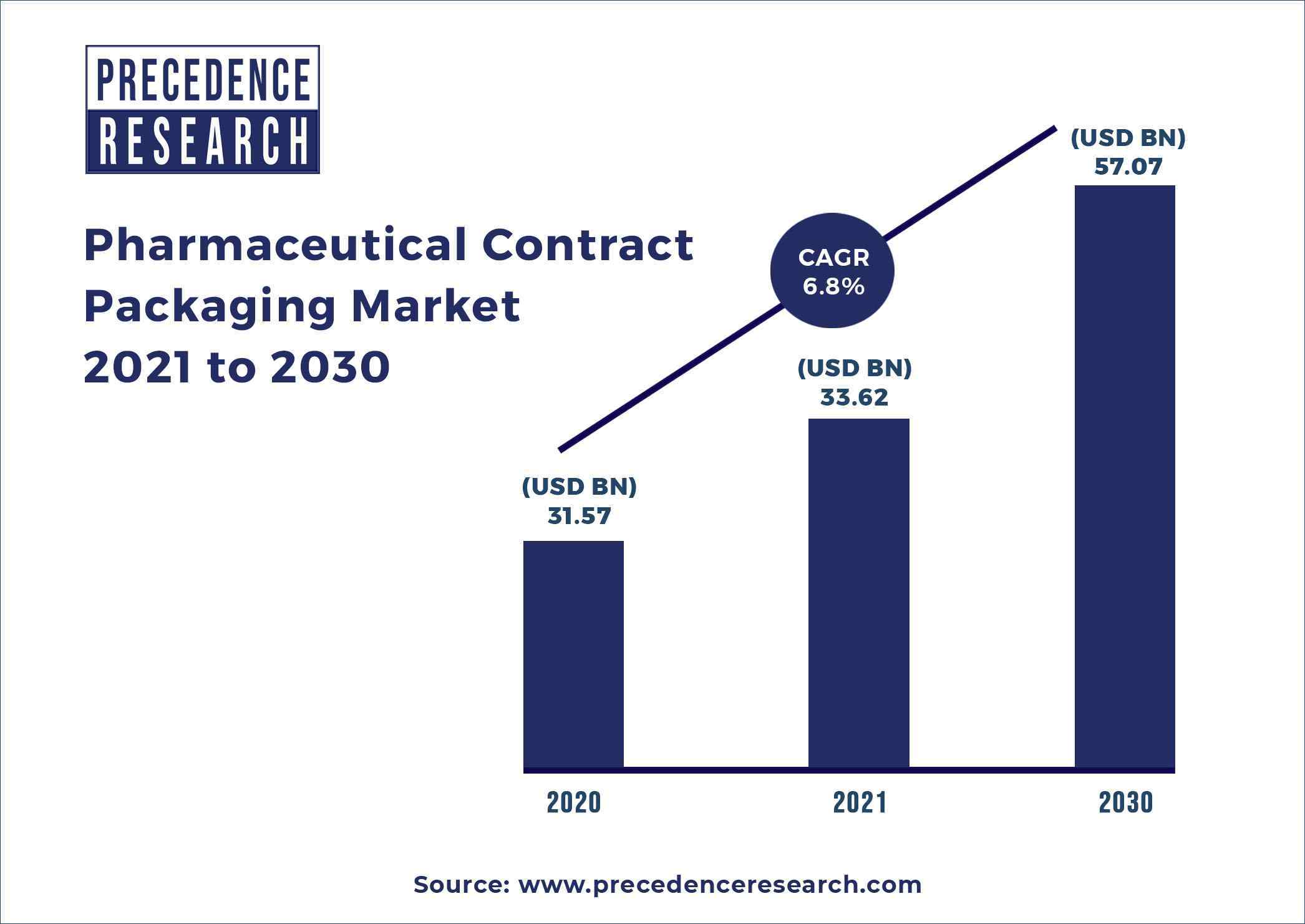

Pharmaceutical Contract Packaging Market Size to Reach USD 57.07 Bn by 2030

The global pharmaceutical contract packaging market size was accounted at around USD 31.57 billion in 2021 and is expected to reach around USD 57.07 billion by 2030 with a CAGR of 6.8% from 2021 to 2030.

To provide patients with the best pharmacological effects, drugs must be packed safely and delivered to the end users with security and safety. As a result, pharmaceutical market players all over the world are turning to contract companies to handle secondary activities like drug packaging and labeling. Assembling and secondary packing of drugs and medications are all provided by contract companies.

Pharmaceutical contract packagingis in high demand around the world since it is reasonably flexible, profitable, and helps businesses keep up with the fast-paced industry. Over the forecast period, the pharmaceutical contract packaging market is likely to be driven by rising quality standards and the outsourcing of pharmaceutical packaging to contract packagers in emerging economies. To lower total manufacturing costs and time to market, pharmaceutical companies are outsourcing packaging to contract packagers.

The contract service providers are working hard to meet their clients’ expectations and provide cutting-edge packaging facilities. Furthermore, the pharmaceutical contract packaging market is expected to be driven by the world’s growing pharmaceutical industry.

Report Highlights

- Based on the type, the primary packaging segment dominated the global pharmaceutical contract packaging market in 2021 with highest market share 43%. Due to lack of in-house capacities and competencies, the segment is expected to dominate the pharmaceutical contract packaging market.

- Based on the material, the glass segment dominated the global pharmaceutical contract packaging market in 2021 with highest market share 40%. The pharmaceutical glass wrapping industry is projected to be driven by low-cost service offerings by contract packaging organizations and contract development and manufacturing organizations.

- The plastics and polymers segment is expected to witness growth at a CAGR 8.5% from 2022 to 2030.

Regional Snapshot

North America region accounted largest revenue share of around 38% in 2021. Due to the high level of service provided by U.S. based contract packaging organizations and contract development and manufacturing organizations. In addition, most pharmaceutical companies outsource their packaging to North American contract packagers to make entry in the U.S. market.

Asia-Pacific region is the fastest growing region in the pharmaceutical contract packaging market. Due to the presence of a high number of contract packaging service providers in the area, Asia-Pacific is predicted to develop at the quickest rate throughout the forecast period. Furthermore, the growing outsourcing of pharmaceutical manufacturing to rising countries like India and China is fueling the region’s growth.

Scope of the Report

| Report Attributes | Details |

| Market Size in 2021 | USD 31.57 Billion |

| Revenue Forecast By 2029 | USD 53.28 Billion |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Companies Covered | AmerisourceBergen Corp., SCHOTT AG, WestRock Co., Becton, Dickinson and Co., Constantia Flexibles Group GmbH, Bilcare Ltd., CCL Industries Inc., Berlin Packaging, FedEx Corp. |

Market Dynamics

Drivers

Lack of expertise in packaging

The pharmaceutical major market players lack expertise for the packaging of the drugs and medicines. They are also not aware about the regulatory frameworks for pharmaceutical packaging. The pharmaceutical industry is heavily regulated, yet there are some differences in detail depending on the nation of origin. Pharmaceutical packaging is an essential component. Pharmaceutical packaging is always given an extra attention or focus by pharmaceutical marketing firms and franchising companies. As a result, the lack of expertise in packaging is propelling the growth of the pharmaceutical contract packaging market during the forecast period.

Restraints

Stringent government regulations

The packaging of pharmaceuticals comes into two types such as primary and secondary packaging. A carton or an accessory like a syringe plunger rod are examples of secondary packaging that do not come into direct contact with the product. All primary and secondary packaging materials must meet Food and Drug Administration requirements for their intended application. These regulatory frameworks must be followed by contract packagers. Thus, the stringent government regulations is hampering the growth of the pharmaceutical contract packaging market during the forecast period.

Opportunities

Smart packaging solutions

Each stakeholder in the pharmaceutical supply chain benefits from smart packaging. It can improve patient adherence and compliance, as well as validate authenticity, promote monitoring, anti-counterfeiting, and addiction prevention efforts, extended shelf life, and improve sustainability features. Intelligent packaging and active packaging are two types of smart packaging solutions in the pharmaceutical industry. All these solutions help contract packagers to pack and label drugs and medicines at a rapid pace of time. As a result, the smart packaging solutions is creating lucrative opportunities for the growth of the pharmaceutical contract packaging market during the forecast period.

Challenges

Lack of resources

The packaging of pharmaceuticals requires lots of resources. Sometimes, small and medium enterprises or contract packagers lacks in the resources of pharmaceutical packaging. The different types of materials used in the pharmaceutical packaging are polyethylene, nylon, polycarbonate, and plastic. Apart from materials, the packaging units also require huge space for the packaging process. Thus, lack of resources is a huge challenge for the market growth.

Buy this premium research report - https://www.precedenceresearch.com/checkout/1171

Any question regarding this study, please feel free to contact at sales@precedenceresearch.com