Single-Use Filtration Assemblies Market Will Grow at CAGR of 13.40% By 2032

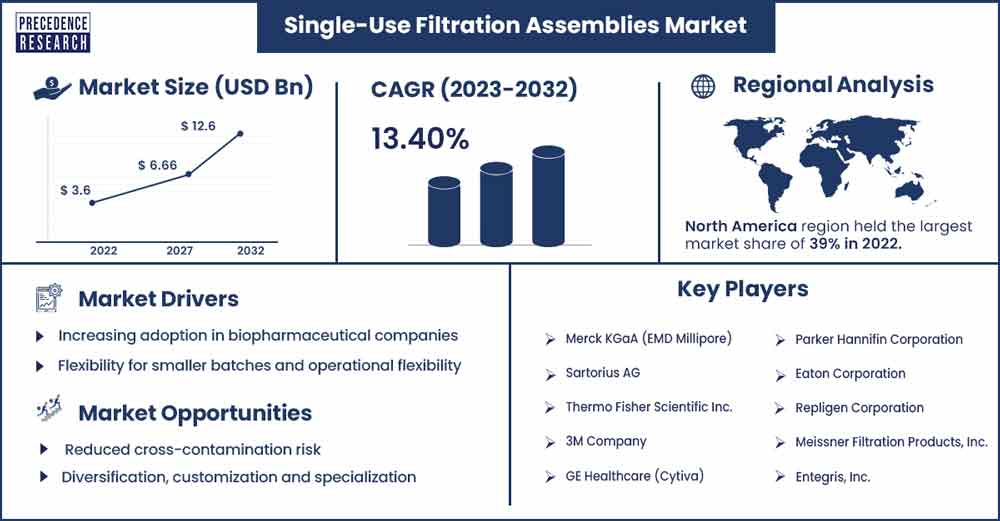

The global single-use filtration assemblies market size accounted for USD 3.6 billion in 2022 and is projected to reach around USD 12.6 billion by 2032, growing at a CAGR of 13.40% from 2023 to 2032.

Market Overview

Single-use filtration assemblies refer to a type of filtration system that is designed for a one-time or limited-use application. These assemblies typically consist of disposable components, such as filters and housings, that are used to separate particles or contaminants from a fluid (liquid or gas). The term single-use emphasizes the convenience and efficiency of these filtration systems, as they eliminate the need for cleaning and sterilization between uses.

These assemblies find widespread use in various industries, including biopharmaceutical manufacturing, food & beverage processing, and other applications where maintaining product purity is critical. Single-use filtration assemblies are particularly advantageous in industries with stringent hygiene requirements, as they help prevent cross-contamination between different batches or products.

The single-use filtration assemblies market is driven by various factors including the growing biopharmaceutical industry, cost efficiency, advancement in technology, regulatory support and others. Furthermore, the growing novel product launch will also propel the market growth during the forecast period.

- For instance, in September 2022, the Thermo Scientific DynaSpin single-use centrifuge system was unveiled by Thermo Fisher Scientific Inc. during the bioprocess international conference held in Boston, Massachusetts. The goal of the technique is to provide the finest single-use alternative for mass cell culture collection.

Regional Insights

North America is expected to dominate the market in the upcoming period. The single-use filtration assemblies market in the region is driven by the growing biopharmaceutical industry. The need for efficient and flexible manufacturing processes in the production of biologics and other pharmaceuticals has led to increased use of single-use systems.

- For instance, as per the European Federation of Pharmaceutical Industries and Associations, in 2022, pharmaceutical sales worldwide were split 52.3% in North America and 22.4% in Europe. Furthermore, 64.4% of sales of newly introduced medications between 2017 and 2022 took place in the US, but just 16.4% did so in Europe, according to IQVIA.

Moreover, the growing investment by the key companies in the biopharmaceutical industry is expected to drive the market expansion. For instance, in May 2022, to increase its industrial presence in Indiana, US, Eli Lilly and Company stated that it would be investing USD 2.1 billion. Similarly, the East Syracuse, New York, manufacturing site of Bristol Myers Squibb was acquired by LOTTE in May 2022. For LOTTE's new biologics contract development and manufacturing organization (CDMO) business in the US, the East Syracuse location will operate as the Center for North America Operations.

In the region, the US is expected to capture a significant market share over the forecast period. The growth in the country is attributed to the rapid adoption of bioprocessing. Bioprocessing applications, such as cell culture, clarification, and downstream processing, have witnessed a rapid adoption of single-use filtration assemblies in the US.

The advantages of reduced contamination risk, cost savings and operational flexibility contribute to their popularity. Additionally, the ongoing advancements in materials and design contribute to the continuous improvement of single-use filtration assemblies. Innovations in membrane technology and the development of robust single-use components enhance their performance in diverse applications. Thus, this is expected to drive the market expansion in the country.

Single-Use Filtration Assemblies Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 4.06 Billion |

| Projected Forecast Revenue by 2032 | USD 12.6 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 13.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Increasing adoption in biopharmaceutical companies

The single-use filtration assemblies market is expanding due to biopharmaceutical producers growing utilization of disposable filtering units. This is because sterile single-use filtering assemblies are often used in place of conventional pharmaceutical processing products for cleaning, in-home sterilization, and recycling. It includes several unit processes for both upstream and downstream production purification. Due to ongoing technological advancements, it is now feasible to manufacture single-use filtration assemblies. Consequently, the single-use assemblies market is expected to expand.

Technological advancements

The market for single-use filtration assemblies is expanding as a result of technological developments. Manufacturers are now able to create single-use filtration assemblies with ingestible flow sensors because of technological improvements. Growing developments in single-use filtering assembly have given biomanufacturers an opportunity. The production of aseptically filled goods became the focus of most technological developments. Consequently, the single-use filtration assemblies market is expected to expand.

Restraints

High cost and limited reusability

Single-use systems may save expense on cleaning and validation procedures, but the cost of their disposable parts may be prohibitive. This may affect the general viability of the economy, particularly in the case of large-scale manufacturing operations. Additionally, single-use filtering assemblies are made for a single or restricted application. This feature reduces the need for cleaning and sterilizing, but it also produces additional waste, which might concern companies who care about the environment.

Lack of standardization

The lack of standardized technologies and components across the industry can pose challenges. Different suppliers may use varying designs and materials for their single-use filtration assemblies, making it challenging for end-users to switch between suppliers or integrate components seamlessly. Thus, the lack of standardization is expected to hamper the market growth.

Opportunities

Growing expansion

The increasing expansion is expected to offer a lucrative opportunity for market growth during the forecast period. For instance, in September 2022, Pall Corporation added three new Allergo Connect Systems to its line-up of bioprocessing products. Complete automation of unit activities is made possible by these systems, which facilitate the manufacture of different vaccines and drugs. Pall Allegro single-use items complement them. The Allegro Connect technology portfolio includes technologies for bulk fill, virus filtering, and depth filtering of active pharmaceutical ingredients in addition to a buffer management system that streamlines production processes.

Reduced cross-contamination risk

The disposable nature of single-use filtration components helps minimize the risk of cross-contamination between different batches or products. This is crucial in industries such as biopharmaceuticals and food & beverage processing where product purity is paramount. Thus, this is expected to offer a lucrative opportunity for market development.

Recent Developments

- In July 2023, to hasten the development of treatments that can save lives, Trelleborg Healthcare and Medical introduced the BioPharmaPro series of cutting-edge goods, components, and services for fluid route single-use equipment. The BioPharmaPro line from Trelleborg Healthcare & Medical offers solutions made from a wide range of materials, such as silicones, other elastomers, thermoplastics, and composites. These materials can be processed into processing columns up to complete assemblies, tubing, and custom molded components, among many other products.

- In May 2023, DuPont announced that, during BioProcess International Europe, which will be held from May 9 to May 12 at RAI Amsterdam in The Netherlands, it will highlight DuPontTM LiveoTM single-use biopharma processing solutions for essential fluid transport applications.

- In November 2023, the 2023 Single-Use Manufacturing Component Quality Test Matrices (QTM) were released, according to the Bio-Process Systems Alliance (BPSA), an international trade group for the single-use bioprocessing sector. The BPSA QTM is a technical reference that was first created in 2007 to aid in the validation and certification of single-use items. The introduction of new standards, an increase in the number of components, and an extension of test techniques made the most recent third edition necessary.

Key Market Players

- Pall Corporation (a part of Danaher Corporation)

- Merck KGaA (EMD Millipore)

- Sartorius AG

- Thermo Fisher Scientific Inc.

- 3M Company

- GE Healthcare (Cytiva)

- Parker Hannifin Corporation

- Eaton Corporation

- Repligen Corporation

- Meissner Filtration Products, Inc.

- Entegris, Inc.

- Amazon Filters Ltd.

- Advantec MFS, Inc.

- Graver Technologies LLC

- Sterlitech Corporation

Market Segmentation

By Type

- Membrane Filtration

- Depth Filtration

- Centrifugation

- Others

By Application

- Pharmaceuticals Manufacturing Market

- Bioprocessing/Biopharmaceuticals Market

- Laboratory Use

By Product

- Filters

- Cartridges

- Membranes

- Manifold

- Cassettes

- Syringes

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3327

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308