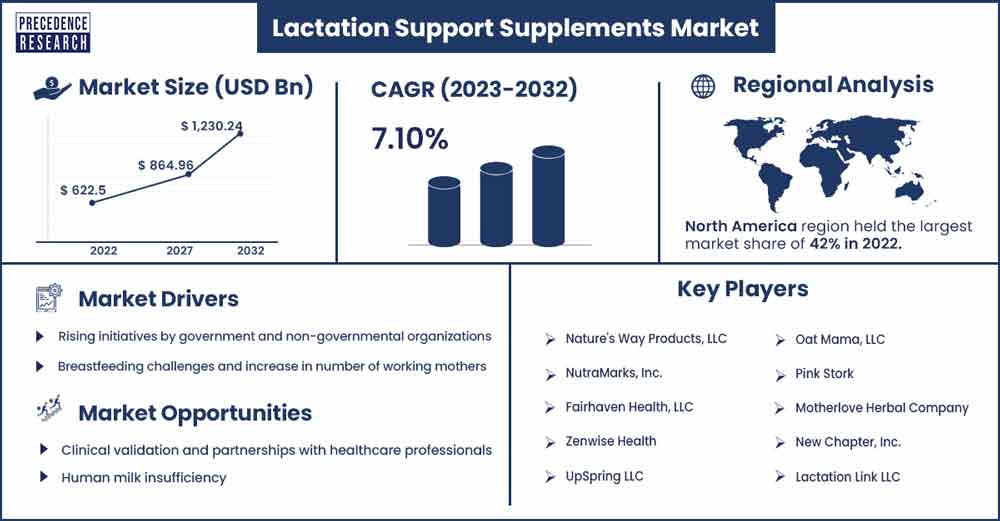

Lactation Support Supplements Market Size To Rake USD 1,230.24 Mn By 2032

The global lactation support supplements market size reached USD 622.5 million in 2022 and is projected to be worth around USD 1,230.24 million by 2032, expanding at a CAGR of 7.10% from 2023 to 2032.

Market Overview

Supplements that assist lactation are made to help and improve the process of nursing by encouraging the production of breast milk, or lactation. These supplements usually include a variety of components that are thought to have lactogenic qualities, which means they might aid in stimulating or boosting a nursing mother's production of milk. There are common ingredients found in lactation support supplements which include fenugreek, blessed thistle, fennel, brewer yeast, oats, alfalfa and others.

Growth Factors

The market growth of lactation support supplements is driven by growing awareness and acceptance, rising birth rates and population growth, growing trends of women workforce, increasing investment in research and development, growing e-commerce retail, increasing global health initiatives and rising healthcare professional’s recommendations. Furthermore, the growing product launches in the industry provide an enormous opportunity for the development of the market.

For instance, in July 2023, Almimama is a probiotic supplement that Danone created using their knowledge of nursing and breastmilk research to potentially lower the occurrence of mastitis. Mastitis, or inflammation of the breast, affects around one in four moms and is characterized by flu-like symptoms, breast discomfort, skin rashes, fever, and breast engorgement.

According to Danone, about one in four nursing moms have mastitis, which is one of the main reasons why breastfeeding ends prematurely and unintentionally.

According to the Australian Institute of Health and Welfare, in Australia, 315,705 infants were born to 311,360 women in 2021. 105.4 male kids for every 100 female newborns (51 percent males and 49 percent females).

Regional Insights

North America is expected to dominate the market over the forecast period. The market growth in the region is attributed to the growing trend of health and wellness. The overall trend toward health and wellness has positively impacted the market. Women are increasingly looking for products that promote overall well-being during the postpartum period, and lactation support supplements fit into this broader health-conscious trend. Moreover, the well-established healthcare infrastructure in North America, including access to healthcare professionals and lactation consultants, has facilitated the dissemination of information about lactation support supplements. Healthcare professionals often play a key role in advising new mothers on postpartum care. Thereby, driving the market growth in the region.

In the region, the US is expected to capture a significant market share over the projected timeframe. The US has seen a consistent number of annual births, and there is a growing awareness of the importance of maternal health and well-being. This has contributed to an increased demand for products, including lactation support supplements, that support postpartum care. For instance, according to secondary sources, as of 2023, there are 12.023 births per 1000 inhabitants in the United States, a 0.09% rise from 2022. Consequently, these characteristics fuel the nation's market expansion.

Lactation Support Supplements Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 663.59 Million |

| Market Size by 2032 | USD 1,230.24 Million |

| Largest Market | North America |

| Growth Rate from 2023 to 2032 | CAGR of 7.1% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising initiatives by government and non-governmental organizations

Numerous governmental, nonprofit, and social development organizations are implementing a range of initiatives to increase nursing mothers' knowledge about breastfeeding. As a result, the demand for supplements to encourage nursing has increased and the need for human milk substitutes has decreased. The Smile Foundation, for instance, runs several seminars and campaigns in India as part of the Swabhiman program to educate women about the benefits of breastfeeding and to create awareness of health and nutrition concerns among nursing mothers and their newborns. Consequently, promoting market expansion through a rise in these activities.

Restraints

Regulatory challenge

The regulatory environment for dietary supplements can be complex, and ensuring compliance with various regulations poses a major constraint to manufacturers. For instance, in February 2023, a $13,320 infringement notice for suspected violations of the Therapeutic Goods Act 1989 was sent to Sydney-based JSHealth Vitamins Pty Ltd by the Therapeutic Goods Administration (TGA), a division of the Department of Health and Aged Care.

A supplemental medication that JSHealth Vitamins provided, according to TGA, did not follow legal standards. An ingredient taken from the fennel plant, Foeniculum vulgare, was included in the product. Women who are nursing a baby or who are pregnant or likely to get pregnant shouldn't take this ingredient in, nor should they give it to children under the age of 12. Thus, stringent regulations or changes in regulatory requirements can affect the market.

Limited scientific evidence

Although there is a conventional belief that certain ingredients in lactation support supplements increase the production of milk, there is not often sufficient scientific evidence to support this assumption. Customers and healthcare professionals may become skeptical as a result of this lack of strong scientific support. Thus, acting as a major restraint for the market growth over the forecasted period.

Opportunities

Human milk insufficiency

Human milk insufficiency is a major issue worldwide. It can lead to nutritional deficiencies and severe diseases in newborns and infants, which can eventually end in infant death. According to the February 2022 International Breastfeeding Journal article, human milk insufficiency, which impacts between 60 and 90 percent of women in the region, is the main issue in underdeveloped nations. This is expected to raise the demand for lactation support supplements, assuming that it can assist in addressing the conditions related to human milk insufficiency.

Collaboration with healthcare professionals

The reliability of breastfeeding support supplements can be increased by forming alliances with medical experts like as midwives, doctors, and lactation consultants. Professional recommendations and endorsements have a favorable effect on customer trust. Thus, this is expected to offer a lucrative opportunity for market expansion over the upcoming period.

Recent Development

- In June 2022, the Better Health Company (TBHC), the parent business of GO Healthy and Egmont, will be acquired by Nestlé Health Science from CDH Investments and the original owners of TBHC. The Better Health Company will be fully acquired by Nestlé Health Science as a result of the deal. These include the biggest supplement brand in New Zealand, GO Healthy; New Zealand Health Manufacturing, an Auckland-based factory that manufactures vitamins, minerals, and supplements; and Egmont, a Manuka honey brand.

Lactation Support Supplements Market Players

- Nature's Way Products, LLC

- NutraMarks, Inc.

- Fairhaven Health, LLC

- Zenwise Health

- UpSpring LLC

- Oat Mama, LLC

- Pink Stork

- Motherlove Herbal Company

- New Chapter, Inc.

- Lactation Link LLC

- Milky Mama LLC

- Herbaland Naturals Inc.

- Maxi Health Research

- Legendary Milk LLC

- Mommy Knows Best

Segments Covered in the Report

By Ingredient Type

- Fenugreek

- Moringa

- Milk thistle

- Fennel

- Oatmeal

- Others

By Formulation

- Capsules/Tablets

- Powder

- Liquid

- Others

By Sales Channel

- Online Sales Channel

- Direct Sales Channel

- Pharmacies/Drug Stores

- Other Offline Channels

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Buy this Research Report@ https://www.precedenceresearch.com/sample/3347

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308