Interactive Wound Dressing Market Size To Rise USD 7.60 Bn By 2032

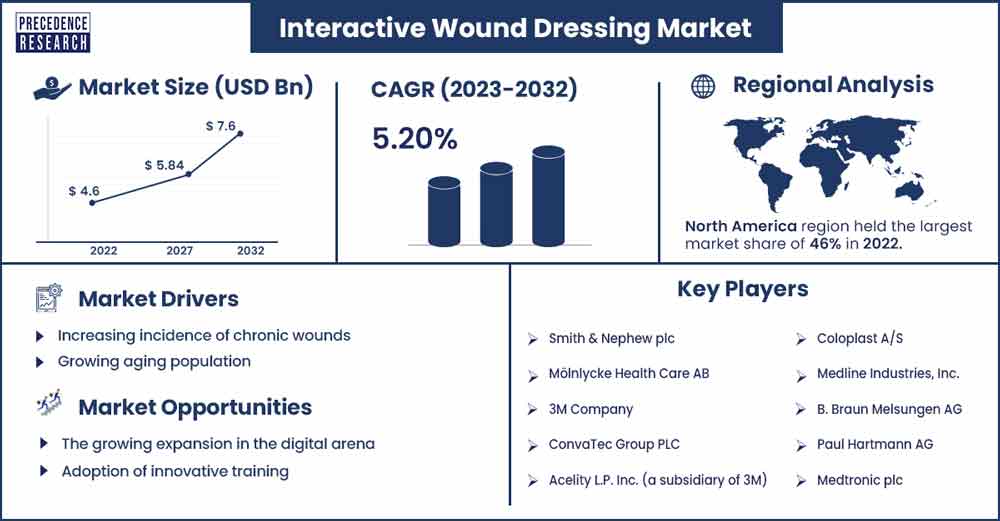

The global interactive wound dressing market size is estimated at USD 4.6 billion in 2022 and is expected to reach USD 7.60 billion by 2032, growing at a CAGR of 5.20% during the forecast period.

Market Overview

The terms passive, active, and interactive are occasionally used to characterize wound dressings. Active wound dressings facilitate healing by generating a moist wound environment, whereas passive dressings just provide protection. Contrarily, interactive wound dressings engage with the elements of the wound bed in addition to producing a wet wound environment to promote wound healing even further. For instance, interactive wound dressings can increase wound bed moisture retention, decrease the amount of exudate, eliminate cellular products, decrease the colonization count, and preserve the epithelializing bed.

Growth Factors

The interactive wound dressing market is driven by several factors including a growing ageing population, rising technological advancements, increasing incidence of chronic wounds, prevalence of diabetes and growing awareness and education. Furthermore, the increasing investment in interactive wound care dressing is expected to propel the market expansion during the projected timeframe.

In June 2022, to enhance advanced wound care, Smith & Nephew recently opened its newest production and research facility. The investment has a USD 100 million value. It's also probable that a grant from the UK government will help fund the development. In its first ten years of operation, the new plant is anticipated to support sales of more than USD 10 billion.

- The Medicare program received around USD 6.1 billion from the Australian government, which served as the impetus for major improvements. It begins changes to create a better Medicare for future generations while providing vital funds to satisfy the pressing healthcare needs of the present.

- In June 2023, Flanders Innovation & Entrepreneurship (VLAIO) granted Flen Health a research and development grant of 1.7 million to further capitalize on its leadership experience in biological wound therapy research and development. The total monetary amount represented by the grant is around 60% of the project's $3,000,000 budget. The grant's funding will help Flen Health's unique enzyme technology and research platform be implemented more quickly. It will also advance our understanding of recombinant engineering and pave the way for the creation of cutting-edge biological enzyme-based treatments for chronic and non-healing wounds. Facilitating the cross-fertilization of the business's expanding pipeline of innovative and patentable wound and skin care candidate medications.

Regional Insights

North America held the largest market share in 2022 and is expected to continue the same pattern during the forecast period. The regional market expansion is driven by several factors including the growing ageing population, the prevalence of chronic diseases and an increasing emphasis on advanced wound care.

- For instance, according to the U.S. Census Bureau's Vintage 2022 Population Estimates, the median age in the US grew by 0.2 years to 38.9 years between 2021 and 2022. The age at which 50% of people are older and 50% are younger is known as the median age. Meanwhile, the Population Reference Bureau projects that the number of Americans 65 and over will almost double from 52 million in 2018 to 95 million by 2060, accounting for a 23 percent increase in the age group's proportion of the overall population.

The United States in North America is expected to hold the prominent market revenue share during the projected timeframe. The market growth in the US is mainly driven by the growing population having chronic conditions. In addition, the market growth is also driven by the advanced healthcare infrastructures and the growing government funding for advanced technologies.

Interactive Wound Dressing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 4.82 Billion |

| Projected Forecast Revenue by 2032 | USD 7.60 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.20% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing incidence of chronic wounds

The rising incidence of chronic wounds, such as diabetic ulcers and pressure sores, is likely to drive the demand for innovative wound care solutions, including interactive dressings. For instance, according to the National Institute of Health, between 9.1 and 26.1 million diabetic foot ulcers occur each year worldwide. Throughout their lives, 15 to 25% of people with diabetes mellitus will get a diabetic foot ulcer. The frequency of diabetic foot ulcers is certain to rise in tandem with the annual increase in the number of people diagnosed with diabetes.

Growing aging population

The global ageing population is increasing, leading to a higher prevalence of chronic disease and age-related conditions. This demographic trend may contribute to the expansion of the wound care market, including interactive wound dressings. For instance, according to the Australian Institute of Health and Welfare, diabetes became more common as people age in 2022, with about 1 in 5 Australians aged 80–84 having the disease, which is nearly 30 times higher than the 0.7% of those under 40 who had the disease. After adjusting for age, males had a 1.3-fold higher prevalence of diabetes than females. Between 2000 and 2012, the age-standardized prevalence rate of diabetes rose by more than 80%, and in the ten years that have passed, it has essentially not altered.

Restraints

High cost

Interactive wound dressings often involve advanced technologies and materials, making them more expensive than traditional dressings. The higher costs may be a barrier to widespread adoption, especially in healthcare systems where cost-effectiveness is a critical consideration. Thus, the high cost is expected to hamper the market growth during the forecast period.

Limited clinical evidence and educational barriers

Some interactive wound dressing technologies may lack extensive clinical evidence supporting their efficacy and superiority over traditional wound care methods. Healthcare providers may be cautious in adopting new technologies without robust clinical data. In addition, healthcare professionals and patients may require education and training to properly use and understand the benefits of interactive wound dressings. Overcoming educational barriers is essential for the successful adoption of these technologies. Thus, this is expected to negatively impact the market expansion during the projected period.

Opportunities

Growing expansion

The growing expansion in the digital arena by the market players is expected to provide a lucrative opportunity for market growth during the forecast period. For instance, in June 2022, NATROX® IQ, a new product from NATROX® Wound Care, marked the company's entry into the digital space. A computerized application called the advanced wound hub was created especially to assist wound care teams in better managing their caseloads. When collecting and recording patient wound data, clinicians can attain uniformity in their work. NATROX® IQ, which is now accessible through distribution partners in Malaysia and Hong Kong, is intended to simplify wound documentation.

Adoption of innovative training

The growing initiatives by the market players to adopt innovative ways of training in the wound care industry are expected to offer a potential opportunity for market development over the forecast period. For instance, in March 2022, HARTMANN declared the launch of their Virtual Reality Wound Care Training globally. This unique learning opportunity is built around their proprietary VR simulation, which gives a genuine clinical experience in wound management.

At the World Union Wound Healing Societies (WUWHS) Congress in 2022, medical practitioners will have the opportunity to test VR modules. By immersing students in 3D replicas of wound care clinic rooms furnished with HARTMANN wound dressings, the virtual reality modules on chronic wounds replicate every facet of wound evaluation and therapy. The students practice handling real-world scenarios by assessing wounds, selecting the most appropriate course of action, and applying dressings correctly.

Recent Developments

- In June 2023, the Evonik company JeNaCell introduced the epicite® balancing wound dressing to the German market. Pressure ulcers, venous leg ulcers, arterial leg ulcers, diabetic foot ulcers, and soft tissue lesions are among the chronic wounds with low to medium exudation for which the dressing is especially well-suited and optimized. Hospitals and homecare facilities will get epicite® balance, which is available in three sizes, from Coopmed ApS.

- In September 2023, a leading provider of point-of-care fluorescence imaging for the real-time identification of wounds with elevated bacterial loads, MolecuLight Inc., announced that six clinical posters, a presentation, and a hands-on workshop will be presented at the American Professional Wound Care Association's (APWCA) Wound WeekTM, which will take place in Philadelphia, Pennsylvania. Leading interdisciplinary wound care specialists gather for Wound Week, where faculty members share state-of-the-art clinical results and best practices.

Key Market Players

- Smith & Nephew plc

- Mölnlycke Health Care AB

- 3M Company

- ConvaTec Group PLC

- Acelity L.P. Inc. (a subsidiary of 3M)

- Coloplast A/S

- Medline Industries, Inc.

- B. Braun Melsungen AG

- Paul Hartmann AG

- Medtronic plc

- Integra LifeSciences Holdings Corporation

- Lohmann & Rauscher GmbH & Co. KG

- Gentell, Inc.

- DermaRite Industries, LLC

- Advancis Medical Ltd.

Market Segmentation

By Product

- Semi-permeable films dressing

- Semi-permeable foams dressing

- Hydrogel dressing

By Application

- Chronic Wounds

- Acute Wounds

By End-use

- Hospitals

- Outpatient Facilities

- Home care

- Research & manufacturing

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3328

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308