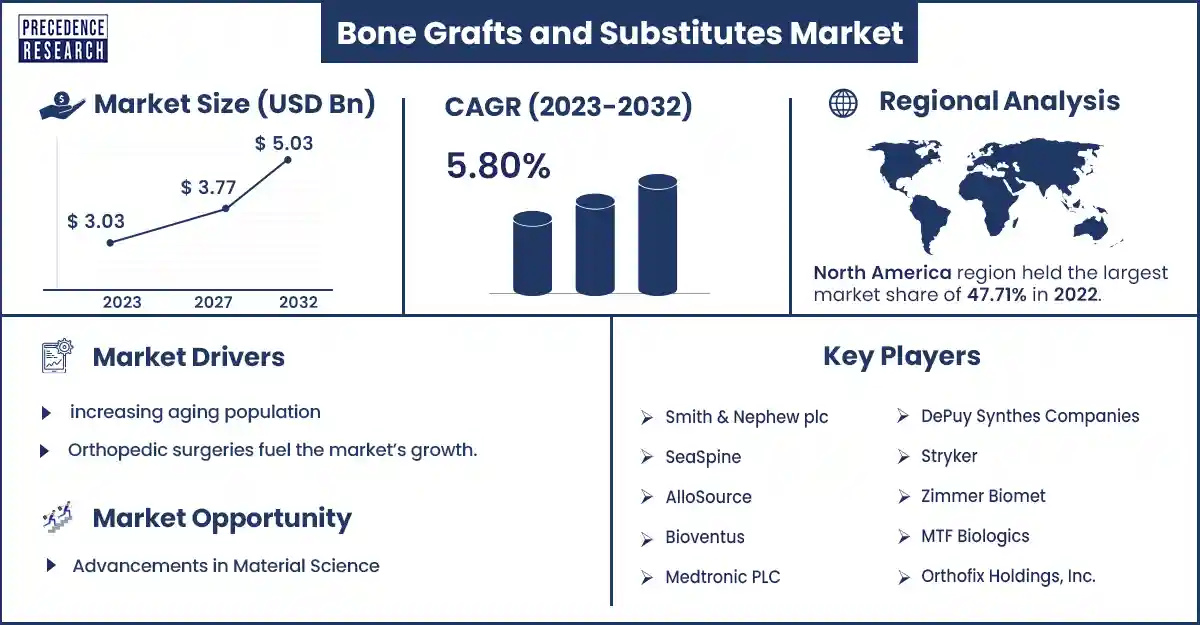

Bone Grafts and Substitutes Market Size to Rise USD 5.03 Bn By 2032

The global bone grafts and substitutes market size surpassed USD 3.03 billion in 2023 and is expected to rise around USD 5.03 billion by 2032, expanding at a CAGR of 5.80% during the forecast period from 2023 to 2032. The market is growing due to increasing awareness about bone grafts and substitutes, raising the utilization of substitutes because of fewer complications, the process of grafting is easy and utilized by surgeons, and increasing the number of orthopedic disorders globally also growing the market.

Market Overview

The bone grafts and substitutes market deals with bone grafting procedures, bone grafts, and substitutes used in several surgeries such as orthopedic, plastic, neurosurgery, and dental surgery, also used in traumatology, spine surgery, tumor surgery, revision arthroplasty, and infections.

Additionally, the market is frequently growing due to many benefits, including the use of growth stimulation devices for spinal fusion procedures, advancements in orthopedic surgery, and the development of advanced bone grafts. The market's growth is further fueled by the increased investments by key players globally and the increasing number of surgeries, along with that driven by the ongoing need for effective treatments for orthopedic disorders and the aging population's higher incidence of arthritic conditions.

The increasing aging population and Orthopedic surgeries fuel the market’s growth

The bone grafts, and substitutes market is experiencing continuous growth due to the increasing aging population and the rising number of orthopedic surgeries. As the global geriatric population grows, the demand for treatments to address age-related conditions such as osteoporosis. These conditions often require surgical interventions, including joint replacements and other orthopedic procedures, where a need to utilize bone grafts and substitutes. The trend towards minimally invasive surgical procedures is also influencing the market, with injectable and resorbable substitutes becoming popular due to their benefits, such as less invasive surgeries and faster recovery times.

However, the high cost of bone grafts and substitutes can be a restraint for the bone grafts and substitutes market. The cost of these treatments can limit their accessibility, especially for patients who do not have comprehensive health insurance or who are self-paying. Additionally, the costs based on each patient's needs, including the type of bone graft or substitute used, can further complicate the financial aspect of treatment. The high cost of bone grafts and substitutes not only affects individual patients but also impacts the overall market growth by potentially limiting the adoption of these treatments. Efforts to reduce the cost of these treatments, such as through advancements in technology that lower the price of materials or through more affordable payment options, are important to overcoming the market restraint.

Bone Grafts and Substitutes Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 3.03 Billion |

| Projected Forecast Revenue by 2032 | USD 5.03 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.80% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Top Companies in the Bone Grafts and Substitutes Market

- DePuy Synthes Companies (Johnson & Johnson Services, Inc.)

- Stryker

- Zimmer Biomet

- MTF Biologics

- Orthofix Holdings, Inc.

- Smith & Nephew plc

- SeaSpine

- AlloSource

- Bioventus

- Medtronic PLC

Recent Development by Johnson & Johnson’s DePuy

- In April 2024, Johnson & Johnson’s DePuy Synthes Orthopedic Unit launched a new spine screw system.

- In December 2023, DePuy Synthes, an orthopedic and neurosurgery company, launched its new flagship technology to help treat patients suffering from degenerative disc disease, a condition that can cause extreme pain due to a damaged disc in the spine.

Recent Development by Stryker

- In July 2023, Stryker launched the new autonomous Ortho Q Guidance System, which has been integrated with new optical tracking options and redesigned camera algorithms to provide additional surgical guidance and planning capabilities.

- In February 2024, Stryker touts introduced new technology and updates to its Mako surgical robotic platform.

Regional Insights

Asia Pacific is expected to grow at the fastest rate during the forecast period due to the growing prevalence of orthopedic disorders, increased medical tourism, and government initiatives. The need for bone replacements and grafts is rising in this area because of the aging population's increased risk of bone disorders and joint issues. Due to its benefits, which include less discomfort, a shorter recovery period after surgery, and less tissue damage, minimally invasive surgeries are becoming more and more popular among surgeons. The market for artificial bone replacements and grafts is expanding due to technological developments in synthetic bone grafts.

North America dominated the bone grafts and substitutes market in 2023 due to several factors, including technological advancements, a strong healthcare infrastructure, and the presence of leading medical device manufacturers. The region's healthcare system is highly developed, with innovation and the adoption of advanced medical technologies. The development and adoption of new bone grafts and substitutes, including allografts, and also companies are investing in research and development to create new products that fulfill the needs of patients and surgeons and drive North America’s position in the market. The region focuses on quality care, and the adoption of minimally invasive surgical techniques also supports the demand for bone grafts and substitutes.

Market Potential and Growth Opportunity

Advancements in Material Science

Advancements in material science are significantly contributing to the growth of the bone grafts and substitutes market. The development of new materials that can imitate the properties of natural bone, such as hydroxyapatite and tricalcium phosphate, has opened up new possibilities for bone grafts and substitutes. These materials are designed to be biocompatible, meaning they are not rejected by the body, and they promote the growth of new bone cells. The use of these materials in bone grafts and substitutes not only enhances the effectiveness of the treatment but also reduces the need for autogenous grafts, which can be limited in supply and may cause complications. Technological advancements in surgical procedures, including minimally invasive techniques, further support the adoption of bone grafts and substitutes by improving surgical outcomes and patient recovery. These innovations are combined with the development of biocompatible materials.

The Bone Grafts and Substitutes Market News

- In June 2023, BoneSupport launched the next generation of breakthrough antibiotic-eluting bone graft substitutes made to increase ease of use and reduce environmental impact.

- In November 2022, Lithoz launched the development of the LithaBone HA 480 for 3D-printed bone replacements. The company claims that the LithaBone HA 480 has a ten-fold longer shelf life and enables parts to be cleaned more easily, meaning greater availability and faster processes.

- In May 2023, Royal Biologics launched BIO-REIGN 3D™, a natural hyper-crosslinked carbohydrate polymer bone graft substitute (BGS) that uses advanced cellular and autologous technologies for enhanced surgical solutions.

- In May 2022, KPower launched the synthetic bone cement Prosteomax, Malaysia's first halal-certified bone.

Market Segmentation

By Material

- Allograft

- Demineralized Bone Matrix

- Others

- Synthetic

- Ceramics

- HAP

- β-TCP

- α-TCP

- Bi-phasic Calcium Phosphates (BCP)

- Others

- Ceramics

- Composites

- Polymers

- Bone Morphogenic Proteins (BMP)

By Application

- Spinal Fusion

- Trauma Fixation

- Joint Reconstruction

- CMF

By End User

- Hospital

- Specialty Clinics

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2006

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308