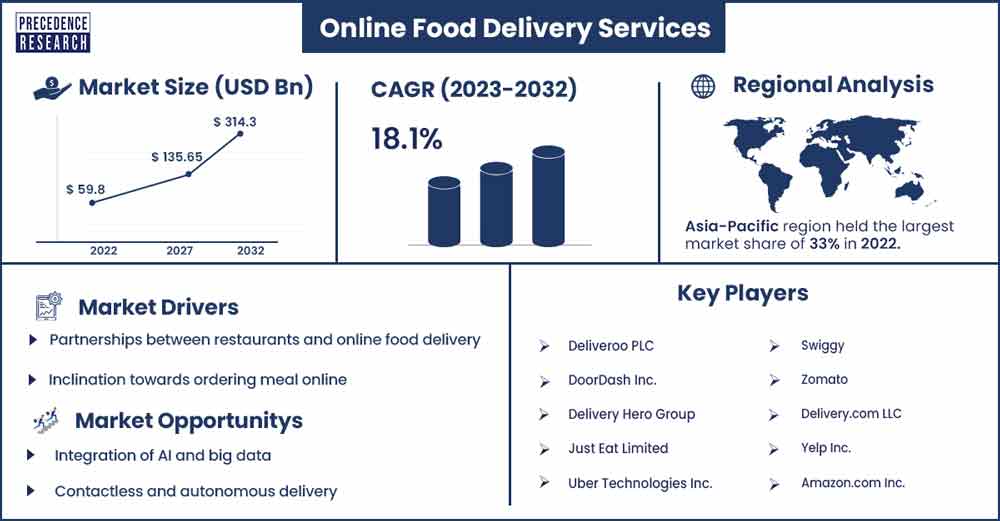

Online Food Delivery Services Market Will Grow at CAGR of 18.1% By 2032

The global online food delivery services market size is anticipated to reach around USD 314.3 billion by 2032 up from USD 59.8 billion in 2022 with a CAGR of 18.1% between 2023 and 2032.

Market Overview

Online food delivery services are digital platforms or applications that connect customers with a wide range of restaurants and eateries, allowing them to order food for delivery or takeout through the internet. These services have become increasingly popular due to their convenience and the ability to satisfy the growing demand for food delivered to one’s doorstep. Online food delivery services have become an integral part of the modern food industry, enabling consumers to enjoy a wide variety of cuisines without leaving their homes. These platforms have also provided new opportunities for restaurants to expand their reach and consumer base.

- According to the data given by the United Nations, the growing number of cities in North America and throughout the world the percentage of people that reside in urban regions is 82%, with Latin America coming in second. The percentage is 74% in Europe. The UN predicts that by 2050, more than two-thirds of the world's population will reside in urban regions, up from the current average of 55%.

- With a total of $9.9 billion raised as of January 2023, the German food delivery business Delivery Hero is by far the most well-funded in the world.

- In April 2023, Uber Eats, a food delivery business, declared only days after getting a hard time from the Competition Commission of South Africa that it will invest US$10.7 million to provide job possibilities for youths in townships, which are often low-income regions.

- TradingPlatforms.com predicts that by 2023, there will be over $2.85 billion users of online meal delivery.

The online food delivery services market is driven by several factors such as the growing penetration of smartphones, convenience offered by online food delivery, rising investment, growing app development software, rising digitalization, growing disposable income, increasing urbanization and busy lifestyles of individuals.

Furthermore, the growing internet penetration across the globe is expected to offer enormous potential for market growth over the projection period. For instance, according to the World Population Review, 4.9 billion people, or 69% of the world's population, are expected to be active internet users by 2022. According to trends, the number of people using the internet is increasing at a pace of 4% annually, which translates to over 196 million new users joining the network annually.

Regional Insights

Asia Pacific is expected to dominate the market over the forecast period. The market growth in the region is attributed to the growing urbanization and rising disposable income of the population particularly in China and India. The substantial penetration of technology and smartphones in the region is also predicted to expand the market’s growth in Asia Pacific.

- According to the data given by the United Nations, one of the key megatrends that defines the Asia-Pacific area is still urbanization. With over 2.2 billion inhabitants, Asia is home to 54% of the world's metropolitan population. It is anticipated that by 2050, there will be 1.2 billion more urban residents in Asia, a 50% increase in population.

Moreover, the increasing usage of internet-enabled smartphones by millennials and their quick uptake of cutting-edge technology like voice-assistant applications are major factors driving the growth of the regional market. The adoption of food delivery applications in the area is being further aided by the expansion of the e-commerce industry in developing nations like Japan and India. Furthermore, the region is known for its diverse cuisines, and online food delivery services have made it easier for consumers to access a wide range of these cuisines. This variety attracts a diverse customer base.

Online Food Delivery Services Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 70.32 Billion |

| Projected Forecast Revenue by 2032 | USD 314.3 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 18.1% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Partnerships between restaurants and online food delivery

In recent years, there has been a global upsurge in the number of strategic alliances formed by food chains and online food aggregators. Restaurants may access the large consumer base of online food aggregators through these relationships, and vice versa. Furthermore, in exchange for consumer insights and data analytics, online food delivery service providers are getting into delivery agreements and contractual relationships with well-known restaurants.

In September 2023, a partnership was established between Toast, the all-in-one digital platform designed for restaurants, and Gordon Food Service, a prominent family-run foodservice distributor in North America. The two businesses will collaborate to serve the Canadian restaurant industry. Gordon Food Service Canada has chosen Toast as its preferred point of sale (POS) provider. With the help of this new alliance with Gordon Food Service, restaurants will be able to take advantage of a more efficient customer experience, access to technology solutions, and other advantages.

Inclination towards ordering meal online

Ready-to-eat food delivery has become a significant industry because of the development of tech-enabled driver networks, user-friendly apps, and shifting customer expectations. The lockdown's implications early in the epidemic greatly helped the industry as more people ordered meals online. It's probably going to stay a solid fixture in the restaurant industry for some time to come. It is now possible for customers to have their favorite meal delivered straight to their homes without compromising on quality or serving time. The main driver is that consumers can access a range of offers, discounts, and deals in one place and through a single app. It is up to them to visit the individual websites of each restaurant. Thereby, driving the market growth.

Restraints

Lack of infrastructure

The majority of online food delivery services are unable to handle the current setup. Many applications have a range of reach that fluctuates, which acts as a constraint, particularly for emerging and underdeveloped businesses. Only a small portion of the methods and services have been outfitted for use in typical settings. Manufacturers need to concentrate on creating resource-efficient settings that are sustainable for the food delivery online sector. Developers continue to face difficulties in operating autonomous cars for food delivery, particularly in developing nations with huge populations and crowded environments.

Food quality and packaging

It might be difficult to guarantee that food quality is preserved throughout delivery and that packaging is eco-friendly. A platform's reputation may suffer if customers have unpleasant experiences as a result of poor food quality. This can also create consumer skepticism that can limit the expansion of online food delivery platforms. Thereby, the factor is observed to create a restraint for the industry.

Opportunities

Integration of AI and big data

Managing several orders at once and selecting the most suitable delivery partners may be greatly simplified by artificial intelligence, guaranteeing that the food will arrive on schedule. The most probable delivery partners to deliver the order swiftly might be selected by a meal delivery app using sophisticated AI algorithms that do many assessments to find close delivery partners. This may be done by confirming previous reviews and the delivery partner's total rating.

The AI algorithm may choose the fastest and most capable delivery partner right away based on the results, expediting the completion of the transaction. Artificial intelligence has evolved in the last several years from a futuristic technology concept to a real technology with innovative uses across many industries. One of the most effective technologies to engage customers and encourage repeat business in the on-demand food delivery industry may be artificial intelligence.

Contactless and autonomous delivery

Developing or partnering with autonomous delivery methods, such as drones or self-driving vehicles, can offer efficient, contactless delivery options and reduce labor costs. For instance, in September, Autonomous Pickup was introduced by Flytrex Inc. According to the company, it permits a completely autonomous delivery procedure, from the order placing to pick-up and delivery to customer's yards. As stated by Flytrex, this new capacity can reduce delivery times from the moment orders are available to five minutes or less, which will open up development potential for family-run restaurants and QSRs. Thus, this is expected to offer a lucrative opportunity for the market growth.

Recent Developments

- In September 2023, Uber and Deliverect, a ResTech platform that combines online ordering for eateries and food enterprises, have teamed together to assist restaurants in streamlining their delivery processes. The partnership intends to give businesses the resources they need to improve and grow their online food sales, increasing profits and improving customer satisfaction. Nine markets presently provide Uber Direct and Deliverect Dispatch integration: the US, Australia, New Zealand, Canada, France, Germany, Portugal, Spain, and the UK.

- In May 2023, Amazon will keep providing free access to a premium food delivery service for Prime members. The online retailer is extending its complimentary 12-month offer for US Prime paid loyalty program members to join up for a complimentary one-year subscription to the Grubhub+ premium plan, which offers limitless free delivery for orders over $12.

Major Key Players

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc.

Market Segmentation

By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

By Channel Type

- Websites/Desktop

- Mobile Applications

By Payment Method

- Cash on Delivery

- Online

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3285

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333