Computer Numerical Control (CNC) Machine Market Report 2030

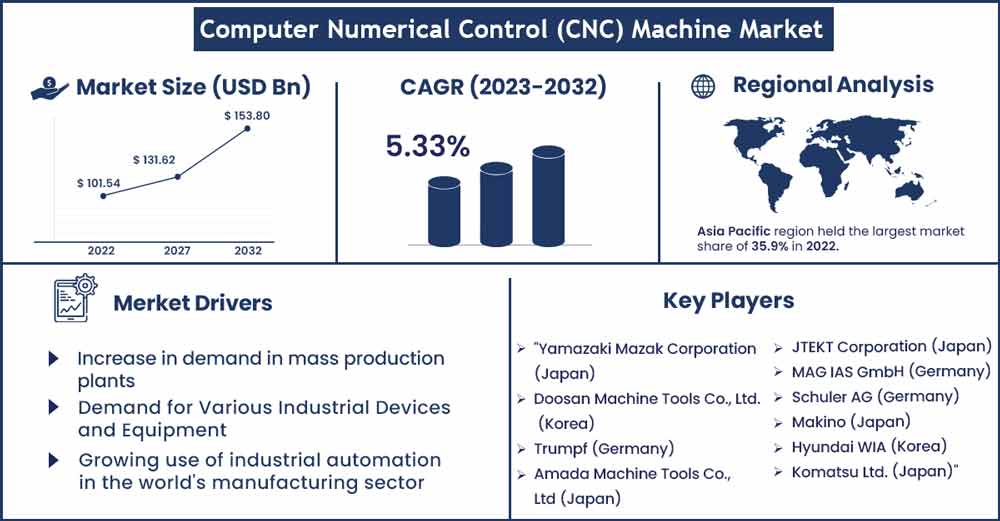

The global computer numerical control (CNC) machine market size exceeded USD 101.54 billion in 2022 and it is expected to rake around USD 153.8 billion by 2030, poised to grow at a CAGR of 5.33% between 2022 to 2030.

The use of CNC equipment is essential to the industrial sector. The CNC lathes are being used by several manufacturing industries. The manufacturing items produced by the CNC automation machine are exact and accurate. Industries nowadays need automation. It is difficult to fulfil the enormous demand in the manufacturing business without this automation equipment. A monitoring system may be incorporated with the CNC machines. It is a very adaptable machine that can create many different manufacturing parts. Any producer may generate desired things in multiple sizes, shapes, and designs by inputting algorithms onto a monitor.

In the woodworking sector, it is the best machine. The CNC machine's easy operation is ideal for industries that need skilled craftsmanship while producing finished goods. The automation tool lowers labor costs and improves time efficiency for the industry. Between 2020 and 2026, the size of the global CNC machine market is projected to increase by 5% CAGR and reach over USD 90 billion. The most demanding end users of CNC machines nowadays are factories and manufacturing facilities. In the next years, the efficiency and efficacy of CNC machines will become even more crucial. An exponential rate of CNC machine adoption is being seen across a range of industries.

Report Highlights:

- Around 498 thousand milling machines are estimated to be in demand by 2030. The expansion is explained by the increasing acceptance of multi-axis milling in the automotive and aerospace sectors.

- The automotive industry is predicted to experience a rise in the demand for electric vehicles, which will increase the requirement for CNC machines. As a result, the category is anticipated to have a CAGR of more than 12% over the given period.

- The industrial sector's explosive growth, particularly in the metalworking and semiconductors manufacturing sectors, is anticipated to fuel expansion in the Asia-Pacific regional market. It is anticipated to have the greatest CAGR, at 12.9%, between 2022 and 2030.

- Developing nations like China and India have had tremendous industrialisation expansion, which is boosting the market.

- The metal cutting segment is anticipated to dominate because to its high precision, focus on energy efficiency, and time; the automotive industry is anticipated to develop considerably over the projection period due to the increased demand for vehicles in the area. Additionally, a high level of demand for outstanding performance and accurate management could promote segmental expansion.

Regional Snapshots:

During the projection period, the Asia Pacific region will continue to dominate the CNC machine industry. The significant CNC machine market in 2026 will be mostly attributable to the regional players in Europe, North America, and Asia Pacific. The key market drivers are the expanding industrial units and the rising need for automation technologies. The market for CNC machines in North America is the second-largest in the world. The primary causes of the strong demand are the prosperous industrial industries. Furthermore, the CNC machine market is expanding favorably throughout Europe. The driving force behind the market demand is the automobile industry's enormous need for automation technologies.

Computer Numerical Control (CNC) Machine Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 106.95 Billion |

| Projected Forecast Revenue in 2030 | USD 153.8 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 5.33% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics:

Drivers:

Most industrial facilities today require sophisticated technologies. Manufacturers are implementing automation technology to increase output. The desire of manufacturers to produce work items effectively and efficiently is what drives the CNC machine market. Cutting, drilling, designing, and turning activities are straightforward with a CNC lathe. The ease of use of these automation systems is one of the primary market drivers.

Additionally, there is a sizable market for cutting-edge autonomous technology. The majority of industries are prepared to implement this novel technology. One such device that can do a variety of activities unattended is the CNC. The CNC machine also lowers operational expenses, labor costs, and time. Factory owners are drawn to automation machines because of these characteristics. It is yet another aspect with high demand that propels the market for CNC machines. The lack of enough workspace in tiny enterprises is another issue that the CNC machine resolves. Even modest manufacturers may fit these CNC machines. It is a significant demand-generating driver for the market for CNC machines. Additionally, there will be a greater need for industrial modernization in the coming years. As a result, there are several variables that will drive demand for CNC machines in the years to come.

Restraints:

The cost of obtaining a CNC machine is significant. This serves as a major barrier to the expansion of the worldwide CNC controller market. Depending on the brand and model, brand-new CNC lathes and routers can cost thousands of dollars. Additionally, these expenditures involve shipping, installation, operating, and maintenance fees, all of which raise the overall cost for businesses using CNC machines. Due to their weight, CNC machines can range in weight from 100 pounds to several tons. Normally, shipping expenses are covered by purchase agreements; but, if they are not, clients may be forced to pay hundreds of dollars. Additionally, CNC machines may be modified to meet the expectations and specifications of end customers. The specifications for CNC machines vary based on the applications for which they are employed. Additionally, when the production process and/or goods change and/or become more expensive, CNC machines must be modernized.

Opportunities:

The market for CNC controllers is anticipated to have considerable prospects due to the integration of 3D printing with CNC machining. Because of the highly competitive business climate, businesses across all industries are concentrating on implementing efficient production practices. They are also revamping their production procedures in an effort to obtain a competitive edge. The major players in the CNC controller market have so integrated CNC machines with 3D printing technology to provide hybrid manufacturing options to end customers.

The primary function of CNC controllers in CNC machines is to regulate the relative movement of machine tools that remove waste materials to produce a specific component with the specified shape. Additionally known as subtractive manufacturing, this method. Materials are added layer by layer while using 3D printing technology to create components with the specified geometry. As a result, it is known as additive manufacturing. Although the subtractive and additive manufacturing processes are distinct from one another, they have several characteristics. This motivates producers to introduce integrated solutions built on these processes in order to produce higher quality goods with the least amount of waste.

Challenges:

The expansion of the CNC controller industry is significantly hampered by a shortage of skilled CNC setup machinists, programmers, and operators. Making the best use of machines' finite powers was a struggle in the past. However, this obstacle has already been solved with the development of CNC technology. The main issue at hand is the lack of qualified personnel for setting up, running, and programming these equipment. If properly programmed, CNC machines are capable of carrying out a variety of jobs. However, incorrect CNC machine programming causes production problems that place needless financial pressures on end users.

Recent Developments:

- In April 2019, Simens released a new edition of the software program used to develop and simulate automation networks. The plant planner, the builders, and the operators of the automation are supported by Sinetplam V2.0. At the 2019 Hannover Messe, the business intends to demonstrate its new features that incorporate into the digitized planning and engineering workflow.

- May 2018 saw the first opportunity deep reinforcement learning has been effectively used to auto-calibrate real-world CNC equipment when Bonsai, the AI company, and Siemens implemented AI on a real-world machine in a test setting. Using Bonsai's AI platform, Siemens engineers trained an AI model to adjust a CNC machine more quickly than a skilled human operator—more than 30 times quicker.

Major Key Players:

- Yamazaki Mazak Corporation (Japan)

- Doosan Machine Tools Co., Ltd. (Korea)

- Trumpf (Germany)

- Amada Machine Tools Co., Ltd (Japan)

- JTEKT Corporation (Japan)

- MAG IAS GmbH (Germany)

- Schuler AG (Germany)

- Makino (Japan)

- Hyundai WIA (Korea)

- Komatsu Ltd. (Japan)

- Okuma Corporation (Japan)

- FANUC Corporation (Japan)

- XYZ Machine Tools (U.K.)

- Mitsubishi Heavy Industries Machine Tool Co., Ltd. (Japan)

- General Technology Group Dalian Machine Tool Corporation (Liaoning Province)

- ANCA Group (Australia)

Market Segmentation:

By Type

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

By End Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2138

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333