What is the Internet of Things in Retail Market Size?

The global internet of things in retail market size is calculated at USD 93.55 billion in 2025, and is projected to hit around USD 119.93 billion in 2026, and is expected to reach around USD 847.52 billion by 2035, expanding at a CAGR of 24.66% from 2026 to 2035.

Internet of Things in Retail Market Key Takeaways

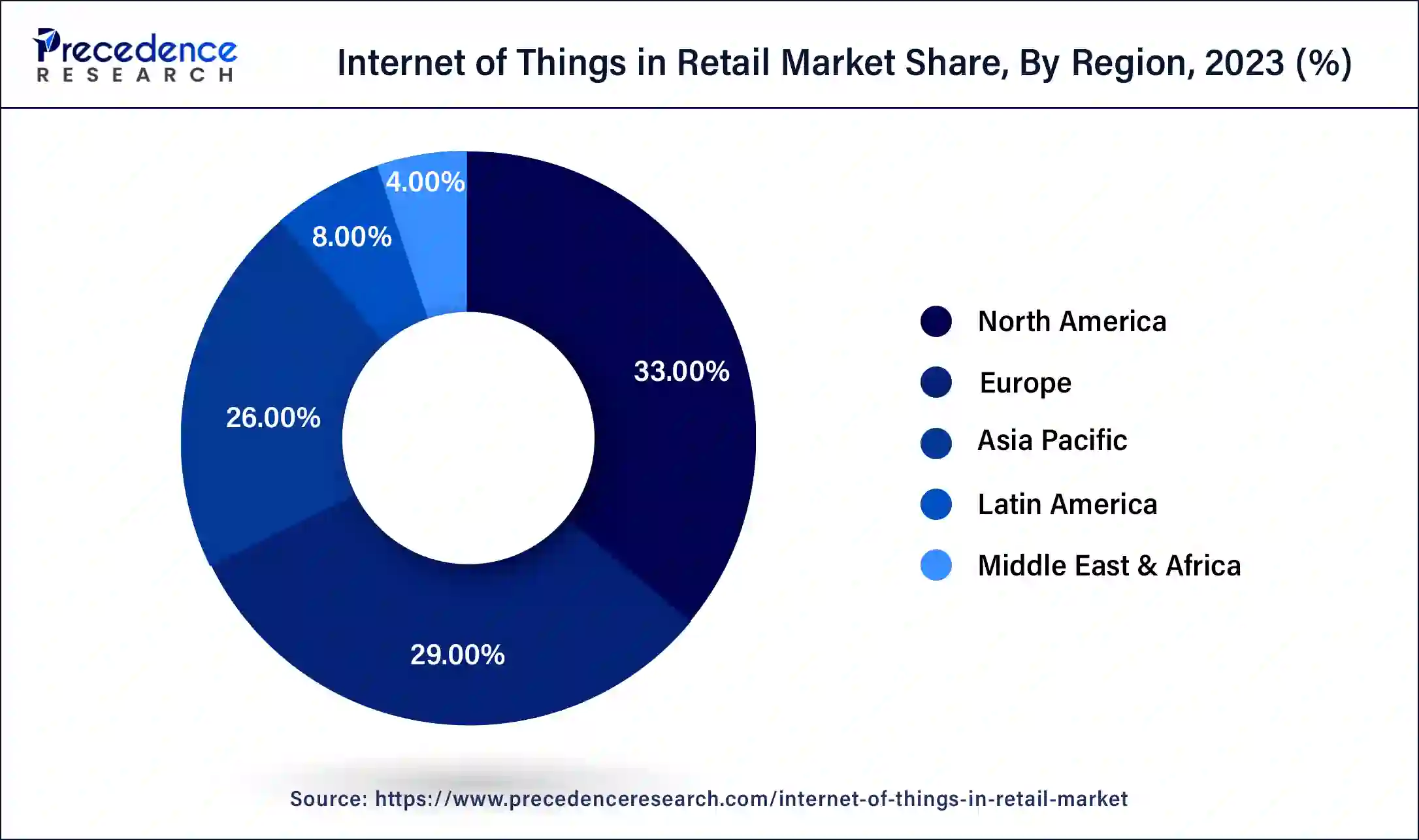

- North America has held the highest revenue share of 33% in 2025.

- Asia-Pacific region is estimated to expand at the fastest expansion during the forecast period.

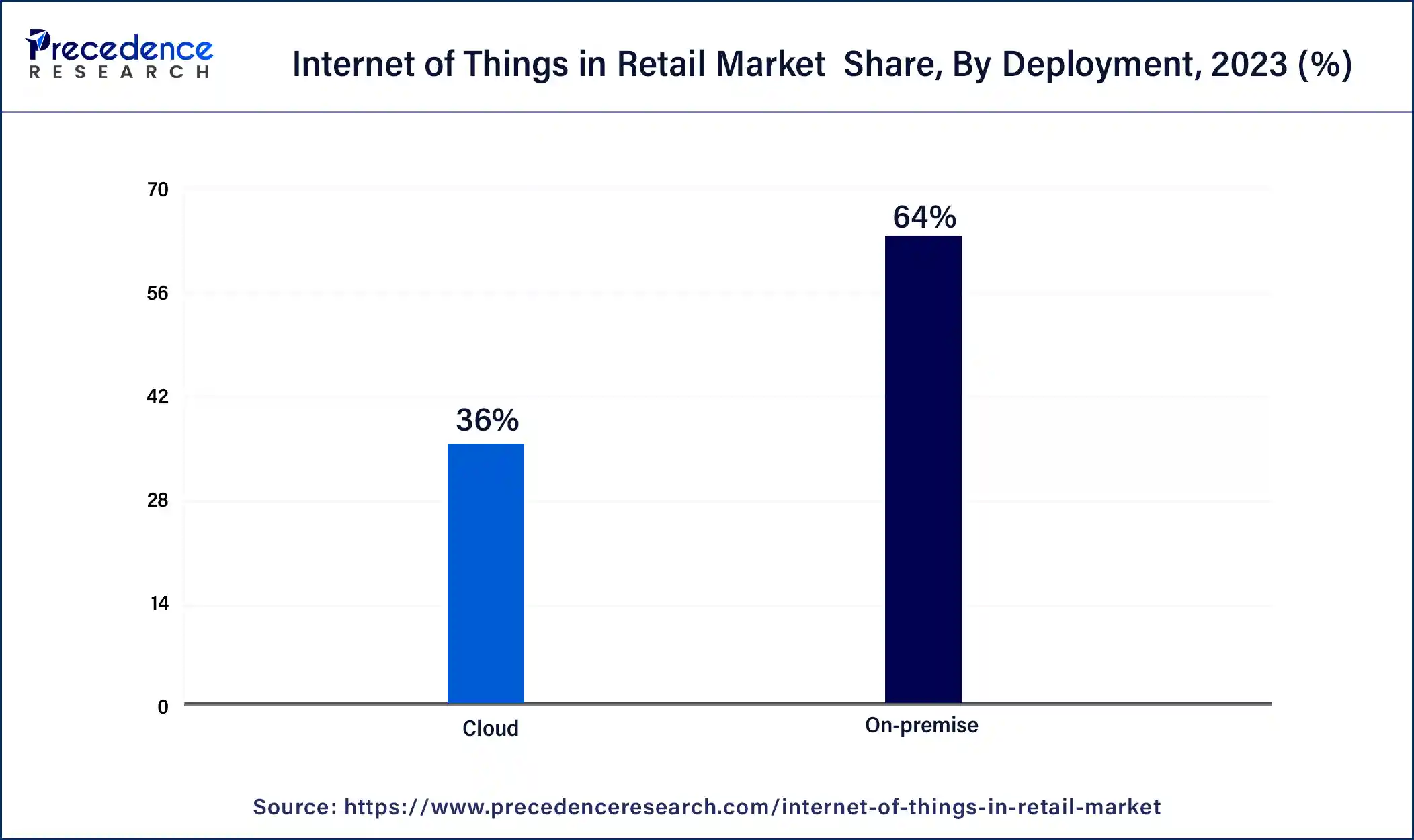

- By Deployment, the on-premise segment has held the biggest revenue share of 64% in 2025.

- By Deployment, the cloud segment is anticipated to expand at a remarkable CAGR of 31.5% during the projected period.

- By Technology, the near field communication segment contributed more than 32% of revenue share in 2025.

- By Technology, the bluetooth low energy segment is estimated to grow at the fastest CAGR over the projected period.

- By Application, the operations management segment held the highest revenue share of 31% in 2025.

- By Application, the customer management segment is growing at a noteworthy CAGR of 32.9% over the predicted period.

- By Component, the hardware segment has held the highest market share of 46.1 % in 2025.

- By Component, the services segment is expanding at a remarkable CAGR of 30.8% over the predicted period.

What is the Significance of Internet of Things in Retail?

The internet of things in retail market pertains to the incorporation of intelligent, interconnected devices and sensors within retail establishments, aiming to elevate operational efficiency and enrich customer interactions. IoT technology facilitates the gathering and real-time analysis of data, streamlining inventory management, crafting personalized shopping journeys, and seamlessly uniting online and offline shopping realms. Its prominence has surged owing to its capacity to stimulate sales, curtail expenses, and adapt to changing consumer preferences. Within the IoT in retail market, IoT gadgets and solutions are being implemented to revolutionize traditional retail, morphing it into a digitally linked, data-centric industry.

How is AI Influencing the Internet of Things in Retail Market?

AI plays an important role in the Internet of Things in retail market. Retail outlets have started integrating AI to enhance supply chain optimization and strengthen security through fraud detection. Moreover, several AI providers are delivering AI-enabled operations management to the retail sector to improve their overall productivity.

- In October 2025, Peak launched a new series of agentic AI solutions. These solutions are designed to transform the landscape of the retail sector across the world.(Source: https://peak.ai/hub/)

Internet of Things in Retail Market Outlook

- Industry Growth Overview: The Internet of Things in retail market is expected to experience strong growth from 2025 to 2034, driven by global retailers accelerating the shift toward hyper-connected store environments. The need for automated inventory traceability, real-time shelf monitoring, and AI-powered customer behavior analytics is reshaping the operational backbone of both large retail chains and mid-sized stores. Retailers are increasingly deploying smart devices, such as RFID tags, edge cameras, beacons, and smart POS systems, to reduce shrinkage and strengthen omnichannel fulfillment, which further supports market growth.

- Technology & Innovation:Innovation in the IoT retail ecosystem is driven by rapid advances in edge computing, computer vision, advanced RFID, digital twins, and 5G connectivity. Leading tech companies like Intel, Cisco, Google, Microsoft, and Arm are launching improved IoT processors and secure edge AI systems designed for ultra-fast analytics within stores. Additionally, retail sensor technology is evolving toward more accurate, lower-latency, and privacy-focused data collection, enabling planogram compliance, real-time restocking, and automated checkout systems.

- Digital Transformation & Global Deployment:Global retailers are increasingly modernizing their store infrastructure by integrating connected devices and machine learning-powered analytics into their daily operations. The smart retail format is being aggressively adopted by countries such as China, South Korea, and Japan to meet consumer demand for frictionless checkout, dynamic pricing, and hyper-personalized shopping experiences. Additionally, improving sustainability, energy efficiency, and compliance with emerging data protection regulations are becoming priorities in Europe, which puts pressure on vendors to adopt secure-by-design architectures in every IoT implementation. Market growth is further supported by labor shortages in emerging regions, prompting greater reliance on automation and data-driven store management. In addition, the market continues to advance in North America, Europe, and Asia-Pacific, where digital-first retail formats are rapidly becoming standard.

- Major Investors:Major investors in the market include leading technology companies, cloud service providers, and venture capital firms that fund innovations in sensors, AI analytics, automation platforms, and connected retail infrastructure. Their investments accelerate the development of smart devices, enhance data-driven retail operations, and expand deployment capabilities, enabling retailers to adopt scalable IoT solutions for improved efficiency and customer experiences.

- Startup Ecosystem & Emerging Innovators:The IoT retail startup ecosystem is growing rapidly, driven by advances in AI vision checkout, sensor-based shelf intelligence, indoor location tracking, and autonomous store management platforms. Companies like Standard AI, Trigo, Focal Systems, AiFi, and Wiseshelf are developing highly scalable retail automation systems that rely on cameras and sensors. Such startups are attracting significant venture capital due to their ability to lower labor costs, reduce out-of-stocks, and provide real-time product performance data. Furthermore, an expanding ecosystem is transforming the competitive landscape, prompting established vendors to innovate more quickly and collaborate more closely with emerging technology providers.

Internet of Things in Retail Market Growth Factors

The Internet of things (IoT) has rapidly transformed the retail industry, ushering in an era of enhanced customer experiences and operational efficiency. The IoT in retail market is projected to witness substantial growth as it capitalizes on several key trends and drivers.

IoT technology has enabled retailers to create smart stores, enhancing customer engagement through personalized shopping experiences. Smart shelves equipped with RFID tags and sensors help monitor inventory in real-time, reducing out-of-stock situations. In addition, IoT-driven data analytics provide valuable insights into customer behavior, enabling retailers to optimize store layouts and product placements for maximum sales.

One of the primary growth drivers in the IoT in retail market is the increasing demand for seamless, omnichannel shopping experiences. IoT devices facilitate the integration of online and offline retail, offering consumers a consistent journey across various touch points. Moreover, the COVID-19 pandemic has accelerated the adoption of IoT in retail as contactless shopping options and curbside pickup became essential services for safety-conscious shoppers.

The proliferation of connected devices and the expansion of 5G networks play a pivotal role in the growth of IoT in retail. These technologies enable faster and more reliable data transmission, supporting the real-time communication between devices and systems. Furthermore, the decreasing cost of IoT sensors and devices makes it more accessible for retailers of all sizes to implement IoT solutions, further fueling market growth.

Despite the promising prospects, the IoT in retail market faces several challenges. Data security and privacy concerns are paramount, as the vast amount of customer data collected by IoT devices requires stringent protection against cyber threats. Additionally, interoperability issues among various IoT platforms and devices can hinder seamless integration and limit the full potential of IoT in the retail sector.

For businesses, the IoT in Retail Market offers numerous opportunities for innovation and revenue generation. Retailers can leverage IoT to automate inventory management, reduce energy consumption through smart lighting and HVAC systems, and create more targeted marketing campaigns based on real-time customer data. Collaborations with IoT solution providers and investment in IoT infrastructure are key steps for retailers to tap into these exciting opportunities and remain competitive in the evolving retail landscape.

In conclusion, the IoT in retail market is experiencing significant growth driven by trends such as smart stores and omnichannel experiences, as well as factors like the proliferation of connected devices and 5G networks. While challenges like data security and interoperability persist, the industry's potential for enhanced customer engagement, operational efficiency, and innovation presents compelling business opportunities for retailers willing to embrace IoT technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 847.52 Billion |

| Market Size in 2026 | USD 119.93 Billion |

| Market Size in 2025 | USD 93.55 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.66% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Deployment, By Technology, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Omnichannel integration

Omnichannel integration stands as a potent catalyst propelling substantial market expansion within the retail sector. This strategy hinges on the seamless amalgamation of diverse shopping avenues, encompassing physical brick-and-mortar stores, e-commerce platforms, mobile applications, and social media channels.

The core objective is to furnish customers with a harmonized, unbroken, and coherent shopping experience. Foremost, modern consumers ardently seek versatility and convenience in shopping. They desire the ability to research products online, effectuate purchases in physical establishments, and execute returns via digital interfaces, all while anticipating uniform pricing, promotions, and personalized product suggestions across every channel.

Omnichannel integration satisfactorily addresses these expectations, amplifying customer contentment and commitment. Moreover, retailers leveraging omnichannel strategies gain a competitive edge. They can reach a broader audience and tap into new markets, all while capturing valuable data on customer behavior and preferences. This data-driven approach empowers retailers to refine their marketing efforts, optimize inventory management, and tailor their product offerings.

Additionally, the COVID-19 pandemic accelerated the importance of omnichannel strategies as consumers sought safe and convenient shopping options. Retailers with robust omnichannel capabilities, such as curbside pickup and contactless payment, were better equipped to meet changing consumer needs. In essence, omnichannel integration is not just a growth driver but a necessity in today's retail landscape. It aligns with evolving consumer expectations, offers competitive advantages, and ensures retailers remain adaptable and relevant in an increasingly digital world.

Restraints

Costs and ROI uncertainty

The uncertainty surrounding costs and return on investment (ROI) stands as a significant restraint impeding the growth of the omnichannel integration market. Implementing omnichannel strategies requires substantial investments in technology, infrastructure, staff training, and ongoing maintenance. These upfront costs can be daunting for businesses, especially smaller retailers with limited resources. Moreover, the timeline for realizing ROI in omnichannel initiatives can be protracted, making it challenging to justify the initial expenses. ROI uncertainty arises from various factors, including the evolving nature of consumer behavior and the rapid pace of technological change.

Predicting how quickly customers will adapt to new omnichannel offerings and estimating the precise impact on sales and customer loyalty is complex and uncertain. Additionally, the competitive landscape complicates ROI calculations. As more businesses adopt omnichannel strategies, achieving a distinct competitive advantage becomes harder, potentially delaying ROI. Overall, the ambiguity surrounding costs and ROI can deter businesses from fully embracing omnichannel integration, inhibiting the market's growth potential.

Opportunities

Inventory optimization

Inventory optimization is creating significant opportunities in the market by revolutionizing how retailers manage their stock. Through the deployment of Internet of Things (IoT) sensors, RFID technology, and advanced data analytics, businesses gain real-time visibility into their inventory, enabling them to make informed decisions and enhance their operations. This newfound precision leads to reduced stockouts, minimized overstock situations, and more efficient supply chain management, ultimately translating into substantial cost savings and improved profitability.

Moreover, inventory optimization also allows retailers to meet the evolving demands of today's consumers who expect products to be readily available when and where they want them. By ensuring products are in stock and accessible, retailers can enhance customer satisfaction and loyalty, driving increased sales and market share. Additionally, retailers can reduce the need for costly manual inventory checks and streamline restocking processes, freeing up resources and time for other value-added activities. This strategic advantage positions businesses to thrive in a highly competitive retail landscape and capitalize on emerging market trends.

Impact of COVID-19:

The COVID-19 pandemic accelerated the adoption of IoT in the retail market. Retailers embraced IoT solutions like contactless payments, occupancy monitoring, and curbside pickup to address health and safety concerns, transforming the shopping experience. IoT helped retailers adapt to shifting consumer behaviors, such as increased online shopping and the demand for seamless omnichannel experiences. It also aided in real-time inventory management, reducing supply chain disruptions. While the pandemic presented challenges, it underscored the essential role of IoT in ensuring business continuity, enhancing safety, and meeting evolving customer expectations, driving its continued growth in the retail sector.\

Segment insights

Deployment Insights

According to the deployment, the on-premise sector held 64% revenue share in 2024. The On-premise segment holds a substantial market share due to its advantages in data control and security. Many businesses, particularly in sensitive industries like finance and healthcare, prefer on-premise IoT solutions to maintain direct oversight and compliance.

On-premise solutions offer greater control over data storage, processing, and security protocols, assuaging concerns about data breaches and privacy. They also ensure consistent availability, reducing reliance on external networks. While cloud-based solutions offer scalability and cost-efficiency, the On-premise segment remains a preferred choice for organizations valuing stringent data control and regulatory compliance, contributing to its significant market share.

The cloud sector is anticipated to expand at a significantly CAGR of 31.5% during the projected period due to its scalability, adaptability, and economic advantages. Cloud-based IoT solutions excel in seamlessly integrating with diverse devices and sensors, enabling the swift collection and analysis of real-time data. With minimal on-site infrastructure demands, they curtail initial expenditures and maintenance burdens. Furthermore, cloud platforms offer secure and centralized data storage, ensuring efficient data governance and accessibility. These features, coupled with their ease of deployment and expandability, make cloud-based IoT solutions exceptionally appealing to enterprises, solidifying their commanding growth within the market.

Technology Insights

Near field communication is anticipated to hold the largest market share of 32% in 2024. Near Field Communication (NFC) holds a significant share in the IoT in Retail market due to its versatility and convenience. NFC technology allows secure, short-range communication between devices, facilitating contactless payments, customer engagement, and inventory management.

It enhances the shopping experience by enabling quick and seamless transactions through mobile wallets and smart cards. NFC's adaptability to various retail applications, its ease of use, and its integration into smartphones have made it a preferred choice for retailers aiming to provide contactless, personalized, and efficient services, thus solidifying its major share in the market.

On the other hand, the Bluetooth low energy sector is projected to grow at the fastest rate over the projected period. Bluetooth Low Energy (BLE) holds a major growth in the market due to its efficiency and versatility. BLE technology offers a balance between power consumption and connectivity, making it ideal for IoT devices in the retail sector. It enables retailers to deploy a wide range of sensors and beacons that facilitate tasks like indoor navigation, proximity marketing, and inventory tracking without draining batteries quickly. This efficiency, coupled with its compatibility with smartphones and tablets, has made BLE a preferred choice for implementing IoT solutions, thus capturing a significant growth in the IoT in retail market.

Application Insights

The operations management segment held the largest revenue share of 31% in 2024. Operations management holds a significant share in the market because it plays a central role in optimizing efficiency, reducing costs, and enhancing customer experiences. By leveraging IoT technologies, retailers can automate inventory management, monitor equipment health, and streamline logistics, resulting in improved operational efficiency. This segment helps retailers adapt to changing consumer expectations, such as seamless omnichannel integration and real-time inventory tracking. Additionally, IoT-driven data analytics empower informed decision-making, making operations management a crucial driver of competitive advantage, cost savings, and overall success in the dynamic retail landscape.

The customer management is anticipated to grow at a significantly faster rate, registering a CAGR of 32.9% over the predicted period. The customer management segment holds substantial growth in the IoT in retail market because it addresses critical retail challenges. IoT solutions enable retailers to gather valuable customer data across various touchpoints, aiding in personalization, targeted marketing, and improved customer experiences.

With IoT, retailers can offer tailored recommendations, streamline checkout processes, and track customer preferences. This enhances customer engagement, loyalty, and ultimately drives sales. Furthermore, the COVID-19 pandemic accelerated the demand for contactless shopping and omnichannel experiences, further boosting the growth of IoT in customer management within the retail sector.

Component Insights

The hardware sector has generated a revenue share of 46.1% in 2024. The dominant share of the hardware segment in the IoT market stems from its fundamental role in facilitating IoT implementations. Hardware components, such as sensors, RFID tags, and connectivity devices, serve as the critical building blocks for real-time data acquisition in the physical realm. This data forms the essential foundation for diverse IoT applications, including inventory management and smart retail systems.

Moreover, the expansion of IoT within the retail sector hinges significantly on these hardware elements, as they constitute the infrastructure necessary for deploying and operationalizing IoT solutions. Consequently, the hardware segment wields substantial influence and importance within the IoT market.

The services sector is anticipated to grow at a significantly faster rate, registering a CAGR of 30.8% over the predicted period. The dominance of the services segment in the market can be attributed to its fundamental role in facilitating the deployment and management of Internet of Things (IoT) solutions across various sectors. Service providers bring their specialized knowledge to the table, aiding in the formulation, integration, upkeep, and data analysis related to IoT technologies.

Furthermore, these providers offer tailor-made solutions to address the specific demands of industries like healthcare, manufacturing, and logistics, ensuring a bespoke approach. Their holistic services, coupled with ongoing assistance, establish them as indispensable partners for organizations seeking to effectively implement and maximize the potential of IoT, resulting in their substantial market share.

Regional Insights

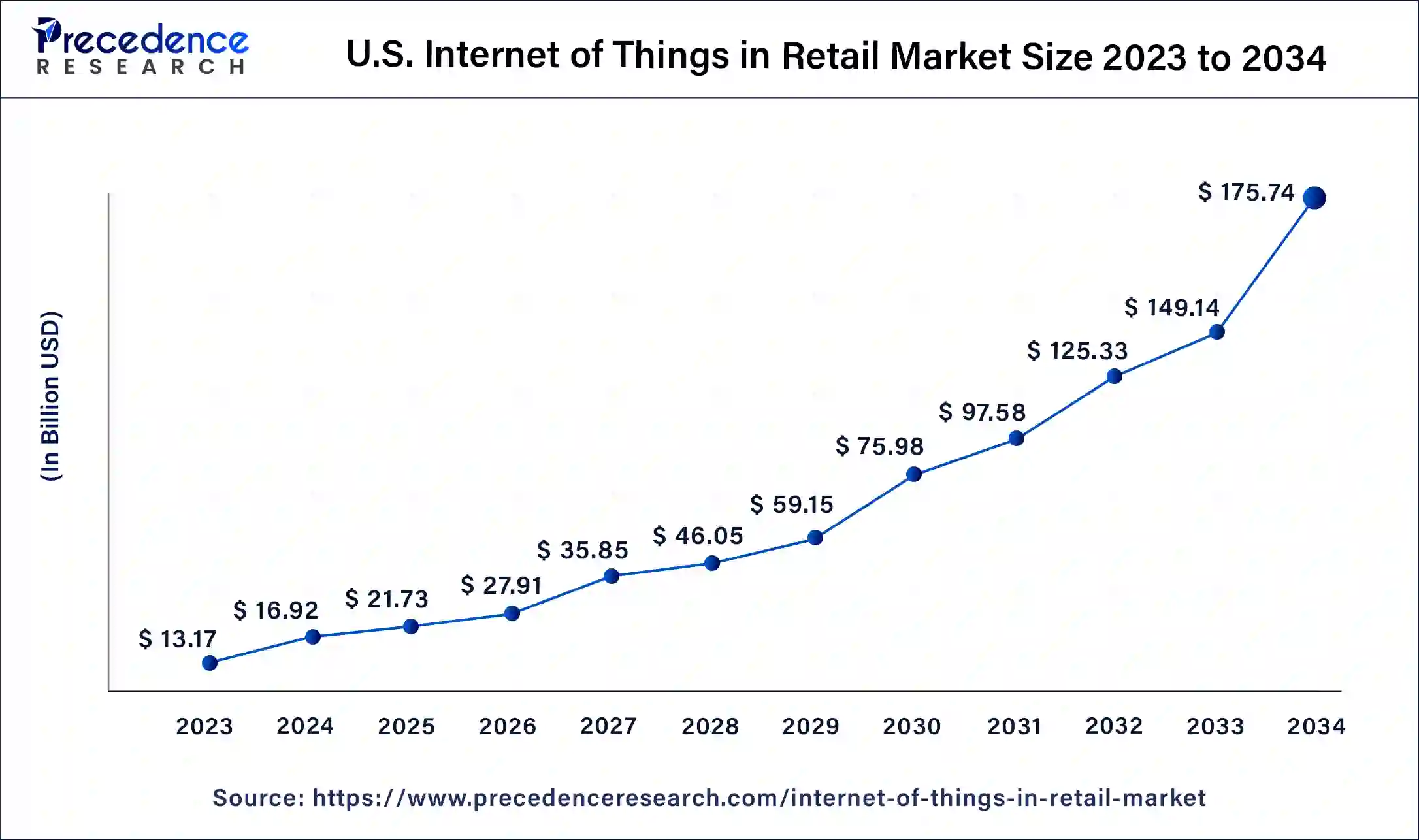

What is the U.S. Internet of Things in Retail Market Size?

The U.S. internet of things in retail market size is valued at USD 21.73 billion in 2025 and is estimated to reach around USD 200.48 billion by 2035, growing at a CAGR of 24.88% from 2026 to 2035.

North America has held the largest revenue share 33% in 2024. North America's commanding position in the market is a result of its rapid and extensive embrace of Internet of Things (IoT) innovations. The region benefits from cutting-edge infrastructure, a well-established IT ecosystem, and a fervent dedication to technological advancement, creating an ideal landscape for IoT integration across diverse sectors. Moreover, substantial investments in IoT research and development, fortified by governmental support, have propelled North America to a prominent stance in the global IoT market arena. The presence of numerous influential IoT solution providers and a tech-savvy populace further reaffirm the region's leadership in the worldwide IoT market.

U.S. Internet of Things in Retail Market Trends

The U.S. is a major player in the North American market. The market in the U.S. is growing as a result of advanced retail digitization, the popularity of cloud, and a robust IoT presence across key retail chains. Retailers are increasingly using IoT devices such as RFID tags, smart shelves, sensors, and automated checkout systems to enable real-time inventory tracking, minimize stockouts, streamline supply-chain operations, and enhance operational precision. Major IoT solution suppliers in the country, including Cisco, Microsoft, Intel, and Zebra, are partnering with global players to meet increasing demand and expand their footprints, thereby contributing to the market.

What are the Factors Driving the Canadian Internet of Things in Retail Market?

The growing emphasis of shop owners to deploy asset management solutions in their outlets to keep proper track of assets and enhance predictive maintenance is boosting the market in Canada. Moreover, numerous government initiatives aimed at digitalizing the retail sector, as well as the rapid adoption of RFID-enabled inventory solutions by retail operators, are expected to drive the growth of the market in the Country.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific's significant market share is attributed to several compelling factors. The region's large and swiftly growing population presents a fertile ground for IoT proliferation. Governments and businesses are actively pouring investments into IoT infrastructure, particularly in sectors like manufacturing, agriculture, and healthcare. Furthermore, the region enjoys a tech-savvy consumer base, spurring the demand for IoT-driven offerings. Asia-Pacific's robust manufacturing industry and supply chain operations stand to gain from IoT's efficiency enhancements. These converging dynamics establish Asia-Pacific as a formidable presence in the global IoT market, reflecting its substantial market share.

Which Factors Boost the Japanese Internet of Things in the Retail Market?

The increasing deployment of humanoid robots in retail outlets for operating numerous applications, such as customer dealing and payment collection, is boosting market growth. Also, the rapid adoption of IoT-enabled sensors in department stores, coupled with the surging investment by telecom operators for strengthening the internet facilities in this country, is expected to accelerate the growth of the market across the country.

China Internet of Things in Retail Market Trends

China is a major contributor to the market in Asia Pacific, owing to its rapid development of smart retail ecosystems, widespread e-commerce adoption, and substantial government investment in digital infrastructure. Chinese retailers are increasingly deploying IoT‑enabled smart shelves, sensors, edge‑cameras, and cashier-less checkout or mobile‑payment systems to streamline operations and improve customer convenience. With rising e‑commerce volumes, China is heavily investing in IoT-enabled warehouse automation to ensure efficient logistics, faster deliveries, and lower errors, thereby driving market growth.

What Makes Europe a Notably Growing Region in the Market?

Europe is expected to experience a notable growth in the internet of things in retail market in the coming years, driven by its strong data protection, energy efficiency needs, and the rapid deployment of store automation systems. Additionally, rising sustainability goals across the European Union are likely to boost investments in smart building systems and connected retail technologies. The established retail industry and widespread adoption of digital infrastructure in Europe are fueling extensive IoT integration, as retailers transition to smart stores, real-time inventory management, and omnichannel solutions.

Germany Internet of Things in Retail Market Trends

In Germany, the market is driven by strong digitalization initiatives from the government, strict privacy laws, and the growing demand for energy-efficient in-store technologies. Market growth is expected to be supported by the European Commission's efforts to promote secure and interoperable IoT systems in business environments. Moreover, consumers' demand for seamless, personalized shopping experiences and omnichannel convenience is driving retailers to deploy IoT-powered customer analytics, interactive store formats, and integrated retail tech solutions.

What are the Drivers of the UK Internet of Things in Retail Market?

The deployment of cloud-based workforce management solutions in the retail sector, along with the rapid adoption of contactless payment by consumers for purchasing goods from retail shops, is driving market growth in the UK. Additionally, surging investment by the government for developing the 5G infrastructure, as well as the increasing focus of clothing brands to open new retail outlets in the city centers, is expected to propel the growth of the market.

How is the Opportunistic Rise of Latin America in the Internet of Things in Retail Market?

Latin America is expected to experience an opportunistic rise in the market over the forecast period, driven by the high adoption of IoT technology as retailers prioritize inventory accuracy, supply chain visibility, and secure digital payments. Retail digitalization is projected to accelerate as vendors expand their IoT solutions into Tier I and Tier II cities to address demand for real-time store monitoring. Furthermore, the region is estimated to gain momentum as cloud adoption increases and IoT-enabled loss-prevention technologies become more essential.

Brazil Internet of Things in Retail Market Trends

Brazil leads the market in Latin America due to retailers' need for a clearer view of stock, a secure payment system, and improved customer experience through automation. Retail chains are adopting IoT-based loss prevention systems and real-time store surveillance to address operational inefficiencies. Additionally, the expansion of telecoms and the broader coverage of 4G/5G are anticipated to support the increased integration of smart devices in supermarkets and hypermarkets.

What Influences the Argentine Internet of Things in the Retail Market?

The market in Argentina is driven by the rapid deployment of smart vending machines in retail shops, as well as the increasing preference of consumers to pay through online platforms. Moreover, the growing investment by manufacturers to open smart stores, along with the availability of public Wi-Fi in urban areas, is expected to boost the growth of the market.

What Potentiates the Growth of the Middle East & Africa Internet of Things in Retail Market?

The market in the Middle East & Africa is driven by increasing adoption of connected retail systems. Large retail groups in the region are investing in digital transformation and advanced customer experience solutions. Gulf Cooperation Council countries are expected to accelerate the adoption of IoT driven by smart city projects, 5G connectivity, and a strong focus on operating stores with fewer resources. Additionally, the growth of retail infrastructure in South Africa and Kenya is expected to create new opportunities for linked POS systems and smart store surveillance systems.

How is the Internet of Things in Retail Market Growing in South Africa?

The market is growing gradually in South Africa due to surging investment by diamond companies in deploying NFC-based security solutions in their retail outlets. Also, the rapid adoption of QR-based payments by consumers, coupled with the integration of queue management solutions in the retail centers, is expected to proliferate the growth of the market.

UAE Internet of Things in Retail Market Trends

In the UAE, the market is growing rapidly, driven by the adoption of AI-powered analytics, connected payment systems, and energy-efficient store technologies. These innovations help retailers optimize operations, improve customer experiences, and enhance overall store performance. Government-backed digital policies and widespread 5G availability are expected to further accelerate secure IoT adoption across the nation's retail sector. Additionally, collaboration between international retail groups and local smart store deployments is likely to support market expansion.

Internet of Things in Retail Market - Value Chain Analysis

1. Hardware & Sensor Component Sourcing

The IoT retail ecosystem begins with sourcing essential hardware components, including RFID tags, NFC chips, smart sensors, edge processors, gateways, and low-power connectivity modules that enable real-time tracking and automation.

- Key Players: NXP Semiconductors, Zebra Technologies, Intel Corporation, Impinj, Arm Limited

2. Device Manufacturing & Integration

Specialized IoT devices, such as smart shelves, beacons, RFID readers, in-store cameras, edge computing units, and POS IoT hardware, are manufactured and integrated with embedded systems to ensure seamless data collection across retail floors

- Key Players: Zebra Technologies, Cisco Systems Inc., Intel Corporation, Softweb Solutions Inc.

3. Connectivity & Network Infrastructure

This stage includes establishing secure connectivity channels using Wi-Fi 6, Bluetooth, LPWAN, 5G, and cloud-linked network hardware that allows IoT devices to communicate efficiently within the retail environment.

- Key Players: Verizon Communications Inc., Cisco Systems Inc., Google (Cloud networking), Microsoft Azure IoT

4. IoT Platforms & Middleware

IoT platforms collect, standardize, and manage data from devices, enabling analytics, device orchestration, remote monitoring, and security. Middleware supports interoperability across diverse retail IoT systems.

- Key Players: Microsoft Azure IoT, IBM Watson IoT, PTC ThingWorx, Losant IoT, SAP Leonardo IoT

5. Data Analytics, AI & Cloud Services

Advanced cloud-based analytics, AI-driven insights, and machine learning models are applied to optimize inventory accuracy, customer behavior tracking, demand forecasting, and operational efficiency across retail stores.

- Key Players: Google Cloud, IBM Corporation, Microsoft Corporation, SAP SE, RetailNext Inc.

6. Application Development & System Integration

Custom retail applications, including smart inventory systems, connected POS, automated checkout, digital signage, and customer engagement platforms, are built and integrated into store operations.

- Key Players: Softweb Solutions Inc., PTC Inc., SAP SE, Losant IoT, RetailNext Inc.

7. Deployment, Maintenance & Managed Services

Retailers deploy IoT systems across physical stores and rely on managed service providers for continuous monitoring, firmware updates, cybersecurity, network management, and performance optimization.

- Key Players: Cisco Systems Inc., Verizon Communications Inc., IBM Corporation, Microsoft Corporation

Internet of Things in Retail Market Companies

- Arm Limited (UK): Arm provides ultra-efficient IoT chip architectures and device-level security foundations that power connected retail sensors, smart shelves, and edge analytics systems.

- Cisco Systems Inc. (U.S.): Cisco delivers enterprise-grade IoT networking, real-time location solutions, and secure retail infrastructure for automated stores, connected POS, and inventory visibility.

- Google LLC (U.S.): Google offers cloud-based IoT services, AI-driven analytics, and retail automation tools through Google Cloud IoT, enabling smarter merchandising and operational optimization.

- IBM Corporation (U.S.): IBM provides hybrid-cloud IoT platforms, AI-powered demand forecasting, and connected retail asset management through IBM Watson IoT.

- Impinj, Inc. (U.S.): Impinj specializes in RAIN RFID platforms that enhance retail inventory accuracy, item tracking, and automated checkout experiences.

- Intel Corporation (U.S.): Intel supplies edge processors, vision systems, and IoT hardware acceleration technologies that support smart stores, self-checkout, and real-time analytics.

- Losant IoT (U.S.): Losant offers a low-code enterprise IoT platform enabling connected retail dashboards, sensor integration, and multi-store operational monitoring.

- Microsoft Corporation (U.S.): Microsoft Azure IoT provides cloud, AI, and edge computing tools for predictive shelf analytics, supply chain automation, and customer-behavior insights.

- NXP Semiconductors (Netherlands): NXP delivers secure IoT chipsets, NFC technologies, and RFID solutions widely used in smart payments, inventory tagging, and access systems.

- PTC Inc. (U.S.): PTC offers the ThingWorx IoT platform, enabling digital twins, smart store automation, and real-time retail operations management.

- RetailNext, Inc. (U.S.): RetailNext provides advanced in-store analytics, IoT sensors, and AI-powered shopper behavior tracking for data-driven retail optimization.

- SAP SE (Germany): SAP delivers IoT-integrated retail solutions, including connected supply chain systems, real-time inventory management, and predictive analytics.

- Softweb Solutions Inc. (U.S.): Softweb develops AI-driven IoT applications for smart shelves, automated retail operations, and connected customer engagement tools.

- Verizon Communications, Inc. (U.S.): Verizon provides IoT connectivity platforms, 5G-enabled retail automation, and real-time asset tracking systems for large retail chains.

- Zebra Technologies Corporation (U.S.): Zebra offers IoT-enabled scanning, mobile computing, RFID tracking, and intelligent inventory visibility solutions for retail environments.

Recent Developments

- In December 2025, Paychex, Inc. launched an AI-enabled workforce management solution. This solution is designed to transform the workforce management experience in the retail sector.(Source: https://www.businesswire.com/)

- In December 2025, T-ROC Global launched a new range of automated retail solutions. This series of retail solutions is developed to automatically deliver products and services in the retail sector.(Source: https://www.retailcustomerexperience.com/)

- In 2023, SATO Holdings Corporation, a prominent player in labeling and auto-ID solutions, partnered with Energous Corporation, a key producer of wireless power networks.

- In 2021, Lowe's completed an $800 million acquisition of Neighborly, a home services marketplace. This strategic move empowers Lowe's to establish connections between customers and local contractors efficiently.

- In 2020, Target made a noteworthy acquisition in 2020, purchasing Shipt, a grocery delivery service, for $550 million. This acquisition positions Target to compete effectively with Amazon's Prime Now service in the realm of convenient and swift grocery delivery.

- In 2019, Alibaba secured a dominant presence in Southeast Asia's expanding e-commerce market through its acquisition of Lazada Group for an impressive $16.2 billion. This move bolstered Alibaba's global reach and market influence.

Segments Covered in the Report:

By Deployment

- On-premise

- Cloud

By Technology

- Bluetooth Low Energy

- Near Field Communication

- ZigBee

- Other Technologies

By Component

- Hardware

- Platform

- Services

By Application

- Operations Management

- Customer Management

- Customer Management

- Asset Management

- Advertising and Marketing

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting