What is the Property and Casualty Insurance Market Size?

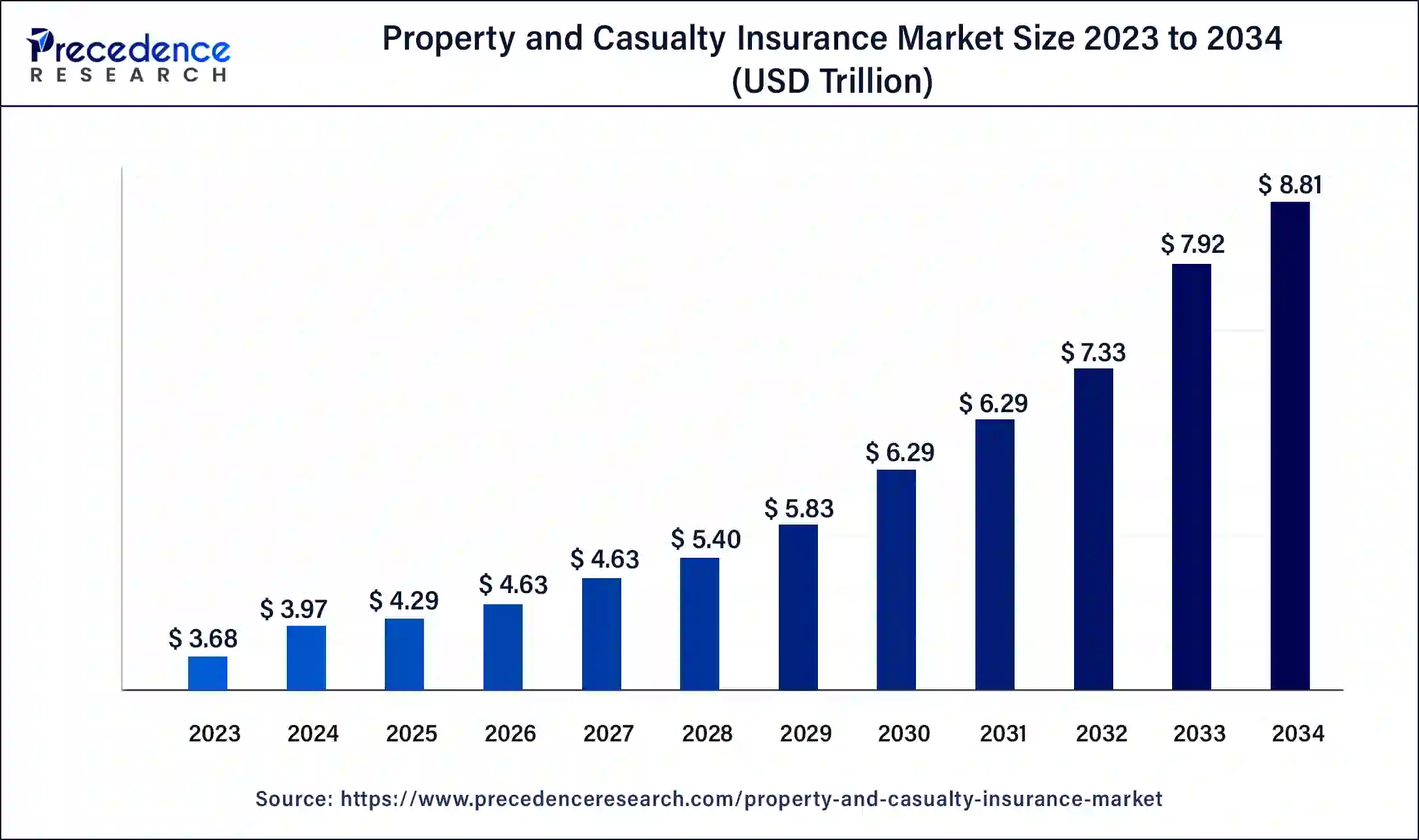

The global property and casualty insurance market size is valued at USD 4.30 trillion in 2025 and is predicted to increase from USD 4.66 trillion in 2026 to approximately USD 9.49 trillion by 2035, expanding at a CAGR of 8.24% from 2026 to 2035.

Property and Casualty Insurance Market Key Takeaways

- The global property and casualty insurance market was valued at USD 4.30 trillion in 2025.

- It is projected to reach USD 9.49 trillion by 2035.

- The property and casualty insurance market is expected to grow at a CAGR of 8.24% from 2026 to 2035.

- The North America property and casualty insurance market size was calculated at USD 1.27 trillion in 2025 and is expected to attain around USD 2.86 trillion by 2035.

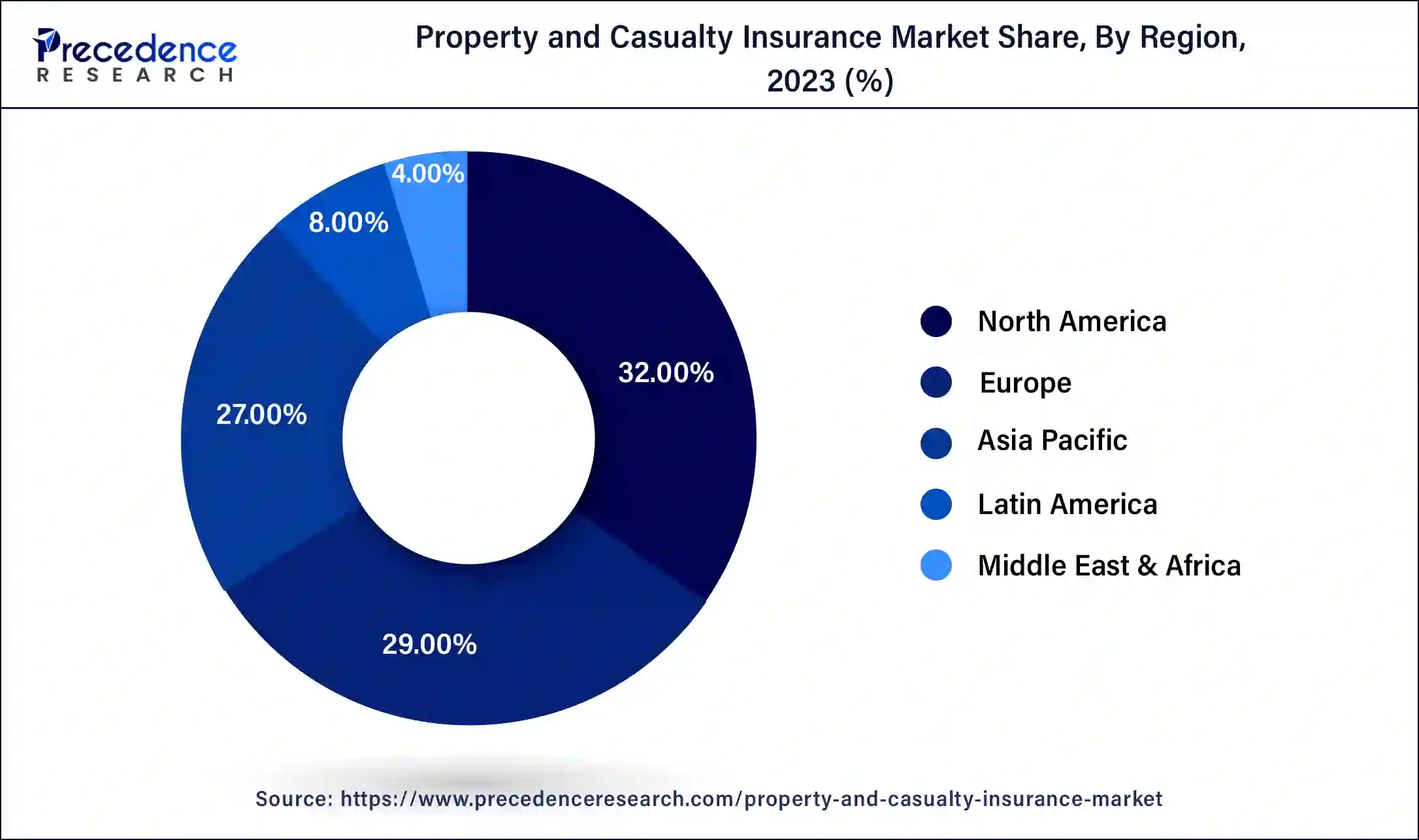

- North America led the market with the largest market share of 32% in 2025.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By product, the homeowners insurance segment has held the largest market share of 38% in 2025.

- By distribution, the brokers segment dominated the market in 2025.

- By distribution, the tied agents and branches segment is expected to grow at the fastest rate during the forecast period.

- By end-users, the individual segment has accounted more than 57% of market share in 2025.

- By end-users, the business segment is expected to grow at the fastest rate during the forecast period.

Market Overview

The property and casualty insurance market provides car insurance, bike insurance, home insurance, life insurance, health insurance, and others, including liability insurance for any damage, injuries, and accidents. The market is continuously growing due to the growing number of benefits such as economic growth, capital generation, and certainty. Now, people are more educated and aware of the benefits and many types of insurance, and many companies provide so many types of insurance and use advanced technology that makes workflow easy for companies and increases the adoption of property and casualty, which leads to market growth.

Property and Casualty Insurance Market Growth Factors

- Increased awareness about the benefits of insurance and the rising adoption of health, life, and more types of insurance in property and casualty insurance.

- The growing cloudification and digitalization and the fact that most companies are already using technology to improve workflow enhance the user experience and consumers.

- Insurance supports medical emergencies in families and every person wants today's time which increases the adoption of insurance in the market.

- Insurance provides many benefits such as financial stability, long-term wealth, personal economic growth, and others, these benefits attract people to invest in insurance and that is growing the market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 8.30% |

| Market Size in 2026 | USD 4.66 Trillion |

| Market Size in 2025 | USD 4.30 Trillion |

| Market Size by 2035 | USD 9.49 Trillion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution, End-use. and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Benefits of different insurance

As the economy grows, the adoption of insurance increases, and people are investing so much in liabilities these days, which increases the insurance rate in the market. Also, people are now aware of the different types of benefits that insurance gives, such as providing protection, certainty, risk sharing, the value of risk, saving habits, and more. Many types of insurance provide benefits such as life, health, education, travel, and more. These benefits drive market growth.

Rise in cloudification and digital workplace adoption.

In the property and casualty insurance market, there is so much increased demand for all types of insurance, including health & life insurance, and some insurance, such as cars and bikes, is mandatory by the government for people to get. Due to this, there is so much insurance data for companies that it is hard to maintain and secure the information, where clarification is a significant solution, which so many companies use to increase their sales. Also, cloudification and digitalization provide some benefits, such as a smooth and fast app user experience, no outages for users and clients, ease of management, less operational cost, on-demand scaling for infrastructure, increased security, and more. These benefits enhance the user experience, and this technology provides a flexible way for consumers to get insurance from any application; in the insurance industry, the evolution of digital transformation makes insurance companies more profitable, and that increases market growth.

Restraint

Increasing cyber-attacks and fraud

In the property and casualty insurance market, as the economy and technological advancements grow, the risk of cyber-attacks is increasing. This can be a barrier for companies as they face challenges in securing consumer data, and that also affects consumers' belief in the insurance market. During the COVID-19 pandemic, the use of digital platforms increased, which increased the number of cyber-attacks in the market. As the property and casualty insurance market grows, the market fraud is increasing. In the market, many fake companies scam people, and because of that, many people avoid investing in insurance, which negatively impacts the market growth.

Opportunities

Rise in the adoption of AI and advanced analytics

Advanced analytics and AI offer new opportunities in the property and casualty insurance market. The integration of AI and advanced analytics can be a significant solution to many problems in the market. Some companies are already using these technologies, such as touchless claims, chatbots, and self-service portals. Also, some insurance apps incorporate chatbots, which simplifies the workflow for companies. Along with that, using deep learning, many insurers are generating underwriting decisions for better accuracy.

Blockchain technology

The use of blockchain in the property and casualty insurance market can make work easier for companies and consumers by using blockchain technology, consumers can reduce the reviewing claims and third-party checking payment costs. Also, by using blockchain technology, consumers can save lost time because of these benefits, so many companies are using this technology and growing the market.

Product Insights

The homeowners insurance segment dominated the property and casualty insurance market in 2025due to some benefits such as extensive protection and coverage against natural disasters, providing cost-efficient protection, protection against theft or third-party liability, protection towards the structure of the home like if a home got damaged such as from fire, hail, or any disaster that time home insurance will provide repairing the house and liability coverage. These benefits are the main reason behind the segment's growth. Along with that, people are now more aware of the benefits of home insurance, which also grows the market.

- In April 2024, Digital insurance company Lamonde powerd by Sociel Impect and AI partnership with BNP Paribas Cardif announced the launch of homwoners insurance in France.

The renters insurance segment is also growing in the property and casualty insurance market because of some benefits, including relatively affordable liability coverage, which means protection while injured during accident time, and covers losses to personal property like if any personal thing such as clothes, luggage, furniture, and computer along with that some landlord might require it and that renters insurance cover additional living expenses.

Distribution Insights

The brokers segment dominated the property and casualty insurance market in 2025 due to benefits including competitive prices and providing insurance for all types of needs such as car, home, business, and farm insurance. Brokers also save lots of time and money in finding the best insurance and protection. Brokers now provide online services as well anywhere. They provide service on the phone by email or call, and that is best for people who don't have enough time to research any type of insurance due to their hectic lifestyle, and these benefits are growing the segment in the market.

The tied agents and branches segment is expected to grow at the fastest rate during the forecast period. Because the client offers the best deal to the insurers, or they work as a localized point of content, and this localized approach provides face-to-face interaction. Tied agents and branches have in-depth knowledge about any insurance, and they meet face-to-face consumers, which increases the trust between consumer and broker, and this is growing the segment in the market.

End-User Insights

The individual segment dominated the property and casualty insurance market in 2025 due to some benefits, such as individual insurance, which is a medical or health-related plan that covers a single employee and their family. Individual insurance is good for people who want insurance for any specific need. It's less typical insurance for employees. This insurance is for people such as independent contractors or freelancers, self-employed, and unemployed individuals.

- In February 2024, HDFC Life International announced the launch of a comprehensive US Dollar Student Health insurance plan. The program is for students who are currently studying abroad under the plan name Global Student Health Care.

The business segment is expected to grow at the fastest rate during the forecast period. This segment consists of businesses seeking insurance coverage for liability, property damage, and business interruption. This segment provides coverage tailored to the unique risks faced by businesses. Business insurance provides many benefits, including protecting employees like medical care, missed wages, and funeral benefits. Insurance protects your customers through public relations and liability. Also, business contracts may require insurance, such as renting a building from a landlord, loan agreements, client agreements, and more, which are growing the market.

- In April 2024, according to Nikkei Asia, Japanese company Nippon Life Insurance announced an insurance firm in Japan, establishment of its newest.

- In December 2023, India's most famous company, Life Insurance Corporation ( LIC), launched five new products such as LIC's New Jeevan Shanti (Plan No.858) (Raised annuity rates), LIC's Dhan Vriddhi (Plan 869)(close-ended planed) and more.

- In March 2024, Gallery Health and Allied Insurance Company was approved by the Indian insurance regulatory authority to commence health insurance operations in India.

Regional Insights

U.S. Property and Casualty Insurance Market Size and Growth 2026 to 2035

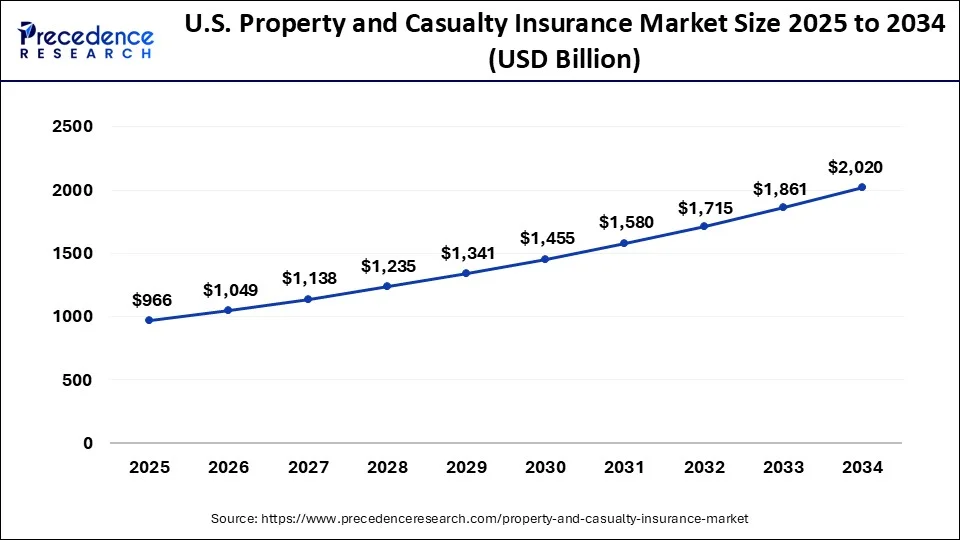

The U.S. property and casualty insurance market size is estimated at USD 966 trillion in 2025 and is projected to hit around USD 2170 trillion by 2035, at a CAGR of 8.43% from 2026 to 2035.

North America dominated the property and casualty insurance market in 2025 as the population here is more aware of the benefits of insurance. Along with this, there are many regulatory bodies, such as the state-based insurance regulatory system and the NAIC acts, which act as a forum for federal regulation of insurance. The U.S. has insurance groups that create awareness, and the benefit of having insurance groups is increased survivability. Along with that, Canada is also growing the market, increasing and more.

- In April 2024, the Canadian government partnered with the country's property and casualty (P&C) insurance to develop a low-cost national flood insurance program for households at high risk of flooding.

- In Nav 2023, Elon Musk, the founder of Tesla company, launched a specialized car insurance.

Asia Pacific is expected to grow at the fastest rate during the forecast period due to increased awareness of insurance benefits in the region and the importance of robust insurance along with natural disasters. also increases the insurance demand in the property and casualty insurance market. The region has countries like China and India, which boost the market. The increasing population of India and China are crucial factors in growth. In the region, countries such as India have many public and private organizations that provide insurance, and the most popular company is LIC, which provides insurance to consumers. Along with that, China is also growing the market, with increasing demand. China has two major organizations that make sure that all the rules and regulations related to insurance are followed properly. These organizations are the Insurance Association of China and the Insurance Institute of China.

What are the Advancements in the Property and Casualty Insurance Market in Europe?

Europe is witnessing significant growth in the market throughout the forecast years. The region highlights a mature market demand with a strong focus on sustainability and quality, and offers cost-competitive expansion with emerging adoption. EU-wide regulations also shape product design and reporting requirements. Recent M&A activity is also focusing on expanding digital capabilities and integrating innovations, enabling these firms to enhance operational efficiencies and customer engagement.

Germany Property and Casualty Insurance Market Trends: Smaller and emerging players in the country are adopting niche specialization and strategic partnerships, which drive market expansion, though the market remains highly concentrated. Climate change and more frequent natural catastrophes are driving greater focus on catastrophe coverage, risk modeling, and sustainable underwriting practices.

Key Property and Casualty Insurance Innovations in Latin America

Latin America is expected to witness substantial growth in the market throughout the forecasted years. The region has experienced notable shifts over the past several years, and this growth and development are driven by increasing societal and regulatory pressures. Brazil and Mexico are leading players in the region. The regulatory landscape varies, and import duties and complex taxes can inflate landed costs. Distribution relies on local distributors, national retail chains, and growing e-commerce penetration.

Brazil Property and Casualty Insurance Market Trends: The region's market landscape through focused strategies and well-defined priorities. Other factors include innovation, enhancing operational efficiency, and leveraging advanced technologies, which help to improve performance and customer engagement.

Middle East and Africa growth in the Property and Casualty Insurance Industry:

The Middle East and Africa are witnessing steady growth in the market. Regulatory frameworks in this region seem to be opaque. Distribution channels include government procurement, regional distributors, and expanding digital ecosystems in major cities. Moreover, the region is witnessing an increasing prevalence of customer preferences and expectations, along with advances in technology, such as data analytics, artificial intelligence, and telematics.

Saudi Arabia Property and Casualty Insurance Market Trends: The region's market landscape continues to shift, and companies remain committed to agility, resilience, and value creation, thus positioning themselves to capitalize on emerging opportunities and gain a competitive advantage.

Property and Casualty Insurance Market Companies

- Chubb

- USAA Insurance Company

- The Travelers Indemnity Company

- CNA Financial Corp.

- Liberty Mutual Insurance Company

- Farmers Insurance Group of Companies

- State Farm Mutual Automobile Insurance Company

- Berkshire Hathaway Specialty Insurance

- Progressive Casualty Insurance Company

- Allstate Insurance Company

Property and Casualty Insurance Market Recent Developments

- In March 2024, Chubb launched a global transactional risk platform to offer transactional risk liability insurance products across international markets.

- In November 2023, Futuristic Underwriters and Tech-Driven MGA launched commercial P&C insurance to reduce risk and drive profitability for agents, insurers, and insureds.

- In January 2024, New MGA, a team of experts TLI, launched Sands Point Risk to support expanded opportunities in financial and property-casualty insurance lines.

- In April 2024, Beat Capital Partners is set to launch Convergence, a credit insurance company led by Stephen Pike, the founder and CEO.

- In March 2024, Future Generali India Insurance, a private general insurer, has recently launched a new product called Health PowHER that caters to the healthcare needs of women at various stages of their lives. This product provides coverage for a range of women-specific medical conditions, including increased limits for cancer treatments specific to females, and coverage for disorders related to puberty and menopause.

Segments Covered in the Report

By Product

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Landlord Insurance

- Others

By Distribution

- Tied Agents and Branches

- Brokers

- Others

By End-users

- Individuals

- Governments

- Businesses

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting