What is the Healthcare Contract Research Outsourcing Market Size?

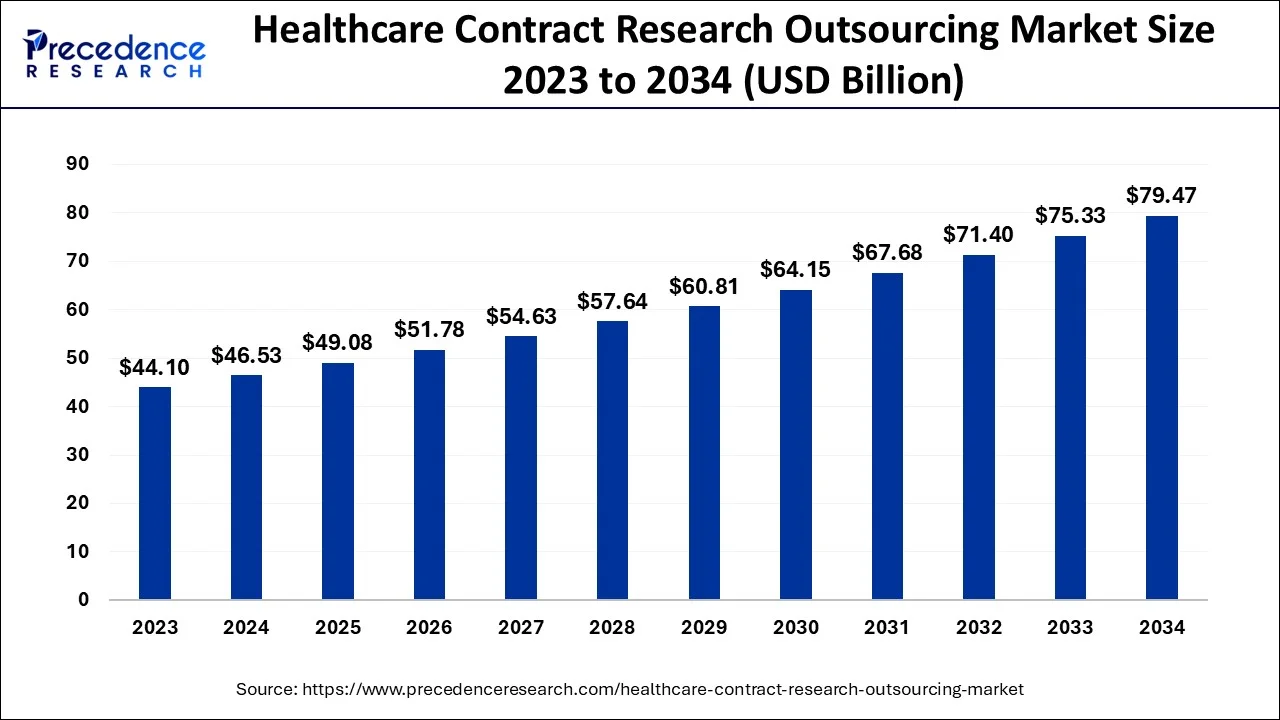

The global healthcare contract research outsourcing market size is calculated at USD 49.08 billion in 2025 and is predicted to increase from USD 51.78 billion in 2026 to approximately USD 83.47 billion by 2035, expanding at a CAGR of 5.45% from 2026 to 2035.

Healthcare Contract Research Outsourcing Market Key Takeaways

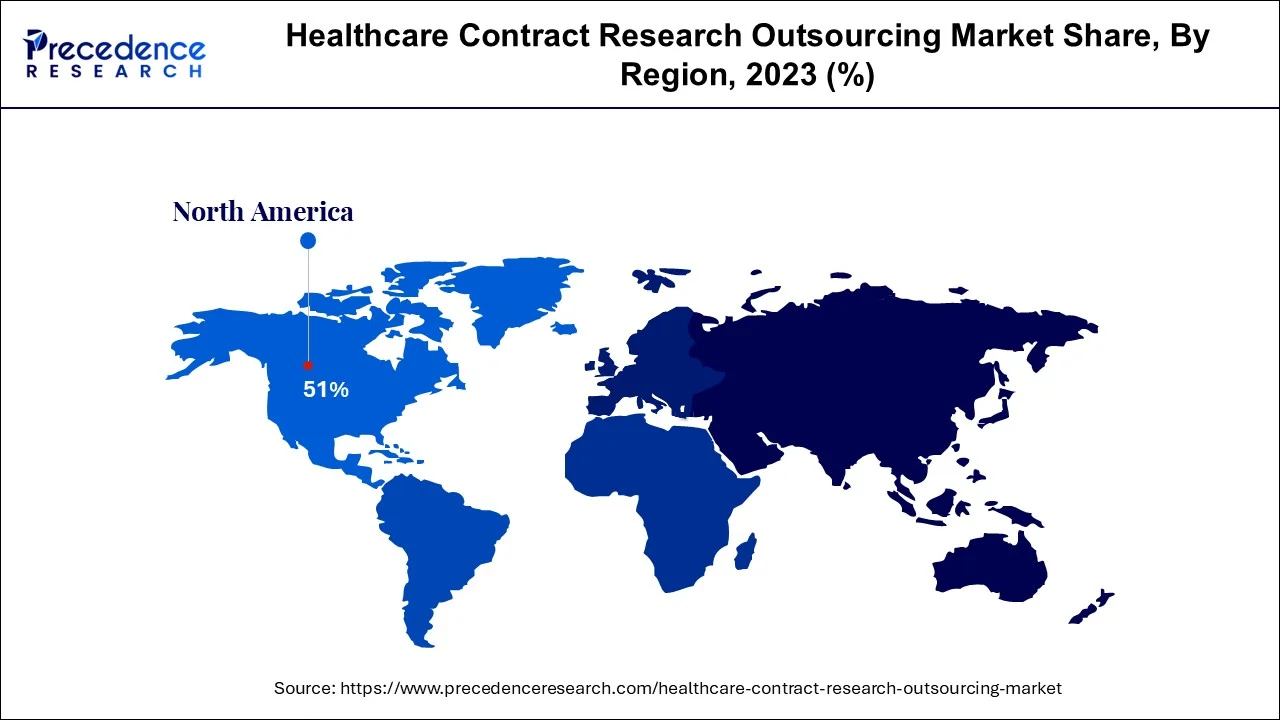

- North America dominated healthcare contract research outsourcing market with share of over 51% in 2025.

- By type, the medical contractual academic researchers segment dominated the market in 2025.

What is healthcare contract research outsourcing?

The key drivers anticipated to propel the market over the coming decades are the rising expenditure in R&D programs, the inclination for outsourced tasks due to cost and time limitations, and patent expiry in the healthcare industry. Government agencies prefer to send initiatives to contractual researcher outsourced partnerships because they provide cutting benefits, which helps the industry flourish. The market for contractual research companies in the medical industry is anticipated to increase as a result of additional pressure on pharmaceutical researchers to handle medical evidence, regulatory regimes, and strict safety regulations.

Organizations in the medical and pharmaceutical industries are exporting not simply the manufacturing of medications and also clinical studies. Exporting to underdeveloped nations has increased along with the privatization of clinical trials. To better serve their clients, several medical contract manufacturing businesses are currently expanding their international research infrastructure. For instance, ICON introduced a range of Accellacare in Sept 2020. This worldwide research connectivity allows consumers to obtain cutting-edge therapies more quickly and easily, allowing clients the opportunity to conduct decentralized studies.

Healthcare Contract Research Outsourcing Market Growth Factors

Due to the growing demand for product manufacturers linked to clinical research administration, government affairs outsourced, and strict safety requirements, there is projected to be an increase in the need for contract manufacturing insourcing within the healthcare industry. Pharmaceutical and healthcare companies outsource not only drug trade but also clinical studies. As clinical studies are becoming more privatized preclinical outsourced to wealthy nations is growing.

The global market for contract manufacturing outsourced in the pharmaceutical industry is projected to be driven by the complexity of regulatory processes and the growing participation of healthcare professionals in developing drugs and financing. The proficiency of CROs in medicinal fields and local registration procedures both contribute to the industry's expansion. At different stages of drug development, several contractual research organizations offer support with quarterly reports.

Market Outlook

- Industry Growth Overview

The growth is significantly driven by the growing complexity and volume of clinical trials, rising R&D investments from pharmaceutical and biotech companies (particularly in cancer and rare diseases), and the strong requirement for affordable and efficient drug development processes. - Global Expansion

The global healthcare contract research outsourcing (CRO) market is undergoing significant expansion, driven mainly by cost-efficiency requirements, growing R&D complexity, and technological development. North America is dominated in the market by a huge biotech presence and robust infrastructure. - Major investors

Major investors in the healthcare contract research outsourcing (CRO) market include massive, specialized private equity (PE) organizations and the venture capital (VC) goals of major pharmaceutical organizations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 49.08 Billion |

| Market Size by 2035 | USD 83.47 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.45% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Service, Application, End Use, and Geography |

Market Dynamics

Key Market Drivers

- Precision Drug development to boost Market Expansion: Due to the change in modern medical emphasis from response to preventive, personalized medicine is a relatively new concept in healthcare. Because court hearing treatment is so expensive, personalized medicine becomes more and more important for therapeutic strategies. The preponderance of CROs is concentrating on personalized medicine to cut down on time and total costs associated with failed drug development. At every stage, CROs provide support and guidance for personalized medicine trials. Due to the high cost of constructing extensive facilities with modern facilities, numerous smaller companies outsource their research and development (R&D) to preclinical CRO offerings to offerings reduce their overall costs along with the resources and time needed to complete the process, which contains all from drug perception to Food and drug administration marketing authorization.

- Chronic Illness Prevalence to Boost Market Expansion: Due to the high incidence of chronic illnesses, the accessibility of different populations, the simplicity with which clients may be attracted and maintained, and the adoption of legislation that follows accepted norms, the marketplace in China is anticipated to grow rapidly. The market is anticipated to grow over the next several years as a result of investments in infrastructure and personnel for essential services like imaging, central, laboratories, and healthcare supplies.

Key Market Challenges

Regulatory Guidelines Varying & Shortage of Skilled Individuals Limiting Market Growth

- The development of the industry is being hampered by a lack of knowledge in the area of medical CROs and variations in federal regulations and licensing procedures in different nations. The lack of skilled workers makes it difficult to implement advanced technology. Exporting research might save costs, but it may also compromise effectiveness and quality.

- It is crucial to make sure that the outcome is of appropriate quality because syndicated research job comprises outsourced clinical studies, medical writing, medical affairs, and government affairs. Some sectors of the industry are still skeptical of outsourcing since contracted research activities continue to be getting managed to the necessary standards.

Key Market Opportunities

Presentation of Well-Known Companies Increasing Market Revenue

- Because of the stringent requirements of the pharmaceutical companies, the United States controls the contractual researcher outsourced market for healthcare. The presence of long-running businesses and simple access to specialist technology both contribute to the industry's sales growth.

- Furthermore, the sector for contract manufacturing outsourced in medicine will advance due to the quick development of its imitation and biologic drugs industries along with an expansion in clinical study initiatives.

The increase in activities aimed at cutting costs and speeding up drug development

- The increment in efforts to cut costs and speed up the pharmaceutical development process, the growth of the variety of products and answers given by CROs, as well as the globalization of clinical studies are just a few of the driving factors in the anticipated expansion of the international healthcare agreement analysis terms of export. In the market for medical contract manufacturing outsourced, among the crucial services involve regulation, site management protocol, clinical trial, pharmacovigilance, and medical writer. These solutions are mostly employed by pharmaceuticals, government, academic, and medical product industries as well as pharmaceutical and biotechnology global businesses.

- According to estimates, the desire for outsourced regulation activities would rise, which will affect businesses in the worldwide healthcare contracts researcher outsourcing industry. This surge is attributable to increased regulatory agency scrutiny of clinical studies at all phases, particularly by the EMA and FDA. Additionally, it is anticipated that shifting regulatory requirements in each location will provide the potential for outsourced regulation activities.

Healthcare Contract Research Outsourcing Market Segment Insights

Type Insights

The market of medical contractual academic researchers was controlled by the medical services category in 2023, which also had the biggest revenue shares. This increase is due to several factors, including the growing use of biological drugs, current epidemics that have increased the requirement for new therapies, the desire for orphan medications and customized medicine, as well as the necessity for cutting-edge technology. Development is also anticipated to be fueled by elements including technological advancement, the globalization of clinical studies, and the need for contractual research organizations to conduct clinical studies. Even though that Phase 3 trial studies are among the costliest phases of clinical trials roughly 90.0% of the costs associated with clinical drug development outsourcing of these studies to medical contractual research firms produced the largest income in 2022.

Preclinical studies are anticipated to rise quickly during the projection period by 8.1%. Preclinical clinical CRO need is predicted to rise in response to a surge in preclinical studies worldwide and a rising need to control R&D costs, which is expected to fuel market expansion. A majority of the pharmaceutical industry is concentrating on the research of innovative therapies for the treatment of COVID-19 disease after 2021, which has significantly increased the supply for preliminary investigations as a result of the COVID-19 pandemic spread. For mRNA instance, Translate Bio, and Sanofi a firm developing clinical-stage mRNA treatments, announced on March 2021 the beginning of a preclinical investigation for MRT5500, a potential for such an mRNA vaccination against COVID-19-causing SARS-CoV-2. As a result, the mentioned factors will strongly aid in segment expansion.

Service Insights

Medical contract manufacturing companies' largest income share in 2025 came from the associated healthcare category, which controlled the industry. This may be explained by the rise in clinical studies and the requirement to keep track of the investigations that are driving up the need for such solutions. Over the past ten years, medical research has been outsourced to CROs for a variety of reasons, including cost efficiency and technical knowledge. It is anticipated that the adoption of real-time data collecting tools and smart analytics will enhance associated healthcare information in the healthcare industry.

The medical contract manufacturing organizations market is projected to develop at the quickest rate in the government affairs sector. Due to the rise in R&D activities, product registration, clinical study submissions, and therapeutic pipelines, the outsourced of government relations is growing quickly. The company's expansion is anticipated to be supported by the rising need to win approval for brand-new goods, enforce consistency, and accomplish more in less time.

Application InsightsÂ

A large oncology pipeline with more than 600 compounds is in the final development stages. Therefore, it is predicted that by the end of the projection period, the oncology or hematology category will hold the biggest market share. The Food and Drug Agency approved 50 new medications in 2021 for 22 purposes, yet there are still a great number of curable cancers kinds that are curable. As a result, there is a greater need for the creation of new pharmaceutical drugs, which stimulate medication innovation. Additionally, since no one medicine is enough for the chemotherapy of cancer, there is intense competition within the oncology market. This necessitates the ongoing creation of improved treatment alternatives, that supports the oncology market.

End User InsightsÂ

Pharmaceutical businesses are focusing on developing safer and more effective technologies. During the projection period, rising R&D spending is anticipated to aid biopharmaceutical businesses in boosting their revenues. R&D is being quickly outsourced by pharmaceutical companies to CROs so order to reduce the expenses associated with the internal testing platforms. Small pharmaceutical enterprises are searching for advancements in product design using CRO technologies as a result of a rise in the market for advanced designs and copyright obsolescence. Pharm companies hold a sizable portion of the worldwide healthcare agreement investigation companies outsource the industry due to the increasing sophistication of developing drugs, the need for shortened drug discovery timeframes, cost efficiency, and the advantage of obtaining medicinal expert knowledge affiliated with outsourcing to CROs.

Healthcare Contract Research Outsourcing Market Regional Insights

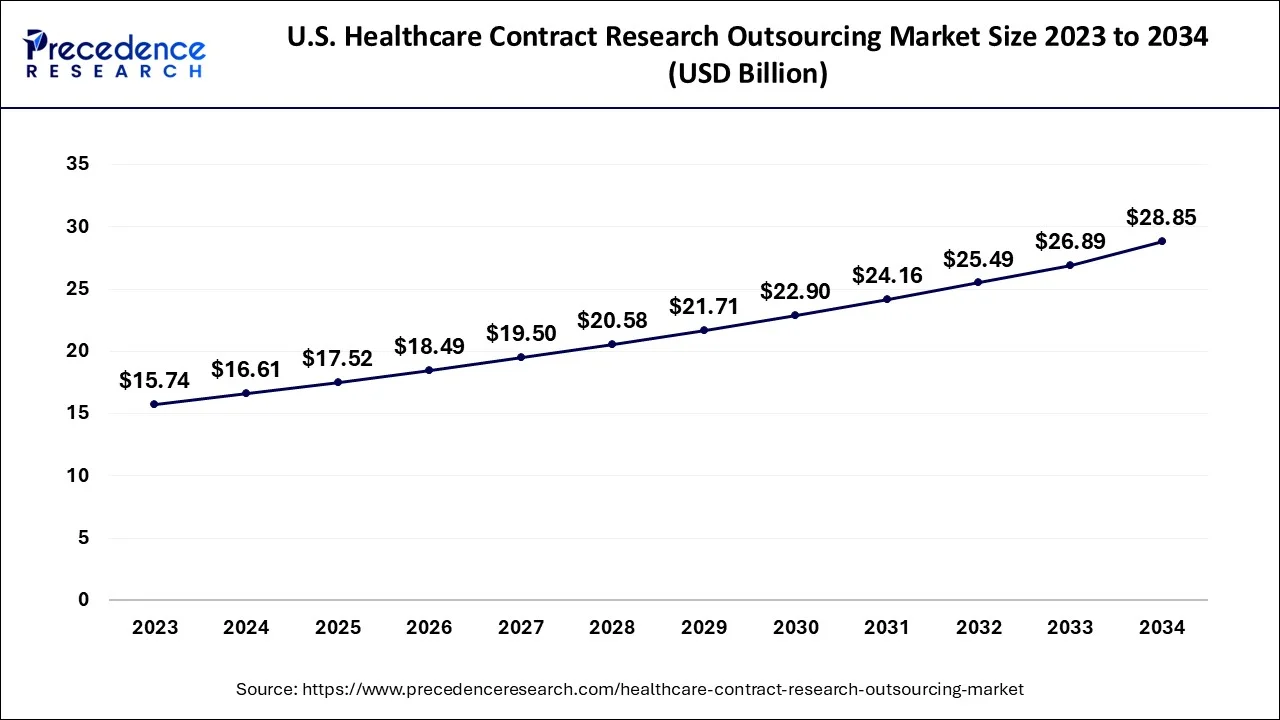

The U.S. healthcare contract research outsourcing market size is evaluated at USD 17.52 billion in 2025 and is predicted to be worth around USD 30.44 billion by 2035, rising at a CAGR of 5.68% from 2026 to 2035.

North America: Increasing government support

Due to the significant volume of trials conducted and outsourcing within the region, North America represented highest share of over 51% in 2023. This regional industry has also been fueled by the increased government assistance for Research and development activities through subsidies and funding to research organizations and businesses. For instance, the United States government made investments in medical and health R&D in 2018. Similar to this, the Pharmaceutical Technological Development and Research Organization engaged in the creation of COVID-19 vaccinations as a result of the epidemic.

Asia Pacific: Significant prevalence of long-term illnesses

The Asia Pacific region is growing at a remarkable CAGR from 2026 to 2035. Additionally, it is projected that the region would expand quickly over the projected timeline. This may be due to the significant prevalence of long-term illnesses, the accessibility of varied populations, the ease of enlisting and keeping patients, and the implementation of rules by generally accepted norms. In addition, effective government attempts to speed up the permitting process for drugs are boosting the industry. For instance, the Directorate of Pharmaceuticals (India) established new regulations in October 2021 to speed up R&D efforts in the nation by reducing the time needed for approvals by a minimum of 50% during the following two years. These approaches should help to accelerate growth in the region even more

In the U.S. advanced biopharmaceutical industry, substantial R&D spending, advanced infrastructure, and a well-developed, promising government environment. The U.S. is a hub for a large number of pharmaceutical and biotech companies, which are the primary clients of CROs. The presence of venture capital organizations and major life science hubs drives the growth of the market.

In India presence of a large population of over 1.4 billion people presents noteworthy genetic and epidemiological diversity, as well as a large pool of treatment-naïve patients in a broad range of diseases. India has invested in world-class research organizations, well-equipped hospitals, and a strong IT infrastructure, which helps the incorporation of developed technologies.

Europe's significant growth in healthcare contract research outsourcing (CRO) stems from increasing pharma R&D spending, challenging guidelines driving the requirement for specialized expertise, growing focus on niche areas such as rare diseases, and rapid tech adoption for efficiency, pushing companies to outsource for expense savings, speed, and better compliance, especially with the EU's combined yet demanding frameworks.

The UK is a hub for leading universities, research centers, and institutions that manufacture top-tier research talent and foster a dynamic pipeline of innovative start-ups. There is a growing trend toward long-term, strategic partnerships among the pharmaceutical firms and UK CROs.

Value Chain Analysis - Healthcare Contract Research Outsourcing Market

- R&D:

Healthcare CRO R&D processes cover the whole drug/device lifecycle, from early drug discovery through Preclinical to extensive clinical trials (Phases I-IV), including regulatory affairs, biometrics, medical writing, Pharmacovigilance, and Post-Market Surveillance.

Key Players:Apollo Global Management and Warburg Pincus - Clinical Trials:

Clinical Trial processes in healthcare contract research outsourcing (CRO) include a full spectrum of services, from site selection, protocol design, patient recruitment, monitoring, data management, biostatistics, and government submissions, to pharmacovigilance.

Key Players: Linden Capital and Leonard Green - Patient Services:

Healthcare Contract Research Organizations (CROs) provide different patient-centric services, primarily as part of managing clinical trials on behalf of pharmaceutical and biotechnology organizations.

Key Players: IQVIA and ICON

Top Companies in the Healthcare Contract Research Outsourcing Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Advanced Clinical |

United States |

Integrated solutions model and therapeutic expertise |

Advanced Clinical provides CRO, FSP, and Strategic Resourcing services that deliver a better clinical experience. |

|

Albany Molecular Research, Inc. |

United States |

Global footprint and customer approaches |

Albany Molecular Research Hyderabad Research Centre Pvt. Ltd. operates within the pharmaceutical contract research and development (CRD) microsector |

|

Charles River Laboratories International, Inc. |

United States |

Comprehensive service offerings and a comprehensive service portfolio |

Charles River provides essential products and services to help pharmaceutical and biotechnology companies, government agencies, and leading academic institutions around the globe accelerate their research and drug development efforts. |

|

Clinipace |

United States |

Personalized and flexible client partnerships |

Clinipace is a global, full-service CRO, aligned with biopharma innovators. |

|

Clintec |

United Kingdom |

It provides flexible, customized solutions |

ClinTec offered comprehensive contract research services, including project management, clinical monitoring, data management, and biostatistics. |

Healthcare Contract Research Outsourcing Market Companies

- Advanced Clinical

- Albany Molecular Research, Inc.

- Charles River Laboratories International, Inc.

- Clinipace

- Clintec

- Covance Clinical Biotech

- CTI Clinical Trial & Consulting

- GVK Biosciences Private Limited

- ICON Plc

- IQVIA HOLDINGS INC.

- Jubilant Biosys Ltd.

- KCR S.A.

- Laboratory Corporation of America Holdings

- Medidata Solutions, Inc.

- Olon Ricerca Bioscience

- PAREXEL International Corp.

- Pharmaceutical Product Development, LLC.

- Pharmaron

- Pharm-Olam, LLC

- PRA Health Sciences, Inc.

- PSI CRO AG

- SGS SA

- Sygnature Discovery Limited

- Syneos Health

- SynteractHCR

- Thermo Fisher Scientific Inc.

- Worldwide Clinical Trials

- WuXi AppTec

Recent Developments

- To integrate its imaging techniques and processes using Medidata Rave imagery for clinical studies, Medpace Holding, Inc., a medical CRO, tied up with Medidata Technologies, a provider of software and services, in Mar 2020.

- May 2021 - Aragon Biological Sciences, a top contract research organization that was previously named GVK Bioscience, reported that Goldman, a prominent Indian investor, had acquired stock that had previously been owned by ChrysCapital as well as other current shareholders.

- March 2021 - One of the biggest medical facilities in Latin America, Hospital Alamo Oswaldo Cruz, has announced cooperation with TriNetX and would join the network for international health study.

- February 2021 - PRA Biomedical Sciences, Inc., a worldwide contract research company, will be acquired by Icon plc, a company that provides an outsourced drug as well as device advancement and corporatization offerings to the biotechnology, pharmaceutical, and medical product industry sectors, as well as government and the public medical associations.

- Inspire launched an initiative to encourage cooperative relationships in September 2020. The Inspired Researcher Accelerated is made to enable collaboration between university scholars from all over the world and the business.

Healthcare Contract Research Outsourcing Market Segments Covered in the Report

By Type

- Drug Discovery

- Target Validation

- Lead Identification

- Lead Optimization

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Service

- Clinical Trial Services

- Preclinical

- Clinical

- Regulatory Services

- Clinical Data Management & Biometrics

- Electronic Data Capture

- Electronic Patient Recorded Outcomes

- Others

- Medical Writing

- Pharmacovigilance

- Site Management Protocol

- Others

By Application

- Oncology/Hematology

- Cardiovascular

- Autoimmune/Inflammation

- Central nervous system (CNS)

- Dermatology

- Infectious diseases

- Diabetes

- Pain

- Other

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device Companies

- Academic Institutes & Government Organizations

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting