Baking Ingredients Market Size To Attain USD 29 Bn By 2030

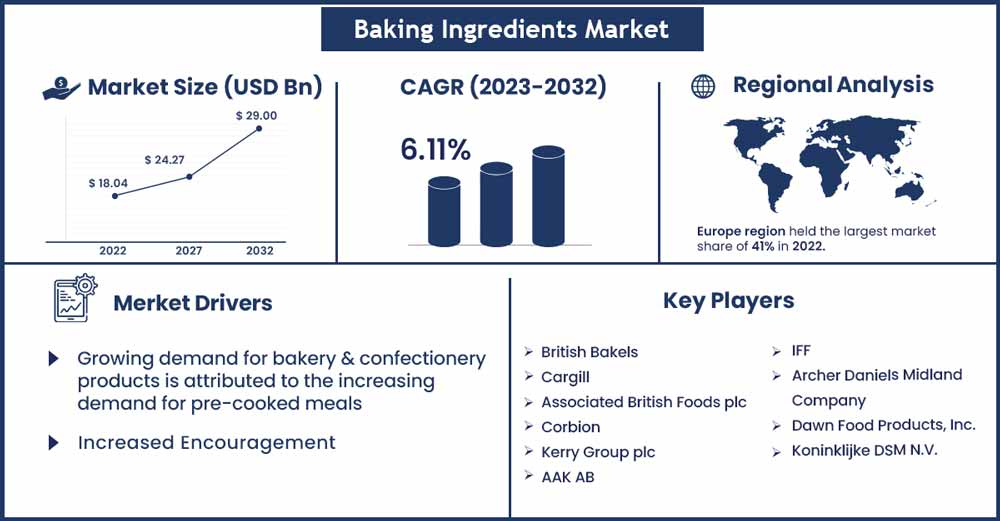

The global baking ingredients market size surpassed USD 18.04 billion in 2022 and is predicted to attain around USD 29 billion by 2030, growing at a CAGR of 6.11% throughout the projection period 2022 to 2030.

Market Overview:

The booming food and beverage industry, along with the rising culture of home bakeries, has supplemented the development of the global bakery industry. The baking ingredients market plays a vital role in the development and growth of the bakery industry by offering essential commodities that contribute to the taste, quality, and texture of the bakery items. The global baking ingredients market plays around the development and distribution of sweeteners, fats, oils, flours, flavors, colors, and multiple other ingredients for baking purposes.

The global baking ingredients market is accelerated by the factors such as rising preferences for quick-bites food products, innovation in ingredients, development of gluten-free bakery products, changing health and wellness trends, and establishment of multiple food services platforms.

Regional Snapshot:

North America held a significant share of the baking ingredients market in 2022; the region is expected to maintain its position during the forecast period due to rising consumer preferences towards Bakery products have become an essential part of the daily diet for the North American population. North America carries a well-established bakery market that is known for high-quality bakery products. Along with the rising consumption of bakery products, the availability of modern bakery plants, flexibility in the innovation of baking ingredients, and the presence of competitive manufacturers in the market are observed to support the market’s growth in North America.

In recent years, the shifting dietary preferences in the region have boosted the demand for healthier and cleaner bakery products such as brown bread, gluten-free cookies/bread, and sugar-free bakery products. Such consumer demands promote the development of cleaner and more innovative baking ingredients in North America. Multiple key players have started focusing on the production of more hygienic food products in the region.

For instance, in April 2023, headquartered in the United States, HighKey launched sugar-free sandwich cookies in vanilla flavor. The newly launched cookies are gluten-free and serve keto-friendly ingredients.

On the other hand, Middle Eastern countries are witnessing a significant demand for convenient food products, along with an emphasis on quality ingredients. These factors are propelling the growth of the market in the Middle East. Moreover, the already present tradition and culture associated with bakery products such as bread supplement the development of the baking ingredients market in the Middle East. Whereas changing consumer preferences and the thriving impact of European food culture, along with urbanization and rising disposable incomes, will fuel the growth of the market in Africa.

Baking Ingredients Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 19.14 Billion |

| Projected Forecast Revenue in 2030 | USD 29 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 6.11% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- By type, the baking powder and mixes segment will continue to grow significantly due to their utilization of multiple bakery products. Moreover, the availability of numerous organic baking powders in the market supplements the segment’s growth while promoting cleaner baking ingredients.

- By application, the bread segment held the largest share of the market; the segment will sustain its position during the estimated period. The continuous innovations in bread and rising focus on adding nutritional value to bread according to consumer preferences will fuel the segment’s growth in the upcoming years.

- By form, the segment of dry baking ingredients is expected to hold the largest share of the market during the forecast period. The convenience of dry ingredients in the bakery industry plays a significant role in the segment’s development. The availability of wide options in the dry ingredients category, such as baking powder, refined flour, and dry sugar, accelerates the sales of dry baking ingredients in the global baking industry.

Market Dynamics:

Driver:

Rising consumption of bakery products in urban areas

According to a report and data published by Statista, the sales of center stored bread for 52 weeks (about 12 months) in 2022 reached up to 3.2 billion units.

The rising consumption of bakery products, especially in urban areas, is considered one of the major drivers for the growth of the baking ingredients market. The increasing demand for convenient and quick-bites food products such as cookies, bread, and pastries supports the production and distribution of bakery items in urban areas. Bakery products are often associated with comfort food, as consumers seek pleasurable experiences with bakery items. Additionally, globalization and rising cultural influences, especially from the European region, boost bakery sales.

As the consumption of bakery items continues to grow, the key players in the bakery ingredients market will get additional opportunities to develop specialized ingredients to meet the preferences and demands of consumers.

Restraint:

Fluctuations in the prices of raw materials

Sugar, cocoa powder, wheat, vegetable oil, and other multiple dairy products are widely and commonly used commodities/raw materials in the bakery industry. In many parts of the world, the prices of commodities are dependent on the supply and demand ratio. For example, the production and supply of cocoa beans directly impact the prices of chocolate and cocoa powder.

For instance, according to Index Box, in June 2022, the price of cocoa powder per ton increased by 4.6% compared to the previous month (United States) while showing an average increase of 2.5% in five months. While France attained a 5.2% increase in the cocoa powder price.

The often fluctuations in the prices of such raw materials directly impact the costs of the final product. The continuously fluctuating prices of raw materials often create challenges for retailers, which affects consumer demand and product sales. In addition, fluctuations in commodity prices may create several uncertainties in the supply chain as suppliers may struggle to maintain the stability and consistency of ingredients. As commodity prices rise, it leads to higher production costs, directly impacting cost transparency with consumers.

Opportunity:

Development of cleaner alternatives for baking ingredients

A recent study published by Michigan State University stated that significant consumption of sodium aluminum phosphate might lead to kidney diseases. In addition, multiple studies suggest that excessive consumption of sodium aluminum phosphate may negatively impact reproductive health. Sodium aluminum phosphate is widely used to prepare waffles, donuts, and other bakery products. However, while considering the significant health concerns associated with the ingredient used in bakery items and the rising number of health-conscious consumers, the global baking ingredients market is shifting its focus to developing cleaner and healthier alternative ingredients. Furthermore, fat mayonnaise, cheap vegetable oil, bleached flour, and colors are some harmful ingredients used in the baking industry. The development of new and cleaner products in the industry is observed to offer a plethora of new opportunities for the market payers in the upcoming period while boosting consumer trust in baking ingredients.

In May 2023, a prominent supplier in the baking industry, Innophos, announced the launch of a new ingredient in its Levair baking portfolio. The newly launched bakery ingredient replaces sodium aluminum phosphate. The new component contains calcium and is totally aluminum free. The new alternative in the market promises a noticeable development for the baking industry.

Challenge:

Regulatory hurdles

Baking ingredients are subjected to comply with all food safety regulations to ensure that their products are safe for consumption. These regulations include rules for ingredient sourcing, processing, and handling of commodities, along with the packaging instructions for baking ingredients. Few regulations may mandate strict allergen labeling on specific ingredients to make sure that consumers with allergies are informed about the potential risk of allergies. Navigating the continuously varying regulatory guidelines from the food safety departments can create a significant challenge for the market players. Achieving necessary permissions for ingredient approval could be lengthy, time-consuming, and costly. Additionally, some manufacturers may find it complicated to understand the regulations specifically for the international trade of baking ingredients, which can limit them from entering into international business.

Recent Developments:

- In March 2023, America’s leading and most prominent brand for frosting ingredients, Pilsbury, announced that the brand would be launching caramel and coffee frostings ‘Creamy Supreme Coffee Frosting and Creamy Supreme Caramel Latte Frosting.

- In November 2022, British Bakels stated that the company would be selling its Ta-Da mix product range directly to consumers. With this announcement, the company also stated that their products, including vanilla cake mix, chocolate cake mix, seed bread mix, and chocolate brownie mix, will be available on the website for selling purposes with a recyclable packaging solution.

Major Key Players:

- British Bakels

- Cargill

- Associated British Foods plc

- Corbion

- Kerry Group plc

- AAK AB

- IFF

- Archer Daniels Midland Company

- Dawn Food Products, Inc.

- Koninklijke DSM N.V.

Market Segmentation:

By Type

- Emulsifiers

- Enzymes

- Starch

- Fiber

- Oils, fats, and shortenings

- Baking powder and mixes

- Preservatives

- Colors & flavors

- Leavening agents

- Others

By Application

- Bread

- Sweet Bakery

By Form

- Dry

- Liquid

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2041

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333