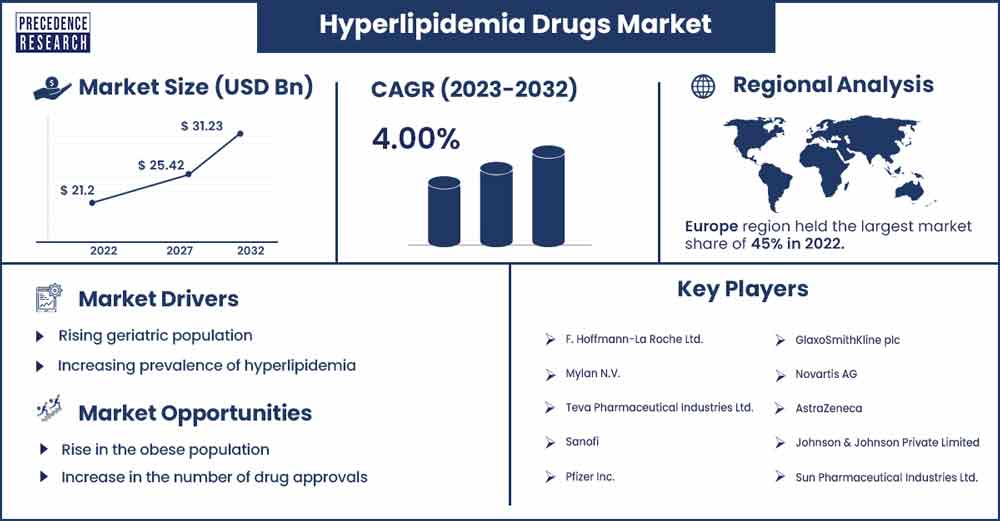

Hyperlipidemia Drugs Market To Attain Revenue USD 31.23 Bn By 2032

The global hyperlipidemia drugs market revenue was exhibited at USD 21.2 billion in 2022 and is projected to attain USD 31.23 billion by 2032, growing at a CAGR of 4% from 2023 to 2032.

Market Overview

In medical terms, hyperlipidemia refers to abnormally high levels of lipids or fats in the blood. The liver can make as much cholesterol as required, but the cholesterol from the consumption of foods is extra. High cholesterol is harmful; it can create roadblocks in artery highways where blood travels around the body, damaging organs as they cannot receive enough blood from the arteries. Hyperlipidemia is mainly classified into types, such as acquired and familial. Acquired hyperlipidemia is caused due to certain lifestyle factors including diet and too little physical activity. The familial type is inherited from the parents.

Hyperlipidemia is a common condition that is an imbalance of cholesterol in the body caused by a combination of excess low-density lipoprotein (LDL) cholesterol and insufficient high-density lipoprotein (HDL) cholesterol to clear it up. Hyperlipidemia can be severe if the high cholesterol is left untreated. This will result in the accumulation of plaque inside the blood vessels, which puts the risk of a heart attack or stroke. This health condition deprives the brain and heart of the necessary nutrients and oxygen to function. Hyperlipidemia drugs assist people by reducing the risk of heart attacks or strokes.

Growth Factors

The hyperlipidemia drugs market is driven by several factors, including inactive or unhealthy lifestyles, increasing healthcare expenditure, rise in population, increasing advanced research and development activities, growing number of high cholesterol patients, increasing demand for personalized medicine, use of health insurance in emerging economies, and expanding aging population. Additionally, widespread public awareness regarding the risk of cardiovascular diseases (CVD) due to persistent hyperlipidemia and increasing product approval for the treatment of hypercholesteremia is projected to boost the growth of the hyperlipidemia drugs market during the forecast period.

- In November 2023, it was announced that two new gene-editing treatments that target severe high levels of cholesterol in people with a genetic predisposition to the condition were found safe and effective in new, groundbreaking research. These studies were presented at the American Heart Association (AHA) annual meeting in Philadelphia.

- In November 2023, Lupin Limited announced that it had received approval from the United States Food and Drug Administration (FDA) for its new drug applications for Pitavastatin tablets, 1 mg, 2 mg, and 4 mg, and to market a generic equivalent of Livalo tablets, 1 mg, 2 mg, and 4 mg, of Kowa Company Limited. The product will be manufactured at Lupin's Pithampur facility in India. Pitavastatin Tablets are indicated as an adjunct to diet to reduce low-density lipoprotein cholesterol (LDL-C) in adults with primary hyperlipidemia. Pitavastatin Tablets (RLD Livalo) had estimated annual sales of $298 million in the United States.

- In August 2023, China's National Medical Products Administration approved the use of Inclisiran, a cholesterol-lowering small interfering RNA (siRNA), for the treatment of adults with primary hypercholesterolemia (heterozygous familial and non-familial) or mixed dyslipidemia. It was developed by Novartis; Inclisiran is the world's only siRNA medicine for LDL-C reduction.

- In November 2023, Eli Lilly announced the expansion of injectable manufacturing capacity with USD 2.5 billion in Germany to support an increasing demand for diabetes and obesity. The facility is expected to be operational in 2027 and is projected to employ more than 1000 highly skilled workers.

- In March 2023, Evonik inaugurated a new facility for pharmaceutical lipids at the site in Hanau, Germany. The company opened a new GMP facility to manufacture lipids for advanced pharmaceutical drug delivery applications. The lipid launch facility provides customers with quantities of lipids as needed for clinical and small-scale commercial manufacturing.

Hyperlipidemia Drugs Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 21.94 Billion |

| Projected Forecast Revenue by 2032 | USD 31.23 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America is expected to hold the largest revenue share over the forecast period owing to the sophisticated healthcare infrastructure, increasing investment in research & development activities, growing ageing population, rising prevalence of hypercholesteremia, and access to advanced medical treatments. The United States is the leading revenue contributor in the region. This is mainly attributed to an increase in the obese population, increased awareness of cardiovascular diseases, rapid advancement in the field of lipid-lowering medications, shifting dietary patterns and sedentary lifestyle, and the presence of prominent market players, including Merk & Co Mylan, Amgen, Pfizer Inc., Johnson & Johnson Private Limited, Eli Lilly and Company, Regeneron Pharmaceuticals Inc., and Esperion Therapeutics, Inc.

The rise in healthcare expenditure in the United States population is likely to drive market growth. According to secondary sources, in 2023, the United States is projected to spend around USD 4.7 trillion or nearly 18 % of the national economy on healthcare. On a per capita basis, the U.S. spends almost double the average of similarly wealthy countries. The rapidly increasing prevalence of obesity is projected to increase United States healthcare spending by USD 170 billion each year (including billions by Medicare and Medicaid). The increasing number of product approvals is also likely to fuel the market expansion.

- In September 2023, Ultragenyx Pharmaceutical Inc., a biopharmaceutical company, announced the approval of Evkeeza (evinacumab) in Canada for the treatment of Homozygous familial hypercholesterolemia (HoFH). The treatment is now available to prescribe for patients with HoFH in Canada. Evkeeza was approved by Health Canada as an adjunct to diet and other low-density lipoprotein cholesterol (LDL-C) lowering therapies for the treatment of adult and paediatric patients aged five years and above with HoFH.

Market Dynamics

Drivers

Rising geriatric population

The increasing geriatric population is projected to boost the growth of the global hyperlipidemia drugs market in the coming years. The rising ageing obese population is more susceptible to heart disease or stroke. The number of persons aged 65 years or older across the globe is projected to double over the next three decades, according to the United Nations World Social Report 2023. The rising ageing population have spurred the demand for hyperlipidemia drugs.

Increasing prevalence of hyperlipidemia

The rising prevalence of hyperlipidemia across the globe is anticipated to fuel the growth of the global hyperlipidemia drugs market in the coming years. Individuals with high cholesterol and triglycerides have hyperlipidemia, which may result in cardiovascular diseases (CVD), stroke, and artery disease. For instance, according to the CDC report published in May 2023, nearly 86 million United States individuals above the age of 20 have levels of cholesterol beyond 200 mg/dL. Roughly 25 million of this group have levels above 240 mg/dL.

Hyperlipidemia is very common; in some cases, high cholesterol has no symptoms, and a simple blood test can detect cholesterol levels. Hyperlipidemia drugs improve cardiovascular health and reduce disparities associated with heart disease and stroke. The acquired type of hyperlipidemia is the general result of lifestyle choices, dietary habits, underlying health conditions, and medications an individual consumes. Thus, this is expected to propel the market growth in the region during the forecast period.

Restraint

The high cost of hyperlipidemia drugs

The high cost associated with the treatment and hyperlipidemia drugs is projected to hamper the market's growth rate. The high cost of drugs may result in less adoption in lower- and middle-income economies. Research, clinical trials, and approval procedures for the development of new medicine are expensive. In addition, stringent regulatory policies limit market growth, which acts as a significant restraint for it.

Opportunities

Rise in the obese population

The rise in the obese population is expected to fuel the global hyperlipidemia drugs market. The growth in the obese population increased the adoption of hyperlipidemia drugs. In 2022, nearly 35% of adults were obese in 22 states; this was a significant increase from 19 states in 2021, as per the US Centers for Disease Control and Prevention data. No state had an adult obesity prevalence at or above 35% ten years ago. According to Harvard University, nearly 2 out of 3 U.S. adults are overweight or obese, and one out of three are obese. If the trend continues to grow, then by 2030, it is estimated that nearly half of all men and women will be obese. The burden of obesity is associated with various chronic diseases, including stroke, heart disease, hypercholesteremia, and others. Therefore, the robust growth in the obese population is projected to the market growth in the region during the forecast period.

Increase in the number of drug approvals

The increase in the number of drug approvals is projected to offer a lucrative opportunity for market growth during the forecast period. The patient population having comorbidities such as hypertension and diabetes and who have not yet had a first cardiovascular event are often targeted by pharmaceuticals. Such an increase in the number of drug approvals is projected to witness the fastest growth during the forecast period.

In July 2023, Novartis Pharmaceuticals Corporation announced that the US FDA approved Leqvio (inclisiran) for the treatment of adults with high LDL-C who have an increased risk of heart disease as an adjunct to diet and statin therapy.

Recent Development

- In August 2022, Esperion announced bempedoic acid (NEXLETOL) as a recommended oral non-statin therapy for LDL-cholesterol (LDL-C) reducing atherosclerotic cardiovascular disease (ASCVD) by the American College of Cardiology (ACC) task force on expert consensus decision pathways (ECDP).

- In May 2022, Zydus Lifesciences launched its bempedoic acid drug in India under the Bemdac brand for the treatment of uncontrolled levels of bad cholesterol.

Key Market Players

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

- AstraZeneca (U.K.)

- Johnson & Johnson Private Limited (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Bristol-Myers Squibb Company (U.S.)

- Eli Lilly and Company (U.S.)

- Regeneron Pharmaceuticals Inc. (U.S.)

- Amgen Inc. (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Alnylam Pharmaceuticals, Inc. (U.S.)

- Dr. Reddy's Laboratories Ltd. (India)

- Esperion Therapeutics, Inc. (U.S.)

- Formac Pharmaceuticals N.V. (Belgium)

Segments Covered in the Report

By Drug Class

- Statins

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- Fibric Acid Derivatives

- PCSK9 Inhibitors

- Combination

- Miscellaneous

By Route of Administration

- Oral

- Parenteral

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3408

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308