Healthcare Contract Research Outsourcing Market Size, Growth, Report 2032

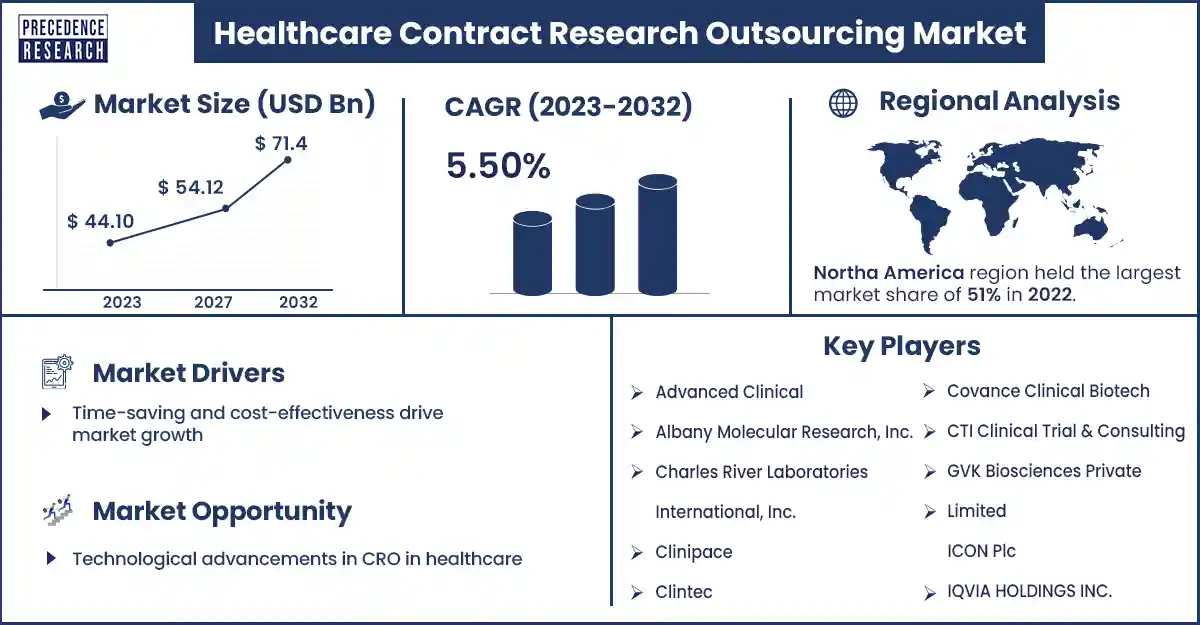

The global healthcare contract research outsourcing market size reached USD 44.10 billion in 2023 and is estimated to hit around USD 71.4 billion by 2032, growing at a CAGR of 5.50% from 2023 to 2032. The patent expiration of blockbuster drugs, preference for outsourcing activities, and growing investment in R&D programs are significant factors expected to drive the growth of the healthcare contract research outsourcing market.

Market Overview

The healthcare contract research outsourcing market deals with regulatory compliance, data analysis, patient recruitment, patient safety, and the security of patients' confidential data in the healthcare industry. The growing pressure on drug manufacturers related to strict safety standards, regulatory environments, and clinical data management is anticipated to enhance the demand for the market. The increasing funding for medical device companies, biotechnology, and small to mid-sized pharmaceuticals is driving the growth of the market. In addition, the increasing access to therapeutics and technologies, rising solutions provided by CROs and various services, increasing efforts for drug development and optimization costs, and increasing adoption of clinical trials are further driving the growth of the market.

Time-saving and cost-effectiveness drive market growth

Drug development can be processed more rapidly and with less functioning expenses for biotech and pharmaceutical businesses. With the help of CROs, they can outsource their clinical research operations. Contract research outsourcing constantly has knowledge and customized infrastructure. In-house teams to conduct clinical trials, individuals only pay for the expertise and services that they need rather than hiring a full-time. Such cost savings can only be registered if trial protocols are conducted to specific demands.

A reputable contract research outsourcing design studies the elements that are needed for the submissions, and it is not unnecessary extras and not expensive. These are the major factors that are anticipated to drive the growth of the healthcare contract research outsourcing market.

However, privacy and data security concerns may hinder the growth of the healthcare CRO market. Privacy and data security are major problems in the management of critical patient information in clinical trials. Data security problems can be a hurdle to the outsourcing of clinical research services, resulting in calls for stringent safeguards to guarantee compliance with data security standards. In contract research outsourcing, it is essential to share confidential data with partners in contract research outsourcing, with unwanted risk. In the healthcare sector, clinical trial data and medical records can be shared, which creates major complications and unwanted risks. These are the restraining factors responsible for hindering the growth of the market.

Healthcare Contract Research Outsourcing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 44.10 Billion |

| Projected Forecast Revenue by 2032 | USD 71.4 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Healthcare Contract Research Outsourcing Market Top Companies

- WuXi App Tec

- Worldwide Clinical Trials

- Thermo Fisher Scientific Inc.

- SynteractHCR

- Syneos Health

- Sygnature Discovery Limited

- SGS SA

- PSI CRO AG

- PRA Health Sciences, Inc.

- Pharm-Olam, LLC

- Pharmaron

- Pharmaceutical Product Development, LLC

- Atlas Clinical Research

- PAREXEL International Corp.

- Olon Ricerca Bioscience

- Medidata Solutions, Inc.

- Laboratory Corporation of America Holdings

- KCR S.A.

- Jubilant Biosys Ltd.

- IQVIA HOLDINGS INC.

- ICON Plc

- GVK Biosciences Private Limited

- CTI Clinical Trial & Consulting

- Covance Clinical Biotech

- Clitec

- Clinipace

- Charles River Laboratories International, Inc.

- Albany Molecular Research, Inc.

- Advanced Clinical

- Curavit

Recent Development by Atlas Clinical Research

- In December 2023, Atlas Clinical Research launched a multi-therapeutic, community-based research facility, Suncoast Clinical Research, in two locations in Palm Harbor and New Port Richey, Florida. Suncoast has managed many clinical research studies, including contract research outsourcing, sponsorships, and strong relationships with local communities.

Recent Development by Curavit Clinical Research

- In September 2023, Curavit Clinical Research launched a virtual contract research organization (VCRO) to manage the study of MedRhythm's neurorehabilitation system for heart attacks. This was designed to improve walking and ambulation in adults with chronic attacks.

Regional Insights

Asia Pacific is expected to grow fastest in the forecast period. The increasing government initiatives to boost drug-making procedures, the ease of keeping and enlisting patients, the adoption of rules by basically accepted norms, the accessibility of varied populations, and the increasing prevalence of chronic diseases and long-term illness are anticipated to drive the growth of the market in Asia Pacific. China, India, Japan, and South Korea are the emerging countries in the Asia Pacific region.

In China, various CRO companies are helping in the development of contract research outsourcing in the healthcare market. Medicilon is the China’s leading CRO company. It is a combined contract research organization offering profitable, complete R&D services for scientific research institutions and pharmaceutical enterprises around the globe. Medicilon focuses on addressing the demand for development and innovation based on the high demands of drug R&D. The company continuously innovates solutions by striving to prove comprehensive preclinical R&D and improving R&D efficiency to all new drug makers as they build into the leading contract research outsourcing.

North America dominated the healthcare contract research outsourcing market in 2023. The rising government initiatives for Research and Development activities through funding and subsidies to businesses and research organizations and growing significant concentration, solid regulatory frameworks, and robust CRO industry are anticipated to drive the growth of the market in North America. The U.S. and Canada are major emerging countries in North America. The U.S. is a highly dominated market in North America.

In the U.S., there are 4,232 contract research organizations and businesses in the healthcare sector. There are so many CRO companies in the healthcare sector in the U.S., such as Sofpromed, ProTials Research, In., Cromos Pharma, Medelis, Criterium, Advanced Clinical, Quality Data Service, Prometrika, Veristat, InClin, ProSciento and many more. These companies are CRO-generated and highly advanced in the management of clinical trials. They provide a full staff of clinical research services from site management to project management. They deliver clean data, trustworthy, top-notch customer service, and attention to detail. These are the major factors and leading companies of healthcare CRO and are expected to drive the growth of the healthcare contract research outsourcing market in North America.

Market Potential and Growth Opportunity

Technological advancements in CRO in healthcare

The adoption of advanced technologies such as artificial intelligence (AI), machine learning, big data, and the Internet of Things (IoT) helps to improve regulatory compliance, data analysis, patient recruitment, patient safety, and the security of patients' confidential data. With the help of advanced technology, contract research outsourcing can work more efficiently without error. These are the major factors anticipated to drive the growth of the market in the coming future.

Healthcare Contract Research Outsourcing Market News

- In January 2024, clinical research organizations and a world-leading healthcare intelligence launched its “Optimizing biotech funding” whitepaper. This offers an overview of the research and development strategies and current state of play for biotech companies. They highly highlighted the complexity of clinical trials.

- In November 2023, AstraZeneca launched an individual digital trial business for manufacturing drugs from digitally generated clinical trials, which provided a great experience. The innovative unit was merged with alliances with contract research organizations Fortrea and Parexel, which helped to transform its digital health services and products to its consumers.

Segments Covered in the Report

By Type

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Service

- Clinical Trial Services

- Preclinical

- Clinical

- Regulatory Services

- Clinical Data Management & Biometrics

- Electronic Data Capture

- Electronic Patient Recorded Outcomes

- Others

- Medical Writing

- Pharmacovigilance

- Site Management Protocol

- Others

By Application

- Oncology/Hematology

- Cardiovascular

- Autoimmune/Inflammation

- Central nervous system (CNS)

- Dermatology

- Infectious diseases

- Diabetes

- Pain

- Other

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device Companies

- Academic Institutes & Government Organizations

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2132

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308