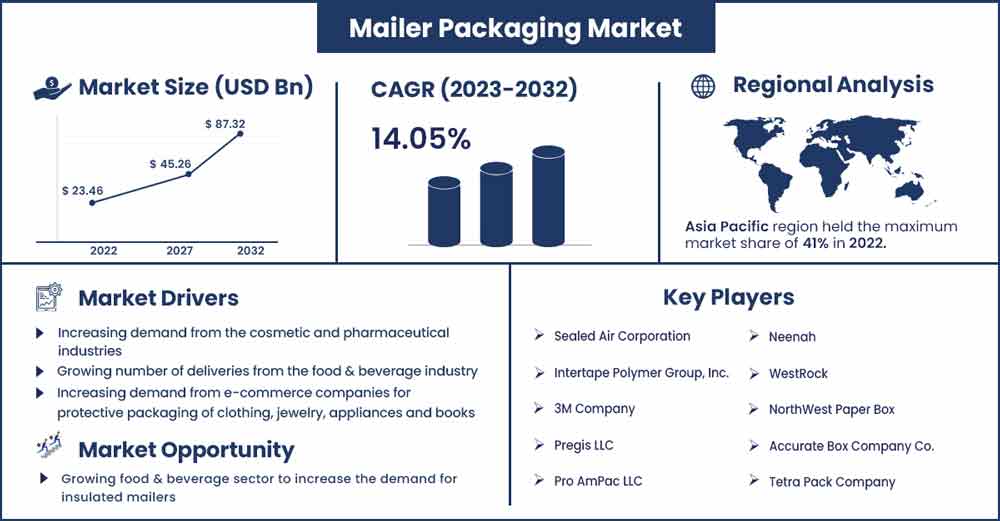

Mailer Packaging Market is Likely to Rise at 14.05% CAGR By 2032

The global mailer packaging market size was exhibited at USD 23.46 billion in 2022 and is projected to attain around USD 87.32 billion by 2032, growing at a CAGR of 14.05% during the forecast period 2023 to 2032.

Market Overview:

Global mailer packaging market size is estimated to grow to USD xx million by 2032 from USD xx million in 2022, at a CAGR of xx% between 2023 & 2032. A small or large parcel shipped using a protective packaging method is considered a mailer, and mailers are more sustainable and cost-effective than any other shipping box. Mailers are regarded as an alternative for shipping goods such as clothes, jewelry, electronic products, medicines, and even food & beverages, and they come in various designs. The invention of paper mailers has become a boon for small, medium, and even large-sized businesses owing to the benefits associated with mailer packaging options, such as low-cost investment in packaging, printable material, reduced risk of damage, and weather-resistant quality.

Packaging mailers are generally manufactured with either plastic or paper. Plastic mailers are prone to cause severe damage to the environment. This growing environmental concern has increased the demand for paper mailers. Due to increased demand for paper material mailers, manufacturers are seen expanding businesses, which have fueled the growth of the global mailer packaging market in recent years. For instance, in November 2022, a leading product packaging company, Huhatamaki, headquartered in Finland, decided to expand its paper-based packaging capacity in its factory in Spain.

The expansion aims to fulfill the customer's growing demand for paper-based packaging options. E-commerce businesses, shipping and logistics, and warehousing units widely use mailers. Among all, the e-commerce segment is predicted to experience the highest growth during the forecast period of 2022-2032, with growing spending on online shopping across the globe. The surging food and beverage industry has also propelled the growth of the mailer packaging market, as insulated mailers are used for the shipment of food items or beverages. Increased focus on reliable, high-quality, eco-friendly, affordable, and aesthetically pleasing packaging by businesses has boosted the growth of the overall mailer packaging market.

Report Highlights:

- Asia pacific dominates the global mailer packaging market. In contrast, North America and Europe are expected to show significant growth during the forecast period.

- Due to increasing environmental concerns, the paper mailer segment is considered the fastest-growing segment.

- The e-commerce segment among all end-users is predicted to grow the demand for paper mailer packaging materials owing to the increased online shopping all across the globe.

Mailer Packaging Market Report Scope:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 26.76 Billion |

| Projected Forecast Revenue in 2032 | USD 87.32 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.05% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot:

Asia Pacific is the leading region in the global mailer packaging market, and China holds the majority of revenue shares in the market. Rising sales of recyclable or reusable paper mailers have boosted the growth of the mailer packaging market in China. High domestic demand and availability of low-labor costs make the region dominate the market. Rising demand for packaged food and beverages in countries like Japan, South Korea, India, and China is seen as another driving factor to widen the scope of the mailer packaging market in the Asia Pacific.

Along with this, initiatives by public and private bodies/organizations to reduce packaging waste have fueled the demand for recyclable mailer packaging products. For instance, one of the world's largest and independent conservation organizations, the World Wide Fund for Nature Singapore (WWF-Singapore), announced in April 2022 that customers could return the packaging of parcels after receiving them to be reused to reduce packaging waste. The presence of major key players such as Shanghai DE Printed Box, Guangzhou Huaisheng Packaging Ltd., Cosmo Films, Mitsui Busan Packaging Co Ltd., Takigawa Corporation, and Asahi Kasei and Essel Propack has boosted the growth of the overall market of mailer packaging in Asia Pacific.

North America is considered the fastest-growing and second-largest revenue-holding region in the global mailer packaging market. An increasing number of small businesses in the US have fueled the growth of recyclable/ reusable and sustainable paper mailers, which has reflected on the overall development of the mailer packaging market in North America. Further, the rise of the e-commerce industry in North America is expected to boost the market's growth. Along with this, the rapid adoption of advanced machinery for automatic packaging to reduce labor efforts and meet the rising demand for sustainable and flexible packaging has shown growth in the market. Companies such as Intertape Polymer Group Inc., Pregis LLC, Georgia-Pacific LLC, Koch Industries Inc., 3M Company, and Sealed Air Corporation have contributed to the development of the mailer packaging market in North America.

The growing number of acquisitions, mergers, and strategic partnerships in North America is expected to fuel the market's growth. For instance, in June 2022, Clearlake Capital Lake LP acquired Intertape Polymer Group. Under the acquisition, Clearlake acquired all of Intertape Polymer Group's outstanding stocks.

Increasing demand for consumer electronics has boosted the demand for cushioned mailers in Europe. The region is expected to grow during the forecast period owing to the population's increasing spending on e-commerce websites. Germany is considered a significant contributor to the growth of the mailer packaging market in the region due to the presence of considerable mailer manufacturers in the country. Abriso Jiffy, VP Group, Polisac SA, and Henkel Corporation are critical players in the European mailer packaging market. Brazil and Mexico are considered significant contributors to the growth of the mailer packaging market in Latin America owing to the rising establishment of private packaging manufacturers in the countries. In contrast, the market in Argentina faced economic challenges during the pandemic. Coveris Holdings SA, Mondi Group, and Berry Global Inc are major key players involved in the mailer packaging market of Latin America.

Gulf countries such as Qatar, Kuwait, United Arab Emirates, and Saudi Arabia are seen promoting eco-friendly mailer packaging options due to increasing environmental concerns. The demand for sustainable and flexible mailers from the food and beverage and cosmetic industries has risen in recent years, which has boosted the mailer packaging market in the Middle East.

The strategic acquisition, expansion of businesses, and partnerships by prominent key players across the globe have fueled the growth of the market in the Middle East. For instance, in March 2022, Comexi, a leading company in the flexible packaging sector, announced a business expansion in the Middle East. Comexi entered into a legal agreement with Madayn Plastic Company for the development. The mailer packaging market in Africa is moderately competitive and expected to grow during the forecast period. Uflex Limited, Napco Group, Amcor, Coveris Management GmBh, and Gulf Packaging are a few key players in the Middle East and Africa mailer packaging market.

Market Dynamics:

Driver:

The rising importance of recyclable mailers to fuel the growth of the market

Rising environmental concerns have boosted the demand for recyclable or at least reusable mailers across the globe, which is seen as a significant driver for the mailer packaging market. Recyclable material used in the manufacturing of mailers helps reduce waste, decrease the carbon footprint, and save resources. Many companies have recently shifted from plastic packaging to recyclable or paper mailer packaging options. For instance, in October 2022, a leading global e-commerce company, Amazon, switched to recyclable paper mailer packaging to pack orders for shipment from single-use mailer packaging options. Amazon customers in the Europe network will be receiving parcels in flexible and recyclable paper bags.

Restraint:

High cost of raw materials required for the production

The cost associated with raw materials required in the manufacturing process of mailers has grown in recent years. The Covid-19 pandemic caused a drastic increase in the prices of raw materials. During the pandemic, the supply chain and manufacturers faced financial loss. To combat the loss, prices for raw materials used in paper mailers and plastic mailers, such as quality paper, cellulose, polyethylene, and other synthetic materials, increased at the beginning of 2022. The high cost of raw materials used in sustainable mailers is considered a restraining factor for the growth of the mailer packaging market as it results in increased production costs and affects demand.

Opportunity:

Growing food & beverage sector to increase the demand for insulated mailers

The insulated mailers restrict heat transfer with their mechanism. Insulated mailers maintain the appearance and condition of food products during the shipment. Thus, they are widely used to deliver meals, meat, cheese, wines, and other food products that need temperature control. The food and beverage industry is considered a rapidly growing industry after e-commerce. The growing food and beverage industry has boosted the demand for insulated mailers to ship food items safely. The investments in insulated mailers manufacturing, research and development of insulated sheets for mailers, and expansion of the company portfolio for insulated materials open vast opportunities for key players to grow in the global mailer packaging market. Insulated sheets used in mailers are manufactured using natural fibers, making them environmentally friendly.

Challenge:

Lack of awareness of e-commerce, shipping industries in underdeveloped countries

The need for more awareness of e-commerce and shipping industries in underdeveloped countries across the globe, including rural areas in developing countries, causes a challenge for the mailer packaging market to grow. The absence of basic market infrastructure, lack of capital for manufacturers, and weak socio-economic conditions have created noticeable barriers to the adoption of packaging industries. Inadequate logistic and telecommunication conditions have caused an obstacle for e-commerce industries in underdeveloped countries or rural areas.

Recent Developments:

- In December 2022, Nelipak, a healthcare packaging company, announced the opening of a packaging plant that will be US-flexible. The Nelipak Healthcare Packaging company will invest $11.8 million in the initial phase on its chosen site for the plant.

- In January 2022, a Bengaluru, India-based packaging startup company, Bambrew, raised $2.35 million in its first pre-series round. Supack Industries and Blue Ashva Capital lead the fresh investments. Bambrew will be utilizing this raised amount to build a tech-enabled platform for sourcing green packaging and to increase supply capacity.

- In August 2022, leading packing manufacturers in the global industry, Atlapac, and TIPA, partnered to produce fully compostable packaging for retail businesses. This is considered a step taken for eco-friendly packaging materials by both companies.

- In October 2021, Smurfit Kappa announced various protective packaging solutions for the growing beauty and pharmaceutical market. The portfolio by the company includes paper-packaging solutions for the safe shipment of items.

- In August 2021, a global leader in packaging, Mondi, announced that the company would increase capacity for their paper-based MailerBAG range to reduce the utilization of plastic mailer packaging in the e-commerce sector.

Major Key Players:

- Sealed Air Corporation

- Intertape Polymer Group, Inc.

- 3M Company

- Pregis LLC

- Pro AmPac LLC

- Neenah

- WestRock

- NorthWest Paper Box

- Accurate Box Company Co.

- Tetra Pack Company

- Salazar Packaging Inc

Market Segmentation:

By Material

- Paper

- Plastic

By Product Type

- Cushioned

- Non-cushioned

By Insulation

- Insulated

- Non-insulated

By End-Use

- E-commerce

- Manufacturing & Warehousing

- Shipping & Logistics

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2531

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333