Plant-Based Protein Market Size to Surpass USD 43.07 Billion by 2034 Driven by Veganism and Clean-Label Demand

Plant-Based Protein Market Size and Forecast 2025 to 2034

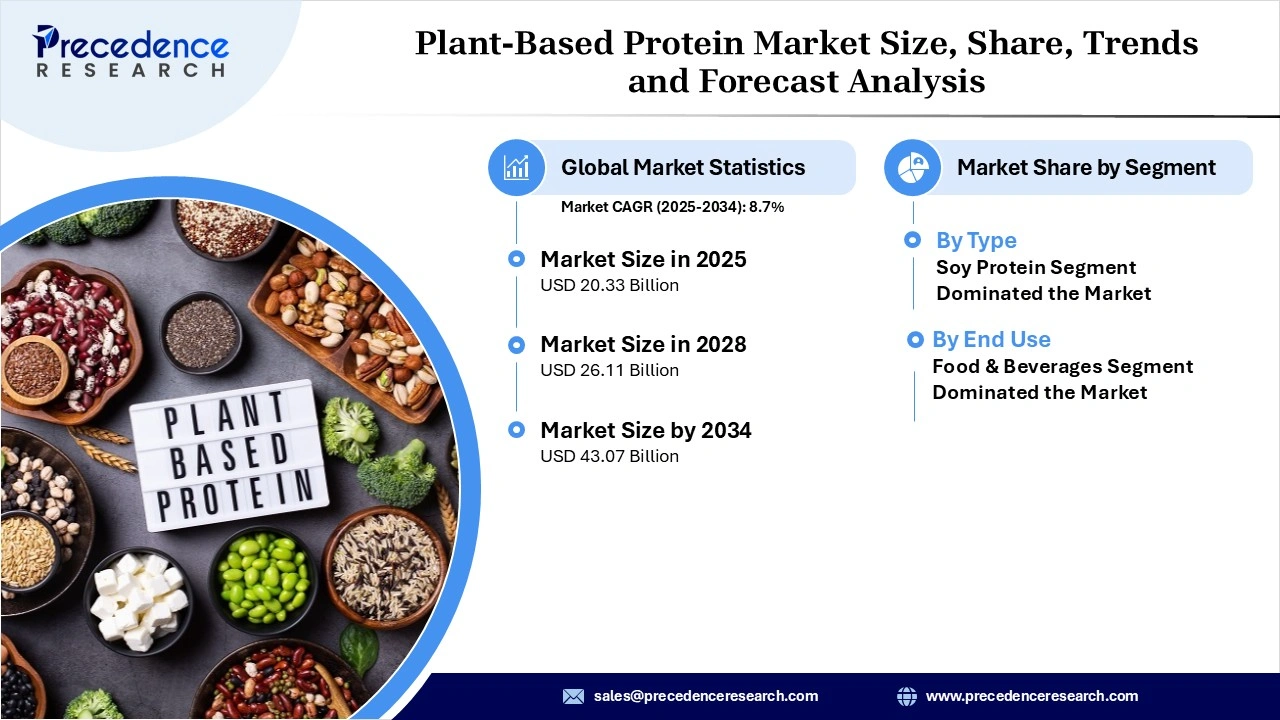

The global plant-based protein market size was calculated at USD 18.70 billion in 2024 with projections indicating a rise from USD 20.33 billion in 2025 to reach nearly USD 43.07 billion by 2034, with a CAGR of 8.7% during the forecast period from 2025 to 2034. The growing shift toward vegan and vegetarian lifestyles is fueling demand for plant-based foods and clean protein sources, driving strong growth in the market.

Plant-Based Protein Market Snapshot

The plant-based protein market has experienced growth in recent years owing to the increasing need for an alternative to animal-based foods and a shift towards fitness. Moreover, technological advancements have played a major role in the expansion of industry nowadays. Furthermore, the manufacturers are actively investing in R&D activities for the innovation of affordable and various flavors in recent years.

Market Opportunities

- The development of the customized functional plant protein is likely to create lucrative opportunities for manufacturers in the coming years.

- The developing partnerships with major sport brands are likely to provide greater advantage to the farmers in the coming years.

Key Growth Factors

- The demand for the blended protein has been driving the industry's potential in recent years.

- The greater adoption of clean-label products has contributed to the industry’s growth in the past few years.

Market Restraint

- The manufacturers are likely to face taste and texture-related problems of plant protein in the coming years.

- The higher initial cost for the production of the plant protection can create growth barriers for the new entrants of the industry during the forecast period.

Plant-Based Protein Industry Coverage

| Report Attribute | Key Statistics |

| Forecast Year | 2025 to 2034 |

| Base Year | 2024 |

| Market Size in 2025 | USD 20.33 Billion |

| Market Size by 2034 | USD 43.07 Billion |

| CAGR from 2025 to 2034 | 8.7% |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Plant-Based Protein Market Segmental Analysis

Type Analysis

What made the Soy Segment Dominant in the Plant-based protein market in 2024?

The soy segment generated the greatest revenue share in 2024, owing to factors such as affordability and wide availability. Moreover, several individuals are seen as considering soy protein as a meat alternative for traditional times. Also, the sudden surge in vegan diet and sports nutrition is actively contributing to the growth of the segment in recent years.

End Use Industry Analysis

What made the Food and beverage Segment Dominant in the Dietary Supplements Market in 2024?

The food and beverage segment generated the greatest revenue share in 2024, because digital platforms offer both variety and trust in certifications. Consumers can easily compare labels, read reviews, and verify authenticity before buying. E-commerce also provides doorstep delivery for perishable organic foods, which is highly convenient for urban buyers. Subscription-based models for organic vegetables, juices, or snack boxes are also thriving online.

Geographical Outlook

North America

North America dominated the plant-based protein market because to region is considered one of the advanced regions for R&D innovation and the presence of major fitness brands. Moreover, the expansion of strong fitness and wellness culture has provided major attention to the region in recent years as per the observation.

Asia Pacific

Asia Pacific is expected to emerge at the fastest CAGR during the forecast period of 2025 to 2034, due to the factors such as culture preference for plant-based diets and the enlarged population. Also, the region has seen under the heavy influence of Western culture and sports fitness culture, which can play a major role in the expansion of industry growth in the future.

Strategic Moves by Key Players

- In March 2025, the Europe-based organization Schouten launched two new snacks: Sea Bites and Power Bites. Power Bites offers a rich and nutty flavor. They do not contain nuts but provide the same taste experience.

- In January 2025, Zyra Protein introduced a plant-based protein powder made with four ingredients that include date powder, pea protein, salt, and strawberry powder. This protein powder is gluten-free, vegan-friendly, non-GMO, and 100% natural.

Plant-Based Protein Market Top Companies

- Fuji Oil Group

- International Flavors & Frangrances Inc.

- Archer Daniels Midland Company

- Kerry Group PLC

- Kansas Protein Foods LLC

- Cargill Incorporated

- Wilmar International Ltd.

- Kerry Group PLC

- Burcon NutraScience Corporation

- DuPont

- Wilmar International Ltd.

Segments Covered in the Report

By Type

- Soy Protein

- Pea Protein

- Rice Protein

- Hemp Protein

- Wheat Protein

- Others

By End Use

- Food & Beverages

- Supplements

- Personal Care & Cosmetics

- Animal Food

By Region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin America