Anti-Money Laundering Software Market Size, Analysis Till 2030

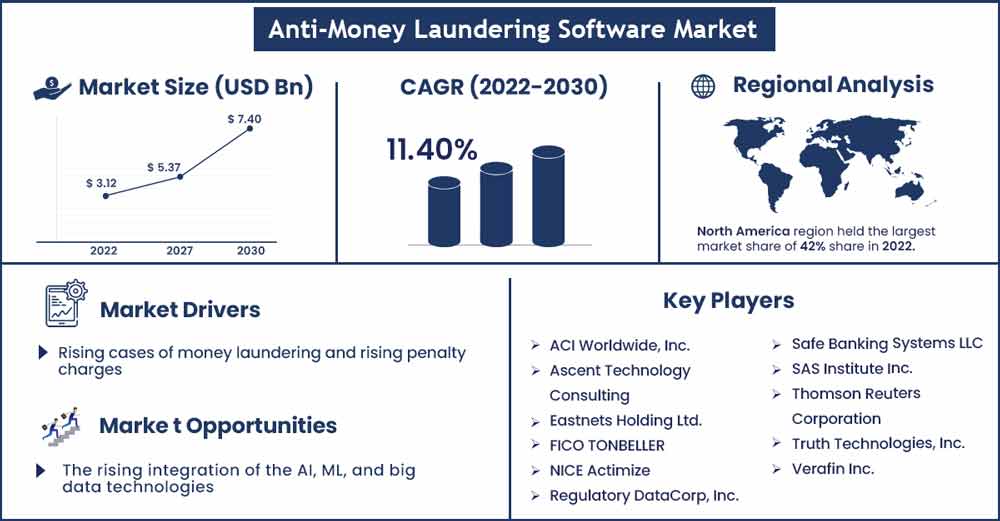

The global anti-money laundering software market size surpassed USD 3.12 billion in 2022 and it is projected to attain around USD 7.4 billion by 2030, expanding at a CAGR of 11.4% between 2022 and 2030.

The global anti-money laundering software market is expected to witness a significant demand for AML software among the various financial and non-financial institutions owing to the rising implementation of stringent government regulations pertaining to financial crimes and money laundering activities. With the rising adoption of digital payment systems across the globe, the risks of money laundering has increased significantly. This is bolstering the demand for AML software. Moreover, the rising adoption of AML software across various end-use verticals such as BFSI, Defense, healthcare, telecom and IUT, and retail industries is significantly driving the growth of the global AML software market. The rapidly growing adoption of the novel technologies like artificial intelligence, machine learning, and big data analytics in the AML software is expected to boost the growth of the AML software market in the forthcoming future.

Report Highlights:

- Based on the component, the software segment dominated the market. The rising cases of financial frauds and money laundering has led to the rapid adoption of the AML software across the globe. The rising adoption of the digital payment systems is expected to boost the demand for the software segment.

- Based on the deployment, the on premise segment dominated the market. The higher safety of the on premise deployment as compared to the on cloud deployment has led to the dominance of this segment in the global market.

- Based on the application, the transaction monitoring dominated owing to the rising need for real time monitoring of money transfers, bank deposits, and withdrawals in the financial institutions.

Anti-Money Laundering Software Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.47 Billion |

| Projected Forecast Revenue in 2030 | USD 7.4 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 11.4% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 To 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot:

North America dominated the global AML software market in 2022. The robust presence of various leading AML solutions providers such as Fiserv Inc., Oracle Corporation, Fidelity National Information Services, and SAS Institute and the various developmental strategies adopted by them has played a crucial role in the growth of the North America AML software market. The presence of well-established banking, digital, and IT infrastructure has led to the increased adoption of mbanking and eBanking for transferring money. Therefore, the rising need for regularly monitoring the transactions of customers, various financial institutions are increasingly adopting AML software. Further, the stringent government regulation and high penalty charges imposed by the government due to the non-compliances of regulations has forced various financial and non-financial institutions to adopt AML software to keep a check on money laundering activities.

Europe is expected to witness the fastest growth rate during the forecast period. This growth is attributed to the increased adoption of online payments in Europe. Moreover, the implementation of various regulations like General Data Protection Regulation, Anti-Money Laundering Directive 5, and Payment Card Industry Data Security Standard is significantly fostering the demand for the AML software in Europe. The globalization of businesses and higher volume of international money transfers has increased the risks of money laundering activities and hence to counter these illegal activities, the demand for AML software is expected to rise significantly in the forthcoming years.

Market Dynamics:

Driver:

Rising cases of money laundering and rising penalty charges

According to the United Nations Office on Drugs and Crime (UNODC), around 2% to 5% of the global GDP worth of money has been laundered across the globe. Moreover, ss per the Complyadvantage, the total AML penalties were around US$7.7 billion across the globe from January to April 2022. Furthermore, the implementation of various regulations such as The Financial Industry Regulatory Authority (FINRA), Australian Transaction Reports and Analysis Centre (AUSTRAC), and China's Banking and Insurance Regulatory Commission (CBIRC) are significantly driving the demand for AML software among the financial and non-financial organizations that will drive the market growth during the forecast period.

Restraint:

The high costs of AML software

There is a high capital investment involved in the deployment of AML software. The high costs involved in the AML software may restrict the small and medium sized enterprises to adopt the latest and advanced software and this may hinder the growth of the market during the forecast period.

Opportunity:

The rising integration of AI, ML, and big data technologies

The rising applications of novel technologies such as AI, ML, and big data analytics in the AML software to enhance the operations and efficiency of the software is expected to offer lucrative growth prospects to the market players in the foreseeable future. The AI can smartly recognize a suspicious transaction and alert the authorities and hence the demand for the AML software is expected to rise significantly.

Challenge:

Cyberattacks and data breach

Along with the rising adoption of the latest software, the risks of data breach and cyberattacks has emerged as a major challenge for the AML software market players. The hackers can attack the on cloud deployment systems and can harm the banking system which may lead to data losses for the customers and financial losses for the financial institutions.

Recent Developments:

- In February 2021, Experian introduced its latest version of fraud prevention solution for those businesses that has a huge demand for digital services.

Major Key Players:

- ACI Worldwide, Inc.

- Ascent Technology Consulting

- Eastnets Holding Ltd.

- FICO TONBELLER

- NICE Actimize

- Regulatory DataCorp, Inc.

- Safe Banking Systems LLC

- SAS Institute Inc.

- Thomson Reuters Corporation

- Truth Technologies, Inc.

- Verafin Inc.

Market Segmentation:

By Component

- Software

- Service

By Deployment

- On Cloud

- On Premise

By Application

- Transaction Monitoring

- Customer Identity Management

- Currency Transaction Reporting

- Compliance Management

- Others

By Solution

- Transactional Monitoring

- KYC (Know Your Customer)

- Fraud, Risk & Compliance Management

- Watch-list Screening

- Data Warehouse Management

- Analytics & Visualization

- Alert Management & Reporting

- Case Management

- Others

By End User

- Retail Banking

- Corporate Banking

- Private Banking

- Investment Banking

- Asset Management

- Insurance

- Multiple Banking Services

- Legal Service Providers

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2236

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333