Complete Nutrition Products Market Size To Rise USD 9.1 Bn By 2032

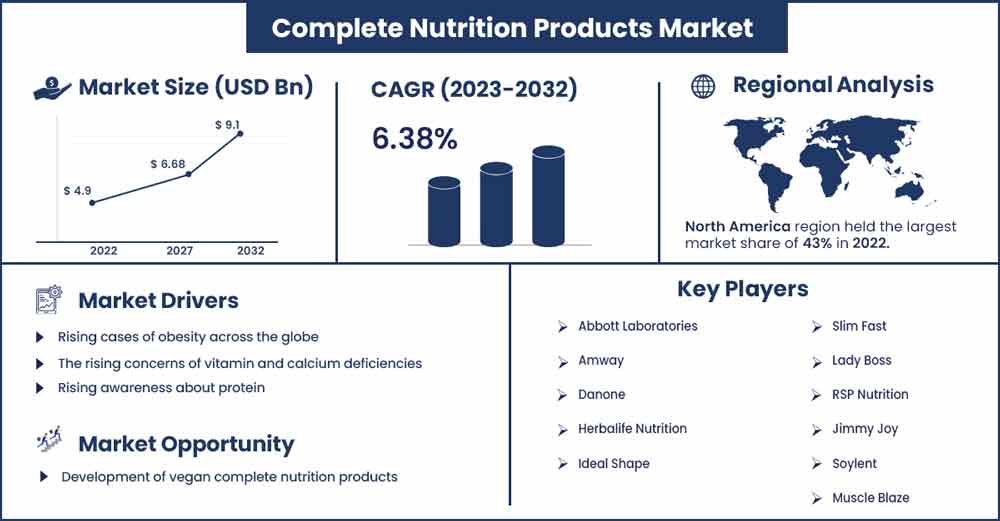

The global complete nutrition products market size surpassed USD 4.9 billion in 2022 and is projected to rise to USD 9.1 billion by 2032, anticipated to grow at a CAGR of 6.38 percent during the projection period from 2023 to 2032. The growing demand for organic and natural ingredient-based nutritional products is fueling the growth of the complete nutrition products market.

Market Overview:

Complete nutrition products are typically formulated to provide a balance of essential macronutrients, such as protein, carbohydrates, and healthy fats. They are generally available in a range of formats, including powders, bars, shakes, and capsules. The market is highly competitive, with many companies offering a wide range of products to meet the diverse needs of consumers. They may also be used by individuals with certain health conditions, such as malnutrition or gastrointestinal disorders, to supplement their nutrient intake.

Factors such as rising demand for weight management products, improving nutrition and wellness industry, availability of a wide range of nutrition products in convenience stores, rising disposable income, increasing dependence on on-the-go food products, and growing awareness about concentrated nutrition products are accelerating the growth of the global complete nutrition products market. Overall, complete nutrition products can be a valuable tool for individuals looking to improve their nutrition, manage their weight, or support their fitness goals.

Regional Snapshot:

North America holds the dominating share in the global complete nutrition products market owing to the massive demand for convenient nutrition products across the region. The North American complete nutrition products market is a rapidly growing industry that offers a wide range of products to meet the diverse needs of consumers.

The market is highly competitive, with many companies offering a wide range of products to meet the diverse needs of consumers. Some of the key players in the North American complete nutrition products market include Abbott Laboratories, Herbalife, GNC Holdings, Glanbia plc, and Nestle.

Asia Pacific is expected to witness a significant increase during the projected timeframe, with Japan, China, and India accounting for the largest share of the market. Another important factor driving the growth of the Asia Pacific complete nutrition products market is the increasing demand for plant-based and natural products. Consumers are seeking products free from artificial preservatives and additives and made from sustainable, environmentally friendly sources.

Europe is another significant marketplace for complete nutrition products; the European complete nutrition products market is expected to continue to grow as consumers seek convenient and practical solutions to meet their nutrition and wellness needs. With a focus on innovation, personalization, and health consciousness, the market is poised for further expansion in the coming years.

Complete Nutrition Products Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 5.22 Billion |

| Projected Forecast Revenue by 2032 | USD 9.1 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.38% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

By product, the powder segment holds the largest share in the global complete nutrition products market; this segment is expected to maintain its dominance during the forecast period. The segment's growth is attributed to the rising demand for natural and organic powder products in the nutraceutical industry. Following the powder segment, the RTD shakes segment is expected to grow at the fastest rate owing to the convenience of drinks offered by ready-to-drink shakes. The bar segment will witness a noticeable increase as people have started preferring sugar-free and all-nutrition products for health benefits.

By distribution channel, the supermarket segment holds the dominating share of the global complete nutrition products market owing to the availability of a wide range of nutritional products in supermarkets. At the same time, the online store segment is growing at a significant rate due to the convenience of online shopping and the availability of nutritional and wellness products on the official websites of critical players.

Market Dynamics:

Driver:

Growing awareness about the health benefits of protein

The rising awareness about protein and its importance in a healthy diet is one of the critical drivers for the growth of the complete nutrition products market. Protein is a crucial macronutrient that is essential for muscle building and repair, and many complete nutrition products are high in protein. Many complete nutrition products are high in protein, making them an attractive option for consumers looking to increase their protein intake. These products can be particularly appealing to athletes, bodybuilders, and fitness enthusiasts who require higher amounts of protein to support muscle growth and recovery. As consumers become more aware of the benefits of protein, they are more likely to seek out complete nutrition products that provide a convenient and easy way to increase their protein intake. This has led to the development of a wide range of complete nutrition products, including protein bars, shakes, and powders, which cater to a variety of dietary preferences and needs.

Restraint:

Complex product formulation

Developing complete nutrition products that are both effective and appealing to consumers is a complicated process that requires expertise in nutrition science, food technology, and sensory science. In addition, the formulation of complete nutrition products requires a careful concentration of balanced nutrition, including fats, carbohydrates, vitamins, and proteins. The bioavailability of nutrients in complete nutrition products is a critical factor considering the product's effectiveness, which affects the production of nutrition products. Along with this, formulating complete nutrition products requires a range of regulatory compliance with a range of regulatory standards related to labeling and health claims. Companies involved in the complete nutrition products market must invest in research and development to create products that meet consumer expectations. Such complicated procedures involved in the product formulation hinder the growth of the complete nutrition products market.

Opportunity:

Increasing demand for personalized nutrition products

Consumers are increasingly looking for complete nutrition products that are tailored to their individual needs and preferences. Personalized nutrition products provide targeted nutrition solutions to address specific health concerns. Personalized nutrition products also help individuals optimize their nutrient intake by providing the right balance of nutritional values. Such products are specifically designed to be more appealing and easier to incorporate into an individual’s daily routine, which can improve compliance and adherence to a healthy diet. The rising demand for personalized nutrition products is driven by the better outcomes achieved by addressing consumer preferences. The rising demand for personalized nutrition products presents an opportunity for companies to develop products and services that offer personalized nutrition recommendations based on health issues, health status, lifestyle and genetics.

Challenge:

Difficult ingredient sourcing and supply chain management

Complete nutrition products often contain a range of ingredients, many of which are sourced from different suppliers around the world. The sourcing and management challenges for nutrition products often result in product inconsistency. Many components used in complete nutrition products are based on agricultural activities. Such ingredients are subject to seasonal availability, and it is difficult to consistently maintain their availability throughout the year. Few ingredients are sourced from specific geographic locations, which can make it complex to maintain a reliable supply.

Moreover, quality control can be challenging when dealing with multiple suppliers and complex supply chains. Price volatility of raw materials creates obstacles for market players by disturbing the production capacity. Additionally, the lack of a proper supply chain, unavailability of storage for ingredients, and overall managing cost create an obstacle for market players.

Recent Developments:

- In June 2022, a rapidly growing meal replacement brand, CTRL, announced the launch of new Meal on-the-go Bars by expanding its product portfolio in the nutritional industry. With the launch of this new product, the company aims to achieve a further step in the functional foods category.

- In May 2022, India-based brand, SoulFuel announced the launch of a protein powder that strengthens the gut. The newly launched product helps in protein absorption and strengthens muscle power. The company aims to offer authentic nutritional supplements to consumers that face gastrointestinal issues.

- In August 2022, a global leader in sports nutrition, Optimum Nutrition, announced the launch of the New Gold Standard Protein Shake, a ready-to-drink whey protein powder. The convenient ready-to-drink protein shake comes in chocolate and vanilla flavors. The protein shake is formulated with 24 essential vitamins, minerals, proteins, and zinc

- In November 2022, India’s leading protein snack brand, RiteBite Max Protein, launched a breakthrough innovation in plant-based protein powder with patented processing technology for fitness-conscious people. The plant-based protein powder is made with seven different grains that offer clean protein and a unique formulation of enzymes and probiotics.

Major Key Players:

- Abbott Laboratories

- Amway

- Danone

- Herbalife Nutrition

- Ideal Shape

- Slim Fast

- Lady Boss

- RSP Nutrition

- Jimmy Joy

- Soylent

- Muscle Blaze

Market Segmentation:

By Product

- Powder

- RTD Shakes

- Bars

By Distribution Channel

- Supermarket

- Convenient Stores

- Online Store

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2727

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333