What is the Specialty Insurance Market Size?

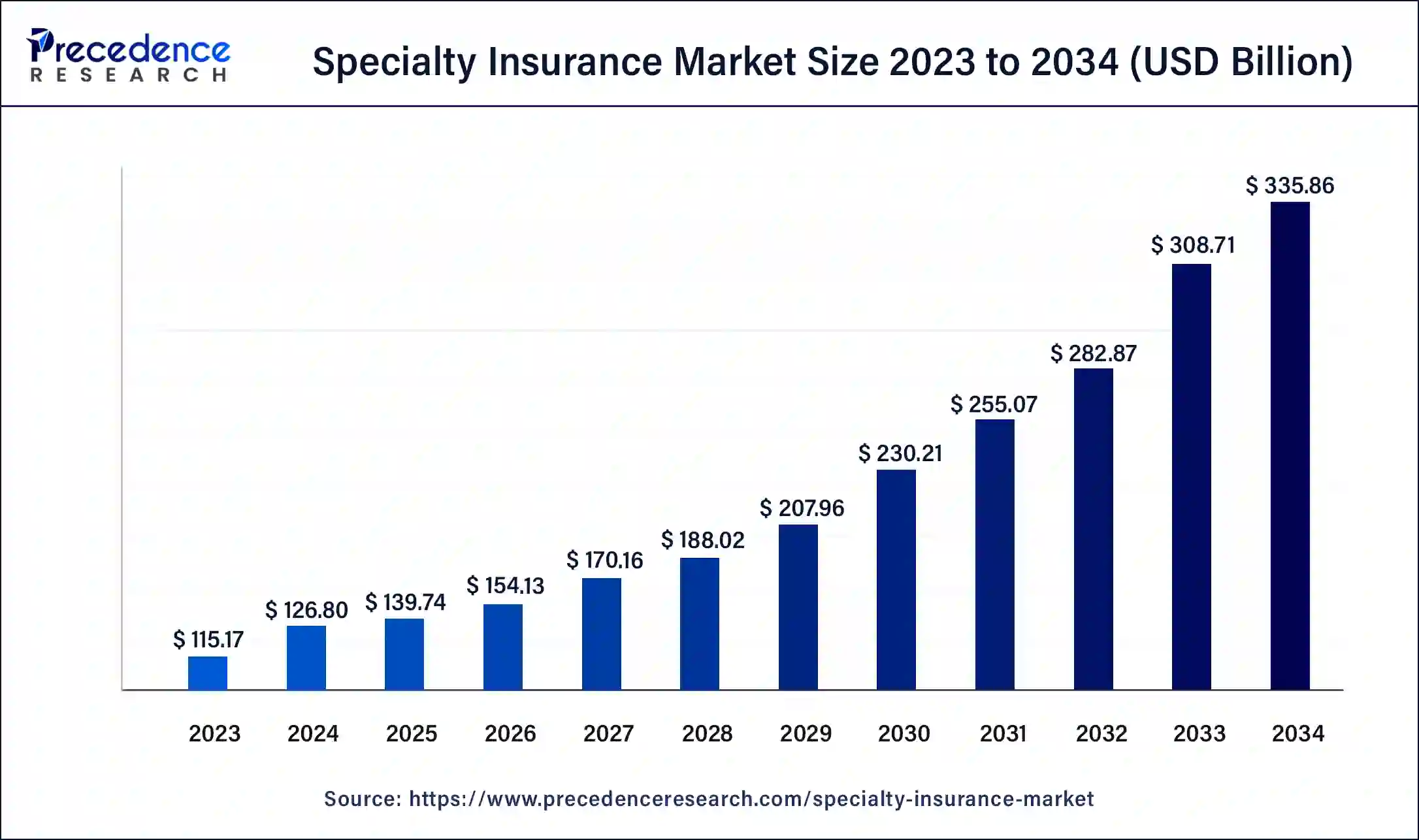

The global specialty insurance market size is calculated at USD 139.74 billion in 2025 and is predicted to increase from USD 154.13 billion in 2026 to approximately USD 362.14 billion by 2035, expanding at a CAGR of 9.99% from 2026 to 2035.

Specialty Insurance Market Key Takeaways

- In terms of revenue, the specialty insurance market is valued at $154.13 billion in 2026.

- It is projected to reach $62.14 billion by 2035.

- The specialty insurance market is expected to grow at a CAGR of 19.99% from 2026 to 2035.

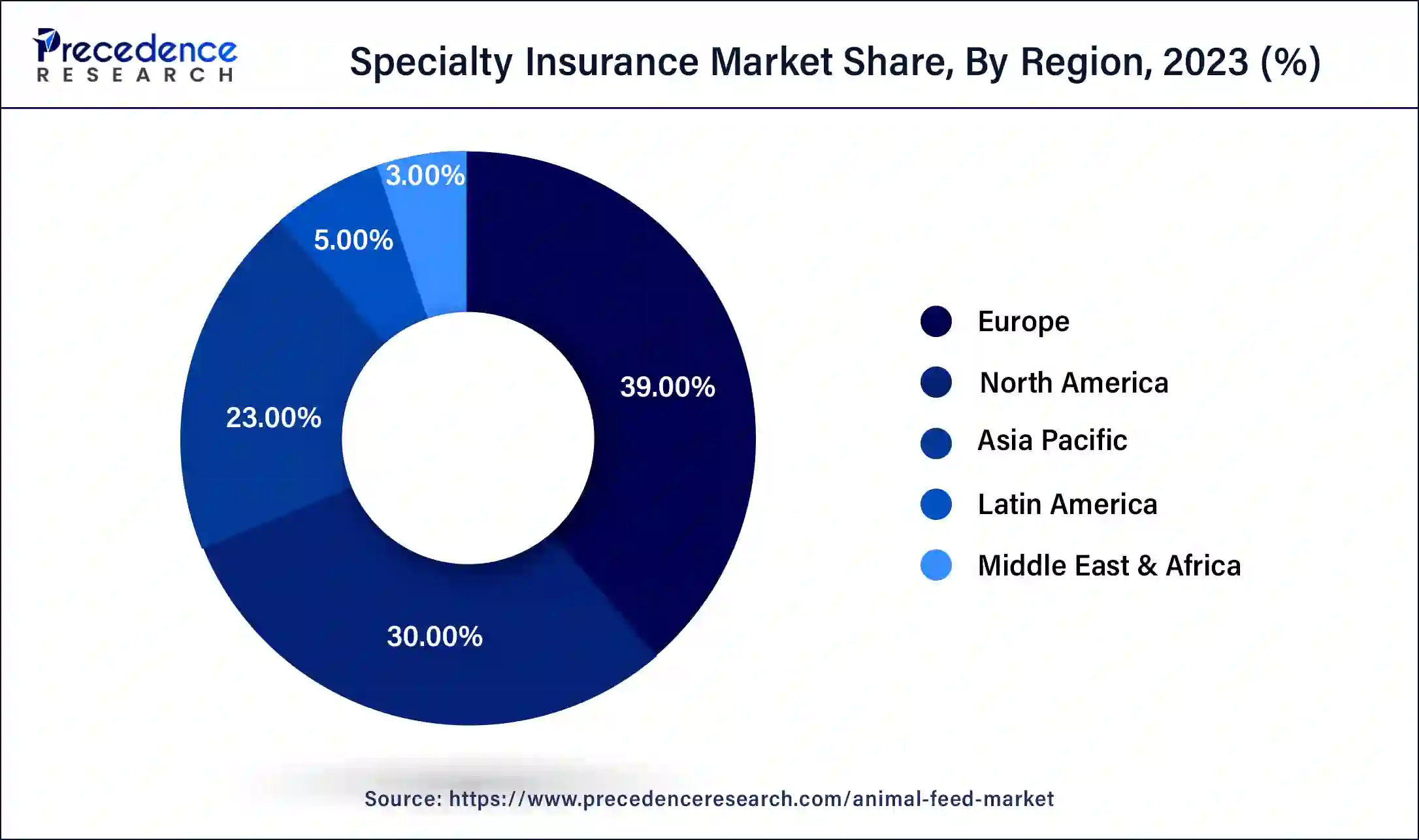

- Europe contributed more than 39% of revenue share in 2025.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2026 and 2035.

- By Type, the marine, aviation, and transport (mat) insurance segment has held the largest market share of 25% in 2025.

- By Type, the other segment is anticipated to grow at a remarkable CAGR of 11.2% between 2026 and 2035.

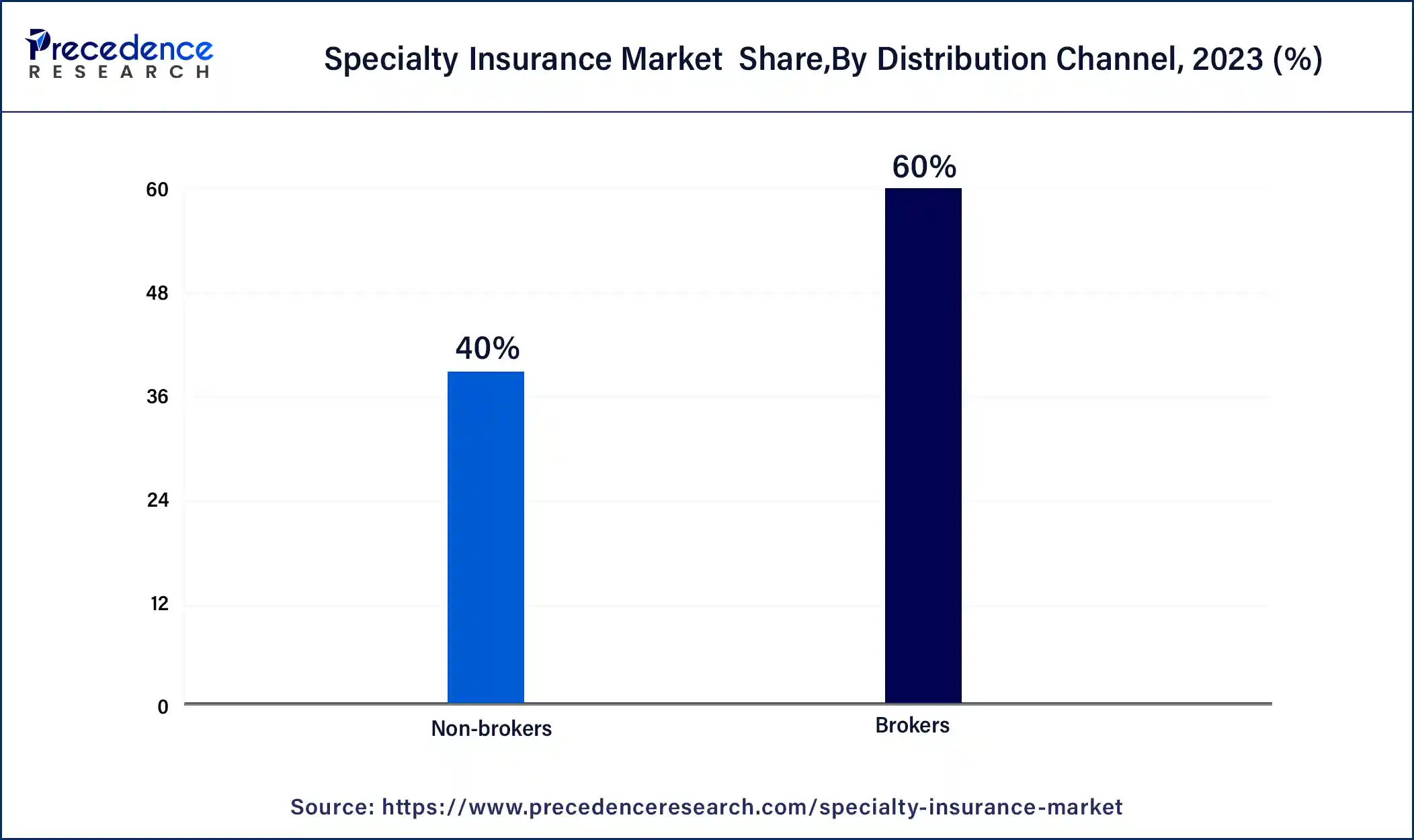

- By Distribution Channel, the brokers' segment generated over 60% of the revenue share in 2025.

- By Distribution Channel, the non-brokers segment is expected to expand at the fastest CAGR over the projected period.

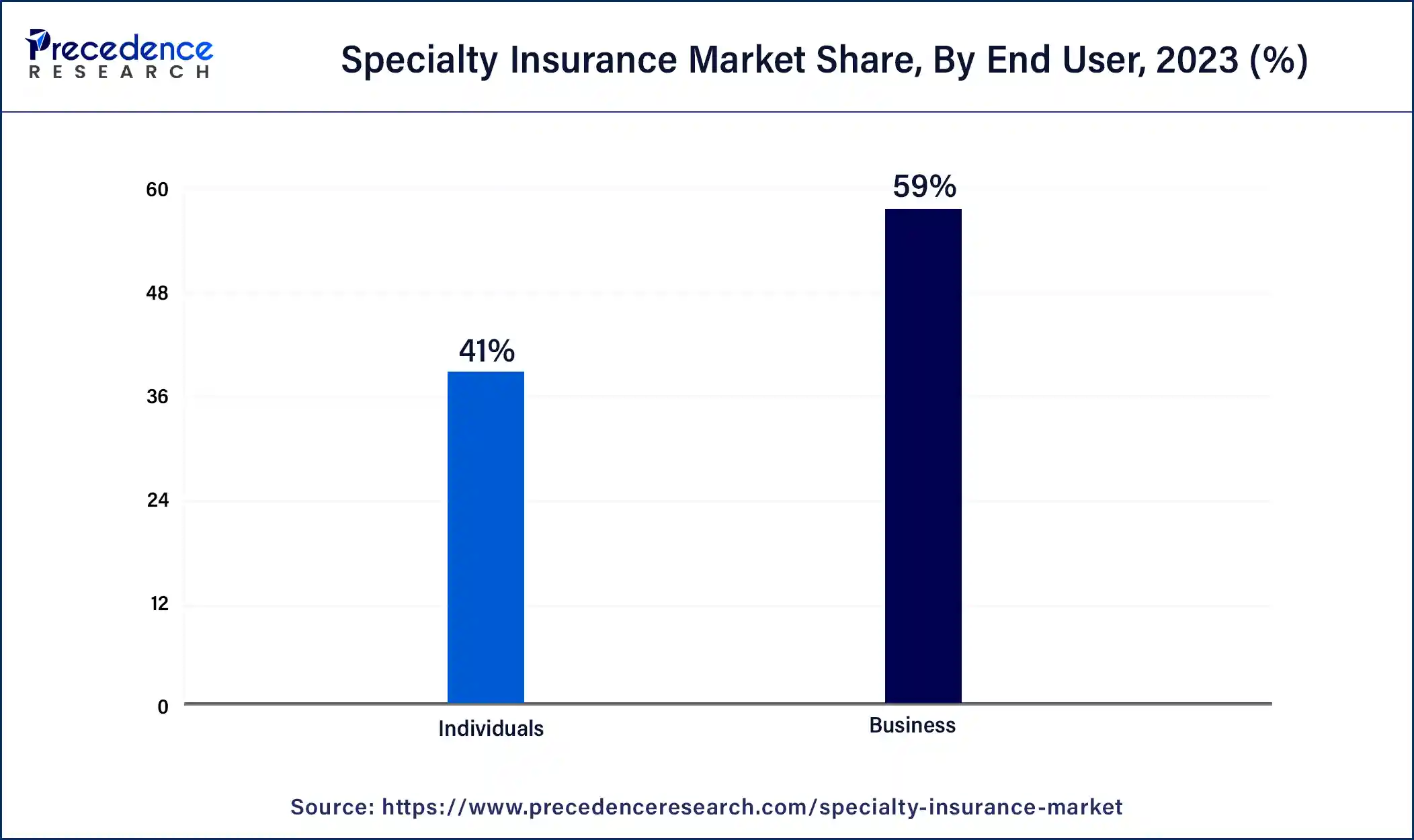

- By End User, the business segment generated over 59% of revenue share in 2025.

- By End User, the individuals segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Specialty insurance refers to a category of insurance that caters to distinct, exceptional, or atypical risks which fall outside the scope of standard insurance policies. Unlike traditional insurance, which offers general coverage for commonplace perils such as auto accidents or property loss, specialty insurance is specifically crafted to address particular, rare, or high-risk scenarios. These policies are customized to match the distinctive requirements of individuals, companies, or sectors.

Specialty insurance encompasses a wide array of domains, including but not restricted to aviation, maritime, valuable artworks, cyber liability, seismic events, and even coverage for pets. Typically, these policies are underwritten by specialized insurers possessing expertise in the specific field, as they necessitate a profound understanding of the associated risks. While specialty insurance might come at a higher cost compared to standard coverage, it serves as a valuable solution for those confronting non-standard risks, offering assurance and safeguarding against unforeseen circumstances that standard insurance products may not adequately address.

Specialty Insurance Market Growth Factors

- Evolving Risks: As new and unconventional risks emerge in our rapidly changing world, there's a growing need for specialized coverage.

- Increased Regulation: Stringent regulations in various industries necessitate specific insurance products to ensure compliance and manage risks effectively.

- Technological Advancements: Innovations like IoT and AI enable insurers to better underwrite and price specialty risks.

- Globalization: Expanding international trade and business operations create demand for unique insurance solutions to cover cross-border risks.

- Climate Change: The escalating impact of climate change leads to a heightened need for specialty insurance related to extreme weather events and environmental liabilities.

- Cybersecurity Threats: The surge in cyberattacks prompts the demand for cyber liability insurance as businesses seek protection against data breaches and digital threats.

- Aging Population: With an aging population, there's increased demand for insurance products related to long-term care, health, and retirement planning.

- Healthcare Innovations: Advances in medical technology and personalized healthcare drive the need for specialized health insurance offerings.

- Agricultural Risks: Specialized crop and livestock insurance address risks associated with agriculture, such as droughts, pests, and market fluctuations.

- Terrorism: The ongoing threat of terrorism has led to the development of terrorism insurance to protect against related damages and liabilities.

- Space Exploration: As commercial space activities increase, space insurance becomes critical for covering satellite launches and space-related risks.

- Fine Arts and Collectibles: The growing art market necessitates insurance solutions to safeguard valuable art collections.

- Niche Sports and Events: Specialty insurance for extreme sports, niche events, and tournaments is on the rise.

- Political Risks: Businesses operating in politically unstable regions seek coverage for political risks such as expropriation or civil unrest.

- Drones and UAVs: The proliferation of drones necessitates insurance coverage for liability and property damage arising from drone operations.

- Alternative Energy: The renewable energy sector demands coverage for unique risks associated with wind, solar, and other sustainable energy sources.

- Maritime and Shipping: Specialized marine insurance is essential to cover shipping, cargo, and offshore risks.

- Aerospace Industry: With space travel and aerospace advancements, insurers are developing products for aerospace and aviation risks.

- Professional Liability: Increased lawsuits and legal actions drive the need for professional liability insurance for various professions.

- Economic Trends: Economic fluctuations, including market volatility and trade disputes, lead to demand for risk management solutions within the specialty insurance market.

- Berkshire Hathaway annual revenue for 2022 was $302,089M, a 9.4% increase from 2021. Bausch Health Company's annual revenue for 2021 was $276,203M, a 12.5% increase from 2020.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 139.74 Billion |

| Market Size in 2026 | USD 154.13 Billion |

| Market Size by 2035 | USD 362.14 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.99% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Distribution Channel, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Fine arts and collectibles

The fine arts and collectibles sector is a significant driver of growth in the specialty insurance market. This is primarily attributed to the increasing value and diversity of art collections and valuable collectibles worldwide. As the art market continues to expand, art collectors and institutions are seeking tailored insurance solutions to safeguard their assets against theft, damage, or loss.

The uniqueness and high value of art and collectibles necessitate specialized coverage that goes beyond what standard insurance policies can offer. Specialty insurance providers offer policies that account for the intrinsic value, rarity, and specific needs of these assets. They provide coverage for a wide range of perils, including accidental damage during transport, restoration, and exhibition, theft, and market value fluctuations.

Furthermore, the demand for fine arts and collectibles insurance has grown in parallel with the proliferation of private art collections, art galleries, and the globalization of the art market. This niche insurance segment caters to the unique risks associated with art and collectibles, making it a driving force behind the growth of the broader specialty insurance market.

Restraints

Limited market size

The limited market size is a significant constraint on the growth of the specialty insurance market. Specialty insurance is, by definition, designed to address unique and niche risks, which naturally limits the potential customer base. These specialized policies cater to a relatively small number of individuals, businesses, or industries facing non-standard risks, as opposed to the broader customer base of standard insurance products. This niche focus restricts the scalability and expansion opportunities for insurers operating in the specialty insurance sector.

With a smaller addressable market, it can be challenging for insurers to achieve significant economies of scale, resulting in potentially higher operational costs and, at times, less competitive pricing. Moreover, as specialty insurance providers vie for a limited pool of clients, market competition intensifies, which can further limit profit margins. In sum, the constrained market size poses challenges to the sustainable growth and profitability of the specialty insurance market, even as it serves a crucial role in addressing unique risk exposures.

Opportunities

Agricultural sector

The agricultural sector is emerging as a significant source of opportunities in the specialty insurance market. As the industry faces evolving challenges driven by climate change, technological adoption, and global supply chain complexities, specialty insurers have a unique chance to provide tailored solutions. These may encompass crop insurance, livestock coverage, and weather-related risk management. In an era of unpredictable weather patterns, droughts, and pests, agricultural producers seek specialized policies to safeguard their investments and ensure business continuity.

Furthermore, the adoption of cutting-edge technologies in agriculture, such as precision farming and drone usage, presents novel risk exposures that can be mitigated through specialized insurance products. The growth in sustainable and organic farming practices also creates an opportunity for insurers to offer coverage that aligns with environmentally conscious agriculture. Overall, the agricultural sector's diverse and evolving risks provide a fertile ground for specialty insurance innovation and expansion.

Technological Advancement

Technological advancements in the specialty insurance market feature machine learning, natural language processing, and artificial intelligence. A natural language processing NLP algorithm is used to gather required information, such as claim descriptions, dates, and policyholder data, through unorganized sources like emails, documents, and claim forms. Artificial intelligence (AI) helps in risk assessment and claim processing. It reduces underwriting time and cost. AI supports insurers with external data sources like health metrics and social media. AI in claim processing automates collection, verification, and payments. It helps in detecting and preventing fraud.

Machine learning in the specialty insurance market analyzes a vast range of existing data to help underwriters identify valuable customers. This helps companies to predict and execute types of insurance and recognize fraudulent insurance claim filings. These technologies empower the market to gain extraordinary expertise in new advancements and trends.

Type Insights

The marine, aviation and transport (mat) insurance segment has held a 25% revenue share in 2025. The Marine, Aviation, and Transport (MAT) Insurance segment holds a significant share in the specialty insurance market due to its unique focus on addressing complex, high-value risks associated with global trade and transportation. MAT insurers offer specialized policies for cargo, vessels, aircraft, and logistical operations, essential in a highly interconnected world.

With the expansion of international trade and the increasing value of transported goods, businesses and organizations increasingly rely on MAT insurance to mitigate risks related to shipping, aviation, and transportation, making it a pivotal and high-demand component of the specialty insurance sector.

The others segment is anticipated to expand at a significant CAGR of 11.2% during the projected period. The "others" segment holds a major growth in the specialty insurance market because it encompasses a wide range of unique and niche insurance categories that don't fit into standard classifications. This catch-all category caters to specialized risks that are not covered by conventional insurance policies, such as pet insurance, event cancellation coverage, and unusual or emerging risks like space tourism. Given the diverse and constantly evolving nature of specialty insurance needs, the "others" segment has become a versatile and substantial component of the market, offering solutions for a variety of non-standard and unique risk exposures.

Distribution Channel Insights

The brokers segment had the highest market share of 60% in 2025 based on the distribution channel. The brokers segment commands a major share in the specialty insurance market primarily due to its role in connecting clients with specialized insurance providers. Brokers act as intermediaries, leveraging their expertise to assess client needs and source customized coverage solutions from a wide array of insurers.

They provide invaluable guidance in a complex and nuanced field, offering clients access to a broader range of options and helping them navigate the intricacies of specialty insurance. This approach builds trust and ensures that clients receive tailored, comprehensive coverage, making brokers a preferred distribution channel for many seeking specialized risk management solutions.

The non-brokers segment is anticipated to expand fastest over the projected period. The Non-brokers distribution channel holds a major growth in the specialty insurance market due to several factors. Many specialty insurance products are highly specialized and require a deep understanding of unique risks, making direct sales channels more effective. Additionally, for businesses and industries with specific needs, dealing directly with insurers allows for tailored coverage.

Non-brokers often include in-house risk managers and dedicated teams, enabling more efficient communication and customization of policies. This direct approach fosters stronger relationships, quicker decision-making, and cost-effective solutions, making it a preferred choice for acquiring specialty insurance among many clients and companies.

End User Insights

The business segment had the highest market share of 59% in 2025 based on the end user. The business segment commands a significant share in the specialty insurance market due to its diverse risk exposures. Businesses encounter a wide range of unique and complex risks, including cyber threats, professional liabilities, supply chain disruptions, and international trade uncertainties. Specialty insurance offers tailored solutions to address these specific perils, ensuring comprehensive protection and regulatory compliance.

As a result, businesses rely on specialty insurance to safeguard their assets, operations, and reputations, making it a major driver of market share as they seek risk management and continuity in an increasingly complex and interconnected global economy.

The individuals segment is anticipated to expand fastest over the projected period. The Individuals segment holds significant growth in the specialty insurance market primarily due to the increasing recognition among individuals of the need for personalized coverage. Specialized insurance products cater to unique risks faced by high-net-worth individuals, collectors, art enthusiasts, and those seeking coverage for niche activities like adventure sports or pet care.

Moreover, the desire for added protection against cyber security threats, fine arts, and collectibles has driven the demand for specialty policies among individuals. As a result, the Individuals segment continues to expand, commanding a substantial growth of the specialty insurance market.

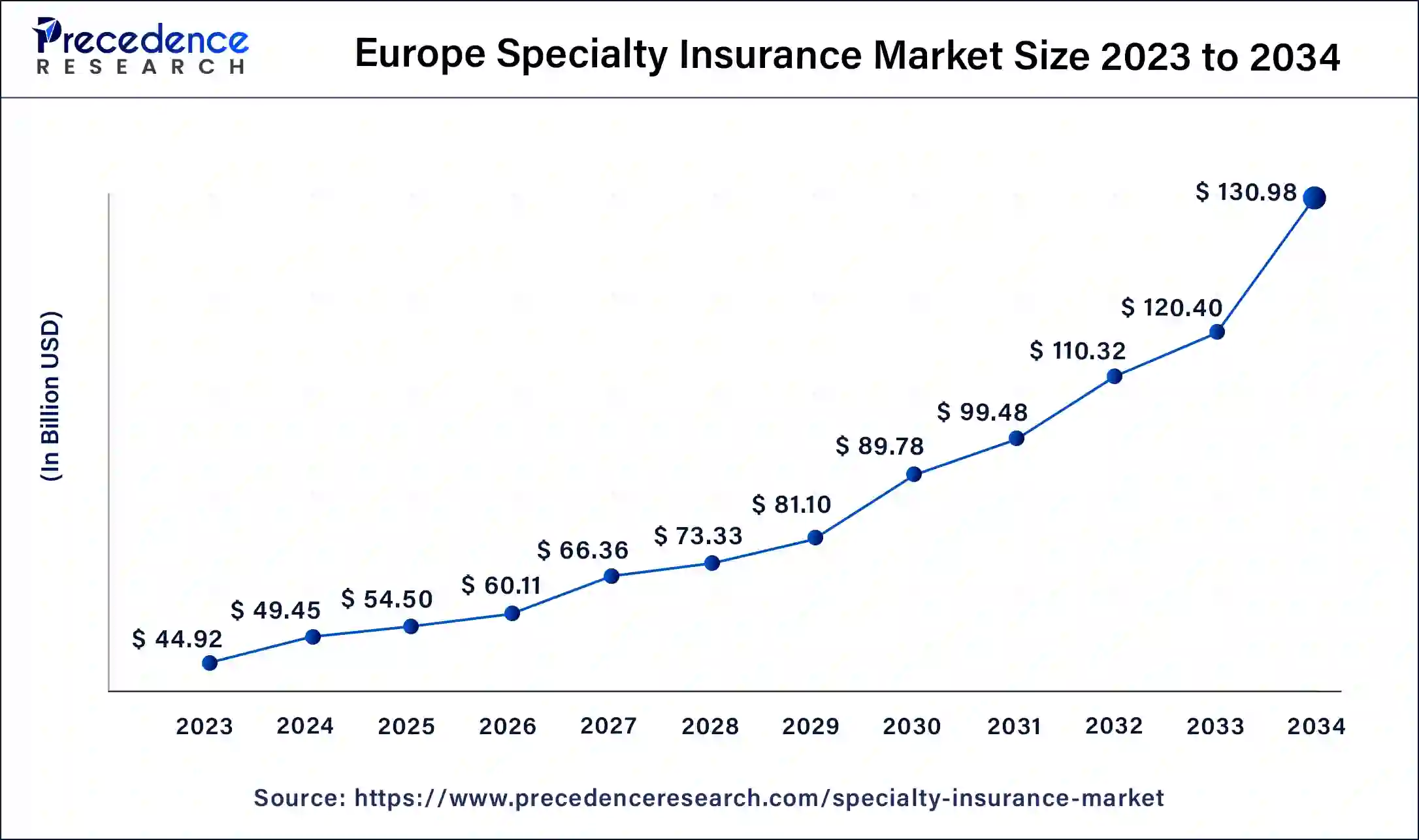

Europe Specialty Insurance Market Size and Growth 2026 To 2035

The Europe specialty insurance market size was valued at USD 54.50 billion in 2025 and is expected to reach USD 141.23 billion by 2035, growing at a CAGR of 10.01% from 2026 to 2035.

Europe has held the largest revenue share 39% in 2025. Europe holds a substantial share in the specialty insurance market due to a combination of factors. First, the region's diverse economy and industries, including the art market, marine activities, and high-net-worth individuals, create a strong demand for specialized coverage. Second, stringent regulatory environments drive the need for specialty policies to navigate complex compliance requirements. Third, Europe's focus on sustainability and renewable energy projects offers opportunities for insurers to address environmental risks. Additionally, Europe's mature insurance market infrastructure and well-established specialty insurers contribute to its significant presence in this niche market, attracting customers and investments.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region has gained significant growth in the specialty insurance market due to several key factors. Rapid economic growth and a burgeoning middle class have led to increased wealth and asset ownership, spurring the demand for specialized insurance coverage, such as fine arts, cyber liability, and health-related policies. Additionally, as the region experiences industrialization and globalization, businesses are seeking protection against unique and international risks, further boosting the demand for specialty insurance. Furthermore, supportive regulatory environments and the proliferation of insurtech solutions have facilitated market growth, making Asia-Pacific a major player in the global specialty insurance landscape.

The exponential growth in the global specialty insurance companies ranks the region first. SMEs and other businesses have approached to grow and expand in this market, accepting the unique risks such as environmental liabilities and cyber threats. The middle-class population of this region contributes the largest amount to the specialty insurance industry by adopting the same.

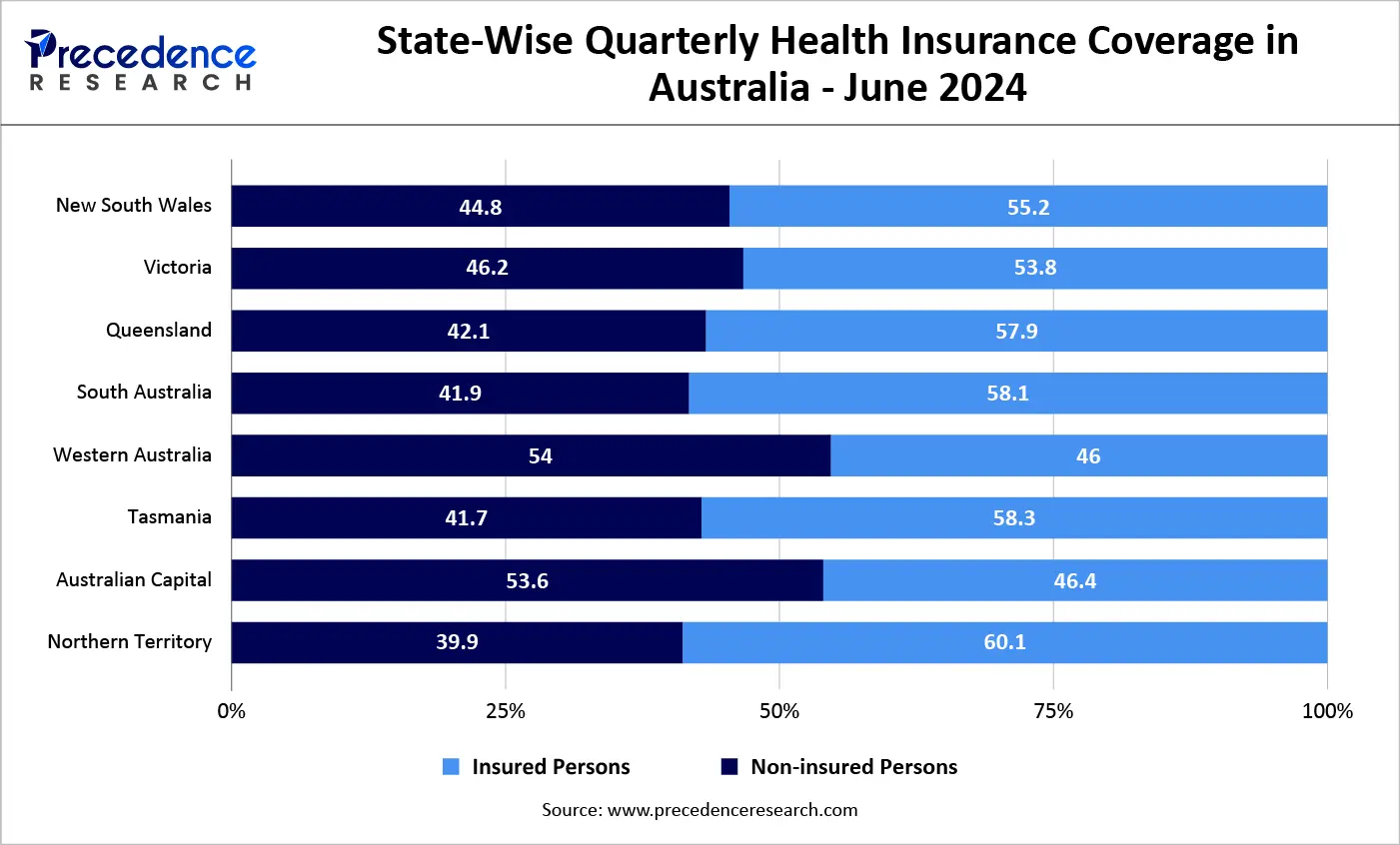

The chart aligns closely with APRA's June 2024 private health insurance statistics and highlights clear state-level differences in hospital treatment coverage across Australia. Nationally, APRA reports that 12.24 million people, or 44.8% of the population, were covered by hospital treatment at 30 June 2024, which is reflected in New South Wales at 44.8% and Victoria at 46.2%.

Western Australia and the Australian Capital Territory stand out with higher insured shares at 54.0% and 53.6%, respectively, indicating stronger private health insurance penetration. In contrast, Queensland, South Australia, Tasmania, and the Northern Territory all show insured proportions near or below 42%, with the Northern Territory recording the lowest coverage at 39.9%. APRA data attributes recent national growth to a net quarterly increase of 63,976 insured persons, driven mainly by family and single policy growth among younger age cohorts. These variations are shaped by demographic structure, income distribution, and reliance on public hospitals, reinforcing the uneven geography of private health insurance participation across Australia.

Specialty Insurance Market Companies

- AIG (American International Group)

- Chubb Limited

- Allianz SE

- Munich Re

- Berkshire Hathaway

- AXA

- Zurich Insurance Group

- The Hartford Financial Services Group

- Hiscox

- Tokio Marine Holdings

- XL Catlin (now part of AXA XL)

- QBE Insurance Group

- Beazley

- Argo Group

- Markel Corporation

Recent Developments

- In May 2025, Ryan's Specialty completed the acquisition of USQRisk Holdings. The experienced management team operating in New York and London underwrites non-traditional insurance risk.

- In May 2025, Velocity announced a strategic sale of Velocity Specialty Insurance Company. The successful partnership with Oaktree boosts innovation and accelerates the strategic agenda to succeed as a team.

- In April 2025, Ignyte Insurance launched as a specialty insurance platform. To leverage high-performance insurance brands in a niche market, the initiative of providing such a platform is a huge contribution to the specialty insurance market.

- In 2023, Lloyd's of London introduced a fresh syndicate aimed at offering coverage for parametric risks. Parametric insurance, a unique type of coverage, disburses compensation upon the occurrence of a predefined event, such as a hurricane or earthquake, rather than depending on actual financial losses sustained. The rising prominence of this insurance is evident as corporations and governments seek strategies to alleviate the financial repercussions of climate change.

- In 2023, Munich Re unveiled its collaboration with a startup to design insurance solutions for self-driving vehicles. This category of insurance is expected to gain substantial significance as autonomous vehicles proliferate further in our transportation landscape.

Segments Covered in the Report

By Type

- Political Risk and Credit Insurance

- Entertainment Insurance

- Art Insurance

- Livestock and Aquaculture Insurance

- Marine, Aviation and Transport (MAT) Insurance

- Others

By Distribution Channel

- Brokers

- Non-brokers

By End User

- Business

- Individuals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting