental consciousness. Additionally, the rising demand for blister packs from the pharma industry is supporting market growth.

What Potentiates the Growth of the Middle East and Africa (MEA) Aluminum Foil Packaging Market?

The market in MEA is experiencing robust growth, driven by the expanding food and beverage industry and a major shift away from plastic to eco-friendly packaging. The region's plentiful raw material (bauxite) reserves and backward integration by leading manufacturers strengthen the supply chain, with increased emphasis on using aluminum for containers, pouches, and blister packs.

Saudi Arabia Aluminum Foil Packaging Market Trends

Saudi Arabia is a major player in the market in MEA, driven by a large population, strong economic growth, and an expanding foodservice sector, including quick-service restaurants and home-delivery services. Government initiatives to curb plastic waste are supporting the demand for aluminum alternatives. The market is characterized by strong local demand for food packaging and containers, with future growth driven by increased infrastructure and healthcare investments.

Value Chain Analysis

- Raw Material Sourcing: Bauxite mining and aluminum extraction are essential in producing aluminum foil packaging materials.

Key Players: Norsk Hydro ASA, Rio Tinto - Material Processing & Conversion: Aluminum is rolled, annealed, and slit into foil sheets ready for commercial uses.

Key Players: Novelis, Rusal (UC Rusal), Amcor, Eurofoil. - Packaging Design and Development: Design and development of foil wraps, pouches, or containers with printing, embossing, or lamination.

Key Players: Amcor, Constantia Flexibles Group GmbH, Reynolds Group Holdings Limited - Logistic & Distribution: Logistics, warehousing, transporting, and distributing the finished foil packaging to retailers, food processors, and pharmaceutical clients.

Key Players: DHL Supply Chain & Global Forwarding, FedEx Logistics, Kuehne + Nagel - Recycling & Waste Management: Waste aluminum foil is collected and processed for sustainable means and to lessen environmental impact.

Key Players: Hindalco Industries, Norsk Hydro ASA, Novelis

Top Five Companies in the Aluminum Foil Packaging Market and Their Offerings

- Amcor Ltd.: Provides diverse foil wraps, laminates, and flexible barrier packaging for food, medical, and pharmaceutical products.

- Novelis Inc.: Supplies high-precision rolled aluminum sheets and coils used to manufacture containers, cans, and flexible packaging.

- United Company RUSAL PLC.: Produces primary aluminum and alloys that serve as the fundamental raw material for the entire foil packaging industry.

- China Hongqiao Group Limited: The world's largest aluminum producer, supplying the essential raw ingots and plates used by packaging manufacturers.

- Ess Dee Aluminum Ltd: Specializes in pharmaceutical packaging solutions like blister packs, along with laminated and plain foils for the food sector in Asia.

Other Key Players

- Alcoa Corporation

- Penny Plate LLC

- Wyda Packaging Ltd.

- Nicholi Food Packaging

- Alufoil Products Pvt. Ltd

Recent Developments

- In March 2025, Cosmo Specialty Chemicals launched the COSEAL-601 heat seal coating solution. COSEAL-601 performs better in terms of seal strength, particularly in the key sealing region of 120 to 160 degrees celsius. The COSEAL-601 coating adheres exceptionally well to aluminium foil laminate structures.

(Source: https://www.manufacturingtodayindia.com) - In May 2025, Oroville Flexible Packaging, LLC, a RE:CIRCLE Solutions company and leader in flexible plastics and packaging solutions for retail and foodservice customers, has announced the official launch of “Oroflex,” a sustainable flexible plastics, packaging and recycling system.

(Source: https://www.packagingstrategies.com) - In July 2025, the US Department of Commerce began anti-circumvention investigations regarding disposable aluminum containers and related products imported from Vi?t Nam and Thailand.

(Source: https://vietnamnews.vn) - In June 2024, Amcor Capsules announced the launch of a plastic-free foil made from aluminium and paper.

(Source: https://www.packaging-gateway.com) - In February 2023,Camvac announced the release of Camfoil, a flexible, multi-layer metalized laminate that uses the company's proprietary protective coating technology to replace standard films. The solution offers the same functionality as film laminate and eliminates the occurrence of holes caused by film laminates. As such, it hopes to ensure that the products it packs, which should include dry food and powder and products highly sensitive to oxygen and/or moisture, remain safe and achieve optimal shelf life. The properties of this barrier coating likely provide an "extreme" gas and water vapor barrier for this solution. Laminate is also reported to use locally sourced raw materials to strengthen its supply chain. It aims to reduce delivery times and minimum order quantities compared to sheet-based laminate structures.

- In September 2022,CEFLEX announced the launch of circular design guidelines for polyolefin-based structures while following a unique value chain collaboration in order to improve the circularity of flexible packaging that contains aluminum foil. The new guidelines are supported by CELFLEX UK Research and innovation project, the project was carried out under the collaboration with FPE and EAFA.

Segments Covered in the Report

ByPackaging Type

- Aerosol

- Blister Pack

- Bottles

- Cans (Food & Beverage)

- Capsule

- Closure

- Collapsable Tubes

- Foil Wrapper

- Pouches

- Tray & Container

- Others

By End User

- Beverages

- Cosmetics

- Food

- HVAC

- Pharmaceutical

- Others

By Thickness

- 0.007 mm – 0.09 mm

- 0.09 mm – 0.2 mm

- 0.2 mm – 0.4 mm

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting