Specialty Insurance Companies | Forecast by 2033

Specialty Insurance Market Growth and Trends

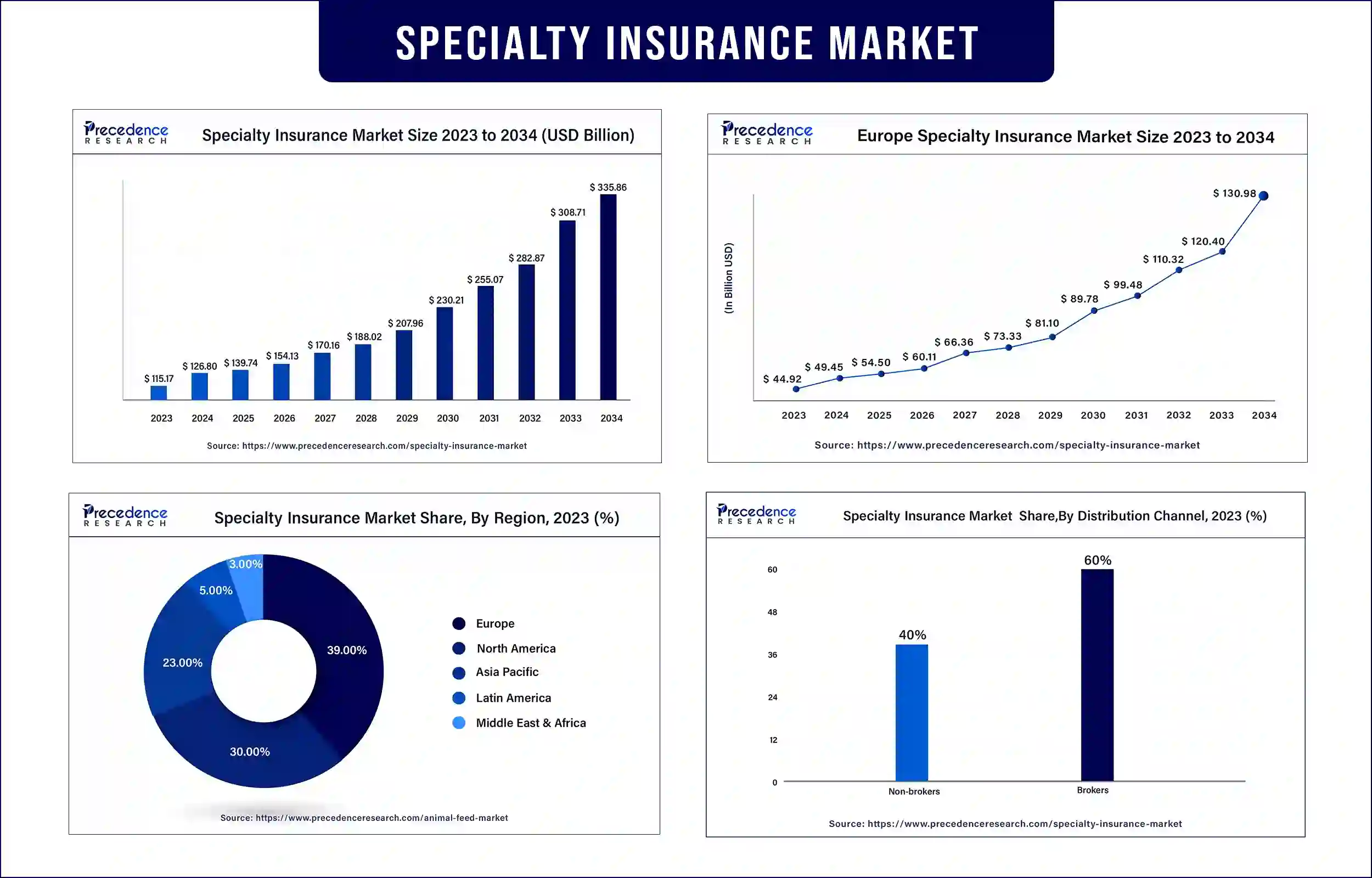

The global specialty insurance market was evaluated at USD 115.17 billion in 2023 and is anticipated to be worth around USD 308.71 billion by 2033, growing at a CAGR of 10.23% during the forecast period. The increasing demand for specialized expertise is expected to drive the growth of the specialty insurance market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3519

Market Overview

The specialty insurance market deals with types of insurance that offer coverage for risks that are not covered under standard insurance policies. Specialty insurance policies are designed to provide insurance coverage for risks such as commercial or personal property and personal automobiles. In addition, specialty insurance policies are employed to meet unusual or niche risks requiring specialized knowledge. The increasing demand for technological advancements is expected to drive the growth of the specialty insurance market during the forecast period.

In addition, the increasingly strict government regulations in several industries necessitate specific insurance products to manage risks and ensure compliance effectively. The increase in cyberattacks surged the demand for cyber liability insurance as businesses searched for protection against digital threats and data breaches, further propelling the market growth during the forecast period.

Specialty Insurance Market Trends

- Increasing demand for insurance products related to retirement planning, health, and long-term care with the aging population driving the market growth.

- The rising advances in personalized healthcare and medical technology are expected to drive market growth.

- The rising technological innovations such as artificial intelligence and the Internet of Things are further expected to drive market growth.

Regulatory and compliance changes in specialty insurance to fuel market growth

Governments of several nations are creating compliance requirements and stricter regulations on industries. Specialty insurance helps businesses ensure compliance and navigate these complex legal landscapes. In addition, there is an increase in trade agreements, which is resulting in the increasing need for new specialty insurance policies for cross-border transactions. Apart from this, the constant improvement of industry standards is motivating businesses to search for specialty insurance.

Furthermore, various large, small, and mid-sized businesses (SMEs) around the world are experiencing uncertainties due to varying legal environments across regions, which is providing a favorable market outlook. Specialty insurance provides tailored solutions to handle these uncertainties. Thus, these driving factors are expected to enhance the growth of the specialty insurance market.

However, the complex underwriting process and limited market share may restrain market growth

Due to the specialized nature of risks being covered, Specialty insurance often includes complex underwriting procedures. The need for detailed data collection, specialized knowledge, and in-depth risk assessment can slow down the underwriting process and potentially deter some clients from searching for specialty coverage.

In addition, while the market for specialty insurance is growing, it remains a complicated segment compared to the broader insurance industry. This complicated and limited market share can cause heightened competition among specialty insurers for a relatively small pool of potential clients, impacting pricing dynamics and profitability. These factors are expected to restrain the growth of the specialty insurance market during the forecast period.

Specialty Insurance Market Top Companies

- AIG (American International Group)

- Zurich Insurance Group

- Allianz SE

- Berkshire Hathaway

- AXA

- The Hartford Financial Services Group

- Emerald Bay Risk Solutions

- BOSTON & MADRID

- QBE Insurance Group

- Hiscox

- XL Catlin (now part of AXA XL)

- Tokio Marine Holdings

- Markel Corporation

- Beazley

- Argo Group

Recent Innovation in the specialty Insurance Market by BOSTON & MADRID

- In July 2024, BOSTON & MADRID announced that Berkshire Hathaway Specialty Insurance (BHSI) had appointed Jesús Barbero and entered the surety market in Spain to lead the product line as Head of Surety by bringing BHSI’s financial strength, credit rating, and long-view commitment.

Recent Innovation in the Specialty Insurance Market by Emerald Bay Risk Solutions.

- In March 2024, Bain Capital Insurance made a sizable strategic investment in Emerald Bay Risk Solutions, a collaborative underwriting carrier, to coincide with the establishment of the company's specialized insurance investing division. Through rigorous underwriting and integrated solutions bolstered by a unique data-driven technology platform, Emerald Bay was an innovative program specialist who sought to achieve an alignment of interests along the entire risk value chain.

Regional Insights

Asia Pacific is expected to grow fastest during the forecast period

Asia-Pacific is expected to observe the fastest growth during the forecast period. A number of important reasons have contributed to the region's notable rise in the specialty insurance industry. Rapid economic expansion and the emergence of a growing middle class have raised asset ownership and wealth, which has raised demand for specialty insurance products, including liability, fine art, and health-related policies.

Specialty insurance is becoming more and more in demand as the region becomes more globalized and industrialized and as firms look for protection against foreign and specific hazards. In addition, the spread of Insurtech solutions and legislative frameworks that encourage them have spurred market expansion and elevated Asia-Pacific to a prominent position in the world specialized insurance market. The region's principal nations are South Korea, Japan, China, and India.

- For instance, In May 2024, the National Financial Regulatory Administration and the Ministry of Public Security of China launched a seven-month special operation. This new initiative targeted fraud crimes happening in the insurance industry.

Europe dominated the specialty insurance market in 2023

The market for specialty insurance is robust and dynamic, driven by various factors unique to the region in Europe. European businesses seek specialized insurance solutions to address their specific risks, with a diverse economy encompassing industries ranging from manufacturing to finance. In addition, the growing focus on environmental stewardship and sustainability of the region increases demand for meeting climate-related risks and environmental liabilities.

Furthermore, the market growth in the region is driven by the myriad advantages provided, such as coverage of niche business segments and substantial flexibility. Also, small and medium enterprises (SMEs) and the presence of multinational corporations across diverse sectors contribute to the diversity and complexity of the European market during the forecast period. Thus, these factors are expected to drive the growth of the specialty insurance market in Europe.

Market Potential and Growth Opportunity

Increasing collaboration among specialty insurers

The market's industry is changing due to a cutting-edge trend in leading players' partnerships. Several variables, including the necessity for creative solutions due to the growing complexity of hazards and the need to broaden market reach and capabilities, all contribute to the improvement of these joint initiatives.

Furthermore, in the near future, it is anticipated that these cooperative efforts will be crucial to the market's growth and advancement. Risk management frameworks are improved by industry stakeholders who, by utilizing insights, resources, and shared experience, are able to address the changing demands of firms operating in varied sectors and open up new opportunities. In light of this, it is anticipated that in the near future, the market for specialty insurance will develop more quickly.

Specialty Insurance Market Highlights

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 126.80 Billion |

| Market Revenue by 2033 | USD 308.71 Billion |

| CAGR | 10.23% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Europe |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Specialty Insurance Market News

- In July 2024, K2 Insurance Services, Warburg Pincus-backed, launched a Rubicon Specialty, a new London market MGA with a former Ascot team that included Matt Eve, Chris McGill, Part Patel, and Gavin Wall.

- In February 2024, a provider of litigation risk insurance, Ignite Specialty Risk, launched a Litigation Capital Protection Insurance offering in the United States. The aim of this launch was to provide assurance to law firms and litigation funders regarding their investments in litigation assets.

- In September 2022, the leading provider of cyber insurance for small and medium-sized enterprises (SMEs), Cowbell, announced a dynamic approach to ensure constantly changing risk, the debut of Adaptive Cyber Insurance and Cowbell Specialty Insurance Company, and the launch of its subsidiary.

Market Segmentation

By Type

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Marine, Aviation and Transport (MAT) Insurance

- Others

By Distribution Channel

- Brokers

- Non-brokers

By End User

- Business

- Individuals

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3519

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308