What is the Artificial Intelligence (AI) in Insurance Market Size?

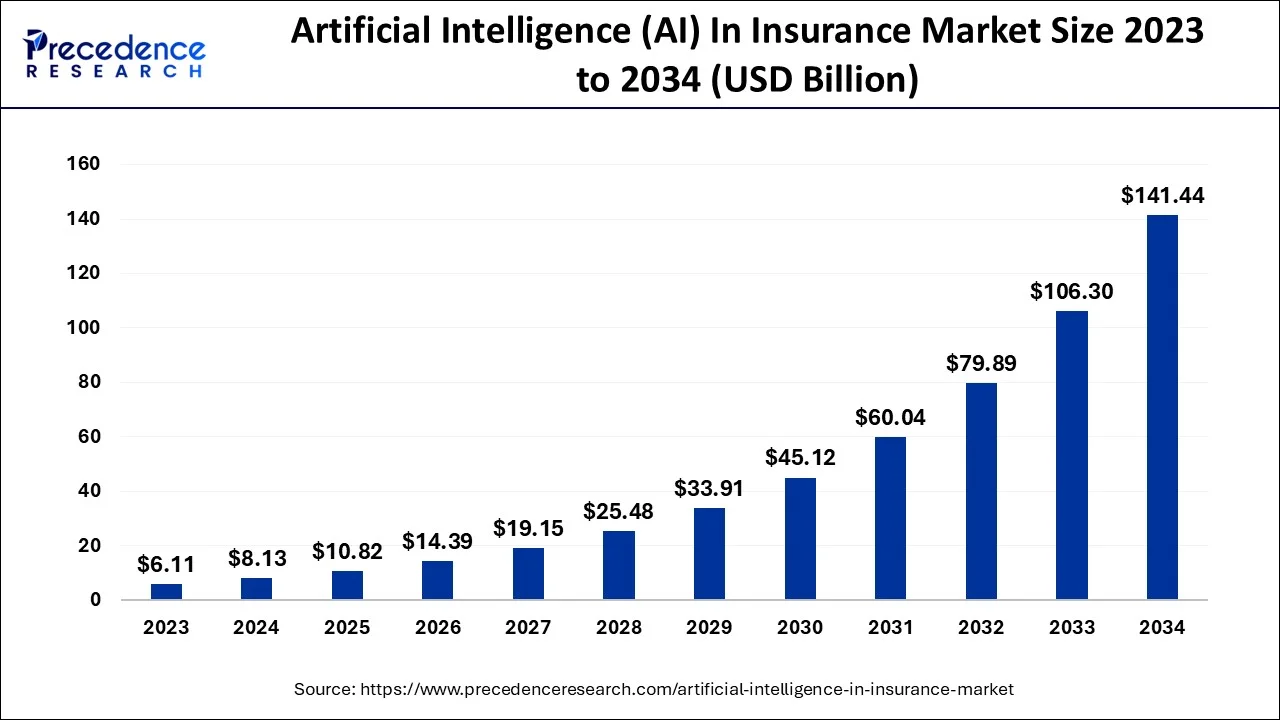

The global artificial intelligence (AI) in insurance market size is accounted at USD 10.82 billion in 2025 and predicted to increase from USD 14.39 billion in 2026 to approximately USD 176.58 billion by 2035, representing a CAGR of 32.21% from 2026 to 2035.

Artificial Intelligence (AI) in Insurance Market Key Takeaways

- North America is expected to dominate the market during the forecast period.

- By offering, the software segment contributed more than 70% of revenue share in 2025.

- By deployment mode, the cloud segment is expected to grow at the highest CAGR over the forecast period.

- By technology, the machine learning segment is expected to dominate the market over the forecast period.

- By organization size, the large enterprise segment is expected to dominate the market over the forecast period.

How is AI Governing the Insurance Companies for Perspective Developments?

The insurance industry, like many others, has been significantly transformed by the rapid advancements in artificial intelligence (AI) technology. AI has emerged as a powerful tool that revolutionizes various aspects of the insurance sector, from risk assessment and underwriting to claims processing and customer service. By harnessing the capabilities of AI, insurance companies have found innovative ways to optimize their operations, enhance customer experiences, and stay competitive in an ever-evolving marketplace. AI's ability to process vast amounts of data and recognize patterns enables insurers to make data-driven decisions, resulting in more accurate risk assessments and personalized insurance offerings.

According to secondary analysis, by 2030, artificial intelligence will "increase productivity in insurance processes and reduce operational costs by up to 40%.

Artificial Intelligence (AI) in Insurance Market Growth Factors

Artificial intelligence empowers insurance companies to streamline traditionally time-consuming and resource-intensive processes, making the entire insurance lifecycle more efficient and cost-effective. One of the key applications of AI in insurance is underwriting. Traditionally, underwriting involved manual assessments and actuarial analysis, which could be time-consuming and subject to human bias. AI-driven underwriting processes leverage data analytics and machine learning to evaluate risks more accurately and efficiently, allowing insurers to tailor coverage and premiums to individual policyholders. The AI in the insurance market is driven by various factors, including increasing product launches, growing investment in AI, and growing data-driven risk assessment.

Trends & Future Outlook in the Artificial Intelligence (AI) in Insurance Market

- Spurring Integration of IoT and Telematics

Current focus on offering insurers a persistent "avalanche" of real-time data for more precise risk assessment and proactive risk management, like drones employed in post-disaster property assessments, and smart sensors. - Surging Multi-Agent AI Systems

Many research activities are bolstering complex, autonomous systems for managing onboarding, data admission (medical records, docs), risk profiling, pricing, and compliance in seconds. - Advancing Explainable AI (XAI)

Day by day, the market is leveraging transparent, ethical decision-making landscapes to ensure fairness, mitigate bias, and meet regulatory scrutiny (like TCFD for climate).

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.82 Billion |

| Market Size by 2035 | USD 176.58 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 32.21% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Offering, By Deployment Mode, By Technology, By Organization Size, By End User, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Growing investments

To improve customer service and revolutionize the insurance management process, insurance firms are investing more money in machine learning and AI technologies. Additionally, as the complexity and rivalry in the insurance business expanded, so did the need for solutions tailored to the industry. As a result, numerous insurance firms and insurtech are investing in AI solutions to suit client needs, which in turn is fueling the development of AI in the insurance sector. Additionally, AI and machine learning may help insurance businesses at different phases of the risk management process, including risk exposure identification, evaluation, estimation, and effect assessment.

For instance, in June 2022, Akur8 and MS&AD Insurance Group announced their new collaboration to stimulate even more innovation. With this transaction, Akur8 will continue to develop in Asia and beyond in collaboration with a renowned global insurer. Akur8's solution, designed specifically for insurers, improves model development procedures by automating risk modeling using Transparent Artificial Intelligence patented technology. Increased predictive performance and speed-to-accuracy for improved market responsiveness and quick business effect are key benefits for insurers while preserving complete transparency and control over the models generated. Thus, such investments in technology are expected to drive market growth over the forecast period.

Restraint

Data privacy and security concerns

As AI in insurance relies heavily on data analysis, storage, and processing, there are heightened concerns about data privacy and security. The industry deals with sensitive customer information, and any data breaches or misuse of personal data can lead to severe consequences, including financial penalties and damage to reputation. Ensuring robust data protection measures and compliance with data privacy regulations becomes crucial but also adds complexities to the adoption of AI. Therefore, data privacy and security concerns are expected to hamper the market growth over the forecast period.

Opportunity

Increasing focus on offering a personalized experience

Research by Accenture found that 80% of insurance consumers desire personalized service and are prepared to give their personal information for it. Insurance firms may provide tailored policies that let people only pay for the coverage they need by utilizing AI to better understand their consumers. For instance, insurance providers can present a tailored policy based on the driving history of the applicants, including any speeding fines, traffic stops and accidents, data-driven services can make insurance more appealing to a larger spectrum of clients. Thus, the increasing focus on offering personalized experiences is expected to offer a lucrative opportunity for market growth over the forecast period.

Offering Insights

Based on the offering, the global artificial intelligence in insurance market is segmented into hardware, software, and service. The software segment is expected to dominate the market over the forecast period.

The growth in the segment is attributed to the increasing popularity of software-based solutions, including predictive analytics software, fraud detection software, claims processing software, and others. For instance, predictive analytics software uses AI algorithms to analyze historical data and identify patterns, enabling insurers to forecast future trends, anticipate risks, and make data-driven decisions. This software helps in underwriting, pricing insurance policies, and improving risk assessment accuracy. Moreover, AI-based fraud detection software helps insurance companies identify and prevent fraudulent claims by analyzing data for suspicious patterns and anomalies. Thereby, driving the market growth over the forecast period.

Deployment Mode Insights

Based on the deployment mode, the global artificial intelligence in the insurance market is segmented into on-premise and cloud. The cloud segment is expected to grow at the highest CAGR over the forecast period. Cloud-based AI platforms provide insurers with a scalable and flexible environment to build, deploy, and manage AI models. These platforms offer pre-built AI tools, machine learning frameworks, and APIs, making it easier for insurers to develop and integrate AI solutions into their existing systems. Moreover, cloud providers offer AI services that allow insurers to access AI capabilities on a pay-as-you-go basis. Furthermore, cloud infrastructure provides insurers with the ability to store and process vast amounts of data necessary for AI applications. Cloud storage solutions enable insurers to securely manage and access structured and unstructured data required for AI-driven analytics and decision-making. Thus, this is expected to drive the segment growth over the forecast period.

Technology Insights

Based on the technology, the global artificial intelligence in Insurance market is segmented into machine learning, natural language processing, computer vision and others. The machine learning segment is expected to dominate the market over the forecast period. Machine learning algorithms play a vital role in risk assessment and underwriting processes. By analyzing vast amounts of historical data, machine learning models can identify patterns and trends, enabling insurers to make more accurate predictions about potential risks associated with insuring individuals or entities. This results in more personalized underwriting decisions and appropriate pricing of insurance policies.

Additionally, machine learning is extensively used in claims processing to automate and expedite the verification and evaluation of claims. By analyzing historical claims data, machine learning models can flag potentially fraudulent claims, helping insurers to detect and prevent insurance fraud more effectively. Thus, the extensive use of ML in insurance industry for numerous applications is expected to drive segment growth.

Organization Size Insights

Based on the organization size, the global artificial intelligence in the Insurance market is segmented into large enterprises and SMEs. The large enterprise segment is expected to dominate the market over the forecast period. Large insurance companies are using AI-powered chatbots and virtual assistants to enhance customer interactions and support. In addition, large insurers are harnessing the power of AI-driven predictive analytics to gain valuable business insights. Predictive models analyze historical data to forecast market trends, identify emerging risks, and optimize business strategies. Thereby, driving the market growth over the forecast period.

Regional Insights

Why did North America Dominate the Market in 2025?

North America is expected to dominate the market over the forecast period. The region's insurance companies have been actively adopting AI solutions to enhance their operations, improve customer experiences, and gain a competitive edge. AI applications such as machine learning, natural language processing, and predictive analytics are being used for underwriting, claims processing, customer service, risk assessment, and fraud detection. In addition, the region has seen a surge in insurtech startups leveraging AI to disrupt the traditional insurance industry. These startups often focus on niche markets, offering innovative AI-powered insurance products and services that cater to specific customer needs. Thus, this is expected to drive market expansion in the region.

U.S. Artificial Intelligence (AI) in Insurance Market Trends

For streamlining administrative burdens, optimising member experience, and placing emphasis on responsible AI, the U.S. market is widely leveraging AI uses mainly in health insurance. Whereas Aetna's Care Paths program employs AI for transparent early authorization, and other health plans are using AI for excellent provider matching and lowering clinician paperwork.

Exploration of Initiatives & Policies is Fostering the Asia Pacific

Asia Pacific is expected to grow at the fastest rate over the forecast period. The region is home to several emerging markets with a growing middle-class population. The rising affluence in countries such as China, India, Indonesia, and others has led to increased demand for insurance products, creating opportunities for AI-driven solutions to cater to this expanding customer base. Additionally, some countries in the region have launched initiatives and policies to promote AI adoption across industries, including insurance. Government support and funding for AI research and development have encouraged insurance companies to invest in AI technologies. Thus, this is expected to drive market growth in the region over the forecast period.

China Artificial Intelligence (AI) in Insurance Market Trends

At a rapid CAGR, China will expand fastest in the artificial intelligence in the insurance market, with certain regulatory steps, like recently China's Cyberspace Administration (CAC) issued AIGC (AI-Generated Content) Labelling Measures, which need clear labeling of AI content, finally boosting transparency and user trust. Moreover, Ping an Health applies AI avatars (like "Xin Yi") trained on a huge amount of medical data for 24/7 consultations, and interpretation of results with high accuracy, mimicking doctors.

Extensive Advanced Claims Processing is Propelling Latin America

A particular instance is Bdeo, which introduced tools in 2024/2025 for faster body shop negotiations (body shop negotiation) and rapid direct customer payments (cash settlements) via digital processes, which enhances satisfaction. Also, the region is incorporating computer vision along with satellite/aerial imagery for faster damage assessment (like roofs).

Brazil Artificial Intelligence (AI) in Insurance Market Trends

Recently, Brazil unveiled a substantial strategy to expand AI adoption, granting billions to support AI innovation, especially in industries such as insurance, which accelerates competitiveness and the digital revolution. A growing insurtech ecosystem and partnerships between traditional insurers and technology providers are further driving innovation and digital transformation. At the same time, data privacy regulations, legacy IT systems, and integration challenges continue to influence the pace and structure of AI adoption across Brazil's insurance sector.

Artificial Intelligence (AI) in Insurance Market Companies

- SAP SE

- IBM Corporation

- Salesforce, Inc.

- Oracle Corporation

- SAS Institute Inc.

- Microsoft Corporation

- Applied Systems

- Shift Technology

- SimpleFinance

- OpenText Corporation

- Quantemplate

- Slice Insurance Technologies

- Pegasystems Inc.

- Vertafore, Inc.

- Zego

What are the Recent Developments in the Artificial Intelligence (AI) in Insurance Industry?

- In June 2023, Simplifai, a firm known for its AI automation solutions, unveiled Simplifai InsuranceGPT, which it describes as the first-ever proprietary GPT tool created especially for the insurance industry. This innovative product is a result of Simplifai's AI-powered, no-code platform, which also strengthens the company's extensive business process automation capabilities.

- In January 2023, a new DX solution has been released by AI within Inc., a company that supports the democratization of AI by offering AI infrastructure, and that bundles AI technology with consulting services. The solution can help with the creation of new insurance products based on semi-structured health certificates that have been digitized by OCR for the life insurance business.

- In April 2023, the Singapore-based corporate SaaS platform ACTYV.AI partnered with Bajaj Allianz General Insurance to provide insurance products to businesses and the partner ecosystem along the supply chain via its technology platform. Using the actyv.ai platform's technological stack, private general insurer Bajaj Allianz General Insurance will offer cutting-edge insurance solutions that support the sustainability of distributors, suppliers, and retailers.

- In December 2025, Zywave, a key provider of insurance technology solutions, launched its Agentic AI strategy and the industry's first set of insurance-specialized AI agents. The details ET announcement were made at a virtual event. (Source- https://www.prnewswire.com)

- In October 2025, Zurich Insurance Group unveiled the Zurich AI Lab, a new initiative focused on expanding the use of AI within the insurance sector. The launch was made through collaboration with the University of St. Gallen and ETH Zurich's Agentic Systems Lab, accelerating industry transformation by utilization of the AI power.

Segments Covered in the Report

By Offering

- Hardware

- Software

- Services

By Deployment Mode

- On-premise

- Cloud

By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Others

By Organization Size

- Large Enterprises

- SMEs

By End User

- Life and Health Insurance

- Property and Casualty Insurance

By Application

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Underwriting and Claims Assessment

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting