Pulp and Paper Market Size to Rise USD 511.53 Bn By 2032

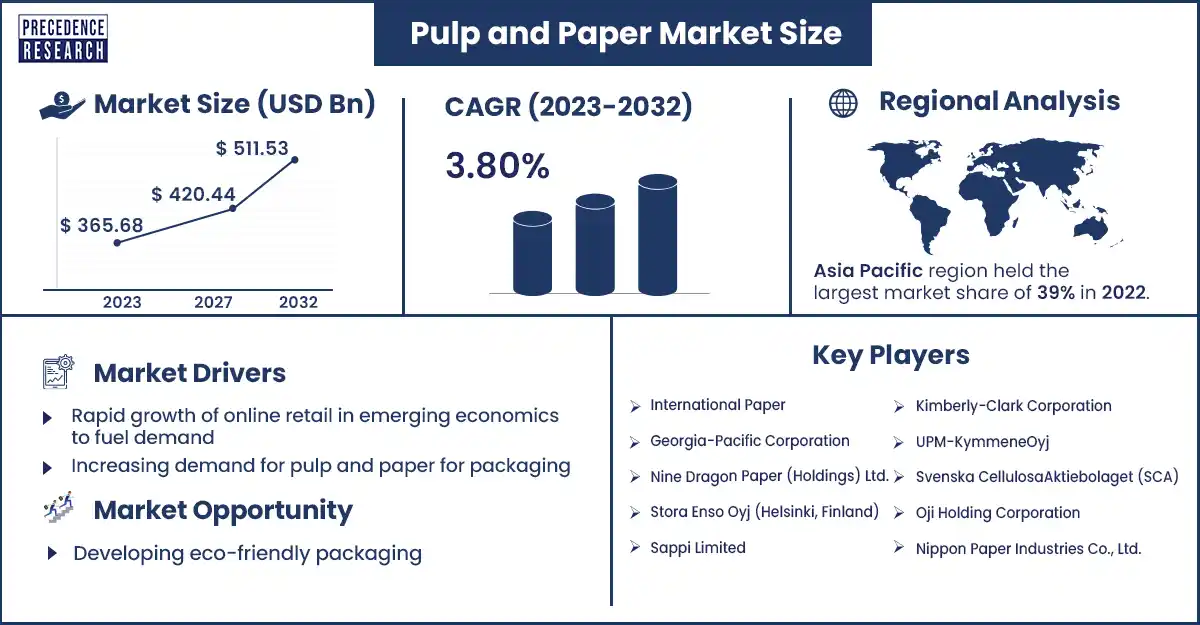

The global pulp and paper market size was evaluated at US$ 365.68 billion in 2023 and is expected to attain around US$ 511.53 billion by 2032, growing at a CAGR of 3.80% from 2023 to 2032.

Market Overview

The pulp and paper market deals with the manufacturing of paper products from recycled paper, wood, and other raw materials. It's an essential and fastest-growing industry that fulfills every side of daily lives, from books, magazines, catalog paper, glossy paper, and packaging that protects the products. The market has a remarkable impact on providing jobs and the economy and contributing to the global trade of paper products. Customers need to understand the manufacturing process and the environmental impact on the pulp and paper industry. The paper-based packaging uses the highest industrial wood traded globally. The Paper and pulp market incorporates industries that use wood as an unprocessed material and produce paperboard, pulp, and other cellulose-based products.

Regional Snapshot

Asia Pacific dominated the paper and pulp market in 2023 and is estimated to grow fastest in the forecast period. This region currently controls the pulp and paper industry due to the commercial printing in the area and the growing requirement for good packaging. Moreover, it is accounted that the increase in the regional market will be supported by the booming economic growth of developing regions like Japan, India, and China. China is the biggest user and producer in the world. Vietnam, Indonesia, and Malaysia are expected to experience profitable expansion due to the growing standard of living and demand for paper-based products. In addition, the increasing urbanization and population in the Asia Pacific are vital factors in navigating the demand for food packaging and commercial printing.

North America and Europe are expected to grow slowly over the estimated period. Increased growth in North America is forecasted to be enhanced by rising fast-moving customer goods consumption, increasing packaging paper requirement in the U.S., and symbolic industries like Georgia-Pacific, WestRock, and international paper. The increasing significance of attaining sustainable goals by recycling paper-based products is likely to simultaneously impulse growth in Europe.

Pulp and Paper Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 365.68 Billion |

| Projected Forecast Revenue by 2032 | USD 511.53 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.80% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Driver

Rapid growth of online retail in emerging economics to fuel demand

Due to the high growth of smartphones and the internet, they are online in emerging economies such as Asian countries, Brazil, India, and China. Customers, especially younger ones, buy food, cosmetics, groceries, and other personal products online. Paper packaging is lightweight and appropriate for management. Also, the rising requirement for sustainability in retail packaging to decrease the negative effect of plastic packaging waste pushes the requirement for paper-passed packaging products. Hence, with fast online retailing, the requirement for corrugated boxes and paper bags will increase during the forecast period.

Restraints

Shifting trend toward digitalization

Printing Industry is continuously changing. So many publishing industries are moving towards electronic versions and replacing preceding printed volumes. A significant part of their respective markets is taken up by magazines, online newspapers, and e-books, while brochures, catalogs, and directories have their electronic alternatives. Most electronic money transactions, such as Phone Pay, Google Pay, and many others, are decreasing for cheques and currency. Moreover, due to the frequent rise of social networking, these factors are responsible for the volumes of some print components, such as books, catalogs, magazines, and many more.

Opportunity

Developing eco-friendly packaging

Developing eco-friendly packaging is a central and vital opportunity in the pulp and paper market. It is motivated by the customer demand for sustainability. Biodegradable and biobased materials involve creating new paper products which are not harmful to the environment. These alternatives disintegrate naturally and decrease waste materials compared to traditional plastics. Recycling materials absorbing a maximum percentage of recycled paper pulp into new packaging decreases interest in pure materials and minimizes environmental impact. Eco-friendly packaging is used in product packaging and packaging for home deliveries. Companies like Amazon have already switched to paper-based packaging for deliveries. Apart from that, companies are also switching to paper-based containers and one-time-use utilities such as straws, cups, and bowls.

- In January 2022, in order to develop its fluff pulp production site in Sweden and Skutskar, Stora Enso conducted research worth USD 40.67 million. The corporation wants to focus on cost-effective processes and reduce its carbon footprint. The pulp that is created will find value in the medical field, particularly in the care of newborns and women.

- In February 2024, the leading company in environmentally friendly packaging, Mondi, created the first skateboard half pipe ever made of a containerboard to demonstrate the robustness and longevity of their materials and to inspire the next generation of environmentally conscious consumers.

Recent Developments

- In February 2024, as part of its dedication to offering innovative and more environmentally friendly solutions for the flexible packaging sector, Lecta developed a wide range of flexible carrier bag applications.

- In December 2022, Asia Pulp and Paper Sinar Mas declared that it will be building a paper factory in the Raigad region of Maharashtra, a state in Western India. The factory will be able to produce 1.2 million MT of paper goods, including packaging boards, tissue, and printing paper, at the Dherand village location.

- In February 2024, the analytics and research from Morningstar Sustainalytics recognized Smurfit Kappa as an outstanding ESG performance of the third year, attaining both corporate and regional top-rated status.

- In April 2022, Georgia Pacific declared a USD 50 million investment in the Muskogee mill. This project enhances the Muskogee Mill's operational efficiency, safety, and dependability by introducing a new production line and equipment. Paper goods, including napkins and paper towels, are produced at the 640-acre plant. This is anticipated to fuel the expansion of the pulp and paper industry in the upcoming years.

- In March 2022, In Honefoss, Billerud Korsnas and Viken Skog started producing bleached chemo-thermochemical pulp.

Key Market Players

- International Paper

- Georgia-Pacific Corporation

- Nine Dragon Paper (Holdings) Ltd.

- Stora Enso Oyj (Helsinki, Finland)

- Sappi Limited

- Kimberly-Clark Corporation

- UPM-KymmeneOyj

- Svenska CellulosaAktiebolaget (SCA)

- Oji Holding Corporation

- Nippon Paper Industries Co., Ltd.

- The Smurfit Kappa Group

- WestRock

Segments Covered in the Report

By Raw Material

- Wood-Based

- Agro Based

- Recycled Fibre Based

By Manufacturing Process

- Pulping Process

- Chemical Pulping

- Chemi-Mechanical Pulping

- Others

- Bleaching Process

- Chlorine Bleaching

- Elemental Chlorine Free (ECF) Bleaching

- Total Chlorine Free (TCF) Bleaching

- Others

By End Use Industry

- Packaging

- Healthcare

- Food & Beverages

- Personal Care

- Other

- Printing

- Commercial Printing

- Packaging Printing

- Publication Printing

- Building and Construction

- Residential

- Commercial

- Industrial

- Infrastructural

- Others

By Category

- Wrapping & Packaging

- Printing & Writing

- Sanitary

- News Print

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1836

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308