Artificial Joints Market Size To Rake USD 43.41 Bn By 2032

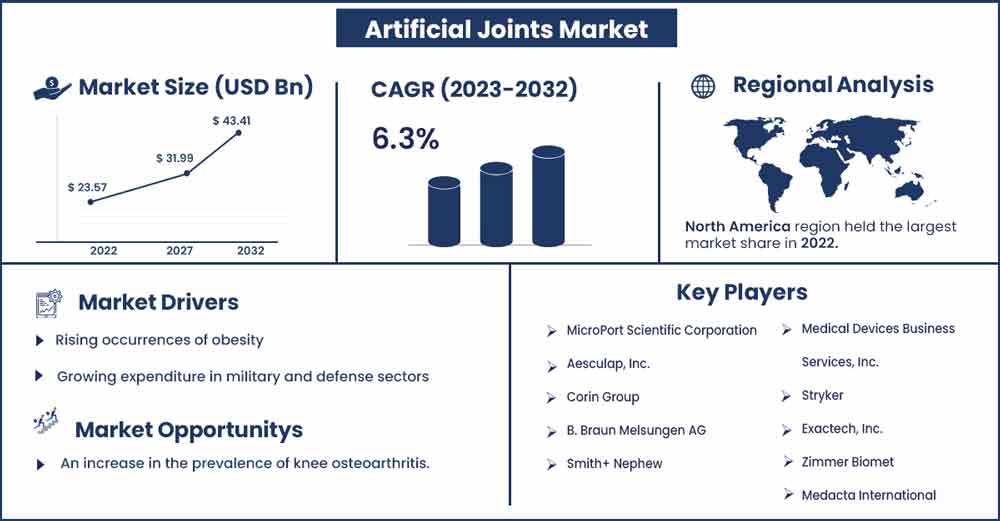

The global artificial joints market size surpassed USD 23.57 billion in 2022 and it is expected to rake around USD 43.41 billion by 2032, poised to grow at a CAGR of 6.3% during the forecast period 2023 to 2032.

Metal, plastic, or ceramic are the materials used to create artificial or prosthetic joints. Artificial joints are used in joint replacement procedures, also known as replacement arthroplasty, to replace a natural joint that has been injured or infected. Depending on the kind of joint, different materials are employed to create prosthetic joints. For instance, hip replacement joints are made of robust, very smooth polymers and strong metal. According to data, factors contributing to the growth of the worldwide market include an increase in the number of obese people and bad eating habits, both of which lead to obesity and the subsequent development of knee and hip replacement procedures.

One of the most common illnesses in developed nations is osteoarthritis. In many developed nations, it is also observed in people under the age of 60 who had to have complete knee and hip replacement procedures and are driving market expansion. The prosthesis, sometimes referred to as an artificial joint, is a device that is surgically inserted to replace a natural bone in order to treat joint problems and enhance joint function. The material employed, such as oxinium, ceramic, alloy, and other materials, is used to segment the worldwide artificial joints market. Artificial joints have become more and more popular recently, and it is predicted that this trend will continue over the projected period. The market would expand as a result of factors including the reduced danger of chemical inertness, resistance to corrosion, osteolysis, non-allergic characteristics, and biocompatibility.

Over the course of the forecast period, the number of obese people and the growing elderly population are likely to fuel growth in the worldwide artificial joints market. One of the most common musculoskeletal conditions affecting the elderly is osteoarthritis, which has increased demand for joint replacement treatments. Technological developments include the creation of new limbs with digital and robotic capabilities that can save important information about limb movement that can be evaluated by the doctor later.

Additionally, research and development efforts pertaining to computerized limbs that can directly access the brain's neuronal impulses and derive movements from them, as well as the development of limbs with integrated circuits that can access and derive movements from electrical impulses in the body, are anticipated to positively reinforce market growth over the forecast period.

Artificial Joints Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 25.05 Billion |

| Projected Forecast Revenue by 2032 | USD 43.41 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.3% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshots:

Due to the continual rise in obesity, increased costs of implanted joints, technical innovation, growing elderly population, and growth in financing from public and private organizations for healthcare, North America now holds the majority of the global market for artificial joints. In North America, Texas, Florida, and California all contribute significantly to national income. Europe is noted to be the second-largest revenue-generating region in the world market for artificial joints. The top four European nations in terms of income contributions are Austria, Belgium, Germany, and Switzerland. The market is expanding in Europe because to factors including rising demand for minimally invasive operations, increased replacement device costs, rising health expenditures, and technical innovation.

Report Highlights:

- Throughout the forecast period, the market for cemented joints, which had the biggest share in 2019, is predicted to rise at the highest CAGR. Cemented joints provide more flexibility, stability, and support. Additionally, they better adhere to the bones.

- The category of artificial knee joints is anticipated to grow at the highest rate (CAGR) over the projected period and had the biggest market share in 2019. The aging population, which is contributing to a rise in age-related musculoskeletal problems including osteoporosis and arthritis, as well as the rising obesity incidence, is mostly to blame for the need for knee and hip replacement procedures and the accompanying implants.

- This is mostly due to the expanded healthcare infrastructure and better facilities in hospitals. The healthcare sector is anticipated to continue to lead the way in the years to come.

- North America accounted for the largest revenue share in the global artificial joint market in 2021, and it is anticipated that the region will continue to dominate the market for the duration of the forecasted period. The two largest economies in the area, the United States and Canada, are the main income generators for the market value in the area.

Market Dynamics:

Drivers:

Due to poor lifestyle choices made by the populace, osteoarthritis has become one of the most prevalent bone ailments among humans. People who have arthritis have problems including limited movement and excruciating pain, which interferes with their ability to lead regular lives. The demand for improved knee replacement surgery is rising among prospective customers worldwide, which has significantly increased the market's size over time.

Due to the enormous customer base that is available in the market, the quickly growing elderly population has contributed to the industry's ability to generate a sizable amount of revenue over time. Osteoarthritis is an aging-related condition that significantly impairs a person's quality of life. A significant factor in the rise in the number of doctors with osteoarthritis is the poor lifestyle choices made by society as a whole. Another significant factor contributing to osteoarthritis development in younger generations is obesity. Potential customers have been drawn to the most recent technical developments in the healthcare industry, which is predicted to significantly increase the market's size.

Restraints:

The low availability of trained surgeons and high cost of orthopedic surgeries are two factors limiting the market growth for artificial joints. Artificial joints are created using implants made of expensive metals using sophisticated technology, which are often expensive. Furthermore, the price of these items is increased by the strict standards that must be met for their approval. Artificial joint introduction has been restricted in developing nations due to low healthcare spending and a lack of qualified surgeons.

Opportunities:

The current advancements in surgical procedures have seen the integration of artificial intelligence into the system, greatly increasing the likelihood of success and so gaining the trust of potential customers. The operations are now more effective because to the use of robots and artificial intelligence in the artificial joints. The healthcare industry has been able to reduce the likelihood of human error during a surgical procedure and subsequently carry out the entire process with more precision and accuracy, which has in turn encouraged potential customers all over the world. Artificial intelligence has been incorporated into surgical procedures. Due to the great success rate that has been shown throughout time, the enormous number of people choosing to have knee replacement surgery has significantly grown. With the use of artificial intelligence, a surgical treatment is developed specifically for the patient based on their condition, taking dynamic mobility into account.

Challenge:

Patients' high costs is also major challenge for the artificial joints market. People's low levels of accessible disposable cash severely restrict the market's capacity to expand. The prohibitive expense of using cutting-edge surgical techniques prevents the general public from choosing them.

Recent Developments:

- In July 2020, the United States Food & Drug Administration (FDA) granted 510(k) clearance to Corin, a leading supplier of a distinctive combination of clinically validated hip, knee, ankle, and shoulder solutions and cutting-edge technologies. This clearance was granted for the most recent OMNIBotics software update, version 2.6. This will enable them to employ the robotically assisted treatment in the United States region in conjunction with the Unity Knee complete knee implant system.

- Johnson & Johnson Medical Devices Companies, a world authority on orthopedic trauma treatment devices, announced in September 2019 that DePuy Synthes would introduce the ATTUNE Cementless Knee in a rotating platform option in a few key international markets. This will make it easier for the business to fulfill both the present-day and future-day needs of their busy lifestyle.

Major Key Players:

- MicroPort Scientific Corporation

- Aesculap, Inc.

- Corin Group

- B. Braun Melsungen AG

- Smith+ Nephew

- Medical Devices Business Services, Inc.

- Stryker

- Exactech, Inc.

- Zimmer Biomet

- Medacta International

- Medtronic

- MicroPort Orthopedics Inc.

- Johnson & Johnson Private Limited

- Conformis Inc.

Market Segmentation:

By Type

- Cemented Joints

- Non-cemented Joints

By Material Type

- Ceramics

- Alloy

- Oxinium

- Other Material

By Application

- Artificial Knee Joints

- Artificial Hip Joints

- Artificial Joints of the Shoulder

- Other Application

By End User

- Prosthetics Clinics

- Hospitals

- Rehabilitation Center

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2723

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333