Mammography Market Size to Attain USD 4.75 Bn by 2032

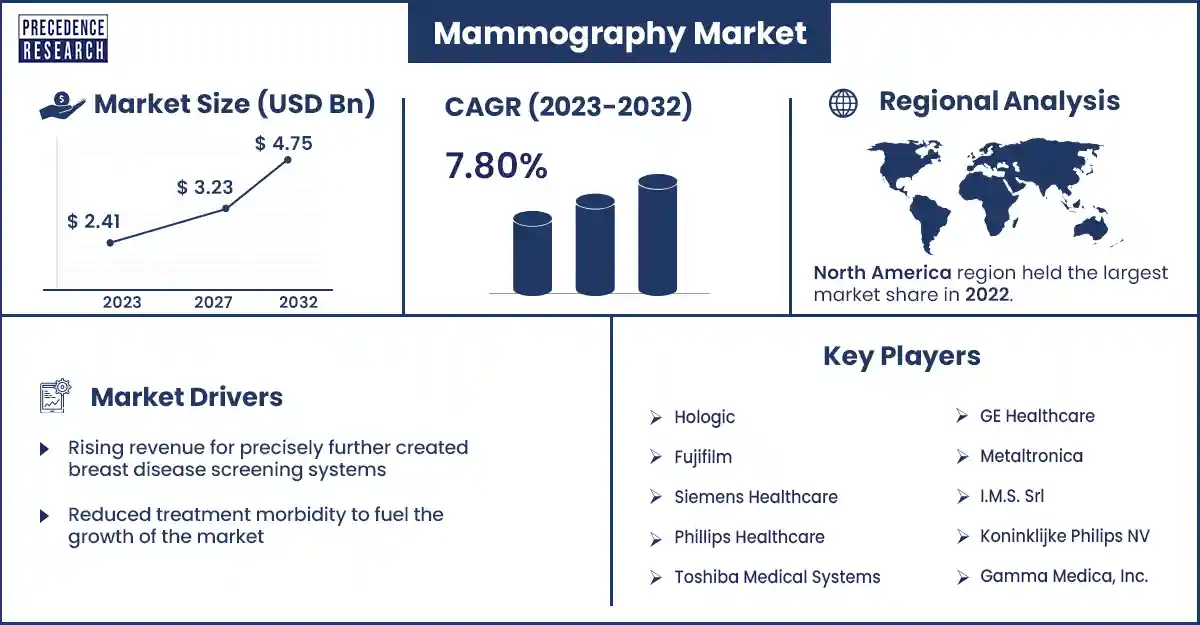

The global mammography market size surpassed USD 2.41 billion in 2023 and is estimated to attain around USD 4.75 billion by 2032, growing at a CAGR of 7.80% from 2023 to 2032. Rising breast cancer, increasing awareness, and government funding to support clinical interpretation are the major factors in the market's growth.

Market Overview

The mammography market deals with medical imaging techniques focused on breast cancer. Mammography is an advanced diagnostic and non-invasive medical imaging technique that uses low-dose X-rays for the treatment of breast issues for the occurrence of tumors. The increasing prevalence of breast cancer all over the world, along with increasing awareness about the early diagnosis and advantages of screening for breast cancer, is a major factor in the growth of the market.

The government's favorable refund policies and life insurance across many developed countries positively affect the market growth. Increasing government initiatives, rising demand for regular treatment, increasing growth in the healthcare industry, and technological advancements in the medical industry also drive the growth of the market.

Reduced treatment morbidity to fuel the growth of the mammography market

In the early stage, screening detects breast cancer. Early-detected cancers are generally smaller and without lymph node involvement as compared to symptomatic cancers. This, in turn, impacts prognosis, with 27% for distant metastatic disease, 86% for regional disease, and 99% for localized disease. Breast cancer stages also increase the treatment procedures with a more comprehensive disease requiring more radiation therapy and aggressive surgery. Between the unscreened and screened women, therapies reflected in data comparing approaches. Most of the expensive surgeries are associated with post-surgical issues, including lymphedema and continuous pain. As a result, the diagnosis of early-stage cancer by screening methods can decrease the morbidity in breast cancer treatment in mammography.

However, radiation injury in mammography may restrain the growth of the market. Exposure to mammography radiation is referred to as significant harm of mammography. The Federal law sets a limit on typical screening mammograms consisting of 2 views of each breast and a limit of 3.0 mGy for every mammogram. Advanced digital breast tomosynthesis and digital mammography generally use radiation doses that are less than the mandated upper limit. In radiology, radiation safety is a very important part of mammography, but a lower risk of radiation-generated injury from mammography should not prevent mammography screening.

Mammography Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 2.41 Billion |

| Projected Forecast Revenue by 2032 | USD 4.75 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.80% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mammography Market Top Companies

- Villa Systems Medical SpA

- UR Medicine

- GENERAL MEDICAL ITALIA

- GE Healthcare

- I.M.S. Srl

- Gamma Medica, Inc.

- BMI Biomedical International SRL

- Carestream Health

- Metaltronica

- Hologic

- Siemens Healthcare

- Fujifilm

- Philips Healthcare

Recent Development by GE Healthcare

- In November 2023, GE Healthcare launched MyBreastAI Suite to detect the challenges of workforce attrition and increase imaging volume in radiology. The reason behind this launch was to improve breast cancer recognition in mammography with the help of artificial intelligence tools. It was an AI platform that helped to detect breast cancer.

Recent Development by UR Medicine

- In November 2023, in New York, to save the lives of breast cancer patients, UR Medicines launched a Mobile Mammography Van. It has 3D breast imaging technology and offers significant major preventive care for women.

Regional Insights

Asia Pacific is expected to grow the fastest in the forecast period. The increasing per capita medical services and increasing prevalence of breast cancers are anticipated to drive market growth in the region. India, Japan, and China are the countries in the Asia Pacific market that majorly contribute to the growth.

In China, breast cancer is the most common tumor in Chinese women, and these cases are increasing very rapidly. Breast cancer in Chinese patients is likely to be smaller than in Western patients. Hence, the age of mammography screening should be earlier in Chinese women. In addition, breast cancer patients have various ancestry-particular genetic features for determining the higher-risk population. In China, breast cancer has been found with millions of new cases and lakhs of deaths in recent years. Mortality rates and breast cancer cases continue to grow in China. China must diagnosis system for early treatment and develop screening of standardized breast cancer to reduce mortality.

In Japan, mammography guidelines conducted by the American College of Radiology Breast Imaging Reporting and Data System are deliberated to regulate the methodology in mammographic reports. In Japan, various diagnostic and specialty centers have made beneficial decisions, including partnerships and collaborations, which will raise the perception of the diagnostic and specialty centers in the mammography market to offer mammography diagnoses to patients.

- For instance, in September 2022, in Japan, for the research and development of breast cancer diagnosis using artificial intelligence, the National Cancer Center of Japan launched an AI-based mammography treatment company.

North America dominated the mammography market in 2023. The increasing prevalence of breast cancer is the major factor driving the market growth in North America. The United States and Canada are the developed countries in North America.

In the United States, breast cancer is the second major reason of cancer death, especially in women. In women aged 50-74, the United States Preventive Services Task Force conducted breast cancer mammography screening every two years. Due to the current screening recommendations, the American Cancer Society conducted either 2D or 3D screening of mammography. The Affordable Care Act requires private life insurance companies in the United States to pay for mammography screenings. At the age of 40 or after that, breast cancer patients can have mammograph screening every 1 to 2 years for free. 3D mammographs are free for breast cancer patients in the United States.

Market Potential and Growth Opportunity

Digital Mammography

Digital mammography is the advanced technology by which the radiographic picture is acquired with digital detectors and recorded digitally in a digital pattern. The image is further displayed and processed as a grey-scale image that can be visible in various formats. Digital mammography has various benefits, such as image storage, display, and acquisition. Image adjustments in magnification, brightness, and contrast of selected regions help radiologists get better views. This digital technology is helping to improve the ability to recognize and diagnose breast cancer.

In digital mammography, scanned pictures can be stored safely for future perspective and can be sent digitally. The major benefit of digital mammography consists of the reduced spatial resolution and cost of the device as compared with film. These are the major opportunities that may drive the growth of the mammography market in the coming years.

Mammography Market News

- In December 2023, in North Central Florida, for the screening of breast cancer, UF Health Cancer Center launched a mobile mammography unit. This mammography unit helps with advanced technology to provide services to the community.

- In October 2023, for the pioneering initiative that aims to tackle radiologists and streamline diagnosis and improvement of breast cancer detection, Lunit AI-powered solutions launched the world’s first AI-driven mammography breast clinic.

Market Segmentation

By Product

- Film Screen Systems

- Digital Systems

- Analog Systems

- Biopsy Systems

- 3D Systems

- Others

By Technology

- Breast Tomosynthesis Mammography

- CAD Mammography

- Digital Mammography

By Modality

- Portable

- Non-Portable

By End Use

- Hospitals

- Special Clinics

- Diagnosis Centers

- Ambulatory Surgical Centers

- Educational & Research Institutes

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1854

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308