Green Coatings Market Revenue, Top Companies, Report 2032

Green Coatings Market Revenue and Opportunity

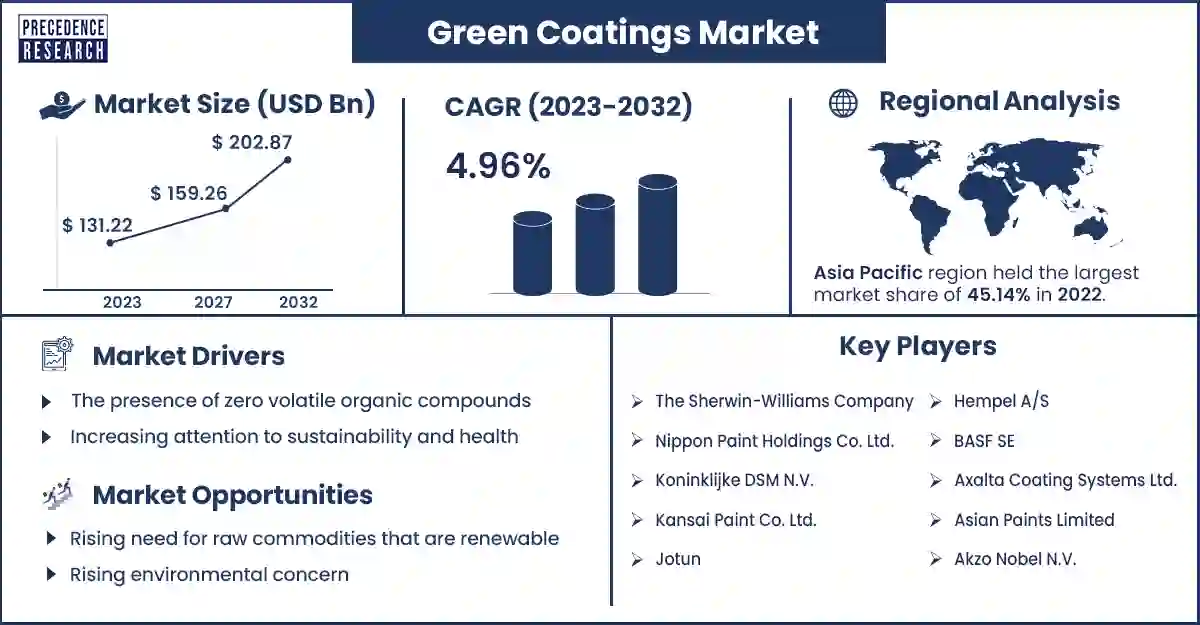

The global green coatings market revenue was valued at USD 131.22 billion in 2023 and is poised to grow from USD 137.73 billion in 2024 to USD 202.87 billion by 2032, at a CAGR of 4.96% during the forecast period 2023 - 2032. The growing awareness of Volatile Organic Compounds emissions is expected to enhance the growth of the green coatings market.

Market Overview

The green coatings market deals with sustainable coating solutions and environmentally friendly solutions used in several industries, such as manufacturing, construction, and automotive. These coatings help reduce toxic environmental impacts by reducing volatile toxic substances, hazardous air pollution, and organic compounds. They often utilize low-solvent and water-based formulations, reducing the overall carbon footprint and promoting healthier air quality.

The rising demand for green coatings, increasing focus on health, and growing preference towards sustainable products are attributed to the growth of the market. In addition, increasing strict environmental regulations, growing advancements and innovations in technology, increasing construction activities, and rising health concerns and awareness among the people related to the challenges of solvent-based coatings are further anticipated to accelerate the growth of the green coatings market during the forecast period.

The rising popularity of green coatings

The increasing popularity of green coatings is a major factor that is expected to cause health and environmental concerns. The growing awareness of the harmful effects of VOC emissions, strict environmental regulations, and increasing global warming is also the move towards eco-friendly coatings. Green coatings such as high solids, UV-curable coatings, powder coatings, and waterborne coatings include very fewer solvents that evaporate during the treatable phase few solvents that evaporate during the treatable phase, making them more eco-friendly.

In the world, governments are actively enforcing regulations against VOCs, and promoting the use of eco-friendly products helps to enhance market growth. Furthermore, green coatings offer various benefits that are expected to increase their adoption due to their low VOC emissions and environmentally friendly properties. These advantages include superior chemical resistance, improved fire resistance, enhanced protection against high wind events, and extended service life, making green coatings appropriate for a broad range of applications. These driving factors continue to enhance the growth of the green coatings market.

However, the high cost of green coatings may restrain the growth of the market. Due to the increasing awareness of global warming, there is a growing demand for green coatings. The high cost of renewable or sustainable materials as compared to convenience petrochemical items remains an obstacle. Furthermore, the insufficient availability of specialty raw materials used in renewable coatings may hinder market growth.

The high cost of manufacturing procedures included in making green coatings also contributes to their higher cost. Addressing the cost and availability of renewable or sustainable raw materials further challenges market development. These factors may restrain the growth of the green coatings market.

Green Coatings Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 137.73 Billion |

| Market Revenue by 2032 | USD 202.87 Billion |

| Market CAGR | CAGR of 4.96% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Green Coatings Market Top Companies

- Akzo Nobel N.V.

- MG Motor India

- Asian Paints Limited

- Axalta Coatings Systems Ltd.

- BASF SE

- Hempwe A/S

- Jotun

- Kansai Paint Co. Ltd.

- Konninklijke DSM N.V.

- Nippon Paint Holdings Co. Ltd.

- The Sherwin-Willians Company

Recent Innovation in the green coatings market by MG Motor India

- In May 2024, new special editions of the ZS EV, Hector, Astor, and Comet were launched by MG Motor India to commemorate MG’s centenary. The name of the new edition was the 100-year Limited Edition. This innovative edition was inspired by the classic British Racing Green paint scheme and specially featured a new ‘Evergreen’ paint. The prices of the special editions are MG ZS EV Rs. 24.81 lakh, MG Hector Rs 21.20 lakh, MG Astor Rs 14.81 lakh and MG Comet EV Rs 9.40 lakh.

Recent Innovation in the green coatings market by BASF SE

- In August 2022, in China, the leading coating manufacturers, Nippon and BASF SE, coupled with manufacturers, Nippon and BASF SE, launched an eco-friendly industrial packaging. This was adopted by the BASF’s water-based acrylic dispersion High-Performance Barrier as the barrier material and Nippon Paint dry-mixed mortar series products. This new packaging material was commercialized for Nippon Paint for construction dry mortar products. This was the first time BASF’s water-based barrier coatings were used in industrial packaging.

Regional Insights

Asia Pacific is expected to show fastest growth during the forecast period. The rapidly growing economic growth rate contributed by higher investment across the industries, including construction industries, furniture, building, appliances, consumer goods, and automotive industries in the region, is anticipated to drive the growth of the market in Asia Pacific. India, China, Japan, and South Africa are the major countries that are helping in the growth of the market in the Asia Pacific region. The increasing presence of a favorable business environment and flourishing construction industry creates a major opportunity for manufacturers in the green coatings market in the Asia Pacific region.

India and China are the major countries and have the biggest share of this market. There are various top green coatings manufacturer companies in Indias in India, such as Asia Paints. This is the largest coating and paint manufacturer in India. Asia Paints has expanded its geographical presence and product range over the years to become the top paint manufacturer in India. Berger Paints India Limited is the second largest coating manufacturer in India. Kansai Nerolac manufactures industrial coatings from its plants in different locations to offer specific segments. The company provides a large-scale portfolio of industrial green coatings, which covers a range of performance coatings, and, including liquid, powder, and automotive coatings. These are the major companies that contribute to the growth of the green coatings market in the Asia Pacific region.

- For instance, in December 2023, a 100% stake in Chemicals and Vibgyor Paints was acquired by Nippon Paints India. In the southern part of the country, Nippon Paints is the major supplier of coatings and paints.

Europe also represents significant growth in the green coatings market. The rising consumer concerns about environmental sustainability, rising technological innovations in the formulation of waterborne coatings, low-VOC, and high-performance provide alternatives that meet both performance and environmental criteria, increasing robust growth, increasing climate action plans, and sustainability goals are expected to drive the growth of the market. The increasing number of infrastructure projects such as airports and seaports and economic development in European countries such as Germany are further anticipated to accelerate the growth of the green coatings market in Europe.

Market Potential and Growth Opportunity

Rising continuous technological advancements

The green coatings market has benefited from various technological advancements that have accelerated application methods and product performance. Innovations in high-solid, waterborne technologies, and nanotechnology have led to the improvement of green coatings with improved corrosion resistance, durability, and finish quality. These technical developments are increasingly often superior alternatives and make green coatings viable to traditional products. In addition, some green coatings provide added fictionalities, including anti-microbial and self-cleaning properties. These are the major opportunities expected to enhance the growth of the market in the coming years.

Green Coatings Market News

- In July 2023, in India, a transparent nanotechnology coating, HeatCure, was launched the major function of this coating based on nanotechnology is to block heat gain from facades, windows, and glass doors. HeatCure’s glass coating products provide ultraviolet rays, and unparalleled protection against infrared, ensuring energy-efficient and comfortable indoor environments.

- In April 2024, a transformative new coating technology for the concrete industry, Sher-Bar TEC, was launched by Protective and Marine Sherwin-Williams. This coating technology is specially designed for an array of environments and construction applications. The textured epoxy offered corrosion resistance and damage tolerance and redefined standards for rebar coatings.

Market Segmentation

By Technology

- Radiation-Cure

- High-Solids

- Powder

- Waterborne

By Application

- Product finishes

- Packaging

- Wood

- High-Performance

- Industrial

- Automotive

- Architectural

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2802

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308