What is the Vehicle Insurance Market Size?

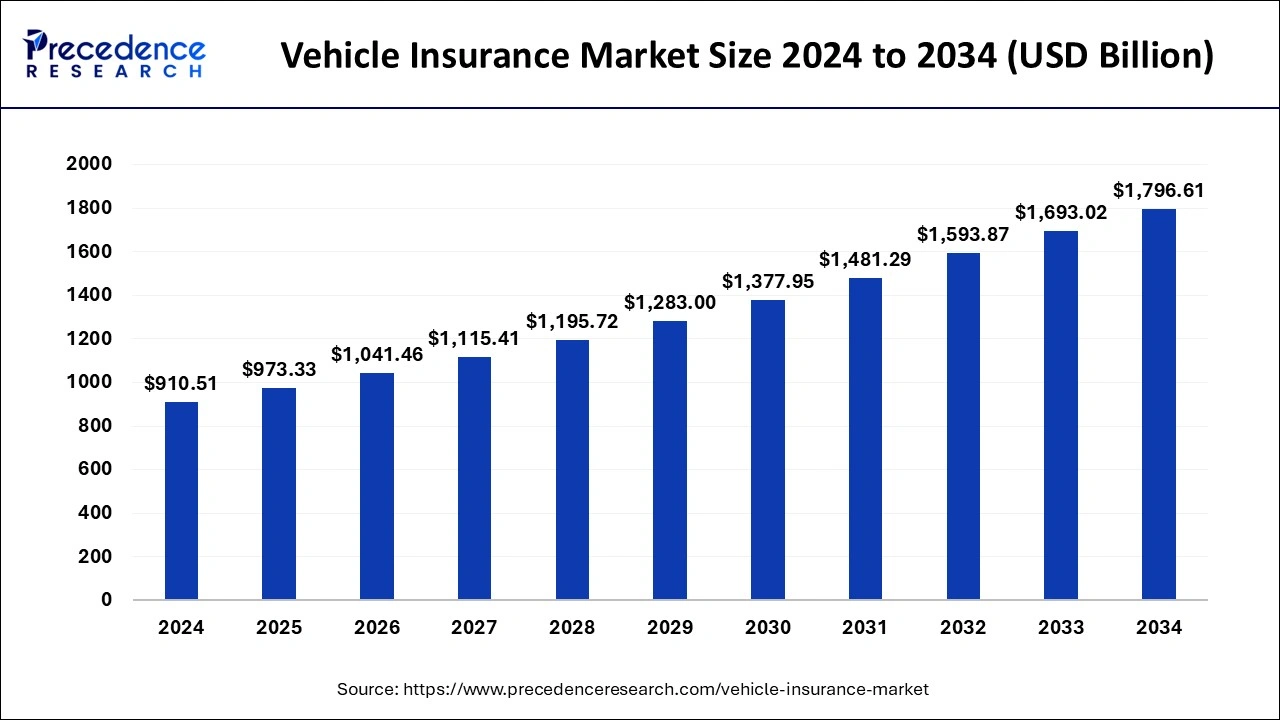

The global vehicle insurance market size is calculated at USD 973.33 billion in 2025 and is predicted to increase from USD 1041.46 billion in 2026 to approximately USD 1.897.24 billion by 2035, expanding at a CAGR of 6.9% from 2026 to 2035. The growth of the vehicle insurance market is driven by rising vehicle ownership worldwide. As more people purchase vehicles, the demand for vehicle insurance increases.

Market Highlights

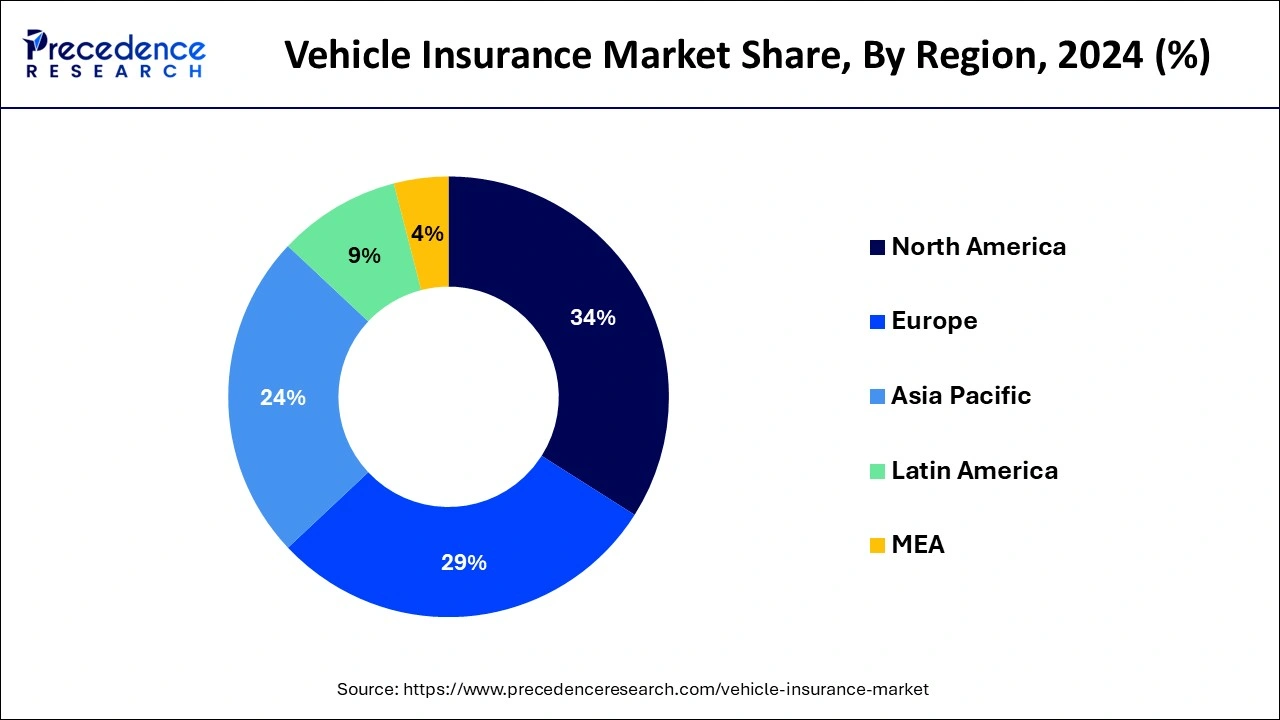

- North America led the global market with the highest market share of 34% in 2025.

- Asia Pacific region is estimated to expand the fastest CAGR between 2026 to 2035.

- By Coverage, the third party liability segment has held the largest market share of 69% in 2025.

- By Application, the personal vehicle segment captured the biggest revenue share in 2025.

Market Overview

Vehicle insurance refers to compliance with laws that offer financial assistance to the people who are injured and vehicles that are damaged. It covers a financial amount that can be provided to concerned people in the form of compensation. It considers various factors such as the type of vehicle under driving, the age and gender of drivers, the driving history of people, the locations of accidents, and the amount of coverage chosen by people. Several insurance coverages including third-party liability insurance, own damage insurance, comprehensive damage insurance, and collision insurance drive the vehicle insurance market. These exclusive benefits are given for two-wheelers, three-wheelers, and four-wheelers which boosts the demand for vehicle insurance premiums or coverage plans to protect the vehicles and achieve personal safety. Allianz, Geico, American International Group, Bajaj Allianz Car Insurance, etc. are leading industries in the market contributing to upscale vehicle protection facilities by protecting people too.

Role of Artificial Intelligence in the Vehicle Insurance Market

Artificial intelligence allows insurance companies to incorporate speed, accuracy, and customer-centric performance in their workflows, which are dedicated to providing insurance coverage plans to all vehicles. AI helps to enhance the efficiency and accuracy of industrial performances. AI can also detect fraud cases which improves customer satisfaction. AI helps insurers to streamline their business operations and provides better services to their customers. AI technology handles insurance claim processes, making them faster, more accurate, and highly efficient. With the help of AI, automated claim processing helps to reduce operational costs, improve accuracy, and speed up claims processing through immediate claim approvals, fewer errors, and a transparent process.

Vehicle Insurance Market Growth Factors

- The growing demand for personal mobility solutions, rising disposable income, and improved living standards boost the market's growth.

- The rising economic activities across developing and developed nations are boosting the demand for commercial vehicles.

- The rising adoption of personal and commercial vehicles across the globe is expected to boost the demand for vehicle insurance during the forecast period.

- In several countries, buying a vehicle insurance policy is a regulatory mandate. Therefore, the regulatory guidelines regarding the purchase of vehicles play a major role in the growth of the vehicle insurance market.

- The growing popularity and demand for electric vehicles across the globe boosts market growth.

- Rising demand for customized insurance plans fuels the growth of the market.

- The rapid expansion of online insurance platforms contributes to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 973.33 Billion |

| Market Size in 2026 | USD 1041.46 Billion |

| Market Size in 2035 | USD 1897.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.9% |

| Largest Market | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Coverage, Application, Distribution Channel, Vehicle Type, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Regulatory Changes

With the rise in vehicle ownership, there has been a significant rise in the adoption of vehicle insurance. However, governments worldwide are continuously changing regulations regarding vehicle insurance, which influence the growth of the market. Consumers are becoming more aware of the importance of vehicle insurance. This, in turn, boosts the demand for customized insurance plans, such as low premiums. Moreover, online insurance websites are gaining immense traction since they provide comprehensive coverage at lower costs than insurance sold through traditional approaches.

Restraint

Rising Competition

The entry of new players intensifies competition among insurers. New companies often come with innovative products and technologies, which force existing insurance companies to reduce their prices. Moreover, a lack of awareness about vehicle insurance and the availability of limited coverage options, especially in underdeveloped areas, limit the growth of the market. People in underserved areas often face challenges due to the digital shift of insurance companies.

Opportunity

Expansion of Insurtech Companies

The rapid expansion of Insurtech companies creates immense opportunities in the market. These companies use technologies such as telematics and mobile applications to offer personalized policies. These companies strive to standardize motor insurance policies to improve clarity and customer confidence. Use and File Framework is an initiative that encourages insurers to experiment with newly launched products and technologies to develop motor insurance solutions such as pay-as-you-drive or pay-as-you-go.

Segment Insights

Coverage Insights

Based on the coverage, the third party liability coverage segment dominated the global vehicle insurance market in 2025. The major benefits of this coverage type is that it compensates any damage caused to the third party like disability, death, or any loss to his/her property. The legal and financial care is taken care in case of third party liability coverage. The probability of the vehicle accidents and damage to the third party is a major reason behind the increased preference for the third party liability coverage insurance.

On the other hand, the comprehensive coverage is anticipated to be the fastest-growing segment during the forecast period. The comprehensive policy not only covers the third party damages but also the damages caused to the customers' vehicles. This is a major benefit of the comprehensive insurance over the third party insurance coverage, which is propelling the demand for the comprehensive coverage across the globe.

Application Insights

The personal vehicle segment dominated the global vehicle insurance market in 2025. The huge number of personal vehicles across the globe has led to the increased demand for the vehicle insurance. The rising affordability owing to the easy financing and EMI options is further fueling the demand for the personal vehicles and consequently the demand for the vehicle insurance is also growing. The rapidly growing popularity of the electric vehicles is expected have a significant impact on the growth of the global vehicle insurance market in the forthcoming years.

The commercial segment is anticipated to witness the highest growth rate during the forecast period. The growing adoption of car rental services and online cab services, along with the growing adoption of electric public transport vehicles is boosting the growth of the commercial vehicles segment. Furthermore, the rising economic development and economic growth owing to rapid industrialization and growing number of economic activities in the developing and underdeveloped regions is significantly boosting the demand for the commercial vehicles and hence it is expected to boost the growth of the vehicle insurance market during the forecast period.

Regional Insights

U.S. Vehicle Insurance Market Size and Growth 2026 to 2035

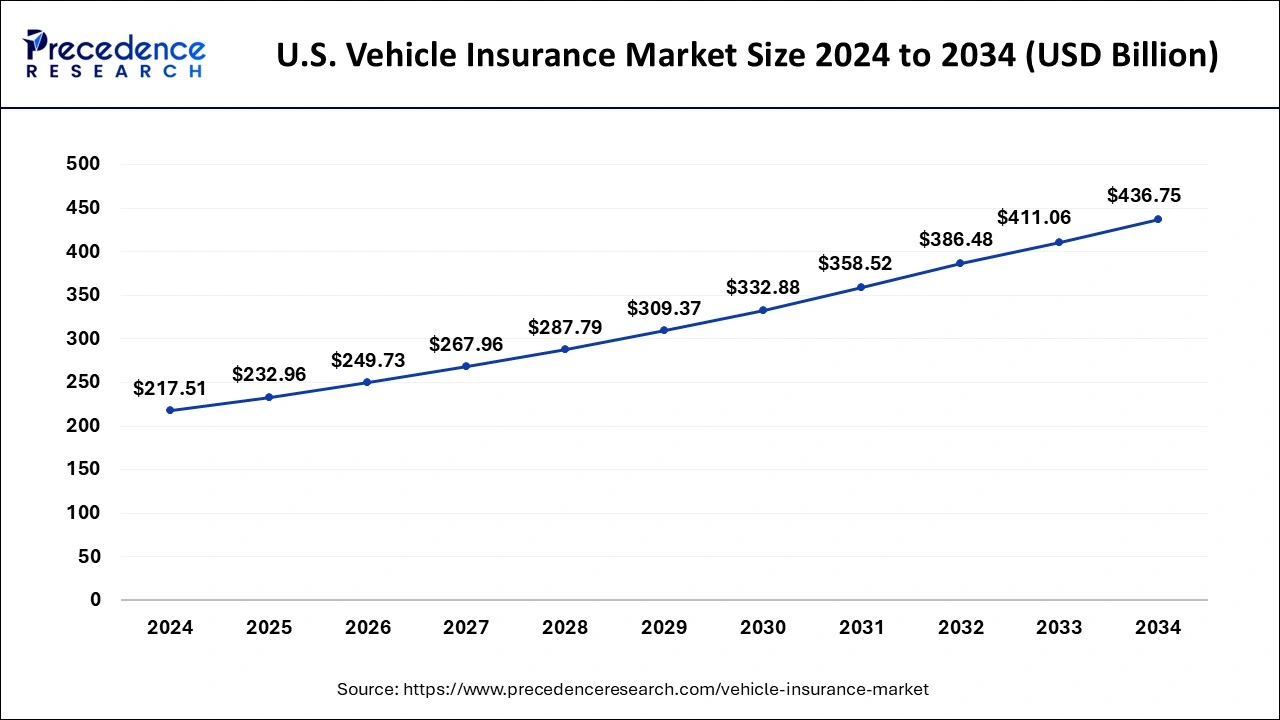

The U.S. vehicle insurance market size is exhibited at USD 232.96 billion in 2025 and is projected to be worth around USD 461.70 billion by 2035, growing at a CAGR of 7.08% from 2026 to 2035

U.S. Vehicle Insurance Market Trends

In the U.S., the market for vehicle insurance is driven by rising driving violations and evolving consumer demographics in insurance purchasing. Significant investments in AI and telematics solutions further support the market by enhancing risk assessment, streamlining claims processing, and enabling personalized pricing. Regulatory mandates requiring coverage, alongside the rapid adoption of connected and electric vehicles, further fuel demand by creating new risk pools and insurance products.

What Made North America the Dominant Region in the Vehicle Insurance Market?

North America dominated the global vehicle insurance market in 2025. The presence of leading insurance providers, increased consumer awareness regarding the benefits of vehicle insurance, high disposable income, higher demand for vehicles, and rising affordability of the middle class is boosting the growth of the North America vehicle insurance market. The rising consumer awareness regarding the benefits of electric vehicles is anticipated to boost the demand for the EVs in the upcoming years and hence the demand for the vehicle insurance is expected to rise significantly in North America. The penetration of insurance sector is significantly high in the developed market of US and Canada. The rising adoption of the digital platforms for buying and renewing vehicle insurance policies is playing a significant role in the growth of the North America vehicle insurance market. Furthermore, the rising technological advancements and growing adoption of the digital technologies among the insurance providers is expected to have a positive effect on the growth of the vehicle insurance market during the forecast period.

What Makes Asia Pacific the Fastest-Growing Market for Vehicle Insurance?

Asia Pacific is expected to be the fastest-growing market during the forecast period. The rising demand for the vehicles owing to rising economic activities, increasing government investments in the infrastructural development, and rapid urbanization. The presence of huge population and rising middle class is fueling the demand for the vehicles in the region. The mandatory government regulations regarding the adoption of vehicle insurance in nation like India is exponentially contributing to the growth of the Asia Pacific vehicle insurance market. The rapidly rising demand for the alternative fuel vehicles in the developing nation like China is boosting the vehicle insurance market growth. China is the largest producer and consumer of the electric vehicles in the globe.

India Vehicle Insurance Market Trends

In India, the market is fueled by mandatory third‑party liability coverage under the Motor Vehicles Act and rapidly increasing vehicle ownership driven by rising incomes and easy financing. In addition, digital transformation, especially the adoption of telematics‑based usage‑based insurance (UBI) models, AI-driven underwriting, and online policy platforms, is significantly boosting demand. The launch of new insurance products, the adoption of advanced technologies, and the expanding production of both electric and conventional vehicles are driving growth in India's vehicle insurance market.

Europe Vehicle Insurance Market Trends

Europe has a very mature vehicle insurance sector but is also highly innovative because of its strict regulatory requirements and total saturation of its market with existing insurers. In many countries (Germany, France, UK) telematics models and usage-based model products are becoming very popular among consumers. In addition, Europe is the leader in electric vehicle insurance development as well as adapting their offerings to fit into new mobility trends.Other key components that add to the competitiveness of the vehicle insurance market in Europe include advancements in analytic capabilities, digital claims processing, and the growing demand for sustainable or 'green' insurance offerings.

Why is Europe Considered a Notably Growing Region in the Vehicle Insurance Market?

Europe is expected to grow at a notable rate in the market in the upcoming period. Regulatory changes and related developments at the European level are shaping the market, highlighted by the European Commission's launch of the EU Automotive Industry Action Plan in March 2025 to enhance the competitiveness of the automotive industry. The UK is leading the market. In October 2024, the UK government and industry ministers convened industry and consumer experts to manage costs for drivers and announced the launch of the Motor Insurance Taskforce. In April 2025, the UK regulator outlined plans to accelerate insurance investments to drive faster growth in the vehicle insurance sector.

What are the Major Factors Contributing to the Latin American Vehicle Insurance Market?

The Latin American market is driven by governments' initiatives to promote safer driving and better risk management, which encourage the adoption of telematics-based policies. Countries like Brazil and Argentina are updating their current insurance systems, aiming to improve them with new legislation. These countries seek to promote competition and lower costs. The specific proposed programs focus on making car insurance mandatory for all vehicle owners to cover damage caused to others in accidents.

Brazil Vehicle Insurance Market Trends

The Brazilian insurance sector has developed a well-established business environment supported by regulatory advances. With a growing focus on major policies and digital platforms, the vehicle insurance market is expected to expand, as many companies commit to integrating new technologies and broadening their operations. At the same time, digital platforms and bundled insurance offerings are gaining traction, as consumers demand more convenience, transparency, and flexible coverage.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the vehicle insurance market, driven by regulatory reforms and the launch of digital initiatives aimed at increasing efficiency, insurance penetration, and compliance. The growth of InsurTech innovations results in streamlined digital experiences and tailored options. Insurers are quickly adopting usage‑based models and telematics, propelled by the expansion of connected cars and InsurTech advancements. Meanwhile, stronger regulatory requirements, rising vehicle ownership, and mobile-first platforms are fueling market growth, especially in countries requiring mandatory motor insurance.

Latin America Vehicle Insurance Market Trends:

Car insurance in Latin America has been rapidly expanding along with urbanization, increasing car penetration and the introduction of mandatory car insurance by governments, including those in Brazil, Mexico and Argentina. Governments are requiring all new car buyers to purchase motor vehicle insurance, which brings many first-time buyers into the insured market. Additionally, as more people use smartphones and digital platforms, they have greater access to car insurance convenience than ever before. This is especially true for underserved markets due to the growth of ride sharing and commercial fleets throughout the region.

Vehicle Insurance Market Companies

- PEOPLE'S INSURANCE COMPANY OF CHINA

- ALLSTATE INSURANCE COMPANY

- CHINA PACIFIC INSURANCE CO.

- ALLIANZ

- STATE FARM MUTUAL

- TOKIO MARINE GROUP

- AUTOMOBILE INSURANCE

- GEICO

- PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

- ADMIRAL GROUP PLC

- BERKSHIRE HATHAWAY INC.

Recent Developments

- In December 2024, Bajaj Allianz General Insurance launched two new motor insurance: Eco Assure Repair Protection and Named Driver Cover. These insurances provide comprehensive and customized coverage.

- In August 2024, ICICI Lombard launched the industry's first innovative Smart Saver Plus add-on for motor insurance policies. This insurance aims to address concerns of policyholders regarding prolonged turnaround times and the need for reliable repair quality by providing quality assurance, swift servicing, and customer convenience.

Segments Covered in the Report

By Coverage

- Third Party Liability

- Comprehensive

By Application

- Personal Vehicle

- Commercial Vehicle

By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

By Vehicle Type

- New Vehicles

- Used Vehicles

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting