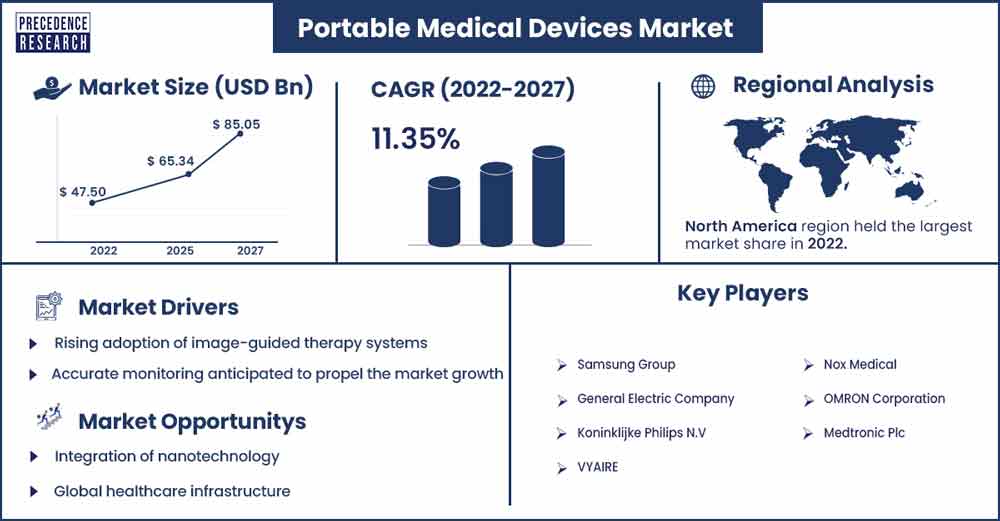

Portable Medical Devices Market Poised to Exceed CAGR 11.35% By 2027

The global portable medical devices market size was evaluated at USD 47.50 billion in 2022 and is expected to touch around USD 85.05 billion by 2027, growing at a noteworthy CAGR of 11.35% from 2022 to 2027.

Market Overview

The global portable medical devices market revolves around the production and distribution of medical devices that are designed to be used remotely. In the upcoming years, it is projected that an increase in chronic disease brought on by altered lifestyle, a preference for home healthcare, and an increase in the population of elderly people will all favorably affect the growth of the portable medical devices market.

- GE Healthcare, a prominent player in portable medical devices market stated that the company has witnessed a year-on-year growth of 7% in the second quarter of 2023. GE Healthcare has also introduced Portrait Mobile in June 2022, a wireless patient monitoring system that enables continuous monitoring throughout a patient's stay.

A survey done by Cross Country Workforce Solutions Group (2022) suggested that 70% of the geriatric population prefer in-home care. Another important cause for the market expansion is the rising demand for wearable electronics and wireless medical devices. The widespread innovative technology and growing public knowledge of the advantages of portable devices are both factors in the general use of mobile medical devices in hospitals and other healthcare facilities.

- In June 2023, Omron Healthcare will build a medical device manufacturing facility in Tamil NÄdu, a manufacturer and distributor of personal healthcare items with headquarters in Japan, at 128 crore rupees. With 60 employees, the factory is anticipated to be operational by March 2025, producing 3 million monitors in the first three years before increasing production capacity in response to demand.

- In August 2022, Vietnam wants to produce medical equipment with international funding. According to the Ho Chi Minh City Medical Equipment, the Vietnamese medical equipment market, which is expanding at more than 18% annually, primarily depends on imports and offers substantial prospects for foreign companies. He stated during a meeting that domestic medical equipment producers mainly produce essential items and only meet 10% of demand, with the remaining 90% being Imported.

Portable Medical Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 52.35 Billion |

| Projected Forecast Revenue by 2027 | USD 85.05 Billion |

| Growth Rate from 2022 to 2027 | CAGR of 11.35% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2027 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Snapshot

North America dominates the global portable device market. High penetration of portable diagnostic, therapeutic, and monitoring medical equipment for illness management is one of the main drivers of this region's growth. The burden of chronic disease and the number of elderly people is rising. For instance, the demand for portable medical gadgets is increasing quickly, along with the burden of chronic diseases like cancer and heart disease. The significant causes of death and disability in the U.S., according to the U.S. Center for disease control and prevention, are chronic diseases, including diabetes, cancer, and heart disease.

The portable device market in the U.S. includes a wide range of items, including smartphones, tablets, laptops, wearable technology, and more. Since 5G networks offer higher internet speeds and enhanced connectivity, which may open up new apps and experiences, it was anticipated that their rollout would have an effect on the market for portable devices. An increasing amount of attention was being paid to how electronic devices affected the environment, which prompted efforts to make them more recyclable and energy efficient.

In Canada, smartphones account for a sizable portion of the portable device market. Canadian consumers like popular companies like Apple, Samsung, and Google. Market characteristics included a high demand for flagship and mid-range cellphones and regular upgrades to the most recent models. Consumers and businesses in Canada continued to rely heavily on laptops. With a rising focus on performance and battery life, the market experienced a shift towards lighter, smaller, and more portable laptop designs. A sizable portion of the Canadian market comprised accessories for portable electronics, such as cases, screen protectors, chargers, and wireless headphones.

- In July 2023, X-ray equipment maker K.A. Imaging introduced the Reveal Mobi pro-dual-energy mobile X-ray system. The item, resulting from a partnership between UMG and Del Medical, will be displayed during the following AHRA annual meeting. Offering technology to enhance the visibility of bones and tissues at the bedside is crucial because mobile imaging has become more prevalent in many healthcare facilities since the epidemic.

- In March 2022, the first-ever U.S. mobile tour was dubbed Canon across America, according to Canon Medical System USA, a world leader in cutting-edge diagnostic imaging technology. For a unique hands-on experience, CMSU will bring its advanced A.I. medical gadgets to hospitals and regional healthcare providers to strengthen community involvement all year.

North America has several key players in the Portable medical device market, including Koninklijke Philips N.V., Hologic Inc., Medtronic, General Electric, OMRON Corporation, Samsung, and F. Hoffmann-La Roche Ltd.

- In May 2023, three new products have been released by G.E. Healthcare to increase the effectiveness and precision of radiation therapy. The new approaches include intelligent radiation therapy, auto segmentation, and an upgraded magnetic resonance radiation therapy suite. To develop the new IRT platform, G.E. worked with more than 150 clinicians from local hospitals to significant healthcare organizations across the globe.

Market Dynamics

Drivers

Technological advancements

Smaller, lighter, and more wearable portable medical equipment is now available in the market with advanced technological features. These include smart watches, activity monitors, and wearable medical devices that can track physical activities, monitor vital signs, and even identify medical issues. Remote patient monitoring is now possible because of advanced sensors and wireless connectivity, essential for managing chronic diseases. Healthcare professionals can get real-time information on a patient's condition while the patient can monitor their health data at home. Smart inhalers are intended to make drug management more accessible for those with respiratory disorders, including asthma and COPD.

Patient empowerment

Real-time information is provided via portable medical equipment, such as a home blood pressure monitor and wearable fitness tracker, that allows patients to monitor their health. By helping patients monitor their health and make wise decisions, this data empower patients. Patients may benefit from using portable gadgets as instructional resources. They give patient knowledge, suggestions, and feedback that might encourage them to follow their treatment plans and lead healthier lifestyles. The data produced by a patient's portable medical gadget should be theirs to own and control.

Restraints

Maintenance and support

Scheduled maintenance is required to keep portable medical devices in top shape. Manufacturers frequently offer instructions for routine maintenance activities like cleaning, calibration, and software upgrades. Many mobile medical devices require software as a critical component. To guarantee data security, device performance, and compliance with evolving standards. This can be a complicated procedure for users. Additionally, lack of user knowledge impacts on the distribution of portable medical devices.

Reliability and accuracy

Important healthcare choices are frequently made using portable medical devices, including blood pressure, pulse, and glucose monitors. This accurate and consistent glucose data may result in misdiagnosis or ineffective therapy, which could harm patients. The healthcare sector places a high focus on patient safety. Manufacturers must apply strict quality control procedures during their products' planning, creation, and testing to preserve dependability and accuracy.

Opportunities

Investment and innovation

High-tech and portable medical gadgets that are both tiny and intelligent have been made possible by recent advances in miniaturization, sensor technology, and connection. These innovations make real-time vital sign monitoring, chronic disease management, and early health issue diagnosis possible. Large corporations, venture capitalists, and private equity firms have invested significantly in start-ups and businesses focusing on portable medical devices. Given the rising need for consumer health technologies, they see room for expansion in this industry.

Global healthcare infrastructure

Depending on economic development, government policy, and societal needs, healthcare infrastructure differs significantly from nation to nation. Developed nations' Healthcare systems frequently include hospitals, clinics, and cutting-edge medical facilities. In contrast, developing nations may have issues like insufficient healthcare infrastructure, a lack of healthcare specialists, and restricted access to medical care. The gap in healthcare access must be closed via portable medical equipment. They enable medical personnel to reach patients in rural or remote places, diagnose and treat patients promptly, and gather health information for telemedicine consultations.

Recent Development

- In June 2023, Serac Imaging Systems, a UK-based firm, created a portable high-resolution hybrid gamma optical camera currently undergoing clinical testing in the United States. It is anticipated that 25 patients will participate in the six-month-long seracam imaging equipment research. The camera has several potential uses, including imaging of the thyroid and other tiny organs, lymphatics, bone, kidney, infection, and sentinel lymph node localization.

- In October 2022, Max Ventilator declared it would introduce smart devices such as monitors, ECGs, and pulse oximeters to broaden its market niche. In a news release, the company said it has developed a solution that provides premium quality at a reasonable price.

Major Key Players

- Samsung Group

- General Electric Company

- Koninklijke Philips N.V

- VYAIRE

- Nox Medical

- OMRON Corporation

- Medtronic Plc

Market Segmentation

By Product

- Therapeutics

- Nebulizer

- Insulin Pump

- Image-guided Therapy Systems

- Oxygen Concentrator

- Smart Wearable Medical Devices

- Diagnostic Imaging

- X-ray

- CT

- Endoscope

- Ultrasound

- Monitoring Devices

- Neuromonitoring

- Electromyography (EMG) Machines

- Electroencephalography (EEG) Machines

- Intracranial pressure (ICP) Monitors

- Cerebral Oximeters

- Others

- Cardiac Monitoring

- Resting ECG System

- Event Monitoring Systems

- Holter Monitors

- Stress ECG Monitors

- ECG Management Systems

- Respiratory Monitoring

- Spirometers

- Capnographs

- Peak Flow Meters

- Neonatal Monitoring

- Fetal Monitoring

- Vital Sign Monitors

- Hemodynamic Monitoring Systems

By Application

- Cardiology

- Orthopedics

- Gynecology

- Urology

- Gastrointestinal

- Neurology

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1068

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333