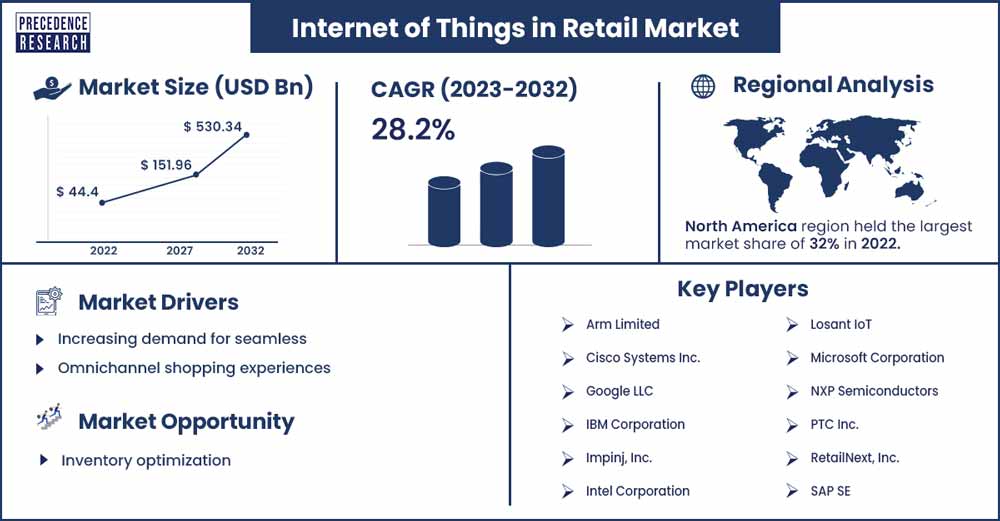

Internet of Things in Retail Market Will Grow at CAGR of 28.2% By 2032

The global internet of things in retail market size was exhibited at USD 44.4 billion in 2022 and is anticipated to reach around USD 530.34 billion by 2032, growing at a CAGR of 28.2% from 2023 to 2032.

Market Overview

Retailers can monitor their inventories in real time with the use of the internet of things (IoT). Throughout the supply chain, efficiency increases by lowering errors, monitoring stock levels, and utilizing sensor technologies like radio frequency identification (RFID). Retailers use IoT to improve the in-store experience for customers. For instance, beacons can provide tailored advertisements to customers' smartphones based on their location within a store, and smart shelves can display product information. IoT is essential to supply chain optimization because it offers real-time data on product movement, improves logistics management, and minimizes errors and delays. Retailers are using IoT technology to build intelligent stores. This involves monitoring foot traffic, analyzing consumer behavior, and refining store layouts for increased productivity using sensors and cameras.

Retailers can collect and analyze consumer data thanks to IoT, enabling more individualized shopping experiences. This results in higher client satisfaction and includes tailored services, targeted marketing, and personalized recommendations. Inventory tracking can be automated with RFID tags and intelligent shelves with IoT sensors installed. This minimizes the need for human stock inspections and reduces errors in stock management. Retailers can utilize this data to optimize pricing strategies, make data-driven decisions, and enhance overall business success. Retailers may maximize energy efficiency using IoT technologies for intelligent HVAC and lighting systems. Self-checkout systems enabled by IoT reduce wait times and enhance the shopping experience by streamlining the payment process.

- In November 2022, Investors were withholding money from firms producing internet-connected retail equipment due to slumping markets, which might stifle new ideas for products like robots that manage inventory and intelligent shopping carts. With some notable outliers in security and linked cars, investment expenditure in Intern tog Thing's businesses decreased 57.2% from the previous quarter to approximately $2.8 billion. This outpaces a 22.2% decline in funding for all information technology firms, which dropped to $59.5 billion.

- In June 2023, a recent report from the international data corporation called the Worldwide Internet of Things spending guide projects that global spending on the IoT would reach $805.7 billion in 2023, up 10.6% from the previous year. The IoT ecosystem is predicted to attract investments exceeding $1 trillion, growing at a CAGR of 10.4%.

Regional Snapshot

North America holds the largest share of the IoT in the retail market. Retailers track and manage inventories in real-time by deploying IoT devices like RFID tags and sensors. This minimizes overstock circumstances, lowers stockouts, and boosts supply chain efficiency. The technology is being used to improve customers' in-store experiences. Retailers are introducing smart shelves, for instance, which can offer individualized promotions and real-time product information based on consumer behavior and interests.

These systems adapt to changes in customer traffic and natural light levels. Retail establishments use IoT equipment, like sensors and video cameras, for security and loss prevention. These gadgets can monitor retail spaces and notify security staff of any questionable activity. North America has several key players of the Internet of Things in the Retail Market, including Cisco, IBM, Intel, Microsoft, PTC, Sierra Wireless, AWS, SAP, Software AG, Bosch.IO, Google, Oracle, AT&T, and Vodafone.

- In November 2023, the industry-leading continuous access and authorization management firm, SGNL.ai, announced that Cisco Investments has become a member of its robust investor syndicate, which also includes Moonshots Capital, Costanoa Ventures, Fika Ventures, and Resolute Ventures.

- In November 2023, a $8.46 billion investment was revealed by Google, Microsoft, and Amazon web services in Thailand. Every business will put in 100 billion baht. Most of the funds will go towards building data centers nationwide. Aws intends to construct one for $5 billion over 15 years.

In the United States, real-time inventory tracking is done through IoT devices like sensors and RFID tags. RFID-enabled smart shelves assist merchants in keeping an eye on product levels, which lowers out-of-stock scenarios and enhances overall inventory control. Depending on location or previous purchases, customers can receive tailored discounts or promotions from beacon technology and intelligent displays. Sensors are used in warehouses and vehicles to guarantee that items arrive at their destination in the best possible condition. These systems frequently give real-time product availability updates through inventory management integration.

Retailers in Canada track and control inventories in real-time using IoT devices like sensors and RFID tags, resulting in better stock accuracy, fewer out-of-stock scenarios, and increased supply chain efficiency. This can include in-store navigation systems, targeted advertising sent straight to customers' cellphones, and smart shelves that display product information. Innovative stores are developed with the help of IoT technologies. These retailers optimize store layouts, boost operational efficiency, and improve energy efficiency through linked devices and data analytics. IoT is used in security, protecting consumer data and the physical shop using smart locks, surveillance cameras, and other networked equipment.

- In December 2022, Wyld's revolutionary new satellite of IoT service was announced. The need for worldwide connectivity is impeding the IoT potential to contribute US$2-3 trillion to the world economy in the next ten years. Wyld Link contributes to the solutions by enabling organizations and governments to use LEO satellites to link their IoT devices globally.

Internet of Things in Retail Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 56.70 Billion |

| Projected Forecast Revenue by 2032 | USD 530.34 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 28.2% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Enhanced marketing and advertising

IoT facilitates inventory tracking, guaranteeing that goods are available for purchase when consumers need them. This raises client satisfaction and lowers the possibility of lost sales opportunities. Personalized marketing messages, deals, and promotions can be made using this data and sent straight to customers' cell phones or other connected devices while they are in the store. Depending on their preferences and actions, customers can interact with dynamic content and targeted adverts on interactive displays outfitted with IoT technology. Retailers can utilize beacons to notify customers via push notifications while in-store about sales, discounts, and recommended products.

Contactless payment and checkout

The intersection of contactless payments and IoT is constantly inspiring new solutions. Retailers frequently include IoT functions and contactless payment methods in their smartphone apps. Thanks to this, customers can now easily handle their shopping experiences, get tailored recommendations, and pay using their smartphones. Encryption, tokenization, and other security measures are crucial to protect transactions and the data shared between IoT devices. One example of an intelligent shopping cart being investigated is one that has IoT sensors and payment capabilities to enable seamless customer checkout.

Restraints

Limited standards and regulations

The formulation of appropriate regulations can be hindered by certain retail industry stakeholders' limited understanding of the technology or unawareness of the potential benefits of IoT standards. Achieving global standardization can be challenging, and specific jurisdictions may prioritize privacy and data protection regulations over standardization in other IoT-related areas. Given IoT's diverse applications, establishing data privacy and security standards can be complex but undeniably crucial.

Environmental Impacts

Energy is needed for IoT devices like beacons and sensors to function. This energy use adds to the environmental impact of the item overall, mainly if it is battery-operated and needs to be changed frequently when an IoT item reaches the end of its life. If it is not recycled or disposed of correctly, it could add to electronic waste or e-waste. The extraction of raw materials, manufacturing procedures, and transportation are all involved in creating IoT devices, and these activities may impact the environment. Resolving privacy issues could prompt the installation of more security measures, which might impact resource and energy usage.

Opportunities

Inventory management

IoT sensors can be attached to products and shelves, providing real-time visibility of inventory levels. This allows retailers to track product movement, monitor stock levels, and receive immediate alerts when stock is low or depleted. This real-time data, transmitted to the central inventory system, aids retailers in maintaining accurate stock levels. Smart shelves can also provide insights into customer preferences and behaviors. IoT sensors can monitor the entire supply chain, tracking the flow of goods from suppliers to distribution hubs and retail locations.

Personalized marketing

IoT can improve customer loyalty programs by monitoring and incentivizing consumer interactions automatically. Since client data is a significant component of personalized marketing, protecting the security and privacy of this data is crucial. Retailers must have robust security measures to safeguard consumer information and adhere to privacy laws. Retailers can monitor inventory levels in real-time with the aid of IoT. This lessens the possibility of dissatisfied clients by guaranteeing that popular items are consistently in stock. Retailers may gather enormous volumes of customer data with the help of IoT devices like beacons, RFID tags, and smart shelves.

Recent Developments

- In May 2023, Amazon opened its first checkout-free store in the UK at London’s Excel Center. With the help of the e-commerce behemoth’s just walk-out technology, the new market express store, in collaboration with catering business levy UK + Ireland, will help speed up the customer journey by enabling customers to make purchases without waiting in line to pay.

- In October 2022, AWS, a division of Amazon.com, revealed intentions to establish an infrastructure region in Thailand. Three availability zones will comprise the new AWS Asia Pacific region, expanding the current 87 availability zones spread over 27 geographical regions.

Key Market Players

- Arm Limited

- Cisco Systems Inc.

- Google LLC

- IBM Corporation

- Impinj, Inc.

- Intel Corporation

- Losant IoT

- Microsoft Corporation

- NXP Semiconductors

- PTC Inc.

- RetailNext, Inc.

- SAP SE

- Softweb Solutions Inc.

- Verizon Communications, Inc.

- Zebra Technologies Corporation

Market Segmentation:

By Deployment

- On-premise

- Cloud

By Technology

- Bluetooth Low Energy

- Near Field Communication

- ZigBee

- Other Technologies

By Component

- Hardware

- Platform

- Services

By Application

- Operations Management

- Customer Management

- Customer Management

- Asset Management

- Advertising and Marketing

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3361

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333