Cryogenic Tanks Market Size To Rake USD 11.41 Bn By 2032

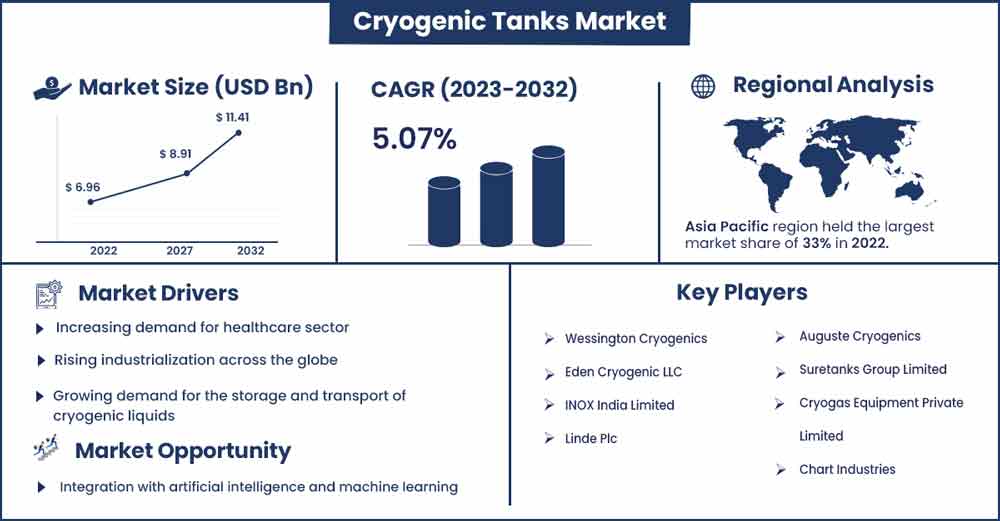

The global cryogenic tanks market size surpassed USD 6.96 billion in 2022 and it is expected to rake around USD 11.41 billion by 2032, poised to grow at a CAGR of 5.07% during the forecast period 2023 to 2032.

Market Overview:

Cryogenic tanks are essential for the storage and transport of cryogenic materials, which are used in a range of industries and applications, including chemical manufacturing, semiconductor production, and medical technologies. Cryogenic tanks come in a range of sizes and configurations, depending on the specific application and requirements of the user. Some tanks are designed for stationary storage, while others are designed for transport on trucks or ships. Additionally, some tanks are designed for the storage of specific cryogenic fluids, such as liquid nitrogen or liquid oxygen. The cryogenic tanks market is expected to experience significant growth in the coming years, driven by a range of factors such as increasing demand for liquefied natural gas (LNG), growing demand for medical gases, and the expansion of industrialization globally.

Regional Snapshot:

Asia Pacific holds the dominating share of the global cryogenic tanks market. Booming industries, improving healthcare infrastructure, and growing demand for cleaner energy solutions with appropriate government initiatives are observed to boost the market growth in Asia Pacific. Being the most attractive developing country, India is expected to witness a significant shift in the cryogenic tank market during the forecast period.

The cryogenic tanks market in India is expected to experience significant growth in the coming years due to the increasing demand for industrial gases such as nitrogen and oxygen in various industries, including healthcare, food and beverage, electronics, and metallurgy. The Indian government is also taking initiatives to promote the use of LNG as a cleaner alternative to fossil fuels, which is expected to further drive the growth of the cryogenic tanks market in the country.

In addition, the increasing demand for electronic products in China has also led to a rise in the demand for industrial gases, as they are used in the manufacturing process of electronic products. The production of steel and other metals also requires industrial gases, which are stored and transported in cryogenic tanks.

North America is the second largest marketplace for cryogenic tanks owing to the stricter regulations by the government on using clean energy resources. The North American cryogenic tanks market is expected to experience steady growth over the forecast period due to the increasing demand for liquefied natural gas (LNG) and the growing adoption of cryogenic technologies in various industries, such as healthcare, energy, and electronics. The United States is the largest market for cryogenic tanks in North America, driven by the growth of the energy and healthcare industries.

Cryogenic Tanks Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 7.31 Billion |

| Projected Forecast Revenue by 2032 | USD 11.41 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.7% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights:

- By raw material, the steel segment will remain the most attractive segment of the global cryogenic market during the forecast period, as steel is able to withstand these extreme temperatures and the thermal stresses that occur during the storage and transportation of cryogenic fluids. It also has excellent corrosion resistance and can be easily formed into various shapes and sizes, making it a versatile material for cryogenic tank construction. The nickel alloy is expected to dominate the global cryogenic tank market. The segment's growth is attributed to its excellent mechanical properties and corrosion resistance at low temperatures.

- By cryogenic liquid, the nitrogen segment dominates the global cryogenic tank market. The rising demand for liquified nitrogen from manufacturing industries and the healthcare sector is considered to maintain the dominance of the nitrogen segment during the forecast period. At the same time, the natural gas segment is witnessing the fastest growth owing to the rising consumption of environmentally cleaner cryogenic liquids across the globe.

- By application, the storage segment leads the global cryogenic tanks market. Cryogenic liquids in the medical sector and other manufacturing units require a specific storage facility to maintain their temperature. Thus, storage becomes the most powerful application for cryogenic tanks. Improving capacity and advanced designs of cryogenic tanks for storage are observed to preserve the dominance of the storage segment. At the same time, the development of advanced trucks and vehicles to carry and deliver cryogenic liquids will boost the growth of the transportation segment during the projected timeframe.

- By end-user, the healthcare sector leads the global cryogenic tanks market. The improving healthcare sector and rising demand for oxygen tanks in hospitals will maintain the dominance of the healthcare segment in the market. The manufacturing segment is another significant segment of the market, with the enormous demand for tanks to transport and store cryogenic gases in the construction and manufacturing industries.

Market Dynamics:

Driver:

Rising industrialization across the globe

Industrial processes such as liquefied natural gas (LNG) production, chemical manufacturing, and medical gas production require the use of cryogenic tanks to store and transport materials that need to be kept at extremely low temperatures. As industrialization continues to grow globally, the demand for these materials and the need for reliable and efficient storage and transport solutions for them also increase. This creates significant opportunities for the cryogenic tank market, as cryogenic tanks are a critical component in ensuring the safe and efficient storage and transport of cryogenic materials.

Moreover, the demand for cryogenic tanks is also driven by the growing need for alternative energy sources, such as LNG, which requires cryogenic tanks for storage and transport. Cryogenic tanks are also used in the storage and transportation of other cryogenic liquids, such as liquid hydrogen and helium, which are increasingly being used in fuel cells and other energy applications. Overall, the growth of industrialization is driving the demand for cryogenic tanks, creating opportunities for manufacturers and suppliers of cryogenic tanks, as well as for companies involved in the construction and operation of industrial facilities and infrastructure.

Restraint:

Safety concerns associated with cryogenic tanks

Cryogenic tanks are used to store and transport materials at extremely low temperatures, typically below -150°C (-238°F), which can pose significant safety risks if the tanks are not designed, operated, and maintained properly. Cryogenic fluids can pose a fire or explosion hazard if they come into contact with certain materials, such as organic materials, fuels, or oxidizers. In addition, cryogenic tanks can rupture if they are exposed to high temperatures or pressures, which can result in an explosion or release of the stored material. Cryogenic fluids can displace oxygen in the air, which can pose a risk of asphyxiation if they leak from the tank or are released during transport or use. This can be particularly dangerous in confined spaces like storage facilities or transport vehicles. Such risks associated with cryogenic tanks make it challenging to obtain regulatory approvals and can limit the adoption of cryogenic tanks in specific applications; this is observed as a significant restraint for the market’s growth.

Opportunity:

The rising demand for liquified natural gas (LNG)

The demand for liquified natural gas is significantly growing, driven by factors such as the transition to cleaner-burning fuel sources and the increasing use of natural gas for power generation. Cryogenic tanks used for LNG storage and transport are constructed of materials such as stainless steel, aluminum, or other high-strength alloys. They are designed to withstand the extreme cold and pressure conditions of LNG. These tanks are typically large and can hold hundreds of thousands of gallons of LNG. They are used in various applications, including LNG storage and regasification terminals, as well as onboard LNG carriers and other vessels. As the demand for LNG continues to grow, the need for reliable and cost-effective cryogenic tanks will increase. This presents significant opportunities for manufacturers and suppliers of cryogenic tanks, as well as for companies involved in the construction and operation of LNG facilities and infrastructure.

Challenge:

Availability of competitive alternative technologies

The cryogenic tanks market faces competition from alternative technologies; each has its advantages. Adsorption-based storage systems use porous materials to store gases or liquids at low temperatures. The most vibrant competitive alternative for cryogenic tanks, compressed gas storage, is typically less expensive than cryogenic tanks, and these systems can offer similar benefits to cryogenic tanks. On the other hand, Phase Change Material (PCM) storage systems use materials that change phase from solid to liquid at low temperatures to store and release heat. These systems can be used to store cryogenic fluids and offer the potential for high energy density and efficiency. The presence of such alternative technologies for carrying cryogenic liquids poses a challenge to the growth of the cryogenic tanks market.

Recent Developments:

- In September 2022, Blue Energy Motors launched India’s first liquified natural gas-fueled green 5528 4x2 truck in Pune. The automotive company Blue Energy Motors collaborated with Iveco Group to use their FPT N67 NG engine, a 1000-liter cryogenic tank. The product by Bleu Energy will be available in a range including light, medium and heavy vehicles.

- In June 2021, TECO 2030, a Norwegian engineering firm, announced to team up with Chart Industries to develop cryogenic hydrogen capture technology solutions for ships. The new solution by Chart Industries and TECO 2030 will be used to capture and store CO2, which would have emitted into the air and contribute to climate change.

- In October 2021, Hindustan Aeronautics Limited (HAL) announced to deliver of the heaviest semi-cryogenic propellent tank to the Indian Space Research Organization (ISRO). The tank provided by HAL will be used in Mk-III launch vehicles for future missions.

Major Key Players:

- Wessington Cryogenics

- Eden Cryogenic LLC

- INOX India Limited

- Linde Plc

- Auguste Cryogenics

- Suretanks Group Limited

- Cryogas Equipment Private Limited

- Chart Industries

Market Segmentation:

By Raw Material

- Steel

- Nickel alloy

- Aluminum alloy

- Others

By Cryogenic Liquid

- Nitrogen

- Argon

- Natural gas

- Oxygen

- Others

By Application

- Storage

- Transportation

By End-User

- Manufacturing industries

- Oil & gas industry

- Power

- Metallurgy

- Healthcare

- Shipping

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2750

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333