Digital Signage Market Size to Touch USD 42.54 Bn by 2030

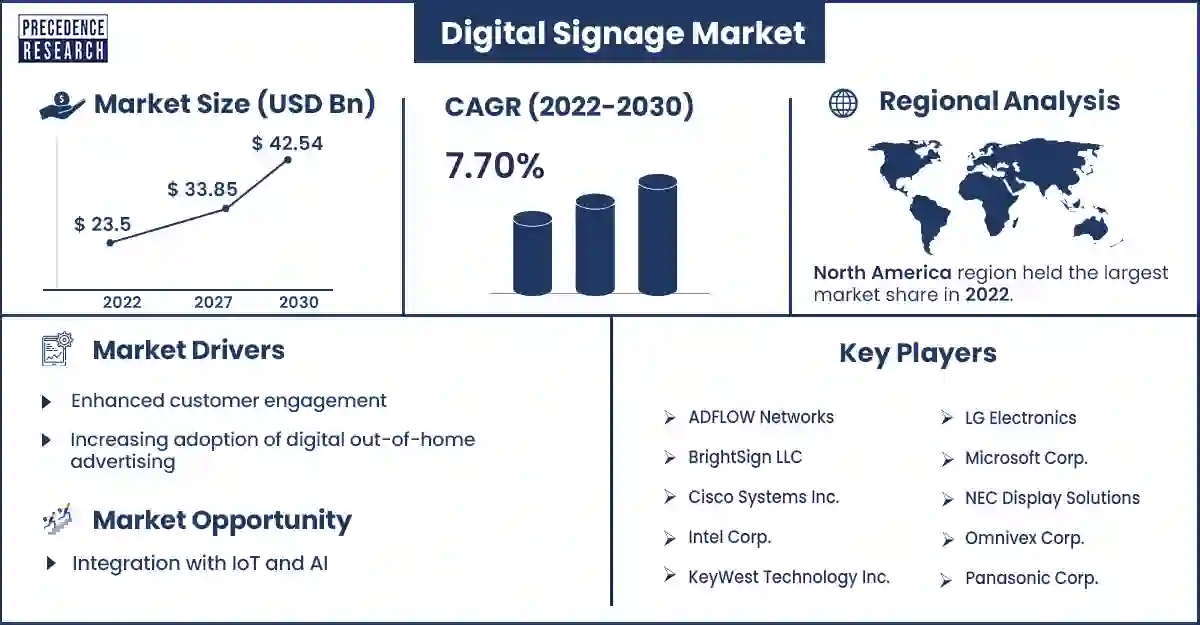

The global digital signage market size was exhibited at USD 25.24 billion in 2023 and is anticipated to touch around USD 42.54 billion by 2030, expanding at a CAGR of 7.70% during the forecast period from 2022 to 2030.

Market Overview

The digital signage market creates, distributes, and implements advanced display solutions for various purposes, such as advertising, information dissemination, and entertainment. It uses diverse technologies, including LCD, LED, projection, and interactive displays in different settings such as retail stores, transportation hubs, corporate offices, healthcare facilities, and public spaces. The market involves hardware components such as screens, media players, mounting systems, and software platforms for content management, scheduling, and analytics that cater to various technical requirements.

The growth of the digital signage market is driven by various factors, including advancements in display technologies like high-resolution screens and interactive features that boost the visual impact and engagement potential of digital signage solutions. This leads to increased adoption across diverse industries ranging from retail and hospitality to transportation and healthcare.

The rising demand for targeted advertising and dynamic content delivery is also a significant driver that fuels the expansion of digital out-of-home (DOOH) advertising networks, which use digital signage for real-time messaging and audience targeting. Additionally, the flexibility and scalability of digital signage systems offer cost-effective solutions for businesses seeking to enhance customer experiences and streamline communication processes. Integrating digital signage with emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT) creates new opportunities for innovative applications, including personalized content delivery and real-time analytics.

Regional Snapshot

North America dominated the digital signage market in 2023. The region's major market players and technological advancements are reasons for its dominance. Fibre optic networks and 5G technology also increase the use of digital signage.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The digital signage market in Asia Pacific is witnessing remarkable growth due to rapid urbanization and the increasing adoption of digital technologies in the region. The retail sector is a significant growth driver of the market, with countries like China, India, and Japan experiencing a surge in demand for digital signage solutions. Retailers leverage this technology to enhance customer engagement, showcase offerings, and provide interactive experiences that drive sales and brand awareness.

The transportation sector in Asia, including airports, railway stations, and public transit systems, also adopts digital signage for passenger information, wayfinding, and advertising purposes. With the acceleration of urbanization and infrastructure development, the demand for digital signage solutions in transportation hubs is expected to increase significantly.

- In October 2023, Tata Tea Gold is set to unveil its latest 3D digital signage campaign. The campaign will utilize cutting-edge technology to create an immersive and interactive consumer experience. The campaign is expected to leverage the latest in 3D graphics and animation technologies to create a truly unique and memorable experience that will leave a lasting impression on consumers.

Digital Signage Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 25.24 Billion |

| Projected Forecast Revenue by 2030 | USD 42.54 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 7.70% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhanced customer engagement

Digital signage is a cutting-edge technology that leverages digital displays to offer customers dynamic and interactive real-time content. It is a powerful tool that empowers businesses to engage their audience and effectively convey their message. With digital signage, companies can showcase a wide range of content, including text, images, videos, and live feeds. This technology mainly benefits businesses that want to captivate their customers and create a distinctive and memorable experience. Digital signage can be used across various settings, such as retail stores, restaurants, healthcare facilities, and public spaces, to provide information, promote products and services, and enhance the overall customer experience.

- In January 2024, LG unveiled a cloud-based platform designed to simplify digital signage management. The platform provides a centralized hub for managing and distributing content to digital displays in various locations.

Increasing adoption of digital out-of-home advertising

In the digital era, leveraging digital signage networks has emerged as a highly effective strategy for advertisers to broaden their audience reach. These networks enable advertisers to generate and showcase personalized messages in real-time, tailored to the specific location and time of day. This empowers advertisers to engage their potential customers more effectively and provide them with visually appealing information about their products or services. The deployment of digital signage networks has brought about a paradigm shift in the advertising industry, equipping businesses with a potent tool to enhance their market coverage and boost their revenue.

Restraints

High initial investment

Adopting digital signage solutions by small and medium-sized enterprises (SMEs) is challenging due to the considerable upfront costs associated with hardware, software, and installation. Hardware costs, such as displays, media players, and mounting equipment, are high, and software licenses and subscriptions, such as content management systems, can quickly add up. Furthermore, installation expenses such as cabling, networking, and professional services are also significant and can hamper the growth of the digital signage market. Despite these challenges, SMEs can benefit from digital signage solutions for improved communication, brand awareness, and customer engagement.

Data security concerns

Digital signage networks have become a crucial medium for businesses to communicate with their customers. With the evolution of these networks, interconnectivity and data-driven approaches have become the new norm. However, this technological advancement also poses significant security and privacy challenges. Businesses must protect their digital signage networks against cyber threats, data breaches, and unauthorized access. Failure to do so can have severe consequences, including loss of customer trust, legal liabilities, and financial losses, which negatively impact the digital signage market. Therefore, it has become imperative for businesses to implement robust security measures to ensure the safety of their digital signage networks and the data they contain.

Opportunities

Integration with IoT and AI

The amalgamation of digital signage with Internet of Things (IoT) devices and AI-powered technologies has unlocked new possibilities for creating inventive and interactive experiences for the audience, making it a great opportunity for the digital signage market. This integration has facilitated the development of real-time audience analytics that can deliver valuable insights into consumer behavior and preferences. Additionally, predictive maintenance can be implemented to ensure that the digital signage system is always operational and free from technical glitches. This saves time and money and guarantees a seamless and uninterrupted experience for the audience.

Personalized content

Data analytics and artificial intelligence (AI) advancements have transformed how businesses interact with their customers. These technologies enable the delivery of highly personalized and contextually relevant content that resonates with the target audience, enhancing customer engagement and driving sales. By utilizing AI, businesses can now scrutinize large volumes of data to gain insights into customer behavior and preferences, which can be used to tailor marketing campaigns and messages to suit individual needs. This enhances the overall customer experience and assists businesses in establishing long-term relationships with their customers, resulting in increased brand loyalty and repeat business.

- In February 2024, Middle Atlantic announced the release of a new pulpit capable of supporting digital signage technology. The pulpit is expected to be available and is designed to enhance users' presentation experiences by seamlessly integrating digital signage capabilities into the podium's design.

Recent Developments

- In November 2023, Maxhub, a leading provider of visual communication technology, announced the launch of its digital signage showroom and solution center in Amsterdam. The center will showcase Maxhub's latest digital signage solutions, including cutting-edge display technologies, interactive displays, and video walls, to give customers a hands-on experience of the company's innovative products.

- In November 2023, PPDS launched its latest offering, the 4K UHD Philips QE-Line 3000 Digital Signage series. The new series promises advanced technical features and cutting-edge technology, providing users with an immersive experience.

Major Key Players

- ADFLOW Networks

- BrightSign LLC

- Cisco Systems Inc.

- Intel Corp.

- KeyWest Technology Inc.

- LG Electronics

- Microsoft Corp.

- NEC Display Solutions

- Omnivex Corp.

- Panasonic Corp.

- SAMSUNG

- Winmate Inc.

Market Segmentation

By Screen Type

- Video Walls

- Video Screens

- Transparent LED Screens

- Digital Posters

- Kiosks

- Others

By Component

- Hardware

- Software

- Services

By Technology

- LCD

- LED

- Projection

By Location

- In-store

- Out-store

By Content Category

- Broadcast

- News

- Weather

- Sports

- Others

- Non-Broadcast

By Screen Size

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

By Application

- Retail

- Hospitality

- Entertainment

- Stadiums & Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transportation

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1312

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308